Unlike a number of countries in Europe the U.S. is currently not dealing with general price declines but, that being said, the risks of such an occurrence have increased materially. Below are a number of such deflationary risks and how they might impact the U.S. economy.

price declines but, that being said, the risks of such an occurrence have increased materially. Below are a number of such deflationary risks and how they might impact the U.S. economy.

By Sober Look (soberlook.com) from an article originally posted* under the title Rising deflationary risks in the United States.

(Sober Look is a no-hype financial blog that relies on data analysis and primary sources. Posts are intended to be succinct, to the point, with no self-promoting nonsense, and no long-winded opinions. If you are looking for Armageddon predictions or conspiracy theories, you will be thoroughly disappointed. Topics include U.S. and global economic developments and financial markets. Sign up for their daily newsletter.)

[Below are a number of such deflationary risks and how they might impact the U.S. economy:]

1. The intermediate-term market-based inflation expectations have fallen to 2009 levels – when deflation was a serious concern.

2. Wage growth is falling from a fairly stable level of 2% per annum.

3. In particular, “production and nonsupervisory employees” saw a sharp decline in wage growth – in spite of robust growth in payrolls.

4. Economists have been expecting the recent strength in U.S. labor markets, including big increases in job openings, to translate into stronger wages but just the opposite has taken place in combination with…with global disinflationary pressures and the collapse in energy as well as other commodity prices… Below is the CRB commodity index.

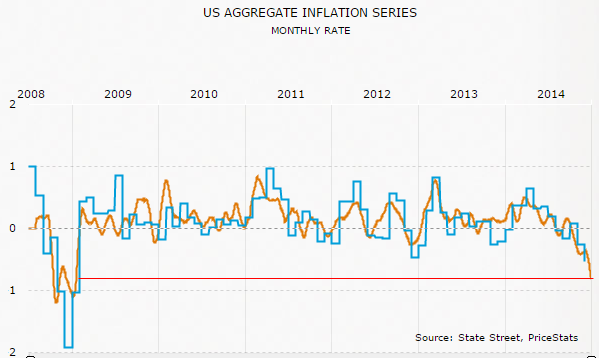

5. [In addition]…the PriceStats CPI trend (online-price-based CPI-tracking model) has fallen to 2009 levels.

|

| Blue = actual CPI, orange = PriceStats index (h/t @jp_koning) |

…[While] some Fed officials are quite open about taking 2015 rate hikes off the table, the markets still anticipate the first hike in late Q3/early Q4 of this year which is somewhat surprising considering that in the U.K., for example, rate hike expectations have been shifted to 2016.

[The above article is presented by Lorimer Wilson, editor of www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This paragraph must be included in any article re-posting to avoid copyright infringement.]

*Original source: http://soberlook.com/2015/01/rising-deflationary-risks-in-united.html?

1. Deflation Doesn’t Necessarily Have To Be Bad – Here’s Why

Deflation is often considered a highly unfavorable phenomenon, however there are different types of deflation that have different implications. In other words, the effects of deflation depend to a large extent on the particular context…This article distinguishes between good deflation and bad deflation. Read More »

2. When the Bubble Bursts It Will Cause Deflation & Drive Widespread Social Unrest – Here’s Why

Should we be concerned when tepid economic growth and low inflation are accompanied by increasing public and private debt? Are we borrowing just to stay alive? [As I see it,] national governments will increase national debt loads in order to stay in power until one or more of them default. Then their will be financial panic which will most certainly be deflationary. Here’s why. Read More »

3. Interest Rates Will Be LOW For the Rest Of Our Lives! Here’s Why

The argument that the past 10 years of low interest rates has just been an anomaly which will normalize to higher levels in the next couple of years is not going to unfold. Interest rates will be perpetually low for the rest of our lives! Here’s why. Read More »

4. Will Higher Interest Rates Result From Additional Tapering?

After a long period of very low interest rates following the global financial crisis the central banks of the U.S. and U.K. are planning to gradually tighten their easy monetary policies as their economies improve. When their benchmark interest rates go up, interest rates elsewhere will go up to so should we worry if and when global financial conditions tighten? Read More »

5. Probability of Deflation Is 60%, Inflation Is 25% and Muddling Through Is 15% – Here’s Why

At the end of last year virtually every every single economist expected interest rates to rise this year as the Fed tapered their purchases and the economy improved but, in fact, interest rates on the 10 year U.S. Treasury have been going down year to date (from 3% to 2.5% after rising from about 1.6% to 3% last year). The masses, going along with this crowd, got fooled but we have been calling for a decline in interest rates for some time now due to world-wide deflation and it couldn’t be clearer to us that this is the most likely scenario for the United States. Let us explain. Read More »

6. Interest Rates NOT Rising Any Time Soon – Even With Fed Tapering. Here’s Why

Everyone and their mom is expecting long-term interest rates to rise now that the Fed is tapering its bond buying programs. I have a couple of problems with this line of thinking because, although it seems like reducing demand for a security (i.e. tapering QE) would result in a drop in price, when you really think about how quantitative easing works this makes no sense and, secondly, the market is telling us this makes no sense. Let me explain. Read More »

7. We’re Headed for Crippling Deflation First & Then Rampant Inflation – Here’s Why

Are we headed for rampant inflation or crippling deflation? I believe that we will see both. The next major financial panic will cause a substantial deflationary wave first, and after that we will see unprecedented inflation as the central bankers and our politicians respond to the financial crisis. [Let me explain why I think that will unfold.] Words: 1025 Charts: 3 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money