Fed Chair Bernanke vehemently denies that the Fed “monetizes the debt,” but our research shows the Fed may be increasingly doing so. We explain why and what the implications may be for the dollar, gold and currencies.

Fed Chair Bernanke vehemently denies that the Fed “monetizes the debt,” but our research shows the Fed may be increasingly doing so. We explain why and what the implications may be for the dollar, gold and currencies.So says Axel Merk (merkinvestments.com)in the introduction to his original article* entitled Is the Fed increasingly monetizing government debt?.

[The following post is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Merk goes on to say in further edited excerpts:

What is debt monetization?

A central bank is said to monetize a government’s debt if it helps to finance its deficit. The buying of Treasuries by the Federal Reserve is a clear indication that the Fed is doing just that, except that Bernanke argues the motivation behind Treasury purchases is to help the economy, not the government.

Shouldn’t one exclude MBS purchases in analyzing debt monetization?

Buying MBS may provide the appearance that the Fed is not monetizing the debt when in fact it is. Don’t take our word for it, but the market’s. In a recent presentation to the CFA society in Melbourne, Merk Senior Economic Adviser and former St. Louis Fed President, Bill Poole, points out that the spread between 30-year fixed-rate mortgages and 10-year U.S. Treasury bonds have been virtually unchanged as a result of MBS purchases; from 1976 to 2006 the average spread was 1.74%. From May 2011 to April 2012 it averaged 1.76%. As such, the direct impact of QE on spreads has been extremely limited.

If it sounds surprising, consider that investors have an array of choices that are highly similar: aside from currency risk, how different are German Treasuries versus U.S. Treasuries? Highly rated U.S. corporate issues versus U.S. Treasuries? They all have distinct risk profiles, but there’s a good reason why absent of issuer-specific news, these securities tend to trade in tandem. As such, the Fed is really just sipping with a straw from the ocean: setting rates may be more a result of communication (the “credibility of the Fed”) rather than the actual purchases.

If rates are set by words rather than action, doesn’t that prove the point the Fed is not monetizing the debt?

We agree that talk is cheap, but talk doesn’t always move the market. As confidence in the Fed’s ability to control rates erodes, policy becomes ever more expensive. Cutting rates, emergency rate cuts, Treasury purchases, Operation Twist, and moving to an explicit employment target are all escalations of a policy to “convince” the market to keep rates low and, along the way, the Fed has to spend more money.

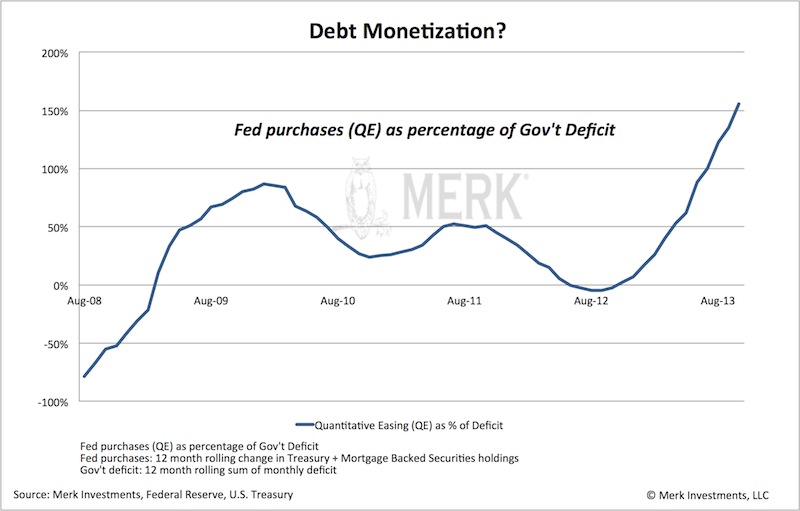

Ask the Fed, and they’ll tell you their operations are profitable. Clearly, as the Fed creates money out of thin air to buy income-generating fixed income securities, the more the Fed “prints”, the more profitable it is. [The fact is, though that] there’s no free lunch and pigs still can’t fly. By all means, no central bank in their right mind would start out with a policy to monetize debt but as the chart above shows, the Fed now spends over 150% of government deficit to hold rates down, suggesting that its firing power is eroding. If and when we come to the stage that the Fed were to explicitly monetize the debt, it may need to buy a high multiple of what it currently does and might still fail to keep rates low. It’s a confidence game.

As the chart above shows, something went wrong, very wrong.

- As tax revenue has picked up throughout the year, government deficits have come down. As such, reducing QE would have been warranted.

- By choosing not to “taper,” however, one can argue that QE has actually increased, as the Fed is buying above and beyond newly issued debt.

Note the Fed will push back yet again, arguing it cannot buy debt directly from the government [but] only in the secondary market. That may well be semantics, however. As a large bond manager has pointed out: in the absence of QE, we might have to sell debt to one another, rather than to the Fed.

Where’s debt monetization heading?

The way we see the dynamics playing out, this confidence game will go on for some time, yet we may increasingly be seeing cracks.

- Lower government deficits may be a short-term phenomenon as over the long-term the cost of entitlements and interest payments may rise substantially, highlighting that deficits may not be sustainable.

- In 10 years from now, the Congressional Budget Office (CBO) estimates the U.S. government may be paying $600 billion more a year in interest expense alone. Indeed, if the average cost of borrowing went back up to the average cost of borrowing since the 1970s, the government may need to pay $1 trillion more per year in interest expense alone.

- To us, this suggests the biggest threat we are facing may be economic growth… Because the bond market has been most sensitive to good economic data…should the bond market sell off (increasing the cost of borrowing), the cost of financing U.S. government deficits may escalate.

- We already have a Fed that has indicated interest rates will stay low for an extended period…[and] we interpret that as the Fed being slow to rising inflationary pressures that are likely to increase should the economy ever pick up again.

This is all too abstract – how will this play out?

If you think this is abstract, think Japan….[If] the Japanese…[are] successful with their policies…[and] achieve sustained economic growth…Japanese Government Bonds…might plunge, making it difficult, if not impossible, to finance Japan’s massive government debt burden. Few observers doubt that the Bank of Japan may step in to help finance government deficits [and] that’s debt monetization. We think the valve for Japan will be the yen that won’t survive this. When we discuss this with investors, most agree that this is a real risk for Japan.

Don’t kid yourself, though. Even if we may be able to kick the can down the road for longer in the U.S., we think it may be hazardous to one’s wealth to ignore the risks posed to the dollar due to a toxic mix of monetary and fiscal policy.

How do I prepare as an investor?

The way we look at the world is in terms of scenarios. If a [particular] scenario is sufficiently likely, we think investors should take it into account in their portfolio allocation; professional investors may even have it as their fiduciary duty.

Alternative #1: Cash

To us, the short answer is that there is no such thing anymore as a risk free investment and investors may want to take a diversified approach to something as mundane as cash. Investors may want to consider throwing out the risk free component in their asset allocation. That’s because the purchasing power of the U.S. dollar may be at risk.

Alternative #2: Gold

Gold has performed rather poorly this year and is increasingly being written off yet those writing off gold should think twice about where they see the economy and the Fed heading. If one believes we will return to a “normal” environment and we’ll live happily ever after, maybe those gold naysayers have a point. Keep in mind, however, that incoming Fed Chair Janet Yellen stated during her confirmation hearings that we shall return to a normal Fed policy once the economy is back to normal. To us, that’s an oxymoron: we cannot return to a normal economy when the Fed prevents risk being priced by market forces.

To us, gold is more than “insurance” to adverse scenarios as some say, as we find it difficult to see how we’ll be facing positive real interest rates for an extended period over the coming decade.

Alternative #3: A basket of currencies

The Chinese government diversifies its reserves to a basket of currencies, clearly adding currency risk to their portfolio. Conversely, U.S. investors may want to consider diversifying to a basket of currencies if they believe we ultimately have the better “printing press” than the rest of the world?

Isn’t it more complex than that?

In some ways, yes. Governments won’t give up without a fight. We believe policy makers want to do the right thing, except that the road to hell might be paved with good intentions…

Aside from cash not being “safe,” political stability may also continue to erode throughout the world as citizens worldwide, dissatisfied that their wages don’t keep up with an increasing cost of living, elect ever more populist politicians.

Conclusion

The only good news we can see is that our policy makers may be predictable and an investment strategy based on staying a step ahead of policy makers might be worth considering. Think currency wars, and think diversifying on a more pro-active basis. We are not suggesting investors become day traders, but we think the currency markets may be well suited to take positions on how one believes these dynamics may play out.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://www.merkinvestments.com/insights/2013/2013-12-03.php (© 2013 Merk Investments LLC; Please subscribe to Merk Insights and follow me on Twitter to learn how policy makers impact investors.)

Related Articles:

1. Fed’s Tapering Plans Will Be Delayed For These 5 Reasons

The financial markets were in distress lately because of Fed Chairman Ben Bernanke’s suggestion that the Fed might taper off its quantitative easing programs starting at the end of this year and ending in 2015. Here are five reasons why markets shouldn’t worry too much about the Fed leaving the stage: Read More »

2. The Fed Is About to Turn Off the Monetary Spigot! Yeah, Sure

Fearing that the flow of nourishing mother milk from the Fed could dry up, a resolutely unweaned Wall Street threw a hissy fit and the dummy out of the pram last Thursday. The end of QE is seen as the beginning of the end of super-easy policy and potentially the first towards normalization. There is only one problem: it won’t happen. Here’s why. Read More »

3. Bernanke Has Created the Mother of ALL Stock Market Bubbles – Here’s Why

We have NEVER been this overextended above this line at any point in the last 20 years. Indeed, if you compare where the S&P 500 is relative to this line, we’re even MORE overbought that we were going into the 2007 peak at the top of the housing bubble. Read More »

4. These Charts Show That Any Fed Tapering WILL Cause Stock Markets to Collapse

Whenever the Fed has decided to reduce the extent of their purchases of “agency” debt products, the SP500 also declined in a dramatic way. [As such,]… it makes it extremely important to contemplate a “tapering” off in the rate of growth of Fed assets, or even an outright end to quantitative easing (QE). [Indeed, if you own stocks you may well want the Fed QEternity program to be just that – to eternity – in spite of the inflation that will surely follow.] Read More »

5. Get Informed: 4 QE Myths Debunked

The Fed continues to assert that its Quantitative Easing bond purchases will boost economic growth by lowering borrowing costs for businesses and consumers but the evidence shows that QE bond purchases have actually coincided with increases in long-term interest rates. Read More »

6.

The Federal Reserve system is an imperfect, but rather innovative, clearinghouse. Its structure as, “independent within government,” makes it hard to decipher precisely who owns it [but here’s my understanding of what it actually is]. Read More »

7. What Will Happen When the Fed Finally Ends Its Extreme Easing Efforts?

Last Wednesday, Fed Chairman Ben Bernanke promised to end his bond-buying addiction – cold turkey – in mid-2014. That is, as long as the economy is strong enough. As a result, investor fortitude was pushed to the brink. Stocks sold off hard, sending the S&P 500 Index down 1.4%. Before you head for the exits, too, let’s get a little perspective. Read More »

Just the mere suggestion that this round of quantitative easing will eventually end if the economy improves is enough to severely rattle Wall Street. U.S. financial markets have become completely and totally addicted to easy money, and nobody is quite sure what is going to happen when the Fed takes the “smack” away. When that day comes, will the largest bond bubble in the history of the world burst? Will interest rates rise dramatically? Will it throw the U.S. economy into another deep recession? Can the Fed fix this mess without it totally blowing up? Read More »

9. Time to Sell the U.S. Dollar & Diversifying Into a Basket of Hard Currencies?

Stocks are up. Bonds are expensive. Dollar cash is unlikely to preserve purchasing power in an environment of negative real rates. Diversifying to a basket of hard currencies might help to mitigate some of the risks out there. It clearly adds currency risk but in an environment where there may not be such a thing as a risk free asset, it might be a risk worth pursuing… Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money