Now, however, investors are feeling the full impact of fear and greed. On one hand, many investors fear missing out on future gains if this rally continues (especially if they missed out on most of the current rally). On the other hand, greed certainly rears its ugly head when investors are sitting on big gains and they don’t want the fun to end.

Is a Correction Coming In 2014?

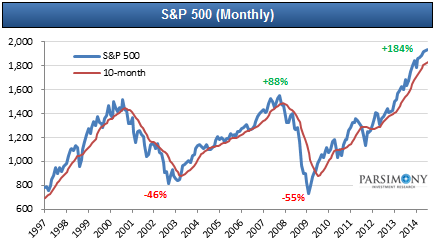

…A correction is a stock market decline of 10% or more and we haven’t seen one in…almost 3 years… Historically, market corrections happen approximately every 2 years on average, so the million dollar question is…will we finally see one in 2014?

Even though the correction bandwagon seems to get louder every day, there have been much larger correction droughts historically.

- Since 1928, there have been 5 periods with correction gaps that were longer than the one that we are currently in.

- The record drought was 1,767 market days (from October 1990 to October 1997).

- The second largest drought was 1,153 days (from March 2003 to October 2007)…

Basically, this tells us that a market correction won’t necessarily be a self-fulfilling prophecy and that we shouldn’t be surprised if stocks continues to chug along in 2014.

Current Valuations

…The S&P 500 is currently trading around 19 times trailing earnings (vs. an average multiple of 15.5x since 1871)! Again, history is littered with examples where above average P/E multiples were sustained for prolonged periods of time. In fact, during the last bull run (2003-2007), stocks spent more than a year trading north of 20 times earnings.

Bottom line is that none of us know when (or if) a correction will occur in 2014 and the best we can do is stick to our investment plan. That said, we think that this rally is getting very long in the tooth and we wouldn’t be surprised if we have a healthy pullback in the coming weeks or months.

For the most part this rally has been Fed-induced (through low rates and easy monetary policy) and economic fundamentals may not be able to support current stock prices. We definitely think that stocks will finish 2014 on a positive note, but we believe that the next 3 months will remain volatile….

Since we won’t be able to time the market top, we feel that now is as good of a time as any to start implementing a short-term “hedge” for your portfolio.

Why Hedge?

First and foremost, it’s important to remember that market corrections happen and, that said, investors need to EXPECT, and more importantly, PLAN for major corrections.

Investors often forget that a significant market correction can wreak havoc on even the highest-quality, dividend-paying stocks. It’s actually difficult to find a dividend stock that didn’t experience a decline of at least 30% during the 2008 recession.

Below are the 2008 maximum drawdowns for some widely held “defensive” dividend stocks:

- Coca-Cola (KO): -40.6%

- Johnson & Johnson (JNJ): -34.4%

- Verizon Communications (VZ): -42.5%

A portfolio hedge could have reduced these losses significantly… without having to sell your stock or give up your dividend. Investors can plan for a market correction by taking the necessary steps to hedge their portfolio. In our opinion, a protective put hedge strategy is the easiest and most cost-effective way to hedge a portfolio.

Market Volatility

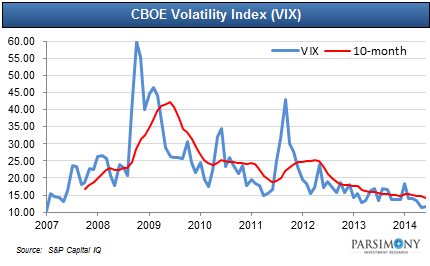

The CBOE Market Volatility Index (VIX) is a popular measure of the implied volatility of S&P 500 index options. Often referred to as the fear index or the fear gauge, it represents one measure of the market’s expectation of stock market volatility over the next 30-day period.

As shown in the graph above, the VIX closed at 11.68 yesterday, which is very close to all-time lows. In theory, when expectations of future implied volatility are so low, it is a contrarian indicator that investors are overly optimistic about the future. In other words, when the VIX is low, there isn’t enough “fear” in the market. Historically, market corrections tend to spawn when implied volatility (or fear) is low. (Note: iPath has an ETN that tracks short-term VIX futures, iPath S&P 500 VIX (VXX), which is also a good proxy for future implied volatility.)

Protective Put Strategy Overview

That said, this is also the best time for an investor to purchase protective puts because the cost of protection is extremely low. Implied volatility is one of the main variables in option pricing models and as implied volatility declines, so does the price of the option.

The main purpose of hedging your dividend portfolio is to limit your downside market exposure (i.e., protect your capital base), while keeping your dividend income intact. As we said above, we believe that purchasing a protective put is the easiest (and most cost effective) way to hedge your portfolio.

We like to use options on the S&P 500 ETF (SPY) for our protective put strategy. Remember that we are only trying to “hedge” the general market exposure in our portfolio and the S&P 500 is a great proxy for the general market. In addition, SPY options are extremely liquid, which makes them very easy to trade.

Conclusion

No hedge is perfect, but a protective put position should help dampen the volatility in your portfolio due to a decline in the general market. Yes, you will be giving up some upside if the market rallies, but that is the nature of a hedge. A hedge is essentially an insurance policy for your portfolio and whether or not you decide to hedge your own portfolio will depend on your specific market outlook and risk tolerance.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/2255693-correction-2014-are-you-prepared?ifp=0 (© 2014 Seeking Alpha)

Related Articles:

1. Extreme Greed By the Crowd Suggests You Show Some Fear! Here’s Why

Greed may have been good for Gordon Gekko. but in the investment world it rarely is. As Warren Buffett is famous for saying “…be fearful when others are greedy and greedy when others are fearful” [and now is such a time]…to start showing some level of fear here in the face of extreme greed by the crowd. The crowd can be right for a long time, but they are rarely right at extremes. While this time may be different, the probabilities suggest that at the very least it will be a more difficult environment for equities going forward.

2. Make No Mistake – A Major Stock Sell-off Looms! Here Are 4 Ominous Signs

The 4 fundamentals and technicals discussed in this article accurately called stock market crashes in 2000 and 2007 and these same market metrics are again TODAY warning that a possible financial tsunami is brewing on the horizon. No one knows for certain WHEN the tsunami will hit Wall Street…but, without question, today’s stocks exhibit extremely exaggerated valuations, and extremes never last, so make no mistake, a major stock sell-off looms.

3. These Indicators Should Scare the Hell Out of Anyone With A Stock Portfolio

For US stocks — and by implication most other equity markets — the danger signals are piling up to the point where a case can be made that the end is, at last, near. Take a look at these examples of indicators that should scare the hell out of anyone with a big stock portfolio.

4. Remember the “Nifty 50″? It’s Back! What Does It Means For the Markets Going Forward?

Market historians will recall the term “Nifty 50” originated in the 1960’s bull market to describe 50 wildly popular large-cap stocks at the time. Interestingly, some of the same names from that list are leading the market higher today. The question for investors, of course, is what this selective advance means for the markets going forward.

5. This Is One “Crazy, Nastyass” Stock Market! Here’s Why

You can call this current stock market a blowoff or call it a Wile E. Coyote moment or call it a divergence or call it a disconnect or call it a lapse of judgement. You can call it whatever you want but I call it the “Honey Badger” market because this is one “crazy, nastyass” stock market – and I can’t believe I’m watching it happen all over again. Read More »

6. Are You A Bull Or A Bear? Here Are Indicators & Charts That Support Your Thesis

The current U.S. equity market has something for everyone. Whether you are bullish or bearish, there is no shortage of indicators or charts you can use to support your thesis. Let’s run through both the Bull and the Bear case here. In the spirit of Confirmation Bias, feel free to skip ahead to the part that best supports your current positioning. Read More »

7. Are We In Phase 3 – the Final Phase – of This Bull Market Yet?

Are we in the third phase of a bull market? Most who will read this article will immediately say “no” but isn’t that what was always believed during the “mania” phase of every previous bull market cycle? With the current bull market now stretching into its sixth year; it seems appropriate to review the three very distinct phases of historical bull market cycles. Read More »

8. Relax! The Stock Market Is Anything But “Scary-Overvalued” – Here’s Why

Are we near the end of one of history’s great stock market rallies? I don’t think so. Yes, prices are in the upper half of their long-term trends, but it’s not what you might call “scary-overvalued.” There is still plenty of room on the upside before historical precedents are violated. Let me explain further. Read More »

9. Is Now the Calm Before the Storm?

I’d argue that the record low volume shows investors aren’t looking ahead as much as looking behind and reminiscing at how good things have been over the past five years or so. They’re expecting more of the same even though it’s mathematically impossible people. Read More »

10. Collapse of S&P 500 May Be Only Weeks Ahead! Here’s Why

When Staple sector (i.e. defensive) stocks started to reflect greater relative strength than Discretionary sector stocks back in 2000 and again in 2007, the S&P 500 began to fall dramatically in the ensuing months. That’s happening again. Can a collapse of the S&P 500 be far behind? Read More »

11. There’s Evidence – Plenty of It – That the Bear Is No Longer Hibernating. Here’s Why

The health of a market is best assessed along three vectors: fundamentals, technicals (price action) and sentiment and this is what each is saying about the health of the markets these days. Read More »

12. A 20%+ Sell-off is Brewing In the Lofty U.S. Stock Markets – Here’s Why & What the Future Holds

For today’s seriously overextended and overvalued US stock markets the best-case scenario is a full-blown correction approaching 20% emerging soon while the worst case is a new cyclical bear market that ultimately leads to catastrophic 50% losses. Read More »

13. Margin Debt: It Doesn’t Matter ’til It Matters! Is Now the Time to Be Worried About the S&P 500?

It doesn’t matter until it matters! IF margin debt should start decreasing swiftly, history would suggest something different is taking place in the mind of aggressive investors. Will a decline in margin debt from all-time highs matter this time? Read More »

14. 2 Stock Market Indicators Are Saying “Be careful, don’t get caught up in the euphoria”

In the midst of all the optimism we see towards key stock indices these days, there are two leading indicators that are flashing warning signals. They say, “Be careful, and don’t get caught up in the euphoria.” Read More »

15. Beginnings of Massive Stock Market Correction Developing: Don’t Delay, Prepare Today!

No stock can resist gravity forever. What goes up must eventually come down. This is especially true for stock prices that become grotesquely distorted. We have been – and still are – living in another dotcom bubble, and – like the last one – it is inevitable that it is going to burst. Read More »

16. 3 Historically Proven Market Indicators Warn of an Impending Market Top

It’s frustrating to see key stock indices keep pushing higher when historically proven market indicators are all warning of a crash ahead. Irrationality is exuberant to say the very least, and that’s why I believe this rally is counting its last days. Read More »

17. The Stock Market Is a Risky Place to Be – Here’s Why

With both the fundamentals and the technicals saying the stock market is a risky place to be, we await its crash back to reality. Here’s why. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I believe that PM’s offer another HEDGE against Stock Market Corrections, I’d be interested in reading the view points of other readers.