The Canadian housing market is deep into bubble territory. We all know that bubbles can go on for longer than most people think but with the crash in oil prices and people fully believing their own hype, the market is set up for a big fall from grace. Canadian households are deep into debt and make American households look like penny pinchers. Here are five charts showing that the implosion in Canada’s housing market is inevitable.

longer than most people think but with the crash in oil prices and people fully believing their own hype, the market is set up for a big fall from grace. Canadian households are deep into debt and make American households look like penny pinchers. Here are five charts showing that the implosion in Canada’s housing market is inevitable.

By mybudget360.com. [The article* was originally posted under the title The Canadian housing market will implode in dramatic fashion: 5 charts highlighting the inevitable pop to Canada’s real estate boom. An almost identical article** by $hane Obata was posted on SoberLook.com under the title The Canadian housing market – in charts. Who plagiarized from whom is unknown as no attributions were provided in either of the aforementioned articles.]

It is interesting how most from the outside can see what is coming but those within the system just can’t accept the fact that prices are massively overvalued…Virtually all analysts did not see the massive correction in oil hitting late in 2014 – but it did.

Many within Canada especially those tied to the real estate industry are deep into a trance believing they are immune to the economic rules that apply to all economies. The economy is dependent on oil and construction and both of those industries are taking hits yet, somehow, home prices will continue to move up – just because.

Canadian households are deep into debt and make American households look like penny pinchers. Here are five charts showing that the implosion in Canada’s housing market is inevitable.

#1 – Canadian Housing Market Didn’t Correct During Global Recession

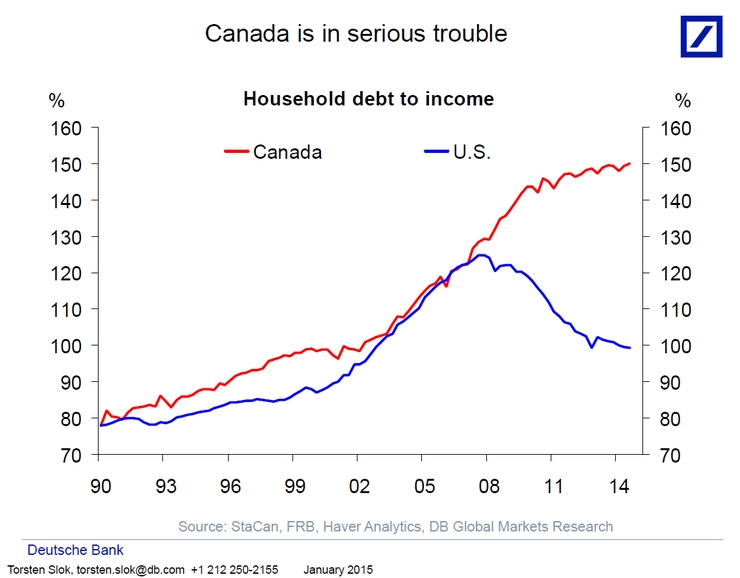

Unlike the U.S. housing market that did suffer a dramatic correction, Canada’s housing market continued going up right through the global recession. Households in the U.S. did deleverage, mostly by force of foreclosures and bankruptcies, while in Canada many households simply double-downed right through the Great Recession.

#2 – Canadian Consumer Debt Is Now Massive

Canadian households are deeper in debt relative to income compared to what the Americans were at the apex of the credit-induced bubble. Take a look at this chart:

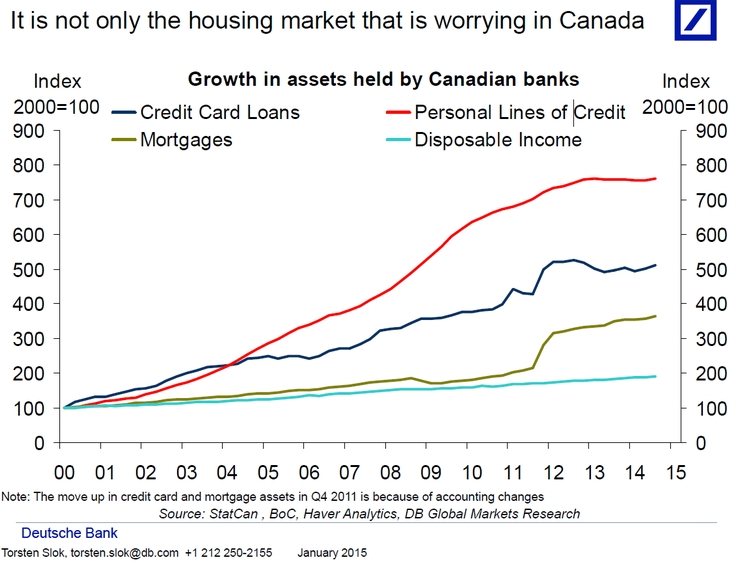

Credit card debt and personal lines of credit are expanding much faster than mortgage debt which is already going off the charts. Look at the light blue line of income growth. This is a debt induced boom and all the data points to this. [A look at the chart below shows that]…Canadians are not using their debt any more wisely than the Americans did.

Now you have the circular business environment where you need real estate to stay inflated to keep things going…

#3 – Canadian Economy Is Heavily Dependent On Construction

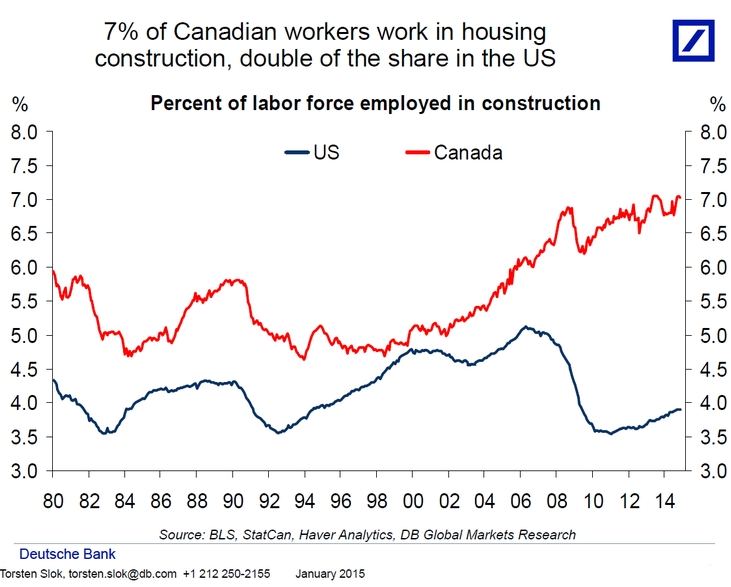

As the chart below shows a big part of the economy in Canada depends on construction at nearly twice the percentage of the U.S. economy…so building must go on to sustain the current structure – but the structure is built on massively inflated prices. What happens when the rate of growth slows down?

#4 – Home Prices In Vancouver/Victoria and Toronto Overvalued

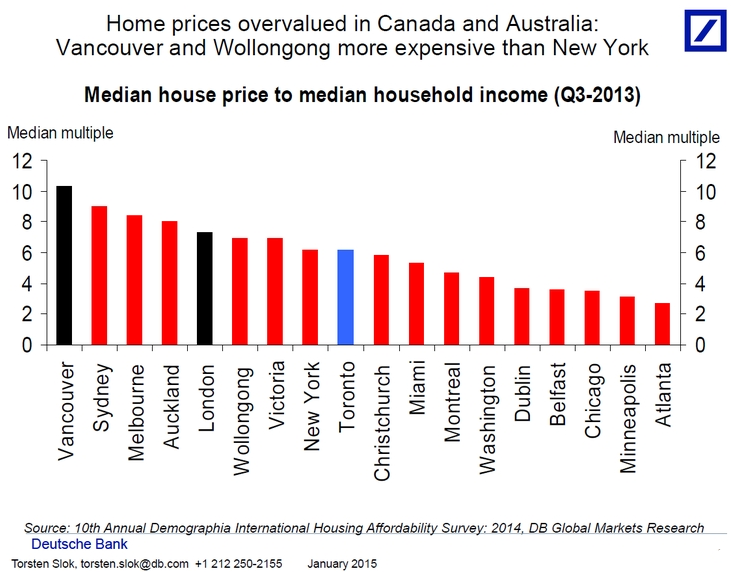

Take a look at some of the most inflated cities in the world. Vancouver and Toronto take the cake here:

Vancouver is enjoying the flood of hot money from foreign money especially from China…and is also fully dependent on that hot money continually flowing in.

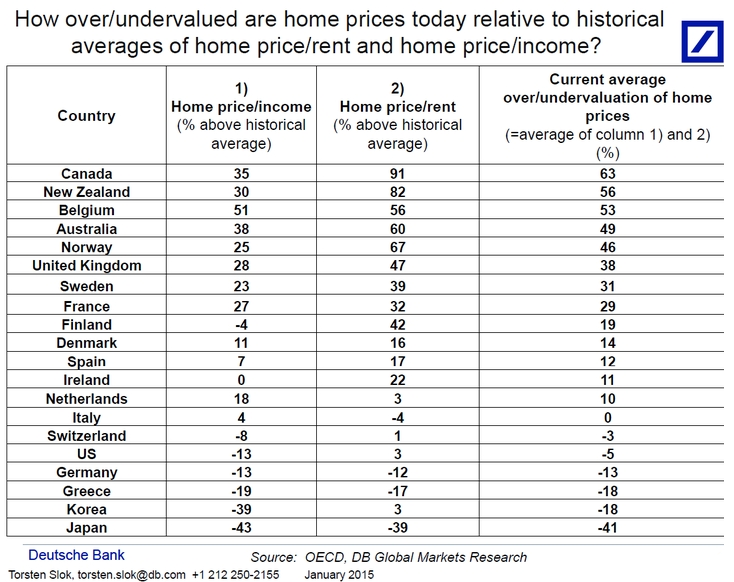

#5 – Canada Has One Of the Most Inflated Housing Markets In the World

Canada’s housing market is one of the most inflated in the world with…prices overvalued by 35% relative to historical income levels.

Of course people will say this does not matter thanks to low interest rates on mortgages but debt is debt. Let us see how someone feels when they buy a condo and see the price plummet by 20 percent how easy it is to swallow that big monthly payment especially with stagnant income growth.

Conclusion

Canada’s housing market is going to have a meeting with reality soon. As we all know [from our experience] in the U.S., bubbles can go on for much longer than we think but, inevitably, bubbles pop, [and when they do,] they make a loud sound.

[The above article is presented by Lorimer Wilson, editor of www.munKNEE.com and www.FinancialArticleSummariesToday.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Original sources: *http://www.mybudget360.com/canada-housing-bubble-canadian-real-estate-bubble-set-for-bust/ (If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!); **http://soberlook.com/2015/02/the-canadian-housing-market-in-charts.html (Content copyright 2009-2015. SoberLook.com. All rights reserved; Subscribe here to the Daily Shot newsletter)

Related Articles:

1. Housing Bubble Threatens Financial Stability of Canada – Here’s Why

Over the last 14 years, house prices in Canada have increased by 150%, twice as fast as in the U.S…[and] far outpacing household incomes. Any increase in interest rates would prick the bubble, and its implosion would trigger all sorts of mayhem to the point that the Canadian government has expressed concerned that such an event would be a significant risk to the “stability of the financial system”. Read More »

2. Canada’s Housing World’s Most OverValued – Where Does Your Country Rank?

Canada’s housing market is the most expensive in the world – 60% overvalued by historical standards – and one simple reason explains it. Read More »

3. Is a Real Estate Bust Coming to Canada – Finally?

The Canadian housing market is headed for a significant bust, in my view. It’s going to be a repeat of the 2008 mortgage bubble deflation. Only it’s happening to the north. People will lose a lot of money but those who understand and are properly positioned may gain fortunes. Read More »

4. Home Price Appreciation Highest In New Zealand, Canada & Australia. Where Do U.S. & U.K. Rank?

This post takes a look at the appreciation (or in some cases, depreciation) of home prices in 11 developed markets. New Zealand, Canada and Australia are in a league of their own at the top, while Germany, Ireland and Japan are at the bottom. Where are the U.S. and the U.K.? Read on! Read More »

5. Canadian Debt-to-Income Ratio Has Entered the Danger Zone! Is a Housing Crash Imminent?

The Canadian ratio of debt to income hit 163.4% in the second quarter, up from 161.7% at the end of last year, according to figures released Monday by Statistics Canada. That’s the highest ratio of debt to income ever recorded in Canada, and more inflated than the levels witnessed in the U.S. and Britain before their housing market collapses in the mid-2000s. Words: 625 Read More »

6. Canada Could Be Developing a Minsky Moment In Real Estate – Here’s Why

According to the Case-Shiller 10-City index Canadian house prices only appreciated by 84% between 1990 and 2006 compared to 181% in the U.S.. However, as U.S. prices plunged by almost 33% between the peak in April 2006 and the trough in May 2009, the chart below shows that Canadian home prices continued to rise, driven by very low interest rates and relatively benign unemployment. By July 2012, they had reached similar heights as U.S. prices before their decline and fall. I believe that house prices and consumer debt levels are overextended in Canada and that a “Minsky-moment” may be developing in Canadian credit markets. [Let me explain why I have come to that conclusion.] Words: 1892 Read More »

7. Still NO Housing Bubble in Canada – So What Will Cause Prices to Finally Correct?

Canada’s housing prices continue to escalate [there has been no housing collapse as there has been in the U.S., Spain, U.K., Australia and elsewhere over the past 4-6 years] but concern is rising as to whether they are now, finally, ‘in a bubble’ and about to correct either modestly or severely. This article discusses what would cause a change in direction in Canadian housing prices. Words: 500 Read More »

8. Are Surging Home Prices in Canada Finally Due For a Major Correction?

Given the global economic backdrop, and in particular the sharp correction in energy prices to which Canada is highly exposed, the risks of a Canadian housing correction are rising. Home prices, which corrected about 10% during the recession, have surged again, making household balance sheets look increasingly fragile. Economists are becoming concerned. [Should Canadians be worried too? Let’s review the situation.] Words: 280 Read More »

9. Will Canada Soon See a 20-30% Correction in House Prices?

Canadians are becoming increasingly vulnerable to a housing correction, exposing them to a perfect storm of high debt and falling assets, the Bank of Canada warns…suggesting that many Canadians have constructed their finances on a house of cards, with ever rising home values the key and vulnerable support. [Sound familiar?] Words: 770 Read More »

10. Housing Collapse Coming to Canada? House Price-to-Rent Ratios vs. America’s At Peak Suggest So

The ownership premium in Canada’s largest cities is unprecedented, dangerous to new buyers, and unlikely to persist – and if analogies to the U.S. situation at its peak back in 2005 are at all valid, this is bad news. [Let me explain.] Words: 430 Read More »

11. Unlike the U.S and U.K, Canada’s Home Prices Are STILL Rising!

Canada, France and Switzerland stood alone among nine markets measured in recording annual price gains, based on second-quarter data, with inflation-adjusted price increases of 5%, 5% and 4%, respectively, compared to declines of 6% in the U.S., the U.K. and Australia, 10% in Spain and 14% in Ireland. In fact, Canada’s home prices have escalated 44% since 2005 – with a high of 68% in Vancouver – and they are up 7.7% in the past 12 months! Words: 1244 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money