Gold, like any merchandise, changes price according to supply and demand. In this article, we will look at the supply and demand to understand where gold price is possibly heading.

supply and demand to understand where gold price is possibly heading.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and the FREE bi-weekly Market Intelligence Report newsletter (register here; sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

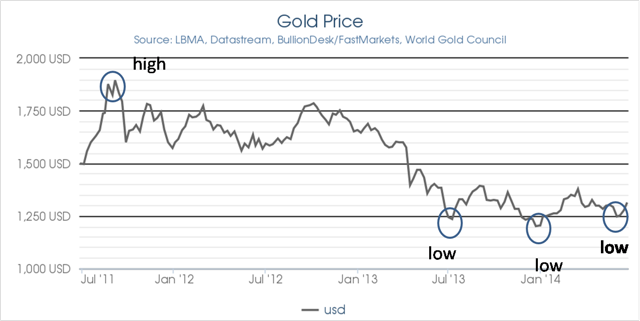

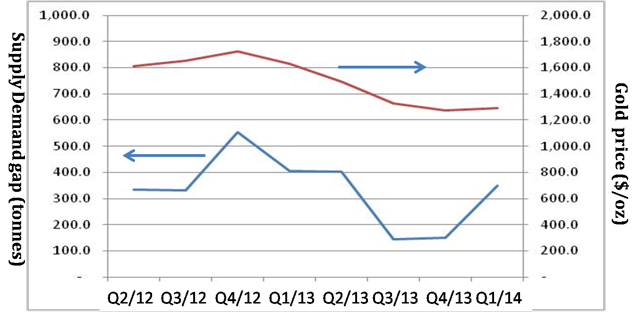

The price of gold has bottomed three times since July of last year at what seems to be strong support at $1250/oz level. Whether the price of gold will go up or go down from here, [though, is up] for…debate. See chart below for the recent gold price:(click to enlarge)

Demand

Gold demand is best summarized by the data…[as per Table 1 below].

The total worldwide demand per quarter is around 1,000 tonnes for the last eight quarters but we notice that the ETF demand was negative in 2013…In Q1 2014, the outflow of gold from ETFs stopped. Whether ETF gold will revert to inflow in the next few quarters remains to be seen.

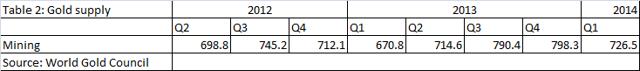

Supply

The supply of gold is coming from mining [is shown in Table 2 below]…is averaging about 730 tonnes per quarter and trending up slightly.

…The average cost per ounce of gold produced by four major gold miners – Goldcorp (GG), Newmont (NEM), Kinross (KGC) and Barrick Gold Corp (ABX), are shown in Table 3 (Visual Capitalist):

Many smaller miners without the economy [of] scale have much higher costs than the big ones. That is the reason all miner shares were hit much harder than the gold price itself in the gold bear market. While gold price dropped by 30% from its high, the gold miner shares dropped more than 50%. GDXJ, ETF of smaller gold miners, dropped by a whopping 73% from its high. If the gold price drops below $1,100, many unprofitable mines will be forced to shut down or reduce production. The gold supply from mining will reduce dramatically. This provides a very strong support for the gold price at $1,100

The reason for the high cost of gold production is because an average grade gold mine produces only 5.3 grams of gold for each ton of earth mined. The cost will continue to rise…[as] the higher grade ores are getting scarcer.

Gold production is decreasing in the four major gold producing countries – South Africa, Canada, the U.S. and Australia – despite the fact that the world’s top 20 gold producers increased their gold exploration budget from $300 million in 2002 to $1.4 billion in 2013. The decline is particularly significant in South Africa, where gold production fell 50% in the last decade. The higher investment and the employment of better technology in gold exploration does not help to produce more gold. The outlook of gold supply is not bright.

Stay connected

- Subscribe to our Newsletter (register here; sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

Gold production in China is offsetting, somewhat, the decline of gold production in the above mentioned four major gold producing countries. China’s gold production has been rising – now at the level of 428 tonnes per year in 2013 – overtaking South Africa as the world leading gold producer since 2007.

China produced about 15% of the gold in the world in 2013 however China’s gold production may not help to suppress the gold price for two reasons:

- China does not export any of its domestically produced gold for strategic reason – it is trying to diversify its foreign currency reserve by shifting toward gold away from US dollars…All Chinese gold miners are small scale, and most of the ores are low and medium grade, thus…it is quite possible that the gold production cost in China exceeds $1,200 per ounce. [As such, given] the current gold price, China finds it cheaper to import gold and, therefore, despite [the fact] that China is the world’s leading gold producer; China is also the world leading gold importer.

- China’s known gold mine reserve is estimated at 8,000 tonnes, less than three years of worldwide production. At the current mining rate, it will be depleted in two decades. The reason that China today still has enough gold mines is because China is a late comer in the gold production and most of its mines are relatively new. As late as 1980, China’s gold production was only 10 tonnes.

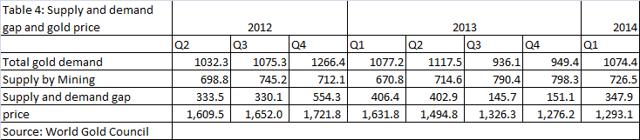

The supply / demand gap

The supply and demand data…as per Table 4 below shows that demand is exceeding supply by a wide margin. Apparently, the gold has to come from someone’s inventories or vaults.

The gold price and the gap between supply and demand are plotted in the Chart below. We can see a rough correlation between these two.

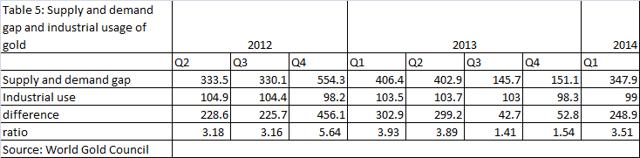

The World Gold Council attributes the gap filler as being gold recovered from industry [i.e. scrap gold]. However, this is not a satisfactory explanation. If we look at the gap of supply and demand and the industrial use of gold [as shown in Table 5 below], we find that it is hard to reconcile the two.

The supply demand gap is in average 3.28 time as large as the industrial usage during the time frame of analysis. It is physically impossible for the recovered gold from industrial usage to fill up this gap because industry cannot spit out more gold than it consumes.

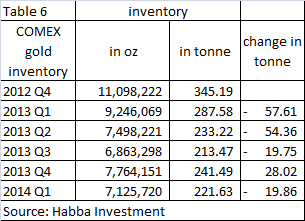

Reduction in the COMEX gold inventory [see Table 6 below] is one possible source given that, even if industry can recover 100% of the gold it consumes, it is still far from enough to close the gap. The quarterly COMEX gold inventory is listed in Table 6 below.

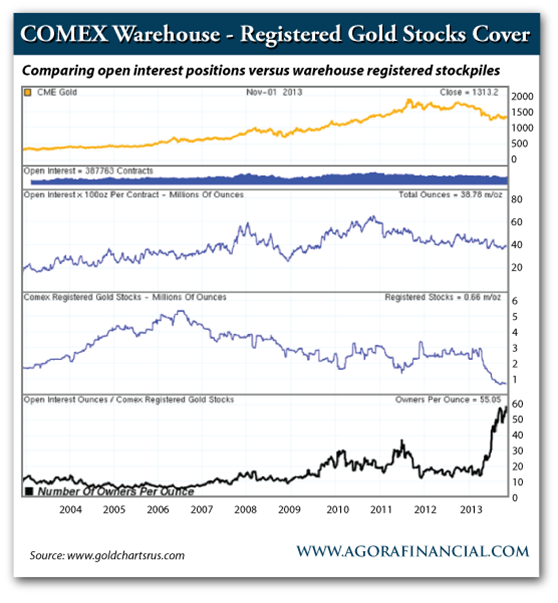

In 2013 COMEX had a net outflow of gold 103.7 tonnes [reducing] its inventory to a level not seen since 2008, right before the gold price doubled in the next four years…because the open interest of paper gold trading is much higher today than in 2008. The potential owner for each ounce of gold is at a scary level of all time high of 55 [see the 4th graph below].

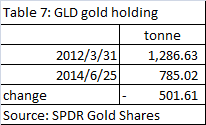

There are other outflows of gold into the market as well…such as the gold holding of SPDR Gold Shares [as shown in table 7 below] which is down dramatically…

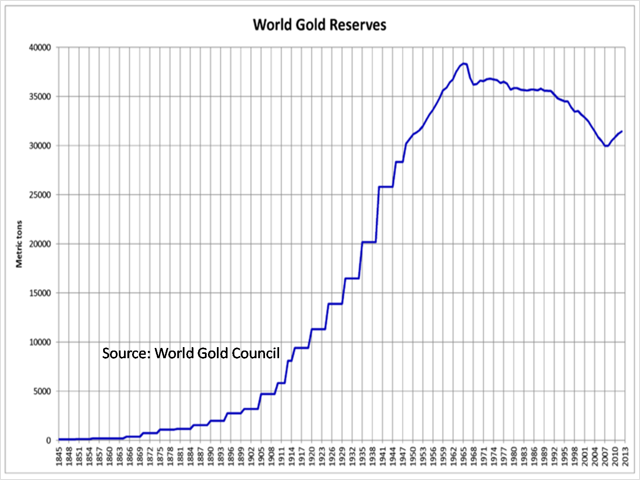

Central banks are the largest owners of gold in the world. The historical gold holding of the Central Banks is shown in the Figure below:

Since 2007, Central Banks have reverted collectively to net gold buyers from net sellers. This is a significant change because of their huge positions in gold and on 19/5/2014, the European Central Bank and 20 other European central banks signed the fourth Central Bank Gold Agreement. In this agreement, the signatories agreed that gold remained an important element of the global monetary reserves and self-imposed a sell limit. Even before the signing of the agreement, in the last five years, major gold holders from European central banks have virtually stopped all gold sales – selling less than 25 tonnes of gold against an agreed limit of 2,000 tonnes.

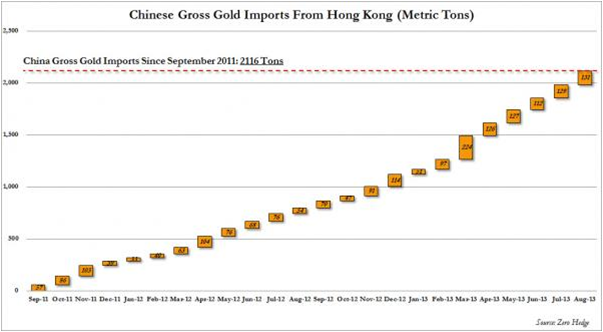

China’s catch-up game to increase its gold reserve on par with the US and EU is apparent from its gold imports. The chart below shows China’s accumulated imports since September 2011. Due to the negative sentiment of gold in the West, China has been able to buy gold at a cheap price. SPDR Gold Shares ETF alone dumped 501 tonnes of gold between Q1 2012 and Q1 2014. China is like a black hole for gold – whatever goes in, does not come out again. Now that the ETF gold outflow has stopped (Table 1), there is likely to be a squeeze in the gold market in the near future.

Conclusion

Conclusion

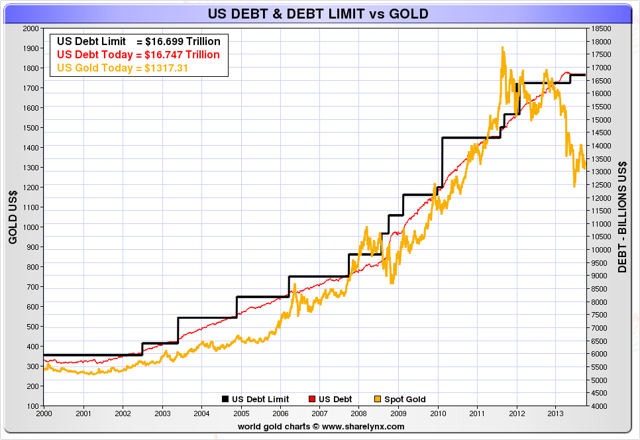

…Comparing the price of gold against US debt…is an excellent way to measure what the price of gold should likely be [as shown in the chart below]. It reflects the effect of more dollars chasing less available gold supply. The supply is determined by what is available for trading, not what is locked up in various vaults around the world. It is the supply and demand that decides the real price action. The analysis shows that the upside for gold is more likely than its downside.

The analysis shows that the upside for gold is more likely than its downside.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/2290503-where-is-gold-price-heading-a-supply-and-demand-point-of-view? (© 2014 Seeking Alpha )

Related Articles:

1. Bear Phase in Bull Market for Gold Will End This Summer – Here Are 30 Reasons Why

Below are the 30 reasons, 23 new and 7 set in cement, of why the Bear phase in the bull market for gold ends this summer without any new lows. Read More »

2. Here’s Why Gold Has Bounced Higher – And Will Go Even Higher Over the Next 6 Months

With the price spike in gold this week (spot gold up nearly 3% and gold stocks up around 7%) some of the perpetual gold naysayers are suggesting the metal had shifted to overbought status but that just is not the case. Below I explain why gold has taken off. Read More »

3. Gold & Silver Still Have More Room to Run – Much More! Here’s Why

When we look at the price of silver and gold, especially when adjusted for inflation, we see a lot of upside potential. Because we believe that the most exciting part of a bull market is at the end of the move, we believe that the best may still be ahead of us. Let us explain with the use of a number of very enlightening charts that support our contention. Read More »

4. Incredible Bounce Coming Soon In Gold & Silver – Here Are 5 Reasons Why

Get ready for an incredible bounce higher in the gold & silver junior miner sector. Here are five reasons why. Read More »

5. Gold Should Be At Least At $2,040/ozt. – Here’s Why

The value of gold relative to oil (Brent Crude) is an embarrassing 11.2 to 1 ratio – way below its historical average – thanks to the manipulation by the Fed and member banks. When the price revalues higher it will do so SHARPLY and it will be PAINFUL for those on the wrong side of the trade or in worthless paper assets. Let me explain why that is the case. Read More »

6. Gold Should Bounce Sharply Higher – Here Are 10 Reasons Why

Is it time to throw in the towel? Is the bull market in precious metals really over? I don’t think so because my analyses suggest that nearly all of the fundamental factors that have been driving the gold price higher in the past decade have only strengthened in the past two years. Now that the correction has most likely run its course, I expect gold to bounce sharply higher. Here are 10 reasons why. Read More »

The pullback I’ve been warning you about in the U.S. equity markets is finally at hand but, once this pullback in the broad stock indices is over, the Dow Jones Industrial will lead the way higher yet again, and catapult to 31,000 over the next three years, with gold reaching $5,000, silver $125 and select individual stocks in the mining sector spinning off gains of 2,000%, 3,000% and even more. No, I’m not out of my mind. Quite to the contrary, I believe I am the one analyst who really understands the forces that are building to enable such to occur. Read on to learn about my enviable track record over the years and specifically why such gains will be realized over the next three years. Read More »

8. Get on Board – NOW! We’re On the Verge of a Major Bull Market Advance Across the PM Sector.

The charts below make it crystal clear that we are on the verge of a major bull market advance across the PM sector. While these charts are for the Market Vectors Junior Gold Miners ETF, what happens to the GDXJ has major implications for the whole sector, for the simple reason that it is not going up without the entire sector going up too. Read More »

9. The Most Explosive Turnaround to the Upside — EVER — Is Coming In the Precious Metals Sector

I am 100% confident that 1) precious metals will bottom this year and resume a new leg to the upside, 2) the extreme emotions right now regarding gold and silver are typical at major turning points and 3) all the underlying fundamental, cyclical and technical conditions for a new bull market in gold and silver are in place. Here’s an update on the latest action in gold, silver, platinum and palladium Read More »

10. Authors Of “The Money Bubble” Foresee $10-12,000 Gold & $500 Silver – Here’s Why

James Turk and John Rubino are well known figures in the gold industry and they’ve just published a new book, ‘The Money Bubble’ in which they argue that the price of gold is about to soar to $10-12,000/ozt. – and silver to $500/ozt. Here’s why. Read More »

11. Could a World of $7,000 Gold, $100 Silver & $400 Oil Be Coming?

Jim Rickards explains in his new book “The Death of Money – The Coming Collapse of the International Monetary System” why a US dollar collapse could be coming and why gold would probably emerge at the heart of a new global monetary system as the only money that you can really trust. Read More »

12. James Rickards on $7000 – $8000 Gold

You are going to see the price of gold go up… a lot and it may go up a lot in a very short period of time. It’s not going to go up 10% per year for seven years and the price doubles. It’s going to chug along sideways, maybe in an upward trend, with a lot of volatility. It will have a kind of a slow grind upward… and then a spike… and then another spike… and then a super-spike. The whole thing could happen in a matter of 90 days — six months at the most. Read More »

13. 3 Models for the Future Price of Gold: $2,900 (2017); $3,500 – $4,000 (2017); $9,000

What will the future top prices for physical gold and silver be? Naturally, no one knows for sure but many analysts have developed interesting models and scenarios as to what the future holds and this article reviews 3 such analyses for your consideration. Read More »

14. Jim Willie: Gold Will Rise to $5,000/ozt. and Beyond & Silver Will Rise Multiples Higher

In the last several months, the world economic crisis has entered a new elevated level of perma-crisis and constant tension, widely recognized as something more serious, more dangerous, and more risk-filled. This new normal is neither without resolution nor the attempt to resolve anything and, as such, is why the price of gold will rise to $5,000 per troy ounce, then higher, and at the same time, the silver price will rise multiples higher. Let me explain. Read More »

15. Gold Projected to Reach $4,000/ozt. Sometime Between Late 2015 & Mid 2017! Here’s My Rationale

I am not predicting a future price of gold or the date that gold will trade at $4,000, but I am making a projection based on rational analysis that indicates a likely time period for gold to trade at $4,000 per troy ounce. Yes, $4,000 gold is completely plausible if you assume the following:

16. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

17. Huge Rebound in Gold & Silver Stocks Coming Soon – Here’s Why

It’s been a tough road for precious metals but the path ahead has strong potential of being significantly profitable and in a short period of time. The buying opportunity that we’ve spoken of for months could be days away. When precious metals equities rebound, they rebound violently. Read More »

18. Jeff Clark: Are Gold Stocks Still Going to Bring the Anticipated Magic? Yes, Here’s Why

We’re invested in gold stocks not just to make money, but for the chance to change our lifestyles and with their lackadaisical [dare I say dismal] year-to-date performance, one may begin to wonder if they’re still going to bring the magic. [Here are my views on the subject.] Words: 740 Read More »

19. If You’re Interested In Gold Stocks This Article is a MUST Read

Historically, junior mining stocks tend to fluctuate between extreme boom and bust cycles and, given that we just completed a major bust cycle, the setup for a major rally in gold stocks is right in front of us. Those with the courage to buy low, and the discipline to sell during a frenzy, could quite possibly realize 10-bagger or even 100-bagger returns that could be worth a million dollars or more. Hold on to your hat! Read More »

20. Gold Producer Stocks Dramatically Undervalued: Don’t Miss This Blood-in-the-Streets Opportunity

While the waterfall decline in gold stocks is painful for those of us already invested, the reality is that this is a setup we get a shot at only a few times in our investing life. It’s a cruel irony that those who are fully invested are now faced with the buying opportunity of a lifetime; however, it would be a shame for anyone to miss this blood-in-the-streets opportunity. Read More »

21. Here’s How to Choose Gold & Silver Stocks With the GREATEST Chance of Major Returns

Which gold/silver mining companies own quality undeveloped gold and silver deposits in safe stable countries – and are extremely well managed? Such companies offer exceptional value in that they provide the best exposure to a rising precious metals price environment. Below are a number of things to look for when considering an investment in such companies. Read More »

22. Focus on Quality Junior Gold & Silver Companies to Maximize Returns – Here’s Why & How

The outlook for many junior resource companies in 2013 is grim so investors should focus on those who own quality undeveloped gold and silver deposits in safe stable countries. Such companies offer exceptional value in that they provide the best exposure to a rising precious metals price environment – and the assets the world’s mining companies desperately need. [Let me explain.] Words: 1328; Charts: 15 Read More »

The timing of this article may seem incongruous given the current weak performance of gold and gold stocks but that was the identical situation in each of the past manias – both the metal and the equities didn’t excel until the frenzy kicked in. The following documentation (exact returns from specific companies during this era are identified) is actually a fresh reminder of why we think you should hold on to your positions – or start accumulating them, if you haven’t already. (Words: 1987; Tables: 7) Read More »

24. Gold Price Forecasts (Update): $5,000 to $11,000 In 2 to 5 Years

During 2011 into 2013 I kept a record of those individuals who expected gold to rise substantially in the coming years and presented updated summaries in a number of articles (see links below). Below are additional or recently updated forecasts by 11 prognosticators whose projections are surprisingly consistent, on average, with previous such estimates. Read More »

25. 33 Analysts: Average Gold Price to Be $5,250 – $6,500 by Late 2014/Early 2015!

Lately analyst after analyst (161 at last count) has been climbing on board the golden wagon with prognostications as to what the parabolic peak price for gold will eventually be. That being said, however, only 33 have been bold enough to include the year in which they think their peak price estimate will occur and they are listed below. Take a look at who is projecting what, by when and why. Words: 644

26. Stock Market (Dow) Should Reach 20,000 By 2018 – Here’s Why

With the stock market up over 20% since we forecast in July, 2012 that we would see the Dow at 20,000…[by the end of the] decade, our forecast seems less ambitious than back then. US stocks are not overpriced or overleveraged, and remain more attractive than at prior peaks. As such, based on current conditions, we now project that…the Dow will reach 20,000 by late 2018. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Admiring the persistence you put into your blog and detailed information you provide.It’s nice to come across a blog every once in a while that isn’t the same outdated rehashed material. Fantastic read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

Until the Chinese start selling Gold, the “true” value of Gold will continue to increase despite the paper shorting that is being used to keep Gold and other PM’s prices below what they should be trading at.

Why price of gold still down? Only China and India are happy with lower gold price,Who holds it down?