Canada’s real estate market has started to look eerily similar to the conditions that were present before the United States’ real estate crash…This article reviews the data to compare the Canadian real estate values to the U.S. real estate market, to suggest why the Canadian real estate market is due for a significant correction.

The above edited excerpts, and those that follow, are from an article* by Michael Munro as posted on SeekingAlpha.com under the title Will Canadian Real Estate Crash? and it can be read in its unabridged format HERE.

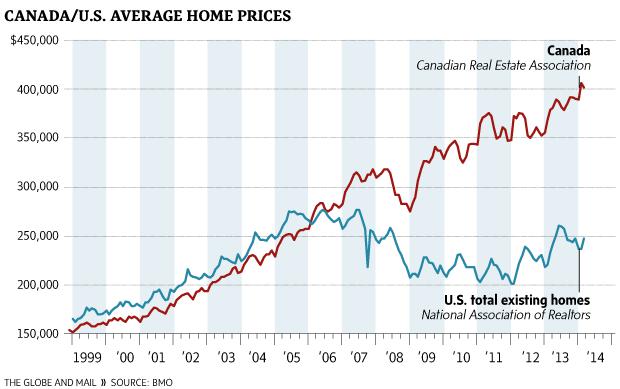

Canadian/U.S. Average Home Prices

Canada’s real estate market followed the trends of the United States’ real estate market very closely for several decades up until 2007. While the U.S. suffered a rapid crash across the country, Canada had only a minor dip, followed by several years of continued growth. A look at the average real estate price in both Canada and the United states demonstrates this point very clearly. We see that as the U.S. faltered in 2007, Canada’s market continued to gain strength.

However, it’s important to be aware of why Canada’s market is different from the United States. [For the details go HERE to the original article.]

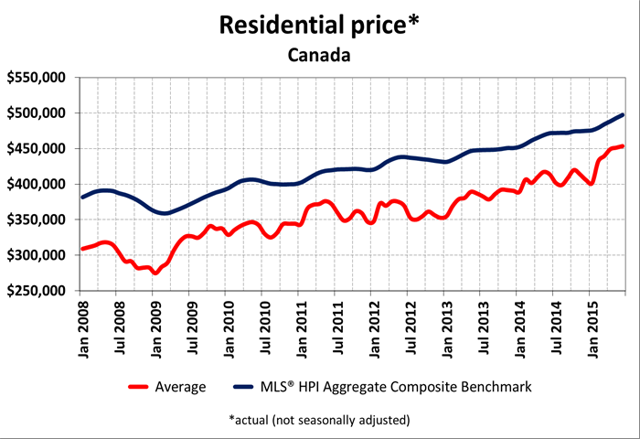

Average House Prices in Canada

Looking at the average house price in Canada more closely for the last few years, we see that Canada’s housing prices have soared since 2009. We see that from January 2009, the house prices rose from approximately $275,000 to just under $400,000 by 2014; therefore, despite a 12% increase in wages, house prices have increased more than 25%. Furthermore, since the end of 2013, house prices have risen more than 10% to exceed an average price of $450,000…

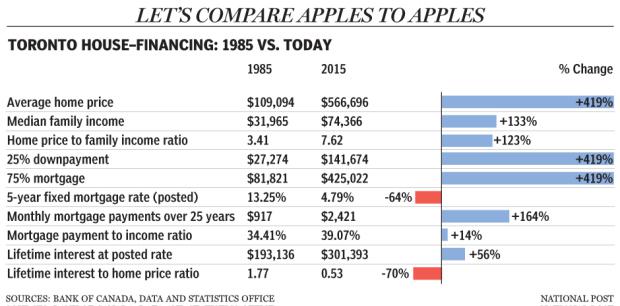

In fact, the Financial Post offered a great example of Canada’s overheated market by using Toronto. We see from the chart below, that in 30 years, in Toronto, house prices have gained about 420%, while income has gone up about 133%. The reason why I specifically included this table is because it shows that despite these two enormous differences in house value and income, the percent of income going towards mortgage payments have only changed less than 5%. The Financial Post stated that it took mortgage rates as a percentage of income to hit 50%, as it did in 1989, before the bubble finally bursting, suggesting we may have another 10% to go. I disagree with this statement, because the interest rates skew the picture entirely.

It’s important to understand that the only way for house values to increase that much beyond wages without a large impact of mortgage as a percentage of income, would be for the average cost of financing to change considerably. This is a perfect example of how prime interest rates can affect house prices. It is also important to understand how quickly mortgage payments can grow when the starting point for interest is almost zero.

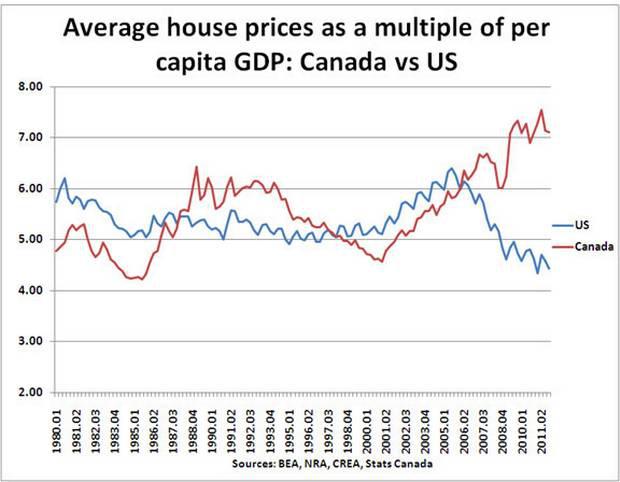

Another similar indicator to test the real estate values is the average house price as a ratio of the GDP. Logically, we would expect this relationship to be somewhat constant, and deviations from this would suggest a poor valuation. Looking at the house price to GDP at both the United States and Canada, we see a pretty scary picture for Canada…

Although I could not find more recent data, this shows the start of a significant deviation of house prices from GDP…

The Demographics

One good thing for Canadian real estate is that Canada has had a steady flow of immigrants moving to Canada, which tends to increase house prices. This can explain some of the differences between the prices and the fundamentals, but does not explain all of it. Furthermore, some of this effect should be offset by the baby-boomer generation not buying a house.

Canadian house prices are not that unreasonable across much of Canada. In fact, if you bought property in a small town almost anywhere in Canada, you likely could obtain a home for a reasonable cost. However, many foreigners are unaware that Canadians generally live in a small number of cities, and that the majority of Canada’s population lives in the few largest cities in Canada. Therefore, although only a few markets are likely to experience heavy corrections, these markets constitute an enormous percent of the Canadian real estate market. The three most overvalued cities I believe are Vancouver, Toronto, and Calgary. As of 2011, Toronto had 5.132 million, Vancouver had 2.135 million, and Calgary had 1.095 million; therefore approximately one fourth of Canada’s population live in these overheated markets.

Toronto’s inflated housing costs seems to be the most legitimate of the three, and may be the least susceptible to a correction. Toronto’s housing market success has been largely driven by increasing immigration, and the success of the Canadian financial markets as it houses the Toronto Stock Exchange. Many would argue that because of this, Toronto’s real estate market should follow the overall strength of the Canadian economy, or at least the strength of the stock market. However, several years of near zero interest rates may have ultimately created a false belief in the strength of the financial markets that are likely to experience pressure with rising interest rates.

The Catalysts

[There are 3] catalyst contributing to overpriced Canadian real estate.

1. The dramatic decline in the price of oil.

Canada has the third largest oil reserves in the world; however, the energy industry in Canada has been hit hard due to the very high cost of production. Massive job cuts have already occurred across the Alberta oil patch, and more job cuts are forecasted. In addition, most energy companies have begun cutting wages and salaries across their workforce as the notoriously overpaid industry has begun to slow down.

The huge job and wage cuts across Calgary will likely have a trickle down effect across a number of industries, most notably the construction industry which is hugely disproportionate in Calgary because of the explosion in growth over the last few years.

2. The enormous amounts of foreign investment in Vancouver.

Vancouver has always been a central location for Chinese immigrants; however, the population has surged over the last few years due to the Chinese economy. There has been huge amounts of capital invested into Vancouver, especially in real estate. Here’s a fact that will shock some of the American readers: The average home price within the city of Vancouver is over 1.9 million dollars Canadian, up from just $700k in 2005. This may not seem as shocking with the USD/CAD at 1.30, but last year when the currencies were close to par, you can see how unbelievable these prices are.

Vancouver has essentially become no longer affordable for locals, and many young people move away due to the very high cost of houses has far exceeded the relatively average wages. Furthermore, Vancouver’s real estate market seems to be the most vulnerable to a crash, as the real estate values are so dependent upon foreign investment. Many Chinese investors have turned Vancouver’s real estate into a Ponzi scheme as more money is piled in from China, and investors have leveraged their properties to purchase more properties.

The unabated purchasing from China has made this Ponzi scheme sustainable, for now. Furthermore, much of this money has been relatively recent wealth made from China’s financial system which ultimately seems to be resting on a house of cards. The Shanghai index has already started to collapse as it has fallen from above 5000 to 3500 in a few short weeks, despite ongoing measures from the Chinese government to spur investment and loosen leveraging rules. This has ultimately set China up for a bigger fall, and much of the ‘new money’ in China (which has invested heavily into Vancouver) will disappear.

As foreign investments are sold off, a chain reaction could occur that would lead to many of the foreign investors being in negative equity and possibly going into default. Although I mentioned earlier that Canada as a whole will likely correct significantly, but not crash, Vancouver is the one city in Canada that has the potential for a U.S. style crash due to the unstable Chinese financial system ultimately driving most of the investment.

3. Several years of near zero interest rates.

The problem with having interest rates so low for so long, is that it has increased the overall mortgage approval amount per person. Over time, this has led to houses as a whole becoming overvalued, as these interest rates are not sustainable. The longer the interest rates remain so low, the more time the bubble has to develop and grow larger. This ultimately creates the possibility of an eventual bigger fall when prices do rise. The problem is that interest rates have been low for so long, it is likely going to have catastrophic consequences if it were to be raised too quickly.

My Predictions

1. Calgary

I believe that either Calgary or Vancouver will be the first to start to fall, and Calgary has already shown evidence of prices starting to decrease in the last few months. Despite the crash in the price of oil, Calgary house prices have remained relatively robust for now, although it is no longer the name your price boom town that it was last year. Sustained low oil prices will ultimately lead to emigration from Calgary, which I think will gradually fall over the next 3-4 years as the price of oil remains in the $40 to $60 slump. I think that Calgary will eventually approach the troughs found in March 2009, or approximately 30% lower.

2. Vancouver

I think that Vancouver’s real estate has the possibility of a fast and sharp correction in prices that is comparable to the United States; however, this would not have a significant chain reaction effect across the country, as other parts of Canada have not experienced the same causes for inflation. I think it is possible that Vancouver house prices could fall anywhere from 30-60%, depending upon the strength of the Chinese economy.

3. Toronto

The Toronto real estate market should fall over the next couple of years, but not nearly to the same degree as those in Calgary and Vancouver. Toronto’s market is the hardest to predict as it is based on variables that do not make it so clearly overvalued, and has been sustained by stable immigration. It seems that Toronto’s market correction will depend upon Canada’s economy as a whole.

*http://seekingalpha.com/article/3382595-will-canadian-real-estate-crash?ifp=0

Related Articles from the munKNEE Vault:

1. Bank of Canada Has Exacerbated Canada’s Majestic Housing Bubble

The Bank of Canada took a good look at the Canadian economy, saw it was sinking into the mire, glanced at the collapsed prices of commodities, particularly oil, saw how they were wreaking havoc in Canada, and then looked at the global economy, particularly at China and the US, and freaked out with the realization (acknowledgement) that things are heading south FAST.

2. Smug Canadians Ignoring Looming “POP” In Housing Bubble

Canadians are using their appreciating homes as ATMs (as Americans did in the early 2000′s before their housing crash) and the funds being borrowed are not just for home improvements, but in many cases to fund living and lifestyle expenses.

3. The Canadian Housing Bubble Will NEVER Blow Up – Supposedly! Here’s Why

The Canadian housing bubble will never blow up. There’s simply too much “plankton” in the water. It keeps the “food chain” healthy and offers ample nourishment for the “big wales and sharks” and shorting the Canadian housing bubble is useless. Here’s why.

4. Canada’s Housing Market Most Overvalued In the World – and Could Burst At Any Time!

The real estate sector in Canada is in a bubble that could burst at any time according to the IMF, Deutsch Bank, the Bank of Canada and The Economist.

5. Canada’s Housing Bubble Is A Sight To Behold – A Terrible Sight! Here’s Why

Canada’s housing bubble has been a sight to behold. Home prices only dipped 8% when the US housing market crashed. Then it re-soared. Now, across the country, home prices are 26% higher than they were at the already crazy peak in 2008. In Toronto, they’re 42% higher! There is a major drawback Canada’s housing bubble beyond the fact that it will eventually crash with terrible consequences.

6. Implosion In Canada’s Housing Market Is Inevitable! Here’s Why

The Canadian housing market is deep into bubble territory. We all know that bubbles can go on for longer than most people think but with the crash in oil prices and people fully believing their own hype, the market is set up for a big fall from grace. Canadian households are deep into debt and make American households look like penny pinchers. Here are five charts showing that the implosion in Canada’s housing market is inevitable.

7. Housing Bubble Threatens Financial Stability of Canada – Here’s Why

Over the last 14 years, house prices in Canada have increased by 150%, twice as fast as in the U.S…[and] far outpacing household incomes. Any increase in interest rates would prick the bubble, and its implosion would trigger all sorts of mayhem to the point that the Canadian government has expressed concerned that such an event would be a significant risk to the “stability of the financial system”.

8. Oh Canada! Are You Prepared For What’s Likely Coming?

Chilling references to a potential (likely) financial crisis in Canada keep cropping up in official statistical data releases. First it was concerns about the housing bubble there and the high level of personal debt to income, now it’s about how hard manufacturing is getting hit there in spite of the loonie (Canadian dollar) dropping 17% against the US dollar in the past 15 months. It really begs the question “Oh Canada, Are You Prepared For What’s Coming?”

9. Canadians Take Note: Country’s Economy Will Blow Up If This Event Happens There

With interest rates being pushed lower year after year, interest expense as a % of disposable income has been declining in Canada and, for the moment, these low interest rates keep the whole thing glued together but, were interest rates to ever rise, Canada’s economy would blow up. Here’s why.

10. Continued Low Oil Prices Could Seriously Damage Canada’s Economy – Here Why & How

If oil prices remain anywhere near the current levels for a prolonged period – something the Saudis are aiming for – Canada’s economy is in serious trouble. Here’s why.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money