For those of you who fall in the gold bug camp, the technicals and sentiment may  finally be aligning in your favor once again. Here’s why.

finally be aligning in your favor once again. Here’s why.

The above introductory comments are edited excerpts from an article* by Jesse Felder (thefelderreport.com) entitled Taking A Shine To The Gold Miners, Part Deux.

Felder goes on to say in further edited excerpts:

I’m not going to try to make the fundamental case for owning gold. You can find great arguments being made on both sides of that debate [refer to the many other archived articles on the munKNEE.com site]. Either you believe that gold is a unique store of value or that it’s just a shinier metal than most. What I’m interested in right now is the technical picture and general sentiment towards the asset after a three-year bear market that has seen the precious metal drop, in dollar terms, nearly forty percent.

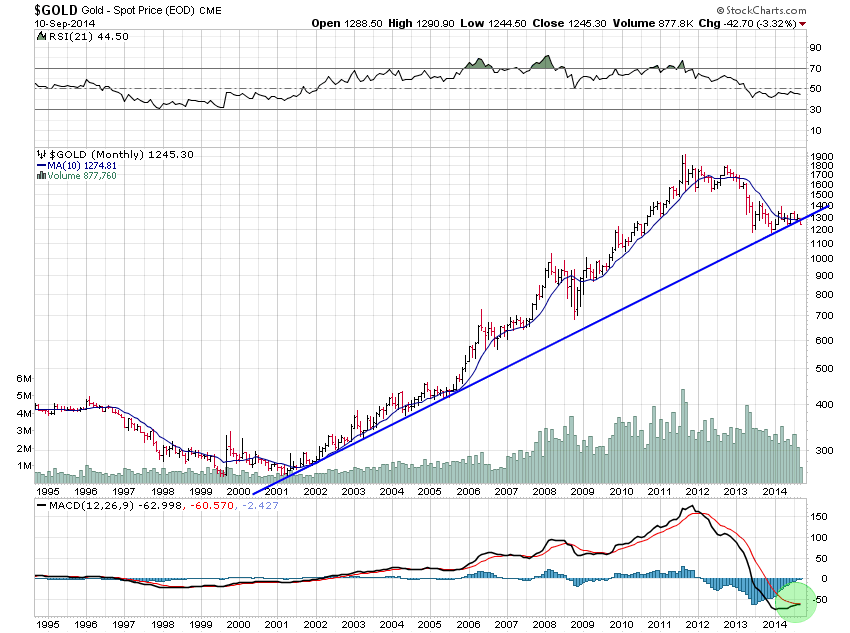

Long-term Trend Line

On a long-term time frame gold is testing a pretty important uptrend right now. Actually, it’s fallen below the uptrend but I’ll be looking for a monthly close below the trend line and/or the 10-month moving average (both around 1275) to determine that the uptrend line is officially broken and there’s a lot of time left in the month of September for it to rally back and close above.

MACD

The MACD lines at the bottom of the chart are also getting very close to turning higher. Notice they last crossed down back in early 2012 which turned out to be a great signal to get out if you owned any gold at the time.

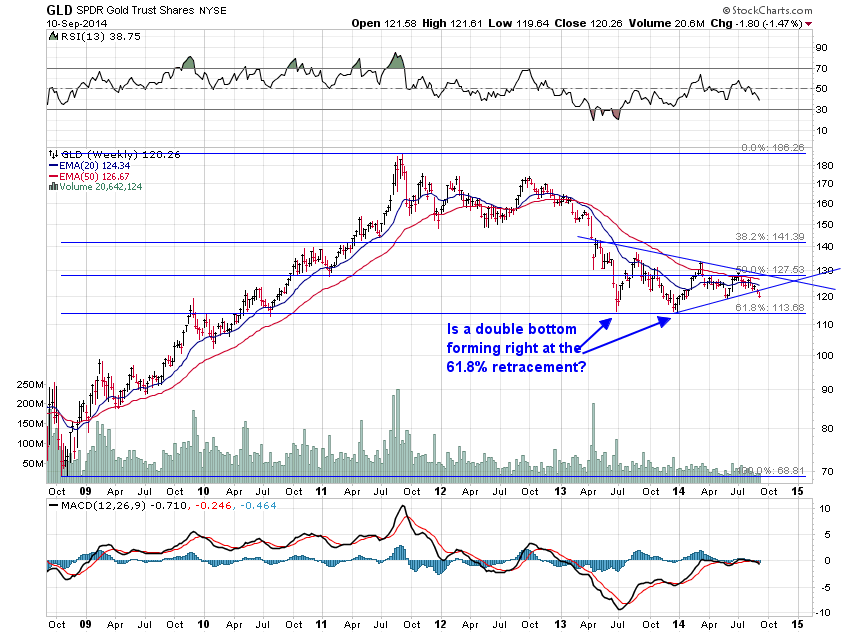

GLD Weekly Time Frame Trend

Looking at the gold ETF on a weekly time frame…it’s clearly breaking down out of a bearish pennant but key support lies just below at the 61.8% Fibonacci retracement around 113.68 (roughly 1200 for the precious metal) so the metal is at a crucial juncture right here..

Can it hold the monthly uptrend and the weekly 61.8% retracement level? Time will tell.

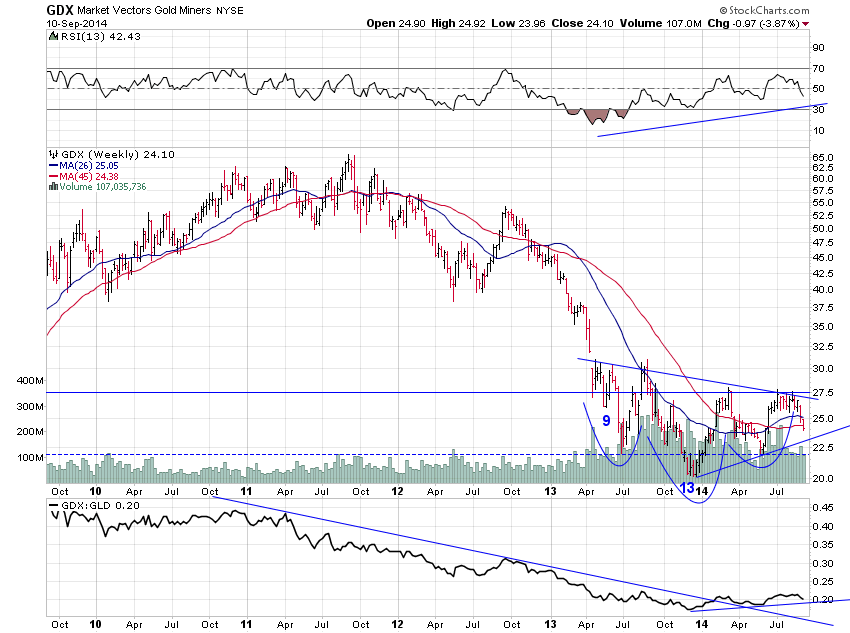

GDX Weekly Chart

Should they both manage to hold these key leves, the best way to play it may be through the gold miners ETF. A look at the weekly chart here shows a potential variation of a head and shoulders bottom with a DeMark 13 buy signal. Technically, you could argue the price action is either basing for a reversal or flagging before continuing lower.

GDX:GLD Ratio

…[A]t the bottom of the chart I’ve included the ratio between the miners ETF and the gold ETF. After underperforming the metal for the past three years or so the miners have recently begun to outperform. If their underperformance back in 2011 was a warning signal that gold’s bull run was coming to an end (and it was) this recent outperformance could mean the bearish trend of the past few years may soon be ending, as well.

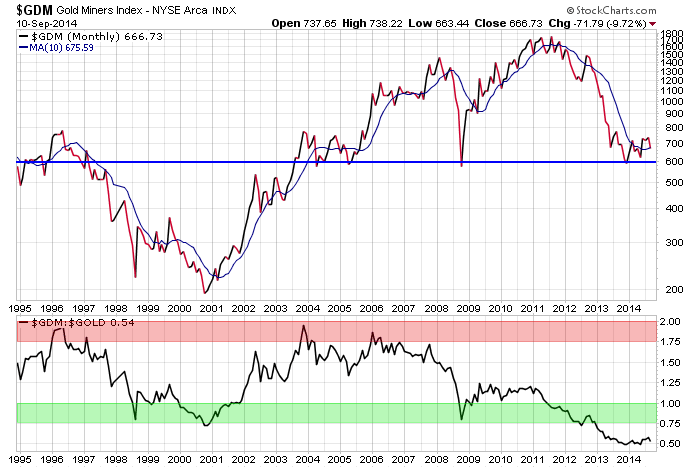

GDM:GOLD

A longer term look at the ratio between the miners and the metal (at the bottom of the chart below) shows the miners have not been this cheap relative to the underlying metal at any point during the past twenty years.

Individual investors

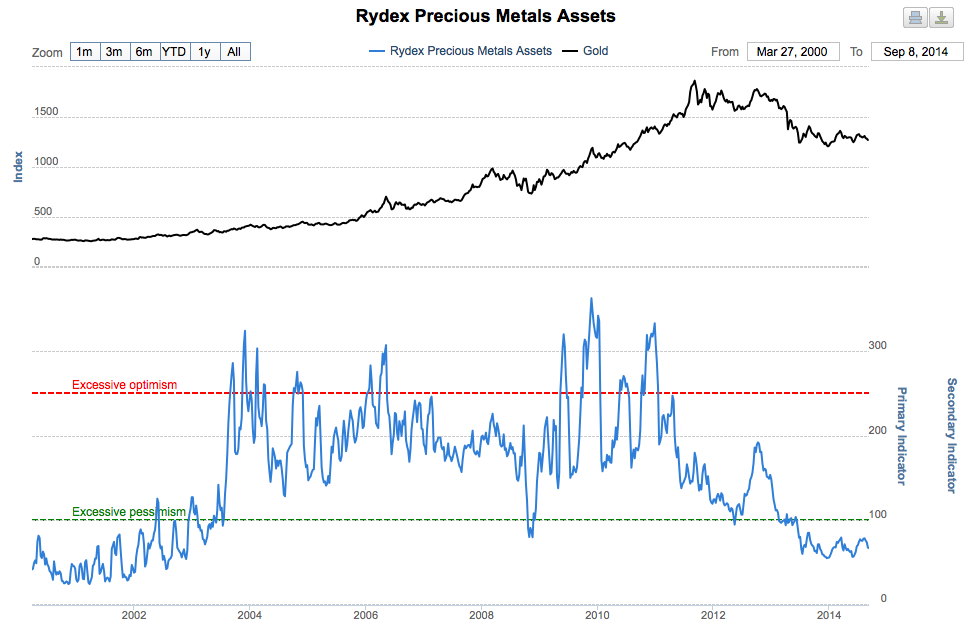

Finally, not only are portfolio managers extremely underweight the precious metals right now, individual investors have pretty much abandoned them, too.

The Smart Money

While the so-called dumb money gives up on the trade, the smart money is getting aggressive on the long side. George Soros nearly doubled his position in the gold miners ETF last quarter to over two million shares. He also bought call options on the gold ETF equivalent to about 1.33 million shares.

Conclusion

For those of you who fall in the gold bug camp, the technicals and sentiment may finally be aligning in your favor once again. Stay tuned.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://thefelderreport.com/2014/09/10/taking-a-shine-to-the-gold-miners-part-deux/(Copyright © 2014 Felder & Company, LLC, All rights reserved.)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. What Are Factors That Motivate Gold Saying Today?

What happens when gold has transitions from a cyclical bull market to a cyclical bear market? what motivates gold to enter a bull market phase? This article has the answers. Read More »

2. Buckle Up: Gold’s About to Begin A Major Breakout! Here’s Why

Buckle up! Gold is coming out of hibernation within the next 6 to 12 months and will then begin a major breakout to the upside to at least $3,600 over the next 2 to 4 years. Read More »

3. Gold Shares Have Bottomed & Will Now Outperform Physical Gold Over Next 5.5 Years

2014 could end up being the turnaround year for precious metals and a bull market ascent could develop in 2015 – especially so in gold shares. Here’s why. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money