History has shown us that all financial bubbles eventually burst. It is not a question of “if” they will burst. It is  only a question of “when” and when the 7 current financial bubbles in America burst, the pain is going to be absolutely enormous. That being said, how much time do you believe that we have before these bubbles start to burst?

only a question of “when” and when the 7 current financial bubbles in America burst, the pain is going to be absolutely enormous. That being said, how much time do you believe that we have before these bubbles start to burst?

The above introductory comments are edited excerpts from an article* by Michael Snyder (theeconomiccollapseblog.com) entitled Bubbles, Bubbles Everywhere.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Snyder goes on to say in further edited excerpts:

Is there any doubt that we are living in a bubble economy? At this moment in the United States we are simultaneously experiencing:

- a stock market bubble,

- a government debt bubble,

- a corporate bond bubble,

- a bubble in San Francisco real estate,

- a farmland bubble,

- a derivatives bubble and

- a student loan debt bubble.

Similar things could be said about most of the rest of the planet as well. In fact, the total amount of government debt around the world has risen by about 40 percent just since the last recession but it is never sustainable when asset prices and debt levels increase much faster than the overall level of economic growth.

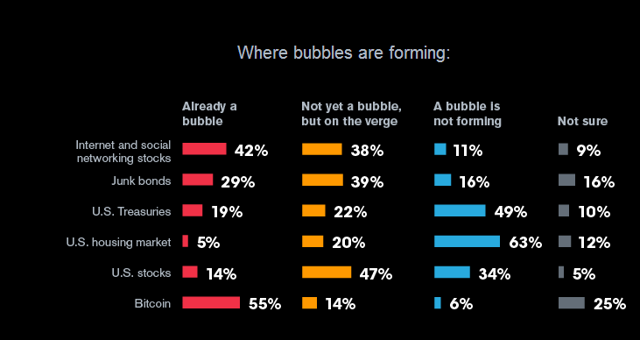

[In a recent poll of investors, Bloomberg found that 47% of those surveyed believed the equity market was close to “unsustainable levels” while 14% already saw a “bubble.” In the high yield bond market, the results were even more alarming, with 70% of those surveyed saying the rally in junk-rated bonds was “in a bubble or close to one.” Source:**Source: Bloomberg Poll]

The Stock Market Bubble

When most people think of financial bubbles the very first thing they think of is the stock market and, without a doubt, we are in a stock market bubble right now. [As illustrated in the chart below] the Dow has risen more than 10,000 points since the depths of the last recession and it is nearly 3,000 points higher than it was at the peak of the last stock market bubble in 2007 when our economy was far stronger than it is now.

These stock prices, however, do not reflect economic reality in any way whatsoever. Our economy has not even come close to recovering to the level it was at prior to the last financial crisis, and yet thanks to massive Federal Reserve money printing stock prices have soared to unprecedented heights.

At some point a massive correction is coming. No stock market bubble lasts forever. For a whole bunch of technical reasons why serious market turmoil is on the horizon, please see…[the large number of articles linked below].

The bubbles in the financial markets have become so glaring that even the central bankers are starting to warn us about them. For example, just consider what the Bank for International Settlements is saying:

“The Bank for International Settlements has warned that “euphoric” financial markets have become detached from the reality of a lingering post-crisis malaise, as it called for governments to ditch policies that risk stoking unsustainable asset booms.

While the global economy is struggling to escape the shadow of the crisis of 2007-09, capital markets are “extraordinarily buoyant”, the Basel-based bank said, in part because of the ultra-low monetary policy being pursued around the world. Leading central banks should not fall into the trap of raising rates “too slowly and too late”, the BIS said, calling for policy makers to halt the steady rise in debt burdens around the world and embark on reforms to boost productivity.

In its annual report, the BIS also warned of the risks brewing in emerging markets, setting out early warning indicators of possible banking crises in a number of jurisdictions, including most notably China.

“Particularly for countries in the late stages of financial booms, the trade-off is now between the risk of bringing forward the downward leg of the cycle and that of suffering a bigger bust later on,” it said.”

Sadly, just like in 2007, most people are choosing not to listen to these warnings.

U.S. Consumer Credit

Another very troubling bubble that is brewing is the massive bubble of consumer credit in the United States. According to the Wall Street Journal, consumer credit in the United States increased at a 7.4 percent annual rate in May…That might be okay if our paychecks were increasing at a 7.4% annual rate, but that is not the case at all. In fact, median household income in America has gone down for five years in a row!

As the quality of our jobs goes down the drain, our paychecks are shrinking even as our bills go up. This is putting an incredible amount of stress on tens of millions of American families.

U.S. Total Debt

When you look at the overall debt bubble in this country, things become even more frightening.

…[There has been] incredible growth of total debt in the United States. Over the past 40 years, it has gone from about 2.2 trillion dollars to nearly 60 trillion dollars [as illustrated in the chart below].

Is this sustainable? Of course not. None of these financial bubbles are. It is not a question of “if” they will burst. It is only a question of “when” and some believe that we are rapidly approaching that point.

It’s the question investors everywhere are wrestling with: Are asset prices in a bubble, or do they simply reflect the fact that the global economy is growing once again? For Marc Faber, editor of the Gloom, Boom & Doom Report, the answer is clear. He says the bubble may already be bursting, “I think it’s a colossal bubble in all asset prices, and eventually it will burst, and maybe it has begun to burst already.”

Conclusion

What do you think? How much time do you believe that we have before these bubbles start to burst?

Please feel free to share your thoughts by posting a comment below [scroll down to the bottom of the page under “Related Articles”].

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://theeconomiccollapseblog.com/archives/bubbles-bubbles-everywhere (Copyright © 2014 The Economic Collapse) **http://pensionpartners.com/blog/?p=544

Related Articles:

1. What Could – What Will – Pop This “Money Bubble”?

There is too much debt. Debt works the same way for a country as it works for an individual or a family, which is to say if you borrow too much, then your life basically craters. Everything gets harder to do, and you end up doing things in order to deal with your past mistakes that you would never do normally. You start trying absolutely crazy things, and that’s where the world’s governments are right now. We are doing all these things that are essentially con games and getting away with it so far, because a printing press is a great tool for fooling people. I don’t see how we can get away with it too much longer. Read More »

2. Today’s Shiller PE Suggests the Stock Market Is Overvalued By 60%!

We estimate that a ‘fair price’ for the market is a Shiller PE of around 16. With the market at close to a Shiller PE of 26, the market is overvalued by about 60%. Now is not a historically good time to initiate a position in the S&P500. Read More »

3. EXPECT & PLAN For A Major Stock Market Correction In the Coming Weeks/Months – Here’s Why & How

The S&P 500 is now up over 180% since troughing in March 2009 and it has been almost 3 years since the stock market experienced a 10% correction. Historically, market corrections happen approximately every 2 years on average. [As such,] we think that this rally is getting very long in the tooth and we wouldn’t be surprised if we have a healthy pullback in the coming weeks or months. Read More »

4. Extreme Greed By the Crowd Suggests You Show Some Fear! Here’s Why

Greed may have been good for Gordon Gekko. but in the investment world it rarely is. As Warren Buffett is famous for saying “…be fearful when others are greedy and greedy when others are fearful” [and now is such a time]…to start showing some level of fear here in the face of extreme greed by the crowd. The crowd can be right for a long time, but they are rarely right at extremes. While this time may be different, the probabilities suggest that at the very least it will be a more difficult environment for equities going forward.

5. Make No Mistake – A Major Stock Sell-off Looms! Here Are 4 Ominous Signs

The 4 fundamentals and technicals discussed in this article accurately called stock market crashes in 2000 and 2007 and these same market metrics are again TODAY warning that a possible financial tsunami is brewing on the horizon. No one knows for certain WHEN the tsunami will hit Wall Street…but, without question, today’s stocks exhibit extremely exaggerated valuations, and extremes never last, so make no mistake, a major stock sell-off looms.

6. These Indicators Should Scare the Hell Out of Anyone With A Stock Portfolio

For US stocks — and by implication most other equity markets — the danger signals are piling up to the point where a case can be made that the end is, at last, near. Take a look at these examples of indicators that should scare the hell out of anyone with a big stock portfolio.

7. Remember the “Nifty 50″? It’s Back! What Does It Means For the Markets Going Forward?

Market historians will recall the term “Nifty 50” originated in the 1960’s bull market to describe 50 wildly popular large-cap stocks at the time. Interestingly, some of the same names from that list are leading the market higher today. The question for investors, of course, is what this selective advance means for the markets going forward.

8. This Is One “Crazy, Nastyass” Stock Market! Here’s Why

You can call this current stock market a blowoff or call it a Wile E. Coyote moment or call it a divergence or call it a disconnect or call it a lapse of judgement. You can call it whatever you want but I call it the “Honey Badger” market because this is one “crazy, nastyass” stock market – and I can’t believe I’m watching it happen all over again. Read More »

9. Are You A Bull Or A Bear? Here Are Indicators & Charts That Support Your Thesis

The current U.S. equity market has something for everyone. Whether you are bullish or bearish, there is no shortage of indicators or charts you can use to support your thesis. Let’s run through both the Bull and the Bear case here. In the spirit of Confirmation Bias, feel free to skip ahead to the part that best supports your current positioning. Read More »

10. Are We In Phase 3 – the Final Phase – of This Bull Market Yet?

Are we in the third phase of a bull market? Most who will read this article will immediately say “no” but isn’t that what was always believed during the “mania” phase of every previous bull market cycle? With the current bull market now stretching into its sixth year; it seems appropriate to review the three very distinct phases of historical bull market cycles. Read More »

11. Is Now the Calm Before the Storm?

I’d argue that the record low volume shows investors aren’t looking ahead as much as looking behind and reminiscing at how good things have been over the past five years or so. They’re expecting more of the same even though it’s mathematically impossible people. Read More »

12. Should You Care What’s Happening On the Nikkei 225? YES! Here’s Why

Should markets around the world really care about what the Nikkei 225 Index does? The Power of the Pattern suggests “yes”! Here’s why. Read More »

13. Collapse of S&P 500 May Be Only Weeks Ahead! Here’s Why

When Staple sector (i.e. defensive) stocks started to reflect greater relative strength than Discretionary sector stocks back in 2000 and again in 2007, the S&P 500 began to fall dramatically in the ensuing months. That’s happening again. Can a collapse of the S&P 500 be far behind? Read More »

14. There’s Evidence – Plenty of It – That the Bear Is No Longer Hibernating. Here’s Why

The health of a market is best assessed along three vectors: fundamentals, technicals (price action) and sentiment and this is what each is saying about the health of the markets these days. Read More »

15. A 20%+ Sell-off is Brewing In the Lofty U.S. Stock Markets – Here’s Why & What the Future Holds

For today’s seriously overextended and overvalued US stock markets the best-case scenario is a full-blown correction approaching 20% emerging soon while the worst case is a new cyclical bear market that ultimately leads to catastrophic 50% losses. Read More »

16. Margin Debt: It Doesn’t Matter ’til It Matters! Is Now the Time to Be Worried About the S&P 500?

It doesn’t matter until it matters! IF margin debt should start decreasing swiftly, history would suggest something different is taking place in the mind of aggressive investors. Will a decline in margin debt from all-time highs matter this time? Read More »

17. 2 Stock Market Indicators Are Saying “Be careful, don’t get caught up in the euphoria”

In the midst of all the optimism we see towards key stock indices these days, there are two leading indicators that are flashing warning signals. They say, “Be careful, and don’t get caught up in the euphoria.” Read More »

18. Beginnings of Massive Stock Market Correction Developing: Don’t Delay, Prepare Today!

No stock can resist gravity forever. What goes up must eventually come down. This is especially true for stock prices that become grotesquely distorted. We have been – and still are – living in another dotcom bubble, and – like the last one – it is inevitable that it is going to burst. Read More »

19. 3 Historically Proven Market Indicators Warn of an Impending Market Top

It’s frustrating to see key stock indices keep pushing higher when historically proven market indicators are all warning of a crash ahead. Irrationality is exuberant to say the very least, and that’s why I believe this rally is counting its last days. Read More »

20. The Stock Market Is a Risky Place to Be – Here’s Why

With both the fundamentals and the technicals saying the stock market is a risky place to be, we await its crash back to reality. Here’s why. Read More »

21. A Crash of the Financial & Monetary System Seems Inevitable. Here’s Why & How to Prepare

A crash of the financial and monetary system seems inevitable. This presentation connects the dots between issues like currency wars, rigged markets, central bankers’ interventions, statistics manipulation, monetary mismanagement and financial repression in a factual way that is also easy to understand. Read More »

22. Next Bear Market Shaping Up To Be Quite the Storm – Here’s Why

The U.S. stock market has been closing at one record high after another but, despite the seemingly unending investor optimism more than five years into the current bull market, some worrisome issues are continuing to build under the surface. Like all past bull markets, the latest episode will eventually come to an end and a new bear market will begin and it has the potential to be even worse than the two previous downturns since the start of the new millennium… Read More »

23. Derivatives Are Nothing More Than A “Game” of Russian Roulette! Here’s Why

Russian Roulette: Put one bullet in the cylinder of a revolver, spin the cylinder, point the gun at YOUR head, and pull the trigger. Most revolvers have 6 chambers, so your odds of surviving are 5 in 6, IF you quit after pulling the trigger once. Press your luck, spin the cylinder, point the gun, and pull the trigger again. It might be okay. Try for a third time? Now let’s play Russian roulette – derivatives style. Read More »

24. $17+ Trillion U.S. National Debt Adversely Affects Every American – Here’s Why & How

For the first time in U.S. history, the national debt has risen past $17 trillion. That number is a bit hard to comprehend and means little to Americans when not applied to their everyday lives. So just how does the national debt affect consumers, and why should the average American care about how much this country owes? Here’s why and how. Read More »

25. Average American Can’t Afford To Own A House – Here’s Why

Regular home buyers are wondering why they are unable to partake in the American Dream of owning a home now that they actually have to document their income and put some skin in the game. The reason is that the current median selling price of $201,000 puts real estate out of reach for most Americans earning the typical $50,000 a year unless they go into massive levels of debt. They are too broke to own a home! Read More »

26. Bursting of Global Derivatives Bubble Will Be An Utter Nightmare

Never before in the history of the United States have we been faced with the threat of such a great financial catastrophe but, sadly, most Americans are totally oblivious to all of this. They continue to have faith that their leaders know what they are doing, and they have been lulled into complacency by the bubble of false stability that we have been enjoying for the last couple of years. Unfortunately for them, however, this bubble of false stability is not going to last much longer and when the financial crisis comes it is going to make 2008 look like a Sunday picnic. Let me explain why I believe the aforementioned to be the case. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Whatever IT is, when it happens it will either happen slowly or quickly and depending upon what speed IT happens, investors will either have little or NO time to respond!

To me that is the biggest reason to consider adding some PM to the portfolio’s you administer!

Also posted here: https://gos.ixm.mybluehost.me/will-pop-money-bubble/#comment-135524