We fail to pay attention to the warnings signs as long as we see no immediate danger and keep our foot pressed to the accelerator believing that since it hasn’t happened yet, it won’t. This time is only “different” from the perspective of the “why” and “when” the next major event occurs. Below are analyses and exhibits to support that contention.

pressed to the accelerator believing that since it hasn’t happened yet, it won’t. This time is only “different” from the perspective of the “why” and “when” the next major event occurs. Below are analyses and exhibits to support that contention.

So says Lance Roberts (stawealth.com) in edited excerpts from his original article* entitled 10 Warnings Signs Of Stock Market Exuberance.

[The following is presented by Lorimer Wilson, editor of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Roberts goes on to say in further edited excerpts:

Imagine that you are speeding down one of those long and lonesome stretches of highway that seems to fall off the edge of the horizon. As the painted white lines become a blur, you notice a sign that says “Warning.” You look ahead for what seems to be miles of endless highway, but see nothing. You assume the sign must be old therefore you disregard it, slipping back into complacency.

A few miles down the road you see another sign that reads “Warning: Danger Ahead.” Yet, you see nothing in distance. Again, a few miles later you see another sign that reads “No, Really, There IS Danger Ahead.” Still, it is clear for miles ahead as the road disappears over the next hill.

You ponder whether you should slow down a bit just in case. However, you know that if you do it will make you late for your appointment. The road remains completely clear ahead, and there are no imminent sings of danger. So, you press ahead. As you crest the next hill there is a large pothole directly in your path. Given your current speed there is simply nothing that can be done to change the following course of events. With your car now totalled, you tell yourself that there was simply “no way to have seen that coming.”

It is interesting that, as humans, we fail to pay attention to the warnings signs as long as we see no immediate danger. Yet, when the inevitable occurs, we refuse to accept responsibility for the consequences.

I was recently discussing the market, current sentiment and other investing related issues with a money manager friend of mine in California. (Normally, I would include a credit for the following work but since he works for a major firm he asked me not to identify him directly.) However, in one of our many email exchanges he sent me the following note detailing the 10 typical warning signs of stock market exuberance.

(1) Expected strong OR acceleration of GDP and EPS (40% of 2013′s EPS increase occurred in the 4th quarter)

(2) Large number of IPOs of unprofitable AND speculative companies

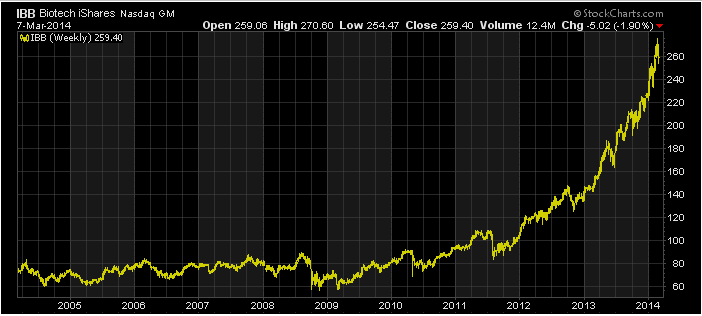

(3) Parabolic move up in stock prices of hot industries (not just individual stocks)

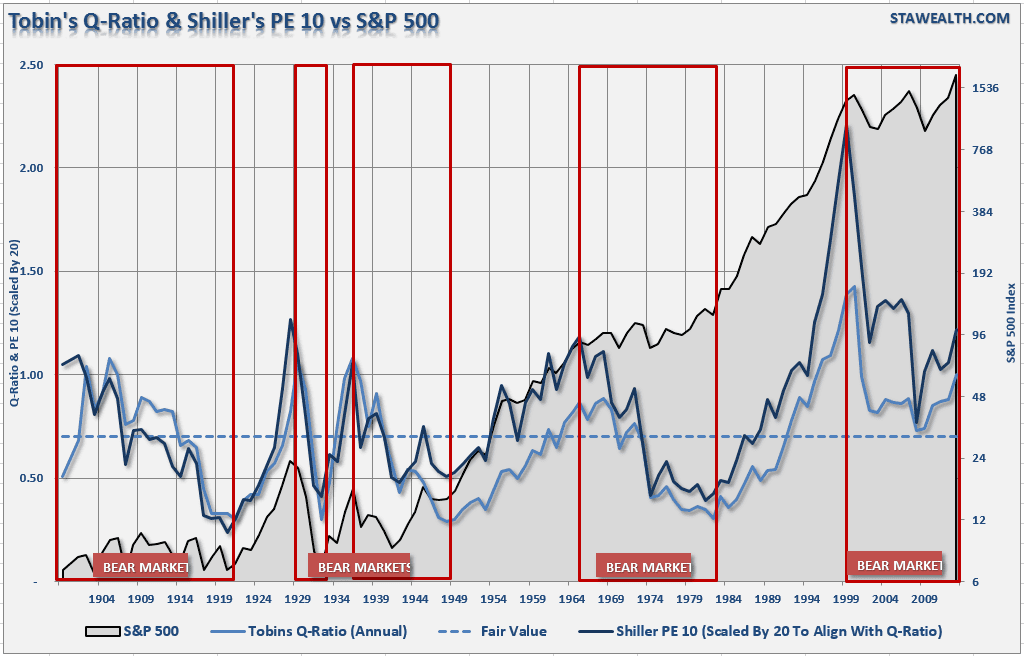

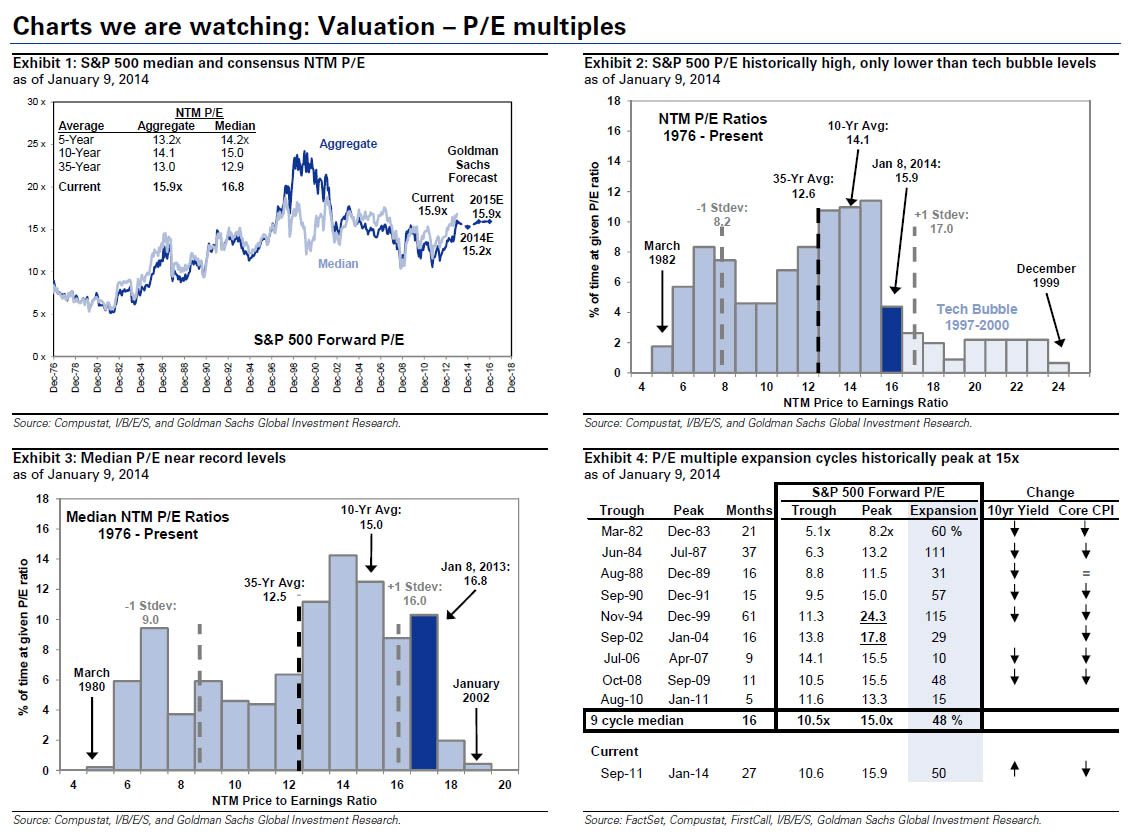

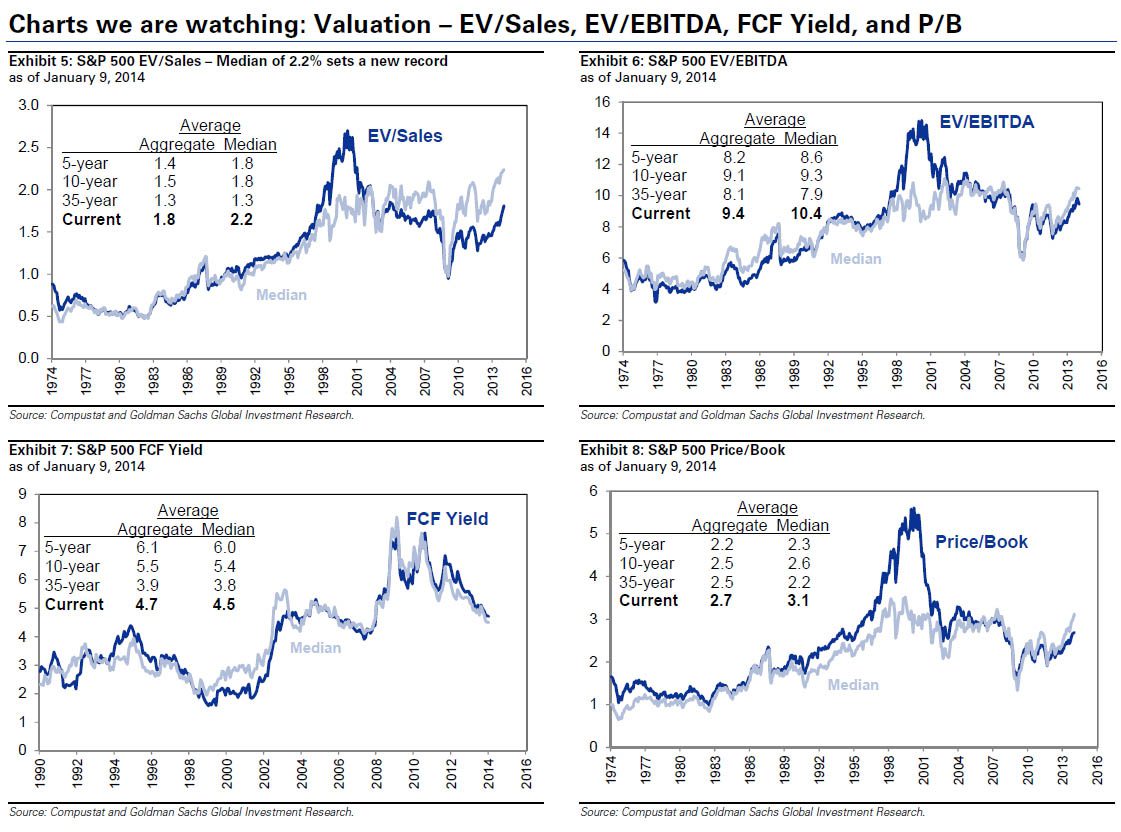

(4) High valuations (many metrics are at near-record highs, a few at record highs)

(5) Fantastic high valuation of some large mergers (e.g., Facebook & WhatsApp)

(6) High NYSE margin debt

- Margin debt/gdp (March 2000: 2.7%, July 2007: 2.6%, Jan 2014: 2.6%)

- Margin debt/market cap (March 2000: 1.8%, July 2007: 2.3%, Jan 2014: 2.0%)

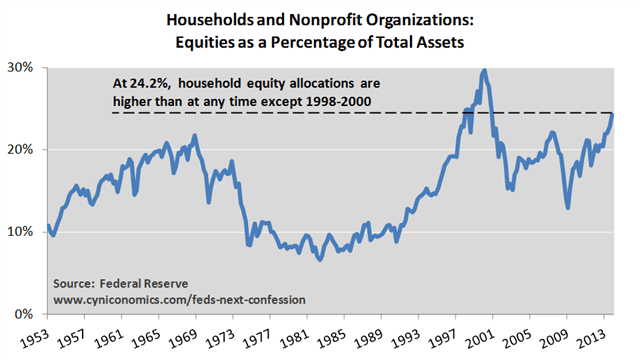

(7) Household direct holdings of equities as % of total financial assets at 24%, second-highest level (data back to 1953, highest was 1998-2000)

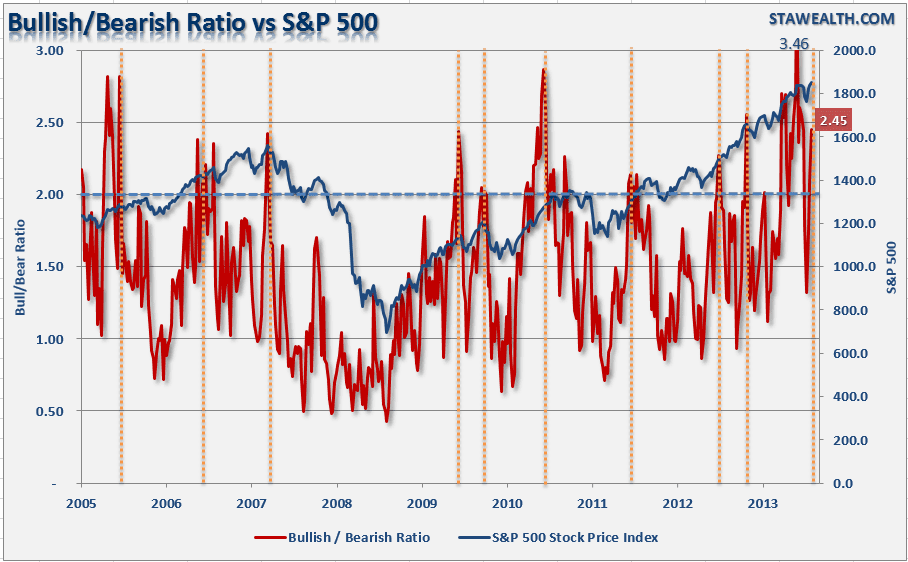

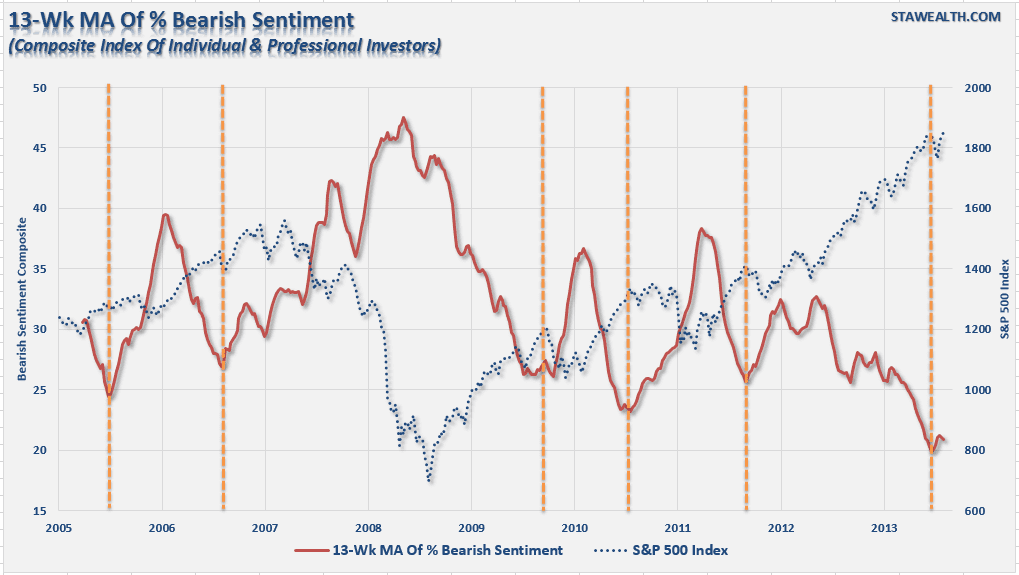

(8) Highly bullish sentiment (down slightly from year-end peaks; still high or near record high, depending on the source)

(9) Unusually high ratio of selling to buying by corporate senior managers (the buy/sell ratio of senior corporate officers is now at the record post-1990 lows seen in Summer 2007 and Spring 2011)

(10) Stock prices rise following speculative press releases (e.g., Tesla will dominate battery business after they get partner who knows how to build batteries and they build a big factory. This also assumes that NO ONE else will enter into that business such as GM, Ford or GE.)

All are true today, and it is the third time in the last 15 years these factors have occurred simultaneously which is the most remarkable aspect of the situation.

The following evidence is presented to support the above claim.

Exhibit #1: Parabolic Price Movements

Exhibit #2: Valuation

Excerpt from a recent report by David J. Kostin, Chief US Equity Strategist for Goldman Sachs, 11 January 2014

“The current valuation of the S&P 500 is lofty by almost any measure, both for the aggregate market as well as the median stock:

- The P/E ratio;

- the current P/E expansion cycle;

- EV/Sales;

- EV/EBITDA;

- Free Cash Flow yield;

- Price/Book as well as the ROE and P/B relationship; and compared with the levels of inflation; nominal 10-year Treasury yields; and real interest rates.

Furthermore, the cyclically-adjusted P/E ratio suggests the S&P 500 is currently 30% overvalued in terms of Operating EPS and about 45% overvalued using As Reported earnings.

Reflecting on our recent client visits and conversations, the biggest surprise is how many investors expect the forward P/E multiple to expand to 17x or 18x. For some reason, many market participants believe the P/E multiple has a long-term average of 15x and therefore expansion to 17-18x seems reasonable. But the common perception is wrong. The forward P/E ratio for the S&P 500 during the past 5-year, 10-year, and 35- year periods has averaged 13.2x, 14.1x, and 13.0x, respectively. At 15.9x, the current aggregate forward P/E multiple is high by historical standards.

Most investors are surprised to learn that since 1976 the S&P 500 P/E multiple has only exceeded 17x during the 1997-2000 Tech Bubble and a brief four-month period in 2003-04. Other than those two episodes, the US stock market has never traded at a P/E of 17x or above.

A graph of the historical distribution of P/E ratios clearly highlights that outside of the Tech Bubble, the market has only rarely (5% of the time) traded at the current forward multiple of 16x.

The elevated market multiple is even more apparent when viewed on a median basis. At 16.8x, the current multiple is at the high end of its historical distribution.

The multiple expansion cycle provides another lens through which we view equity valuation. There have been nine multiple expansion cycles during the past 30 years. The P/E troughed at a median value of 10.5x and peaked at a median value of 15.0x, an increase of roughly 50%. The current expansion cycle began in September 2011 when the market traded at 10.6x forward EPS and it currently trades at 15.9x, an expansion of 50%. However, during most (7 of the 9) of the cycles the backdrop included falling bond yields and declining inflation. In contrast, bond yields are now increasing and inflation is low but expected to rise.

Incorporating inflation into our valuation analysis suggests S&P 500 is slightly overvalued. When real interest rates have been in the 1%-2% band, the P/E has averaged 15.0x. Nominal rates of 3%-4% have been associated with P/E multiples averaging 14.2x, nearly two points below today. As noted earlier, S&P 500 is overvalued on both an aggregate and median basis on many classic metrics, including EV/EBITDA, FCF, and P/B.”

Exhibit #3: Selling Of Company Stock By Senior Managers

Excerpt from a recent article by Mark Hulbert:

“Prof. Seyhun – who is one of the leading experts on interpreting the behavior of corporate insiders – has found that when the transactions of the largest shareholders are stripped out, insiders do have impressive forecasting abilities. In the summer of 2007, for example, his adjusted insider sell-to-buy ratio was more bearish than at any time since 1990, which is how far back his analyses extended. Ominously, that degree of bearish sentiment is where the insider ratio stands today, Prof. Seyhun said in an interview.

Note carefully that even if the insiders turn out to be right and the bull market is coming to an end, this doesn’t have to mean that the U.S. market averages are about to fall as much as they did in 2008 and early 2009. The one other time since that bear market when Prof. Seyhun’s adjusted sell-buy ratio sunk as low as it was in 2007 and is today, the market subsequently fell by ‘just’ 20%.

That other occasion was in early 2011. Stocks’ drop at that time did satisfy the unofficial definition of a bear market, and the insiders’ pessimism was vindicated.”

Exhibit #4: Investor’s Confidence

Exhibit #5: Ownership Of Stocks As % Total Financial Assets

The point my money managing friend wishes to make is simply that the “”warning signs” are all there. However, since the road ahead seems clear, it is human nature that we keep our foot pressed on the accelerator.

As the Federal Reserve extracts liquidity from the markets, the “Bernanke Put” is being removed which leaves the markets vulnerable to a “mean reverting event” at some point in the future.

The mistake that many investors are currently making is believing that since it hasn’t happened yet, it won’t. This time is only “different” from the perspective of the “why” and “when” the next major event occurs.

Of course, despite the repeated warning signs, the next correction will leave investors devastated looking to point blame at everyone other than themselves. The question will simply be “why no one saw it coming?”

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://stawealth.com/daily-x-change/1977-10-warnings-signs-of-stock-market-exuberance.html

Related Articles:

1. Stock Market Will Collapse In May Followed By Major Spike in Gold & Silver Prices! Here’s Why

The unintended consequences of five years of QE are coming home to roost! In May or early June the stock market parabola will collapse…followed by a massive inflationary spike in commodity prices – particularly gold & silver – that will collapse the global economy. Read More »

2. Yes, You Can Time the Market – Use These Trend Indicators

Remember, the trend is your friend and now you have an arsenal of such indicators to make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a “cut and save” investment advisory this article is it. Words: 1579 Read More »

3. Dr. Nu Yu: “Stock Market Alert! S&P 500 Could Correct to 1640! Here’s Why”

Today, the S&P 500 index decisively broke below the lower boundary of the 3-month ascending broadening triangle pattern. We should now watch for a full range decline down to 1640. Read More »]

4. This Chart of the Dow Suggests “Bring on 2014 – We Ain’t Seen Nothin’ Yet!”

The Dow is up almost 28% but the chart below showing how it’s 12% annualized gain over the past 5-years compares with past bull markets suggest we are probably not at a top – that “We ain’t seen nothin’ yet!” Take a look. Read More »

5. Relax! Take Stock Market Bubble Warnings With a Grain of Salt – Here’s Why

Bubble predictions are headline-grabbing claims that are sure to attract reader/viewership and more than a few worried individuals who will be pushed to act but, like all forecasts, these bubble warnings should be taken with a grain of salt. Read More »

6. Stock Market Bubble & Coming Recession? These Charts Say Otherwise

The real value of the stock market is positively correlated, over time, with the amount of freight hauled by the nation’s trucks (in other words, the physical size of the economy has a lot to do with the real, inflation-adjusted value of the economy) and the latest numbers (see chart) strongly suggest that we are not in a stock market bubble. Read More »

7. The Stock Market: There’s NOTHING to Be Bearish About – Take a Look

There’s nothing to be bearish about regarding the stock market these days. I’ve reviewed my 9 point “Bear Market Checklist” of indicators and it is a perfect 0-for-9. Not even one indicator on the list is even close to flashing a warning sign so pop a pill and relax. There’s no immediate danger threatening stocks. Read More »

8. Pop a Pill & Relax ! There’s NO Immediate Danger Threatening Stocks

Right now there’s nothing to be bearish about. I say that with conviction, because my “Bear Market Checklist” is a perfect 0-for-9. Heck, not a single indicator on the list is even close to flashing a warning sign. We’ve got nothing but big whiffers! Take a look. Pop a pill and relax. There’s no immediate danger threatening stocks. Read More »

9. Latest Action Suggests Stock Market Beginning a New Long-term Bull Market – Here’s Why

There are several fundamental reasons to believe that this week’s stock market activity, where the S&P 500 has moved more than 4% above the 13-year trading range defined by the 2000 and 2007 highs, could mark the beginning of a long-term bull market and the end of the range-bound trading that has lasted for 13 years. Read More »

10. Sorry Bears – The Facts Show That the U.S. Recovery Is Legit – Here’s Why

Today, I’m dishing on the unbelievable rebound in residential real estate, pesky rumors about the dollar’s demise and a resurgent U.S. stock market. So let’s get to it. Read More »

11. Correlation of Margin Debt to GDP Suggests Stock Market Has More Room to Run

Are stocks in a bubble? While leverage has returned to the stock market driving up stock prices and aggregate demand in the process, margin debt is still shy of its all-time high as a percentage of GDP, so there is certainly some headroom for further rises. A look at the following 5 charts illustrate that contention quite clearly. Read More »

12. Stocks Should Have a Record-Breaking Year According to These 7 Bullish Fundamentals

“A sluggish economy, political gridlock, tepid earnings, the European debt crisis, high gasoline prices…” I can’t really argue with Barron’s depiction of the current market environment yet, against all these seemingly negative conditions, the stock market keeps surging higher. Can it possibly continue, though?

13. End of “Wall Street Party” Will Be a Catastrophe! Here’s Why

The markets are considerably, fantastically overbought and that whatever happens after this “Wall Street Party” is going to be a sort of catastrophe. Here’s why. Read More »

14. Stock Market Bubble Going to Burst & Unleash Destructive Forces on Global Economy

The Fed has manufactured a parabolic move in the stock market…which is much more aggressive (and thus even more unsustainable) than witnessed at either the 2000 or 2007 stock market tops. Parabolas always collapse – there are never any exceptions – so when the pin finds this bubble it’s going to take down not only our stock market, but unleash a destructive force on the global economy. Read More »

15. Warren Buffett’s Favorite Valuation Metric Suggests Stock Market Is OVERvalued by 15%

Here’s some perspective on the potential value of the U.S. equity market using Warren Buffett’s favorite valuation metric – total stock market capitalization relative to GDP. Read More »

16. These Indicators Suggest Stock Market Returns Are “Too Good To Be True”

Current macro conditions indicate that we are in a sweet spot for equity returns…that global growth is continuing and there is little or no tail risk in the immediate future. It’s time to get long equities…but I have this nagging feeling that these market conditions are too good to be true. If you look, there are a number of technical and fundamental clouds on the horizon. Read More »

17. Bookmark This Article: The Stock Market Will Crash Within 6 Months!

Until recently, I have not used the term “stock market crash”. I do not take using this term lightly. It brings with it major repercussions. I am now breaking out this phrase because of the current state of the stock market. This stock market crash will occur within the next six months from today… The markets will fall within a combined day/few days a total of at least 20%. Bookmark this article. Read More »

18. These 2 Stock Market Metrics Make Me Feel Uneasy – What About You?

It’s been an amazing run in the stock market but…I start to feel a bit uneasy about things when I see all news reported as good news, because it either means the economy is getting better or more QE is coming. The fact, though, is that the market is just driving higher on what looks like sheer optimism of continued QE and little else. You can see this optimism in two indicators you’ll recognize. Read More »

19. 4 Clues That a Stock Market Collapse Is Coming

You might be well advised to keep your powder dry and your portfolio small – or even be tempted to sell everything and wait for the storm to blow over [given the 4 clues put forth in this article]. Read More »

20. We’re on the Precipice of a 50% Drop in the U. S. Stock Market! Here’s Why

Warren Buffett’s favorite indicator – the ratio of the value of U.S. stocks to GDP – is seen by him as a reliable gauge of where the market stands and these days it suggests that all the main indexes are pointing to an imminent 50% crash. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money