Investors commonly assume that rising interest rates adversely impact the gold price, and vise versa. They believe that a rising interest rate environment is indicative of a strong economy, which is supposed to drive investors out of gold and into the stock market. They further assume that investors will want to exchange their gold, which has no yield, for stocks and bonds, both of which have yields and generate income but this intuition is unfounded. Let me explain why that is the case ans why, as such, gold investors shouldn’t fear rising interest rates.

price, and vise versa. They believe that a rising interest rate environment is indicative of a strong economy, which is supposed to drive investors out of gold and into the stock market. They further assume that investors will want to exchange their gold, which has no yield, for stocks and bonds, both of which have yields and generate income but this intuition is unfounded. Let me explain why that is the case ans why, as such, gold investors shouldn’t fear rising interest rates.

The above introductory comments are edited excerpts from an article* by Ben Kramer-Miller (goldstockbull.com) entitled Gold Investors Shouldn’t Fear Rising Interest Rates.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here). This paragraph must be included in any article re-posting to avoid copyright infringement.

Kramer-Miller goes on to say in further edited excerpts:

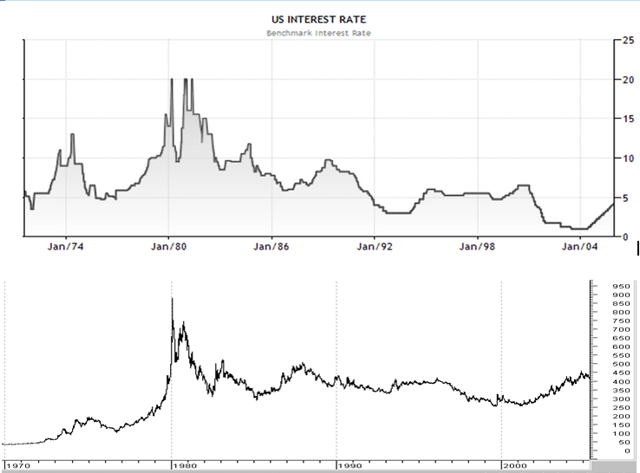

[In fact,] since Nixon abandoned the gold standard (i.e. after August 15th, 1971) a rising Fed Funds Rate has usually coincided with rising gold prices, and vise versa.Consider the following data (gold price data is from Kitco, Fed Funds Rate data is from the St. Louis Fed):

- From August 1971 through December 1974 the gold price rose from $35 to $200 per ounce, while the effective Fed Funds Rate rose from 5.5% to 8.5%.

- From January 1975 through August 1976 the gold price dropped to just over $100/oz, while the Fed Funds Rate fell to 5.25%.

- In January of 1980 the gold price peaked at over $800/oz while the Fed Funds Rate rose to 14%.

- The gold price then fell to about $290/oz in late February, 1985, while the Fed Funds Rate fell to 8.6%.

- The pattern breaks here as the gold price rose to $500 in December, 1987 while the Fed Funds Rate continued to fall to 6.8%.

- However the trend continues as the gold price fell to $330 in March, 1993 while the Fed Funds Rate fell to 3%.

- The gold price then rose to $415 in February, 1996 while the Fed Funds Rate rose to 5.2%.

- The gold price then fell until hitting its September, 1999 bear market bottom at $255. This occurred just before the Washington Agreement on Gold was signed, while the Fed Funds Rate remained steady.

While the correlation is far from perfect, we can clearly see from the following charts that the Fed Funds Rate and the gold price move together more often than not and have similar trends over long time periods.

(Source: The Fed Funds Chart comes from TradingEconomics.com and the gold price chart comes from ChartsRUs.com)

What causes this strong correlation?

When the Fed Funds Rate falls this creates a carry trade that allows banks to borrow cheap money from the Fed in order to buy assets with higher yields. It follows that:

- bonds and stocks – or assets that have value insofar as they have a yield – become more attractive by comparison… and…

- assets that do not have any yield (i.e. gold and other commodities) become less attractive from an investment standpoint.

When the Fed Funds Rate rises the carry trade dissipates (banks have to pay more in order to borrow, and so they are less willing to bid up the prices of income generating assets and, as

- money comes out of income generating assets and finds a home in assets whose value is intrinsic.

Ultimately we can conclude that:

- a high interest rate should indicate to investors that they should sell their gold, but

- a rising interest rate is a tailwind that will drive the gold price higher. Similarly

- a low interest rate is an indication that investors should buy gold, whereas

- a declining interest rate acts as a headwind. It follows that

- the best time to buy gold is when

- rates are low, but set to move higher, and

- the best time to sell gold is when

- rates are high but set to move lower.

Conclusion

1. With the Fed Funds Rate at 0.1%, it is evident that gold is positioned to move substantially higher.

2. Low interest rates are forcing investors into stocks and bonds for now as they reach for yield, but this is generating a bubble in paper assets and an “anti-bubble” in gold and other commodities.

3. Interest rates cannot stay low forever, however, so, while the Fed’s low interest rate policy is pushing stock and bond prices higher, it is also infusing potential energy into the gold market.

Therefore, it is only a matter of “When?” and not “If?” this trend reverses and gold catapults higher.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.goldstockbull.com/articles/gold-investors-should-not-fear-rising-interst-rates/ (Copyright © 2014 Gold Stock Bull – All Rights Reserved.)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Will Higher Interest Rates Result From Additional Tapering?

After a long period of very low interest rates following the global financial crisis the central banks of the U.S. and U.K. are planning to gradually tighten their easy monetary policies as their economies improve. When their benchmark interest rates go up, interest rates elsewhere will go up to so should we worry if and when global financial conditions tighten? Read More »

2. We’re Doomed! Rising Interest Rates Will Cause Our Financial System To Implode

We’re doomed! Even if the economy were growing at a faster pace, it wouldn’t come close to offsetting the interest payments on our ever-expanding debt. As such, any sort of credit shock – either rising rates or a decline in the rate of debt expansion – will cause the system to implode. Let me explain why that is the case. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Generally speaking, as Gold moves, so moves Silver and the rest of the PM’s…