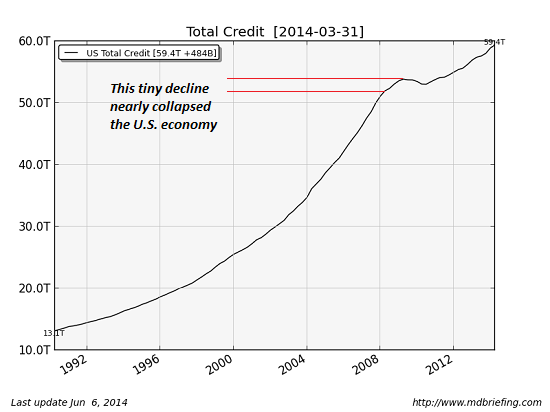

We’re doomed! Even if the economy were growing at a faster pace, it wouldn’t come close to offsetting the interest payments on our ever-expanding debt. [As such,] any sort of credit shock – either rising rates or a decline in the rate of debt expansion – will cause the system to implode. [Let me explain why that is the case.]

come close to offsetting the interest payments on our ever-expanding debt. [As such,] any sort of credit shock – either rising rates or a decline in the rate of debt expansion – will cause the system to implode. [Let me explain why that is the case.]

The above introductory comments are edited excerpts from an article* by Charles Hugh Smith (charleshughsmith.blogspot.ca) entitled Why We’re Doomed: Interest and Debt.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Smith goes on to say in further edited excerpts:

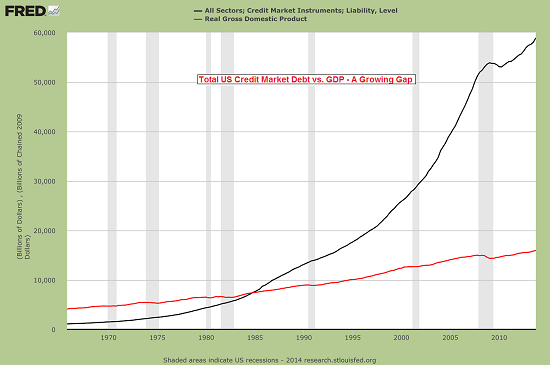

Total U.S. Credit Market Debt vs. GDP – A Growing Gap

It’s easy to see what’s happening with debt and the real economy (as measured by GDP, gross domestic product): debt is skyrocketing while real growth is stagnant. Put another way–we have to create a ton of debt to get a pound of growth. There is no other way to interpret the chart below.

source: Acting Man

10-Year Treasury Constant Maturity Rate At Historic Lows

The Status Quo has only survived this crushing expansion of debt by dropping interest rates to historic lows. Below is a chart of the yield on the 10-year Treasury bond, which reflects the extraordinary decline in interest rates over the past two decades.

The Federal Reserve has pegged rates at essentially 0% for years. That means the strategy of lowering interest rates to enable more debt has run out of oxygen: rates can’t drop any lower, and so they can either stay at current levels or rise.

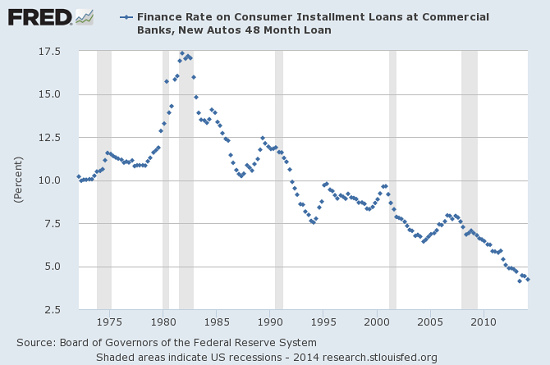

Finance Rate On Consumer Installment Loans Declining

Near-zero interest rates for banks borrowing from the Fed doesn’t mean conventional borrowers get near-zero rates: auto loans are around 4%, credit cards are still typically 16% to 25%, garden-variety student loans are around 8% and conventional mortgages are about 4.25% to 4.5% for 30-year fixed-rate home loans.

This decline in interest rates means households can borrow more money while paying the same amount in interest so:

- the interest payment on a $30,000 car today is actually less than the payment on a $15,000 auto loan back in 2000 and

- the monthly payment on a $400,000 home mortgage is roughly the same as the payment at much higher rates on a $200,000 home loan 15 years ago.

source: The Born Again Debtor

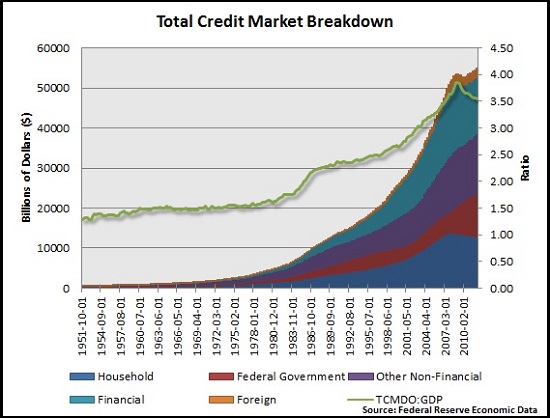

Total Credit Market Breakdown By Segment

Dropping the interest rates has enabled a broad-based expansion of debt across the entire economy. Notice how debt has exploded higher in every segment of the economy: household, finance, government, business.

source: The Born Again Debtor

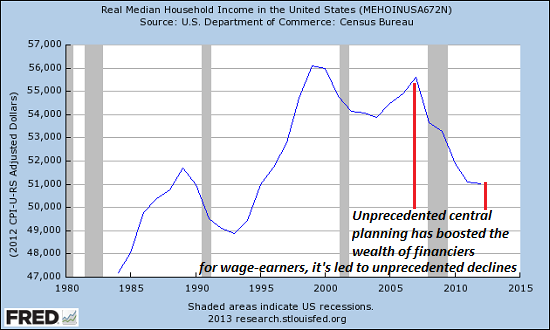

Real Median Household Income

The other half of the debt/interest rate equation is household income: if income is stagnant and declining, the household cannot afford to take on more debt and pay more interest. With real (adjusted for inflation) household income declining for all but the top 10%, households cannot take on more debt unless rates drop significantly. Now that rates are at historic lows, there is no more room to lower rates further to enable more debt. That gambit has run its course.

Many financial pundits claim private debts can simply be transferred to the government and the problem goes away. Unfortunately, they’re dead-wrong. As economist Michael Pettis explains:

“Remember that the only way debt can be resolved is by assigning the losses, either during the period in which the losses occurred or during the subsequent amortization period. There is no other way to “resolve” bad debt – the loss must be assigned, today or tomorrow, to some sector of the economy. “Socializing” the debt, or transferring the debt from one entity to another, does not change this.”

In other words, when marginal borrowers – households, students, businesses, local government agencies, etc.- start defaulting, the losses will have to be taken by somebody…The idea that we can transfer the debt to the government or central bank and the losses magically vanish is simply wrong.

- Even if you drop interest rates, if debt keeps soaring the interest soon becomes crushing.

- Even at historically low rates, the interest on Federal debt will soon double. That means some other spending must be cut or taxes must be increased to pay the higher interest costs. Either action reduces spending and thus growth.

- If rates actually normalize, i.e. rise back toward historic norms, interest payments could triple.

source: Federal Spending by the Numbers, 2013: Government Spending Trends in Graphics, Tables, and Key Points

Understanding how reliance on ever-expanding debt hollows out the economy

- Say the average interest on the $60 trillion in total debt is 4%…That comes to $2.4 trillion annually.

- Now take the $16 trillion U.S. economy and reckon that real growth in gross domestic product (GDP)…is about 1.5% annually. That’s an increase of $240 billion annually.

- That means we’re eating over $2 trillion every year of our real wealth, i.e. our seed corn, to support an ever-increasing mountain of debt. That is not sustainable.

- Even if the economy were growing at a faster pace, it wouldn’t come close to offsetting the interest payments on our ever-expanding debt.

- This leaves the entire Status Quo increasingly vulnerable to any sort of credit shock; either rising rates or a decline in the rate of debt expansion will cause the system to implode.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

Follow the munKNEE!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

1. Interest Rates to Remain Low As Far As the Eye Can See? Perhaps, BUT

Everyone knows that interest rates are going to rise in the future so the real question is not whether they will rise, but when and by how much. [This article analyzes when that will most likely be.] Read More »

2. Higher Interest Rates Will Come Once These 4 Economic Conditions Are Met

4 economic conditions need to be in place for interest rates to rise ahead of – and independent of – the Fed’s forward guidance. The economy met only one of those conditions to date but will likely meet all four by the end of the year…What follows is a status report on the four conditions. Read More »

3. Interest Rates NOT Rising Any Time Soon – Even With Fed Tapering. Here’s Why

Everyone and their mom is expecting long-term interest rates to rise now that the Fed is tapering its bond buying programs. I have a couple of problems with this line of thinking because, although it seems like reducing demand for a security (i.e. tapering QE) would result in a drop in price, when you really think about how quantitative easing works this makes no sense and, secondly, the market is telling us this makes no sense. Let me explain. Read More »

4. Rapid Rise In Interest Rates Will Collapse U.S. Financial System – Here’s Why

There is one vitally important number that everyone needs to be watching right now, and it doesn’t have anything to do with unemployment, inflation or housing. If this number gets too high, it will collapse the entire U.S. financial system. The number that I am talking about is the yield on 10 year U.S. Treasuries. Here’s why. Words: 1161; Charts: 2 Read More »

5. Variable Interest Rates: Staring Into the Abyss

It seems that the past few years of falling interest rates have lulled a big part of the global economy into financing with variable-rate debt…[As such,] when interest rates go up (as they did last week), there’s a world-wide reset in interest costs that, best case, amounts to a tax increase on individuals and businesses and, worst-case, threatens to blow up the whole system. Read More »

6. Bonds Getting Slaughtered, Interest Rates to Rise Dramatically, Economic Bubbles to Implode

What does it look like when a 30 year bull market ends abruptly? What happens when bond yields start doing things that they haven’t done in 50 years? If your answer to those questions involves the word “slaughter”, you are probably on the right track. Right now, bonds are being absolutely slaughtered, and this is only just the beginning. So why should the average American care about this? Read More »

7. Rapidly Rising Interest Rates Could Lead to Financial Collapse – Here’s Why

The global financial system is potentially heading for massive amounts of trouble if interest rates continue to soar. So what does all this mean exactly? [Let me explain.] Read More »

8. Rising Interest Rates Could Plunge Financial System Into a Crisis Worse Than 2008 – Here’s Why

If yields on U.S. Treasury bonds keep rising, things are going to get very messy. What we are ultimately looking at is a sell-off very similar to 2008, only this time we will have to deal with rising interest rates at the same time. The conditions for a “perfect storm” are rapidly developing, and if something is not done we could eventually have a credit crunch unlike anything that we have ever seen before in modern times. Let me explain. Read More »

9. A Rise in Interest Rates Would Derail An Economic Recovery – Yes or No?

[While]… I am not currently predicting an acceleration in inflation [I believe]…that the risk of interest rate instability is very real [given that] core inflation is already above a key benchmark that the Fed has staked its credibility on,. It should be of concern to investors that, despite economic growth being so anemic and overall resource utilization being so low (including human resources), there is currently very little margin for error on the inflation front. [In this article the author evaluates the danger that rising interest rates could potentially have on the U.S. economy.] Words: 2050 Read More »10. Negative Interest Rates Becoming More Prevalent – Here’s Why You Should Be Concerned

The once unthinkable might become policy: negative nominal interest rates. Investors should care as they may be increasingly punished for not taking risks yet masochistic investors believe they may be the prudent ones given the risks lurking in the markets. What are investors to do, and what are the implications for the U.S. dollar and currencies? Words: 779 Read More »

11. Current Distortion of Interest Rates is Unsustainable & Will Have Dire Consequences

Interest rates have been manipulated to keep them extremely low in an attempt to stimulate the economy but…unless deficits are dramatically reduced…. interest rates will eventually rise and government interest expense will double or triple from the amounts being paid today. That potentially triggers a debt death spiral, where government has to borrow more than otherwise expected. It also raises the credit risk and could ratchet interest rates up again. It has happened to Greece, Portugal, Spain and other European countries already this year and could well happen in the U.S. too. Words: 595 Read More »

12. Eventual Rise in Interest Rates Will Be Downfall of U.S. – Here’s Why

Everyone who purchases a Treasury bond is purchasing a depreciating asset. Moreover, the capital risk of investing in Treasuries is very high. The low interest rate means that the price paid for the bond is very high. A rise in interest rates, which must come sooner or later, will collapse the price of the bonds and inflict capital losses on bond holders, both domestic and foreign. The question is: when is sooner or later? The purpose of this article is to examine that question. Words: 2600 Read More »

13. Niall Ferguson: U.S. Playing “Russian Roulette” Assuming Interest Rates Will Remain Low

Countering Krugman’s argument that today’s low interest rates show that no one is worried about lending money to us and, therefore, that we should borrow and spend our way to prosperity, Ferguson argues that today’s interest rates are irrelevant. When countries get into trouble, he says, they get into trouble quickly – the way Greece and other European countries have. Taking … Read More »

14. U.S. Financial System Will Die When Interest Rates Rise! Here’s Why

Right now, interest rates are near historic lows. The U.S. government is able to borrow gigantic mountains of money for next to nothing. U.S. consumers are still able to get home loans, car loans and student loans at ridiculously low interest rates. When this low interest rate environment changes (and it will), it is going to absolutely devastate the U.S. economy. Without low interest rates, the U.S. financial system dies. [Let me explain.] Words: 1529 Read More »

15. Five BIG Reasons Interest Rates MUST Rise

Brace yourself for one of the greatest interest-rate surges in decades — beginning first in the long-term Treasury markets … later spreading to shorter term Treasuries … and ultimately enveloping nearly every loan, debt, credit, and money market instrument on the planet. This rise may not begin with great fanfare, nor will it immediately upset the apple cart of the economic recovery, but with the march of time, it WILL gain momentum and reach critical mass. Words: 614 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

all good points about credit growth in the is country. no question it takes much more debt today to create one unit of growth. I really think you need to refer to japan and their interest rate reduction policy over the last five years!. I believe the fed has much more room to cut rates. why not drop the 10 year to 1.5%. 30 year paper 2.00%. the shock to the economy you talk about comes about from our overall debt is mostly short term paper! because we have so much debt lenders will not lend long. look for 30 year, fixed rate mortgage money to disappear!