While not widely reported or analyzed, over the past several months there has been an enormous amount of buying in the various markets for physical silver – both one-ounce sovereign-minted coins and refined bars. Along with some standard trading signals I’ll discuss below, I believe the activity in the market for physical silver is signaling the potential for a large upside move sometime this year. Let me explain.

buying in the various markets for physical silver – both one-ounce sovereign-minted coins and refined bars. Along with some standard trading signals I’ll discuss below, I believe the activity in the market for physical silver is signaling the potential for a large upside move sometime this year. Let me explain.

So says Dave Kranzler (investmentresearchdynamics.com) in edited excerpts from his original article* entitled Is Something Big Brewing In Silver?.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Kranzler goes on to say in further edited excerpts:

Silver is Oversold

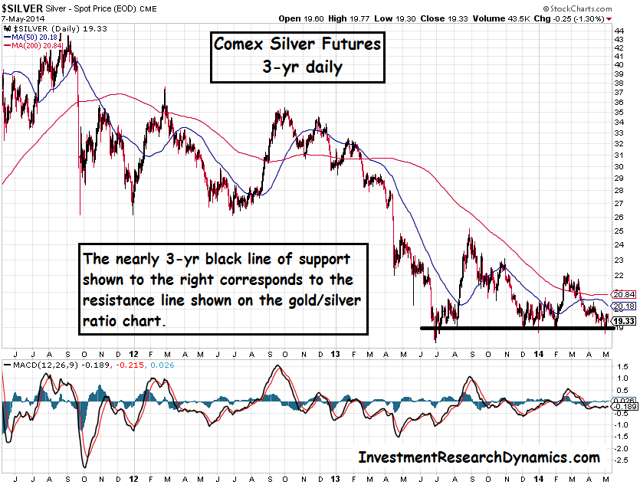

“As you can see from this chart below (source: King World News, edit in white is mine), silver is in its most oversold condition since 1976:

While the 1980 percentage sell-off in silver was greater than the percentage sell-off in silver that started in April 2011, you can see from the MACD momentum indicator on the bottom half of the graph that, technically, silver is more oversold than at any time in the last 28 years. This is significant because it suggests that not only was the 18.56 close on June 27, 2013 most likely the bottom of the big price correction in silver but traders who are short or flat will be looking to cover shorts, start new long positions or add to current long positions on price strength. Thus, from a probability stand-point, silver is more likely to move higher from here than lower.

Record Demand for Silver Coins

- In 2013, the sales of both silver eagles and silver maple leafs hit new record levels. From 2012 to 2013, silver eagle sales increased 26.4% and silver maple leaf sales increased 55.8%…

- The trend has continued into 2014. Despite a 1-month record sales number in January 2013 of 7.5 million silver eagles (a production shortage in December 2012 pushed December sales into January 2013), sales YTD through April 2014 are higher than for January-April 2013 (18.5mm vs. 18mm). Already in the first 4 business days of May, silver eagle sales are nearly half of the sales for the entire month of May 2013.

It seems that as the price of silver continues to drift under $20, silver coin sales continue to increase. At some point the investment demand for physical silver will put a strain on mined supply.

Record Demand for Silver Bars

India

- In 2013, India imported a record 6,125 tonnes of silver…up 189% over what India imported in 2012…in response to the gold import controls put in place by the Indian Government in July 2013, and now represents 21% of the total amount of silver supplied globally from mines, scrap recycling and Government sales…

- In the first two months of 2014, India imported 920 tonnes of silver, or 5,520 tonnes annualized.

In my opinion, the unanticipated demand from India will eventually be reflected in higher silver prices, as the high volume of demand will likely affect relative supply.

Record Withdrawals from Vaults

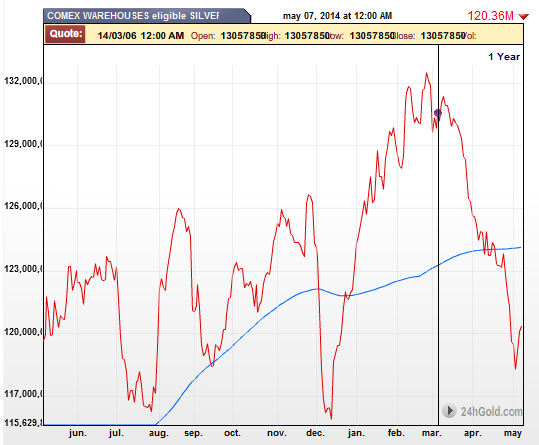

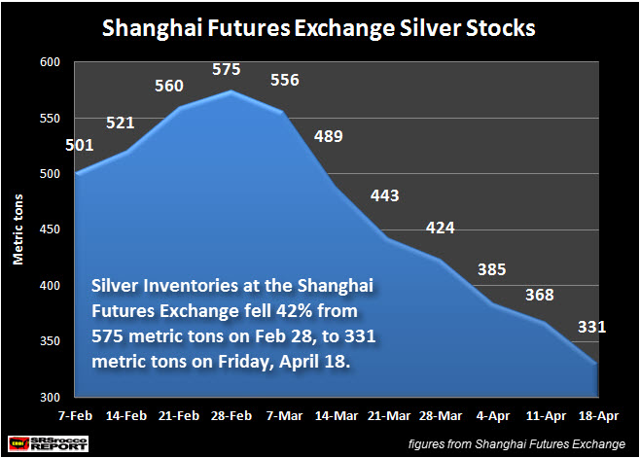

…Recently an extraordinary amount of silver has been withdrawn from both the Comex and the Shanghai Futures Exchange (SFE) (source: SRSrocco.com):

China

In the week after the above graph was produced, another 73 tonnes were removed from the SFE. Since the end of February, a total of 317 tonnes of silver have been taken out…[and] it is highly probable that this silver was either put away in private investment vaults or used in commercial applications inside of China.

COMEX

Similarly, since the end of February, 368 tonnes of silver have been removed from the…Comex vault accounts… As with China, this silver is either being transferred to private vaults or is being used in industrial applications.

The removal of nearly 700 tonnes of silver from the SFE and the Comex in less than two months, in my opinion, is an indication of an acceleration in demand for silver and an indication that the silver bar market is starting to get tight…[and because of this] the price of silver is going to have to move a lot higher as a mechanism of creating some kind of equilibrium between supply and demand. While above-ground visible stocks of silver, like the Comex, the SFE and the various physical silver bullion trusts are potential sources of supply in excess of mining output and scrap recycling, as those sources of silver become depleted a shortage will develop unless the price of silver moves higher.

Gold/Silver Ratio Signaling Move Up for Silver

Finally, the current gold/silver ratio is signaling the potential for at least a big short-term move higher for silver:

Source: StockCharts.com

As you can see, the gold/silver ratio is back up to the level it hit at the end of July 2013, right before silver spiked up from $19 to $25:

Source: StockCharts.com

Although it may not seem like it, gold has been one of the best performing investments YTD in 2014. In comparison, silver is slightly down for the year. If the gold/silver ratio repeats its “behavior” from last summer, it is highly probable that silver will spike higher from here, at least in the short term.

Conclusion

I believe that:

- we are still in the secular bull market for gold and silver that began in 2001. The first two legs of this bull market topped out in 2006 and 2011,

- that we are about to enter the third leg and that this third leg will experience even bigger percentage gains than what occurred in the first two legs…

- the fundamental shortages of physical gold/silver that can be delivered to the possession of large buyers will drive the price movement.

The above being the case, I believe that the trading and fundamental factors as I analyzed them are the start of this process and, in the context of my analysis, I believe silver will ultimately experience significantly higher rates of return than gold over the next few years…”

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/2207703-is-something-big-brewing-in-silver (© 2014 Seeking Alpha )

Related Articles:

1. Gold:Silver Ratio Suggests Much Higher Future Price for Silver – MUCH Higher!

The majority of analysts maintain that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and it is realistic to expect that silver will eventually escalate dramatically in price. How much? This article applies the historical gold:silver ratios to come up with a range of prices based on specific price levels for gold being reached. Words: 691 Read More »

2. There’s a New “Silver Sheriff” in Town & He’s NOT American!

There’s a new Silver Sheriff in town, and it happens to be located north of the U.S. border. While [American] Silver Eagle sales and growth were impressive in 2013, [Canadian] Silver Maple Leaf sales outgunned the competition by a wide margin. [By how much? Take a look.] Read More »

3. Stock Market Will Collapse In May Followed By Major Spike in Gold & Silver Prices! Here’s Why

The unintended consequences of five years of QE are coming home to roost! In May or early June the stock market parabola will collapse…followed by a massive inflationary spike in commodity prices – particularly gold & silver – that will collapse the global economy. Read More »

4. Silver Has the Potential to Increase 4-Fold From Today’s Price – Here’s Why

The price ratio of gold to silver has fallen precipitously in raging bull markets for the metals, so the silver price could have an upwards move at four times the rate of any gold price increase. I think that the fundamentals look better than ever, and…[that] there is an explosive move coming in 2014. [Indeed,] I think that within a reasonable timeframe silver will probably trade over $100. Read More »

5. Massive Debt Levels Will Push Silver To $150 And Beyond

The process of the devaluation of gold and silver, started by the demonetization of gold and silver, is about to reverse at a greater speed than ever before. Read More »

6. The Most Explosive Turnaround to the Upside — EVER — Is Coming In the Precious Metals Sector

I am 100% confident that 1) precious metals will bottom this year and resume a new leg to the upside, 2) the extreme emotions right now regarding gold and silver are typical at major turning points and 3) all the underlying fundamental, cyclical and technical conditions for a new bull market in gold and silver are in place. Here’s an update on the latest action in gold, silver, platinum and palladium Read More »

7. Why Demand For Gold Keeps Expanding In China & India

Lifted by a continued surge in Asian gold sales, consumer demand for gold reached an all-time high in 2013 at 3,893 tonnes. Amazingly, 54% of this demand came from two places: India and China. However, it is only recently that the East has dominated global demand for the yellow metal. In this infographic, we look at India and China specifically to see why demand keeps expanding in the East. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Since Silver is less expensive to acquire, I think of it as the “Common Mans” Gold and as such, it allows far more investors to use Silver as an excellent method of protecting some of their wealth from potential fluctuations in the value of their currency.

Another key issue is that many fear that their Government will confiscate all private Gold holding and that leaves holding Silver as yet another legal manner to sidestep both Government currency fluctuations and Gold regulations, which will give those holding Silver more time to re-position themselves should their currencies values start changing.

I’d be interested in what other readers think of holding Silver vs Gold and Silver’s role in protecting ones holding in an uncertain future.