Canadian households are heavily leveraged and with their level of debt in proportion to income now hovering at record levels, they are vulnerable to a range of economic shocks that could create a financial crisis. I am of the opinion, however, that the range of variables at play discussed in this article would mitigate any possibility of a meltdown of Canada’s financial system. Let me explain.

The above comments, and those below, have been edited by munKNEE.com (Your Key to Making Money!) for the sake of clarity [] and brevity (…) to provide a fast and easy read and have been excerpted from an article* by Caiman Valores as posted on SeekingAlpha.com under the title How Bad Is The Financial Health Of Canada’s Households? and which can be read in its unabridged format HERE.

Record Level Of Household Debt

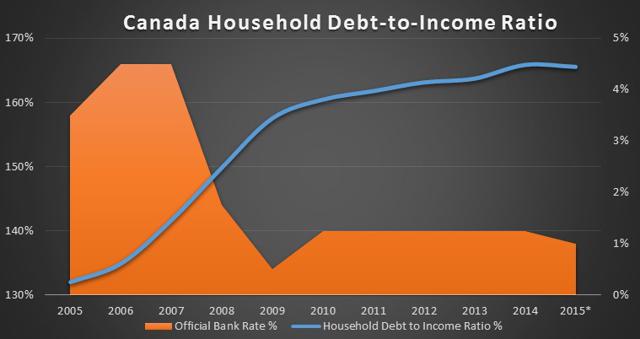

A key concern among Canada’s policymakers is the extremely high levels of household debt in Canada which by the end of 2014 had hit a record high. This concern comes from the belief that such a high debt-to-income ratio now makes Canadian households extremely vulnerable to economic shocks that could derail their ability to meet their financial commitments.

(click to enlarge) Source: Statistics Canada *Latest data is at April 2015.

Source: Statistics Canada *Latest data is at April 2015.

For the fourth quarter 2014, Canada’s household debt ratio hit a new high of 165.84%, but since then it has declined by 31 basis points to 165.53% for the first quarter 2015. This leaves it hovering near record highs and, according to the BoC, makes Canadian households vulnerable to a range of internal and external economic shocks such as:

- the spillover effects of a hard economic landing in China,

- ongoing financial stress in the Eurozone,

- a sharp increase in interest rates or

- a deep recession in Canada.

Given the volatility of the current global macroeconomic environment, it is not hard to imagine that any of these events could easily occur.

Already, we are witnessing the impact of the rout in oil prices that has essentially pushed Canada into recession and caused unemployment to rise, although the effects of weaker oil prices are most notable in western Canada.

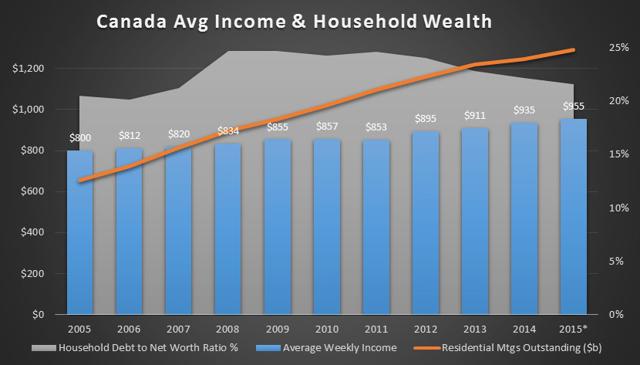

Falling Household Debt-to-net-wealth Ratio

Interestingly, while some businesses and households are struggling because of this, particularly in Alberta, the overall impact has not been catastrophic for Canada. The reason for this is that household debt only shows one side of the equation, the other is growing household wealth and income.

As you can see in the chart below, household wealth and average incomes have increased over the last three years and this has caused the household debt-to-net-wealth ratio to fall. In fact, for that period, as the wealth of Canadian households grew, the ratio of debt-to-net-wealth fell by almost 2.5%, while average incomes rose by 12%. This indicates that while debt may have been increasing so too was household wealth, along with the capability of Canadian households to manage that debt.

(click to enlarge) Source: Statistics Canada *Latest data is at April 2015.

Source: Statistics Canada *Latest data is at April 2015.

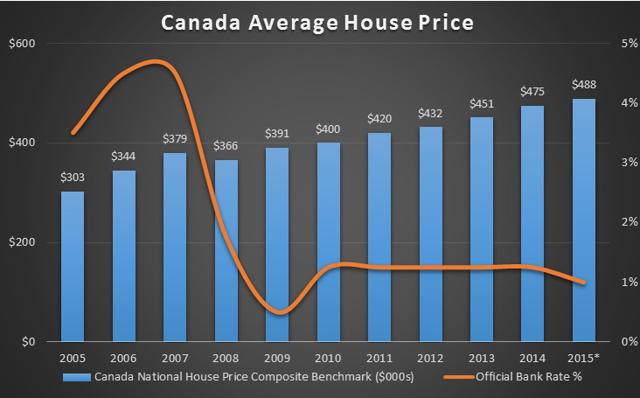

Dramatic Increase In House Prices

Much of the increase in wealth can be attributed to the rising values of investments such as pensions, mutual funds and stocks, although the majority comes from the significant increase in house prices over the last decade.

As you can see in the chart below, Canadian housing prices really picked up steam after the global financial crisis which can be attributed to the artificially low interest rate environment which, in conjunction with Canada coming through the GFC relatively unscathed and rising incomes, made borrowing far more affordable.

(click to enlarge) Source: Statistics Canada *Latest data is at April 2015.

Source: Statistics Canada *Latest data is at April 2015.

The solid increase in average income can be attributed to the post GFC oil boom, which along with favorable government policies, particularly in Alberta, and oil bouncing back to over $90 per barrel, triggered an oil boom of epic proportions.

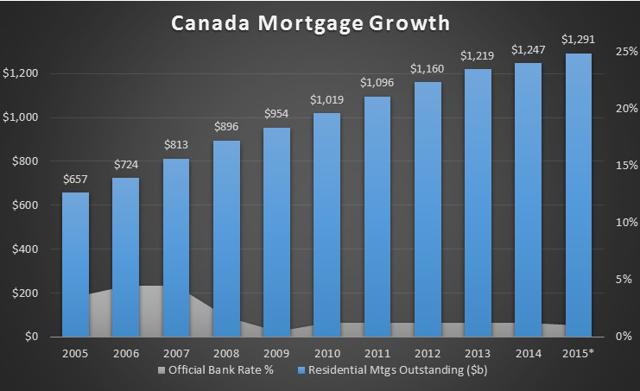

Major Increase In Household Mortgage Debt

It is here that we start to see the nexus between extremely high levels of household debt and the financial system which is creating the concerns among policymakers over the threat this poses to the financial system and economy. Growing incomes, low interest rates and excess funds made it easier for Canadians to borrow and this has fueled a housing boom of epic proportions with Canadians snapping up houses at a frenzied rate.

As you can see in the chart below, the value of residential mortgages in Canada has grown rapidly over the last decade. For the first quarter 2015, mortgage debt grew by 5.3% quarter-over-quarter and 5.5% year-over-year.

(click to enlarge) Source: Statistics Canada *Latest data is at April 2015.

Source: Statistics Canada *Latest data is at April 2015.

Residential mortgages now make up almost 71% of household debt and are the fastest growing component of household debt.

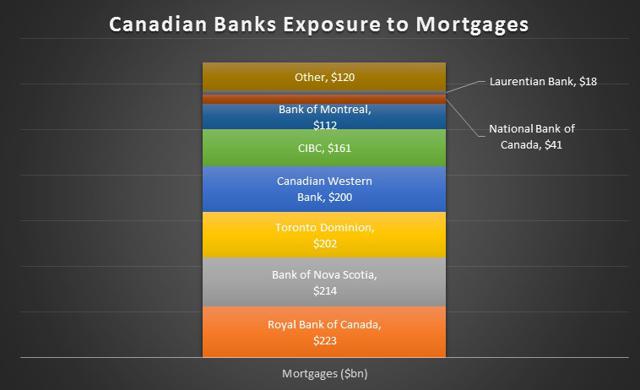

Rising Canadian Bank Exposure to Mortgages

The greatest concern among analysts and policymakers is that, with Canada’s household debt hovering at record levels, any significant financial shock will leave them unable to meet their financial commitments.

The above is particularly worrying because in the eyes of some it could become a fully-fledged financial contagion that would impact the stability of Canada’s banking and financial system…Canada’s banks have engaged in a feeding frenzy by aggressively lending to home buyers as they sought to boost revenues and profitability in a low interest rate environment with the value of residential mortgages outstanding growing by 3.5% year-over-year and double what it was a decade ago.

As you can see in the chart below, Canada’s major banks each have significant exposure to mortgages.

(click to enlarge) Source: Statistics Canada & Company filings.

Source: Statistics Canada & Company filings.

With households heavily leveraged and mortgages being the majority of their debt, this means those institutions that are carrying a considerable volume of mortgages on their balance sheets are potentially highly vulnerable to households not being capable of meeting their financial commitments. [Indeed,] if there was a significant economic shock that saw a broad-based collapse in the ability of Canadian households to meet their financial commitments, all of Canada’s banks would see their primary growth lever disappear overnight.

Bottom Line

Canadian households are certainly heavily leveraged, and now with their level of debt in proportion to income now hovering at record levels, they are vulnerable to a range of economic shocks.

There are a number of variables that could create a financial crisis, with further major external macroeconomic shocks such as a hard landing in China capable of creating considerable fallout for Canada’s households. However, as we have already seen, households have shown themselves to be quite resilient to many of these types of economic shocks, and while the sharp collapse in oil prices has had a marked impact, it certainly hasn’t created a broad-based collapse.

In fact, what many pundits forget to account for when considering the financial health of Canada’s households is their growing wealth. This provides them with a financial buffer that should allow them to absorb the fallout from any external financial shocks.

One of the greatest concerns, however, is that an interest rate rise will sharply affect the financial health of households because of their high levels of debt although the BoC recently cutting the overnight rate to 0.5% has diminished significantly the threat that a rate rise poses for at least the foreseeable future.

Nonetheless, Canada’s housing market is certainly in frothy territory and, in conjunction with the dependence of Canada’s banks on mortgage lending, makes any broad-based collapse of Canada’s housing market a significant risk for the stability of its banking system and economy.

Conclusion

In conclusion, I am of the opinion that the range of variables at play would mitigate any possibility of a meltdown of Canada’s financial system.

*http://seekingalpha.com/article/3417496-how-bad-is-the-financial-health-of-canadas-households?ifp=0

Related Articles from the munKNEE Vault:

1. Bank of Canada Has Exacerbated Canada’s Majestic Housing Bubble

The Bank of Canada took a good look at the Canadian economy, saw it was sinking into the mire, glanced at the collapsed prices of commodities, particularly oil, saw how they were wreaking havoc in Canada, and then looked at the global economy, particularly at China and the US, and freaked out with the realization (acknowledgement) that things are heading south FAST.

2. Canada Has Devalued Its Dollar (Loonie) Again – Why?

The Bank of Canada has cut its overnight rate for the second time in the last six months – to 0.5% – and the Canadian dollar has reacted as expected, [indeed, as intended,] putting the Canadian dollar at a six-year low in terms of dollars (-10.2%) and pound sterling (-10.4%). So why the rate cuts and competitive devaluation?

3. Housing Bubble Threatens Financial Stability of Canada – Here’s Why

Over the last 14 years, house prices in Canada have increased by 150%, twice as fast as in the U.S…[and] far outpacing household incomes. Any increase in interest rates would prick the bubble, and its implosion would trigger all sorts of mayhem to the point that the Canadian government has expressed concerned that such an event would be a significant risk to the “stability of the financial system”.

4. Canadians Take Note: Country’s Economy Will Blow Up If This Event Happens There

With interest rates being pushed lower year after year, interest expense as a % of disposable income has been declining in Canada and, for the moment, these low interest rates keep the whole thing glued together but, were interest rates to ever rise, Canada’s economy would blow up. Here’s why.

5. Continued Low Oil Prices Could Seriously Damage Canada’s Economy – Here Why & How

If oil prices remain anywhere near the current levels for a prolonged period – something the Saudis are aiming for – Canada’s economy is in serious trouble. Here’s why.

6. Oh Canada! Are You Prepared For What’s Likely Coming?

Chilling references to a potential (likely) financial crisis in Canada keep cropping up in official statistical data releases. First it was concerns about the housing bubble there and the high level of personal debt to income, now it’s about how hard manufacturing is getting hit there in spite of the loonie (Canadian dollar) dropping 17% against the US dollar in the past 15 months. It really begs the question “Oh Canada, Are You Prepared For What’s Coming?”

7. Canada’s Housing Market Most Overvalued In the World – and Could Burst At Any Time!

The real estate sector in Canada is in a bubble that could burst at any time according to the IMF, Deutsch Bank, the Bank of Canada and The Economist.

8. Canada’s Housing Bubble Is A Sight To Behold – A Terrible Sight! Here’s Why

Canada’s housing bubble has been a sight to behold. Home prices only dipped 8% when the US housing market crashed. Then it re-soared. Now, across the country, home prices are 26% higher than they were at the already crazy peak in 2008. In Toronto, they’re 42% higher! There is a major drawback Canada’s housing bubble beyond the fact that it will eventually crash with terrible consequences.

9. Implosion In Canada’s Housing Market Is Inevitable! Here’s Why

The Canadian housing market is deep into bubble territory. We all know that bubbles can go on for longer than most people think but with the crash in oil prices and people fully believing their own hype, the market is set up for a big fall from grace. Canadian households are deep into debt and make American households look like penny pinchers. Here are five charts showing that the implosion in Canada’s housing market is inevitable.

10. Smug Canadians Ignoring Looming “POP” In Housing Bubble

Canadians are using their appreciating homes as ATMs (as Americans did in the early 2000′s before their housing crash) and the funds being borrowed are not just for home improvements, but in many cases to fund living and lifestyle expenses.

11. The Canadian Housing Bubble Will NEVER Blow Up – Supposedly! Here’s Why

The Canadian housing bubble will never blow up. There’s simply too much “plankton” in the water. It keeps the “food chain” healthy and offers ample nourishment for the “big wales and sharks” and shorting the Canadian housing bubble is useless. Here’s why.

12. Canadian Real Estate Due For Significant Correction – Here’s Why

Canada’s real estate market has started to look eerily similar to the conditions that were present before the United States’ real estate crash…This article reviews the data to compare the Canadian real estate values to the U.S. real estate market, to suggest why the Canadian real estate market is due for a significant correction.

13. Expected Global Stock Market Returns Over Next 5 Years Say “Avoid Canada & U.S. “

This comparison of stock values across all major world markets and forecast returns over the next five years suggests that, while this is not a “back up the truck” opportunity, it’s not bad either, particularly given how unappealing bonds and cash are at current yields.

14. S&P 500 Companies Most Worried About Economies of Canada, Australia & China

One way to gauge the level of concern about the situation in Greece is to see how many S&P 500 companies mentioned Greece relative to other countries during recent earnings conference calls so FactSet combed through the 21 earnings conference calls held since June 1 by S&P 500 companies and found these 9 countries to have been mentioned the most [where’s Greece?].

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money