Most people seem to think owning a house is a great “investment” but, in actual fact, when you look at the numbers closely, such an acquisition is anything but. Let me explain with supporting evidence.

numbers closely, such an acquisition is anything but. Let me explain with supporting evidence.

So says Cullen Roche (pragcap.com) in edited excerpts from his original article* entitled Is a House Really a Good “Investment”?

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Roche goes on to say in further edited excerpts:

Let’s take a closer look here at this asset class that so many seem to believe is a good “investment” but, before we start, it might help to think of a house as two distinctly different pieces.

- First, there is the land that you own. The land is what I would call an “investment” since it’s highly probable that the land itself will appreciate in value over time.

- Second, there is the actual house itself. The house itself, however, is a depreciating asset that is guaranteed to fall apart just like your car will. If it has any intangible “investment” components those are subjective and not necessarily financial (though I guess they could be, for instance, if you work from home).

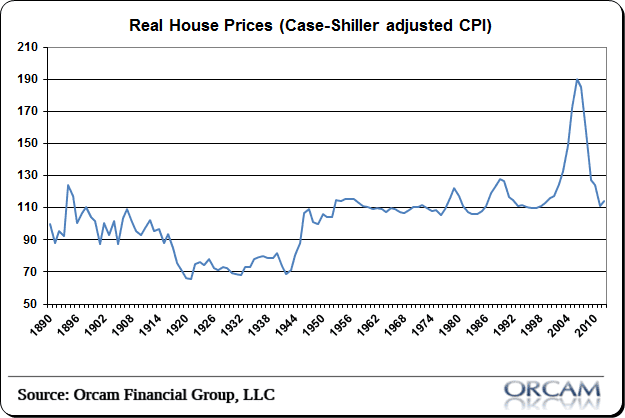

Anyhow, if you’re familiar with Robert Shiller’s work you have likely seen figure 1 below showing real house prices since 1890.

- Since 1890, housing in the USA has averaged a 3.2% annualized return.

- It’s been slightly better since 1960 at 4.2%,

- a bit better than that since 1970 (4.8%) and

- more in-line with the historical average since 1980 (3.8%).

That might not sound so bad were it not for inflation. Inflation has historically averaged about 3.2% as well. Hence the chart below which shows housing prices close to the 100 level throughout their history. Said differently, real estate doesn’t generate a return at all when you back out inflation.

Anyone who works in the financial services business knows that there are always costs attached to purchasing various financial assets. Most of these fees are recurring of some sort and can range from the reasonable (like ETF’s or discount brokerage fees) to the absurd (most hedge fund fees or annuities). Real estate is not immune to the fees and the costs arise in ways that are even better disguised than a bulge bracket brokerage statement.

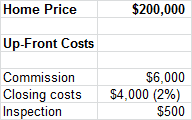

Like all financial asset purchases you are guaranteed to start your purchase in the red by the amount of the fees involved in purchasing the asset. Homes are an unusual financial asset in that they’re extraordinarily expensive from an up-front cost perspective. You have realtor commissions, closing costs, inspection, appraisal, insurance and a whole slew of other potential costs such as moving or maintenance. This is before you’ve even stepped foot into your “investment” and before you’ve started paying the real fees (like your mortgage, which will cost you almost 75% of the cost of the home over the life of a 30 year mortgage AND the maintenance)!

For simplicity, let’s take an example of a home worth $200,000 and assume some relatively modest up-front costs. Let’s also assume, like most Americans, that we have a fixed rate 30 year mortgage at 5.5%. Let’s also assume some fairly conservative estimates for commissions (which I split because one could argue that both the buyer and seller pay the fee), closing costs and inspection. Nothing too complex (I know, I am oversimplifying!) but the total comes out to about 5.25% of the cost of the house. That’s similar to buying an A-share mutual fund, which is something that you only do if you’re suffering from sort of degenerative brain defect.

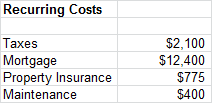

We’re really just getting started with the fees involved in this financial asset! Over the life of a home you’ll have to pay taxes, mortgage payments, property insurance, utilities, water, disposal and routine maintenance. These are all fixed costs and whether you rent or buy you’ll have to pay some of these fees no matter what. So let’s throw out utilities, water and disposal with the assumption that your rental option has those costs embedded but, when you own a home, you’re still paying the mortgage, taxes, property insurance and you’ll have to maintain the property yourself.

According to the 2009 American Housing Survey these costs come out to about 7-8% of the value of the home per year. Here’s the breakdown:

Now, that mortgage “cost” includes principal payments so let’s just take the average national mortgage rate according to the AHS and assume that the 30 year mortgage will cost you roughly $165,000 over the life of the mortgage (this is JUST the interest paid). Using a basic amortization schedule it’s pretty safe to assume a monthly interest payment of $800 or $9,600 per year. That brings our annual costs down to about 6.5%. You could also back out part of the taxes due to the mortgage deduction so let’s be generous and assume that our home costs us about $10,000 per year or roughly 5% of the mortgage. Even in the best periods where real estate returns 4.8%, the total return is still negative! That’s one expensive financial asset and it brings our real, real return down to -5% per year assuming we break-even after inflation.

The Bottom Line

Don’t worry. This post isn’t intended to wreck the “American dream”. None of this analysis means that buying a house is a bad idea. You have to live somewhere and this analysis does not compare the specifics of renting versus the specifics of buying a house outright, buying a house with a mortgage or using the property as an income source. The analysis is simply intended to put the total costs and real, real returns in the right perspective for those of us who buy a house with a mortgage and live in that home (as most people do).

In my personal opinion, I view buying a home as a less expensive way to live than the option of renting (but I guess you could make both arguments depending on where you live) plus there are numerous intangibles involved in owning your own home that make it a wise purchase. Nevertheless, we should stop thinking about housing or talking about it like it’s an amazing “investment”.

(Figure 1 – Real house prices)

(Figure 1 – Real house prices)

Conclusion

Whether you rent or buy you are experiencing an expense. The real costs of that expense will depend on your specific situation. In both real returns and real, real returns (including taxes and fees) the returns are unlikely to be anything to write home about – and certainly not what I would refer to as a good financial “investment”.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://pragcap.com/a-house-is-not-a-great-investment (Copyright © 2014 All Rights Reserved)

Related Articles:

1. The Average Home “Owner” Is Totally Out of Touch With Reality! Here’s Why

A recent Gallup survey on expected future returns of asset prices shows that most Americans still think that owning a home is the best way to generate a high return in the future. Nothing could be further from the truth! It just shows how totally out of touch with reality the average American is. Read More »

2. Your House: A Home, An Investment or a Ponzi Scheme?

In the past few decades, the concept of home ownership has been completely turned on its head. Previously, homes were considered a very long-term consumption good…[No one] ever considered tripling the value of their homes by retirement time and selling them to move beachside yet, somehow along the way, this became a reasonable investment expectation. Even today, home buyers still make their purchases with the hopes of escalating prices. [It begs answers to these questions: Is a house just a home? Should a house be expected to behave like an investment? Is the housing game nothing more than a Ponzi scheme where the end buyer before the market corrects becomes the “greater fool”? Let’s try and answer those questions.] Words: 935 Read More »

3. Canada’s Housing World’s Most OverValued – Where Does Your Country Rank?

Canada’s housing market is the most expensive in the world – 60% overvalued by historical standards – and one simple reason explains it. Read More »

The Canadian housing market is headed for a significant bust, in my view. It’s going to be a repeat of the 2008 mortgage bubble deflation. Only it’s happening to the north. People will lose a lot of money but those who understand and are properly positioned may gain fortunes. Read More »

5. Talk of “Bright Future” for Real Estate Just a Bunch of Nonsense – Here’s Why

All of this talk about a “bright future” for real estate is just a bunch of nonsense. The yield on 10-year U.S. Treasuries is starting to rise aggressively again and, because mortgage rates tend to follow such increases, mortgage rates are going up. As monthly payments go up less people will be able to afford to buy homes at current prices and this will force home prices down. As such, another great real estate crash is inevitable. Let me explain further. Words: 995 ; Charts: 1 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money