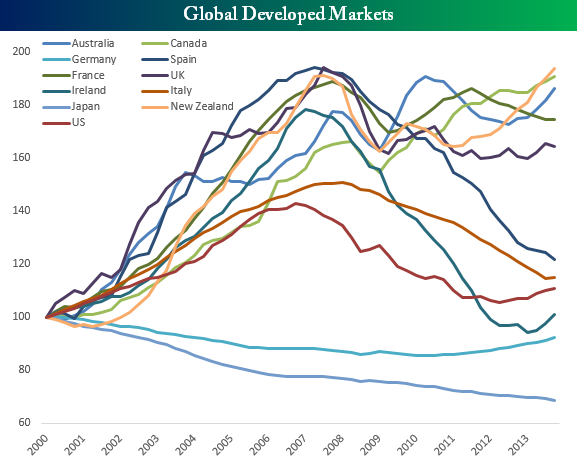

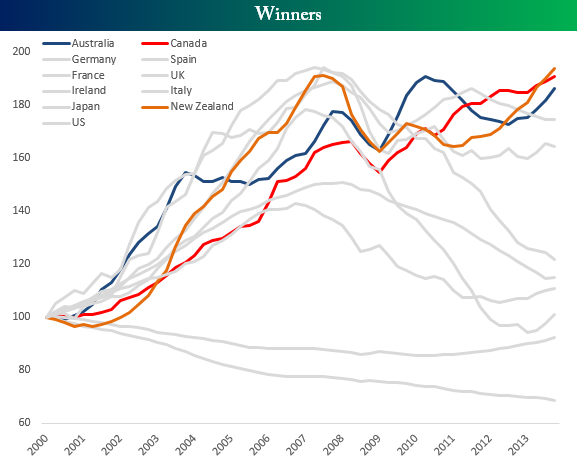

Below is a chart of 11 developed-market home price indices indexed to 100 as of Q1 2000. The data is taken from the Dallas Federal Reserve’s analysis of global home prices, and uses the real prices of homes: prices adjusted for inflation using the PCE deflator for each country in question.

The above chart is a bit hard to read, so we’ve parsed it out into several charts below.

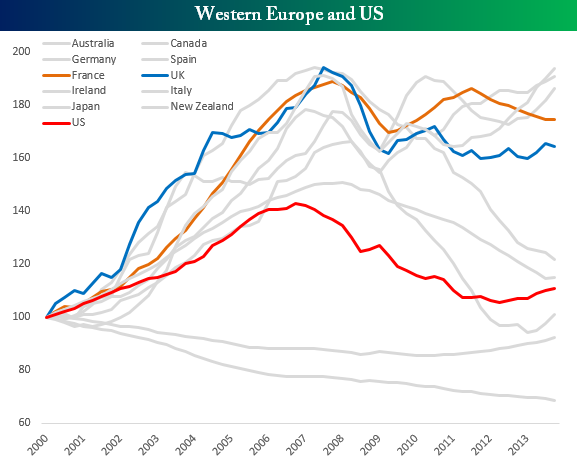

The U.S. has definitely begun to recover from its grinding downtrend in home prices.

[The BusinessInsider.com has a post** in which it reports that, “according to the new Case-Shiller report, the index of 20 cities was up just 0.19% month-over-month and 10.82% year-over-year [but that] on a seasonally-adjusted month-over-month basis home prices were down in five metro areas: Cleveland (-0.6%), Washington (-0.4%), New York (-0.3%), San Diego (-0.3%), Atlanta (-0.03%).Here’s the chart from TD Securities highlighting how many of the 20 cities see monthly price increases and decreases.”]

TD Securities/Business Insider

TD Securities/Business InsiderThe U.K. appears to be relatively stable since the end of the global recession in 2009.Home prices aren’t accelerating aggressively upwards on an aggregate basis, mostly because the concerns of a housing bubble are rooted in one specific area, London.

France, more closely integrated to the European continent and exposed to the deflationary pressure of the eurozone, had a recovery following the recession but has now been trending downwards again for some time.

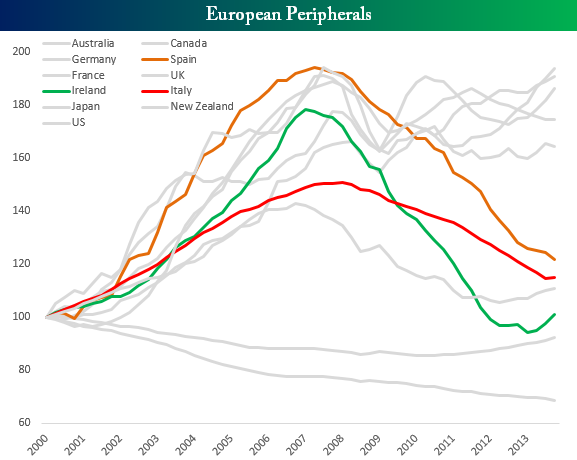

Among peripheral countries, there hasn’t been a recovery, as home prices are still seeking out a bottom after the massive reversal off all-time-highs in 2007.

Ireland is showing signs of life.

Spain and Italy haven’t put in a bottom yet.

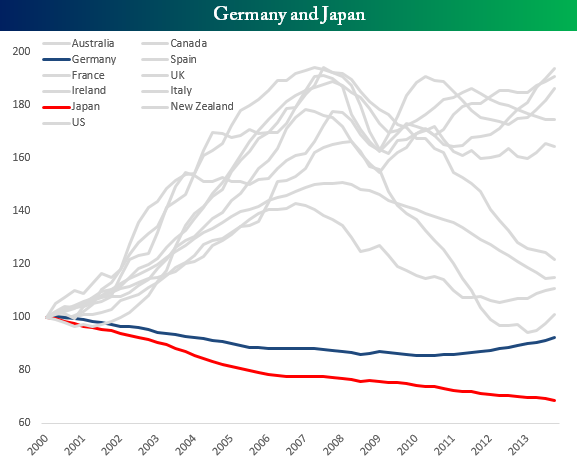

Germany and Japan stand out on the chart as consistent losers when it comes to home price appreciation. Neither market jumped off the line in 2000 – unlike virtually every other economy – and in Japan that deflationary downward trend is constant. The differences are part cultural, part economic.

In Japan, housing is viewed much more as consumption than investment, and local zoning restrictions in markets like Tokyo are often over-shadowed by the government’s focus on constant building and re-building, creating more turnover and density in housing structures.

In Germany, the rental market is much more active and home ownership rates are lower; the German tax code also doesn’t have a deduction for mortgage interest like many other developed economies.

Finally to the good news, for current homeowners anyways.

English-speaking former U.K. colonies are by far the most aggressively expensive home price cohort.

The boom/bust cycle in home prices for Australia, New Zealand, and Canada was much shorter than it was for other economies, and now prices are grinding steadily higher again; Canada and New Zealand are the only two advanced economies at all time highs for home prices.

- The Canadian market, driven by foreign investment in cities like Vancouver and a boom in oil production throughout the central provinces, especially Alberta, is trending strongly to the upside.

- Australia had a mini-cycle downwards but is now once again moving up.

- New Zealand is the real winner among the 11 economies. Home prices there have gone up by more than 93% since 2000, the best performance of any advanced economy. It’s no surprise then that the Reserve Bank of New Zealand hiked interest rates at their last meeting.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.bespokeinvest.com/thinkbig/2014/6/22/global-home-price-values.html (This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License. Bespoke Premium subscribers get this kind of anaylsis delivered right to their inbox. Try Premium out today with a five day free trial!)

**http://www.businessinsider.com/us-home-prices-decouple-2014-6 (Copyright © 2014 Business Insider Inc. All rights reserved.

Related Articles:

1. Canada’s Housing World’s Most OverValued – Where Does Your Country Rank?

Canada’s housing market is the most expensive in the world – 60% overvalued by historical standards – and one simple reason explains it. Read More »

2. Is a Real Estate Bust Coming to Canada – Finally?

The Canadian housing market is headed for a significant bust, in my view. It’s going to be a repeat of the 2008 mortgage bubble deflation. Only it’s happening to the north. People will lose a lot of money but those who understand and are properly positioned may gain fortunes. Read More »

3. Canadian Debt-to-Income Ratio Has Entered the Danger Zone! Is a Housing Crash Imminent?

The Canadian ratio of debt to income hit 163.4% in the second quarter, up from 161.7% at the end of last year, according to figures released Monday by Statistics Canada. That’s the highest ratio of debt to income ever recorded in Canada, and more inflated than the levels witnessed in the U.S. and Britain before their housing market collapses in the mid-2000s. Words: 625 Read More »

4. Canada Could Be Developing a Minsky Moment In Real Estate – Here’s Why

According to the Case-Shiller 10-City index Canadian house prices only appreciated by 84% between 1990 and 2006 compared to 181% in the U.S.. However, as U.S. prices plunged by almost 33% between the peak in April 2006 and the trough in May 2009, the chart below shows that Canadian home prices continued to rise, driven by very low interest rates and relatively benign unemployment. By July 2012, they had reached similar heights as U.S. prices before their decline and fall. I believe that house prices and consumer debt levels are overextended in Canada and that a “Minsky-moment” may be developing in Canadian credit markets. [Let me explain why I have come to that conclusion.] Words: 1892 Read More »

5. U.S. Housing Market Has All the Makings of a Turnaround – Look for Yourself

If I had to guess, I would say that a majority of people in the country still view the housing market in a negative light. They note: •the still-large overhang of foreclosed properties, •the still-low rate of new housing starts, and •the still-depressed level of housing prices in many parts of the country but that is looking at the market from a static viewpoint. There have been some very important improvements in the housing market over the past 18 months…that have all the makings of a clear turnaround that is underway and likely to continue. [Let me explain.] Words: 388 Read More »

6. Talk of “Bright Future” for Real Estate Just a Bunch of Nonsense – Here’s Why

All of this talk about a “bright future” for real estate is just a bunch of nonsense. The yield on 10-year U.S. Treasuries is starting to rise aggressively again and, because mortgage rates tend to follow such increases, mortgage rates are going up. As monthly payments go up less people will be able to afford to buy homes at current prices and this will force home prices down. As such, another great real estate crash is inevitable. Let me explain further. Words: 995 ; Charts: 1 Read More »

7. This Detailed Analysis Suggests the U.S. Housing Crash Is Finally OVER!

For the past few months, existing home sales levels have been weaker than expected. The focus, however, should not be on the weakness of the headline numbers. In actuality, the softening in existing home sales is showcasing the potential for acceleration in new home sales. [Let me expain.] Words: 1205 Read More »

8. Many Not So Sure That Our Housing Problems Are Behind Us – Here’s Why

With recent numbers positive for housing realtors, politicians, and others with vested interests, are quick to claim we are on our way back – but are such numbers really meaningful and sustainable? Many more objective analysts, however, are less sure or disagree with this conclusion that the bottom has been reached yet. Here’s what some of them have to say. Words: 1377 Read More

9. Is a House/Condo a Good “Investment”? Hardly! Here’s Why

Most people seem to think owning a house is a great “investment” but, in actual fact, when you look at the numbers closely, such an acquisition is anything but. Let me explain with supporting evidence. Read More »

10. The Average Home “Owner” Is Totally Out of Touch With Reality! Here’s Why

A recent Gallup survey on expected future returns of asset prices shows that most Americans still think that owning a home is the best way to generate a high return in the future. Nothing could be further from the truth! It just shows how totally out of touch with reality the average American is. Read More »

11. Your House: A Home, An Investment or a Ponzi Scheme?

In the past few decades, the concept of home ownership has been completely turned on its head. Previously, homes were considered a very long-term consumption good…[No one] ever considered tripling the value of their homes by retirement time and selling them to move beachside yet, somehow along the way, this became a reasonable investment expectation. Even today, home buyers still make their purchases with the hopes of escalating prices. [It begs answers to these questions: Is a house just a home? Should a house be expected to behave like an investment? Is the housing game nothing more than a Ponzi scheme where the end buyer before the market corrects becomes the “greater fool”? Let’s try and answer those questions.] Words: 935 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I wonder if those Countries with the highest increases are seeing those increases because people are moving to those Countries “from” the Countries with the lowest numbers and/or people from outside those Countries are investing in Real Estate in those Countries with the highest rates of increases…