Should we be concerned when tepid economic growth and low inflation are  accompanied by increasing public and private debt? Are we borrowing just to stay alive? [As I see it,] national governments will increase national debt loads in order to stay in power until one or more of them default. Then their will be financial panic which will most certainly be deflationary. Here’s why.

accompanied by increasing public and private debt? Are we borrowing just to stay alive? [As I see it,] national governments will increase national debt loads in order to stay in power until one or more of them default. Then their will be financial panic which will most certainly be deflationary. Here’s why.

So writes Ronald R. Cooke (tceconomist.blogspot.ca) going on to say:

According to the OECD:

- Japan’s “official” debt to GDP ratio is projected to be 232% in 2015,

- followed by Greece (188%),

- Italy (147%),

- Portugal (142%),

- Ireland (132%),

- France (116%),

- Spain (111%),

- the United States (107%),

- Belgium (105%), and

- the United Kingdom (103%).

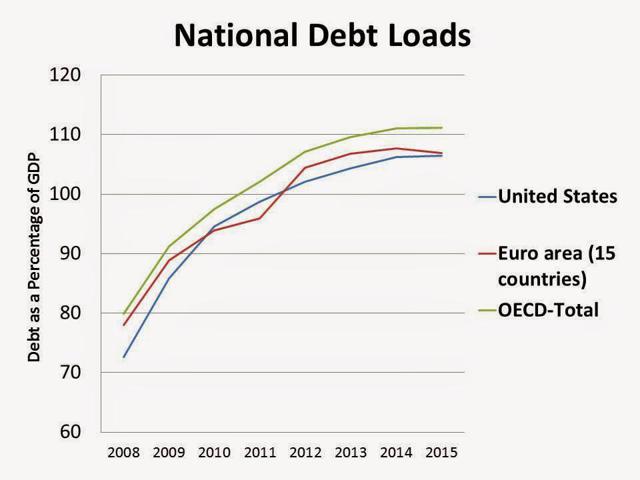

As shown in the following graph,

- the 15 country Euro area has a debt to GDP ratio of 107%, and

- the total average debt burden for all OECD nations is 111%.

- These “official” debt burden numbers do NOT include

- forward spending commitments for promised welfare payments,

- “off the books” public debt, or

- the effect of higher interest rates on public debt service.

There is NO credible plan to pay off these debts. The bubble just keeps getting larger, and larger….

We don’t know how long it will take for this scenario to play out but if the world economy unravels, then:

- unemployment, underemployment, and fear will combine to reduce consumption,

then:

- investment and GDP will decline and the economy will deflate just like in the 1930s:

- fixed asset values will decline,

- rental properties such as homes, apartment buildings, shopping malls, and so on, will face potential bankruptcy because of higher vacancy rates and it will also become increasingly difficult for rents to keep up with property, debt, tax, and maintenance costs,

- incomes will stagnate,

- unemployment will increase,

- credit card debt will cause consumers to prioritize spending decisions based on urgent need: food, fuel, and then rent (or mortgage payments),

and then expect:

- a flood of cheap imports into the OECD nations

- followed by ever increasing national protectionist trade policies (Asia will export deflation; and that will work until the protectionist trade barriers go up),

- stock market to collapse, (aggregate stock valuations and derivative values will decline and that’s deflationary,

- public debt ratings to decline as confidence in the financial viability of the public sector erodes with the continuing printing of money by national central banks,

- Federal and state agencies to pay higher rates of interest in order to offset the perceived risk of buying public debt as it will become increasingly difficult and more expensive to sell new bonds, or to roll over maturing issues of existing public debt,

- bonds not held to maturity to decline in value as public sector bond interest rates go up, bonds not held to maturity will decline in value.

- bond devaluations and declining property rents to jeopardize the asset base that supports existing pension plan and insurance annuity contract payments causing aggregate plan values decrease.

Forecast

The International Monetary Fund (IMF) has recently forecast World GDP to increase by 3.8% in 2015. GDP is expected to increase by:

- 7.1% in China,

- 3.1% in the U.S.,

- 2.7% in the U.K.,

- 1.3% in the Euro area, and

- .8% in Japan

Subscribe to our free Newsletter (sample here)

but this scenario appears to be optimistic. In order to sustain a stable economy through 2015, we have to assume:

- WTI oil prices below $105 for most of 2015,

- no disruption of oil supplies,

- no substantial increase in taxes,

- medical costs are brought under control,

- restrictions will be placed on Federal and State EPA regulatory authority,

- Federal and State regulations will favor private business activity,

- Central Banks will refrain from printing money,

- Central Bank policy will compel the banking system to support private business activity,

- governments will not increase national debts,

- nations will not engage in deliberate currency devaluations,

- the Stock Market will not collapse,

- Vladimir Putin will not try to annex more nations, and

- last – but not least – relative calm will prevail in the Middle East, Africa, and elsewhere,

Follow the munKNEE on Twitter

BUT, since liberal economic and social philosophy dominates OECD national political agendas, we can expect liberal financial solutions will be imposed to solve OECD financial problems and this ideology is:

- unlikely to support the creation of national wealth,

- very likely to increase government spending, and

- absolutely certain to increase the transfer of income and savings from “rich” to “poor”.

Although it decreases national wealth, growth in public employment is seen as beneficial. Fiscal discipline is (deliberately) ignored. National central banks print copious amounts of money. The resulting currency devaluation:

- is likely to increase the cost of living

- will possibly have the net effect of driving OECD nations into a long period of high inflation accompanied by declining business activity,

- will cause high rates of unemployment and underemployment,

- and the resultant poverty will drive widespread social unrest

– but I could be wrong.

- Perhaps the collapse of the financial system will usher in a period of deflation like the 1930s.

- Perhaps currency devaluations will result in high rates of inflation

- and maybe the IMF is right.

Do your own homework and then judge for yourself.

Post a Comment on this article (Scroll down to bottom of page)

The above post is presented compliments of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

*http://www.tceconomist.blogspot.ca/2014/10/what-are-odds-in-2015-inflation-or.html

Related Articles:

1. Crushing Debt Cannot – & Will Not – Be Repaid! Here’s Why

The central bankers of the world have painted themselves into corner. Growing mountain of debt makes it harder for economies to grow at higher interest rates, hence forcing central banks into a downward spiral of record low rates and monetary stimulus that simply encourages more borrowing and worsening the underlying problem – what the BIS calls “a debt trap” Read More »

2. We’re Doomed! Rising Interest Rates Will Cause Our Financial System To Implode

We’re doomed! Even if the economy were growing at a faster pace, it wouldn’t come close to offsetting the interest payments on our ever-expanding debt. As such, any sort of credit shock – either rising rates or a decline in the rate of debt expansion – will cause the system to implode. Let me explain why that is the case. Read More »

3. There’s debt, Then There’s Debt, Then There’s U.S. DEBT

The next time someone says, “The U.S. is the richest country on Earth” correct them and state that “The U.S. is the most bankrupt and indebted country in the history of the world” because that’s reality. Let me explain. Read More »

4. What Could – What Will – Pop This “Money Bubble”?

There is too much debt. Debt works the same way for a country as it works for an individual or a family, which is to say if you borrow too much, then your life basically craters. Everything gets harder to do, and you end up doing things in order to deal with your past mistakes that you would never do normally. You start trying absolutely crazy things, and that’s where the world’s governments are right now. We are doing all these things that are essentially con games and getting away with it so far, because a printing press is a great tool for fooling people. I don’t see how we can get away with it too much longer. Read More »

5. Inflation or Deflation: Are We Approaching the Tipping Point?

Might our Inflation-Deflation Watch be suggesting a breakout in asset price inflation is about to take place? Could it, in fact, be presaging the start of John William’s hyper inflationary depression in which prices rise exponentially even in light of massive unemployment and bankruptcies? This article analyzes the situation. Read More »

6. Probability of Deflation Is 60%, Inflation Is 25% and Muddling Through Is 15% – Here’s Why

At the end of last year virtually every every single economist expected interest rates to rise this year as the Fed tapered their purchases and the economy improved but, in fact, interest rates on the 10 year U.S. Treasury have been going down year to date (from 3% to 2.5% after rising from about 1.6% to 3% last year). The masses, going along with this crowd, got fooled but we have been calling for a decline in interest rates for some time now due to world-wide deflation and it couldn’t be clearer to us that this is the most likely scenario for the United States. Let us explain. Read More »

7. Now Underway: A Spiral of Debt Deflation Into a Bottomless Economic Abyss!

von Mises once said, “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later, as a final and total catastrophe of the currency involved” and just that is happening before our very eyes. Words: 2242 Read More »

8. Risk for the Economy is Deflation, NOT Inflation

Presently, the federal government is increasing spending that in the end may actually retard economic activity, and is also proposing tax increases that will further restrain private sector growth. In other words, fiscal policy is executing a program that is 180 degrees opposite from what it should be to stimulate the economy. How is it possible to get an inflationary cocktail out of deflationary ingredients? Words: 1461 Read More »

9. Deflationary Pressures In Economy Are Primary Concern of the Fed

Despite the Fed’s recent communications that they are planning to “taper” the current monetary program by the end of this year – the index is suggesting that their interventions, in one form or another, are unlikely to end anytime soon. The threat of “deflation” remains the Fed’s primary concern. Read More »

10. Deflation: What You Need to Know (and Fear) & How to Prepare for Such an Eventuality

All in all, deflation should be one of the most serious words in a commodity investor’s vocabulary and is something to always keep an eye on. While its presence may seem removed from our economy, the possibility always remains and preparation will be key to survive a deflationary environment. Read More »

11. We’re Headed for Crippling Deflation First & Then Rampant Inflation – Here’s Why

Are we headed for rampant inflation or crippling deflation? I believe that we will see both. The next major financial panic will cause a substantial deflationary wave first, and after that we will see unprecedented inflation as the central bankers and our politicians respond to the financial crisis. [Let me explain why I think that will unfold.] Words: 1025 Charts: 3 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money