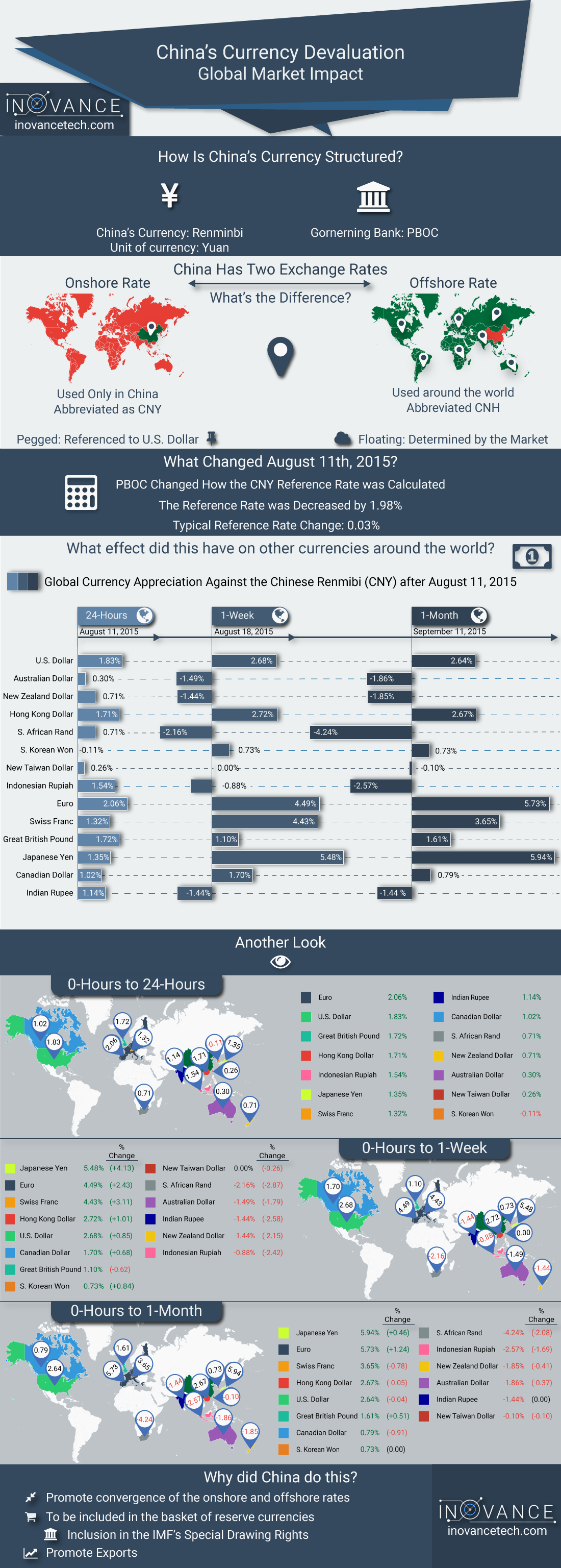

Even the slightest movement made by China can create a ripple effect on fragile global markets. On August 11 China devalued its currency by 1.9% and has made some smaller changes since then. Today’s infographic looks at the reaction in currency markets in three time frames after the event: 24 hours, one week, and one month after.

fragile global markets. On August 11 China devalued its currency by 1.9% and has made some smaller changes since then. Today’s infographic looks at the reaction in currency markets in three time frames after the event: 24 hours, one week, and one month after.

The following infographic is from visualcapitalist.com as originally created by Justin Cahoon of inovancetech.com. The original commentaries can be read HERE or HERE.

The commentary associated with the infographic above was edited by Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – register here) for the sake of clarity ([ ]) and brevity (…) to provide a fast and easy read.

*http://www.visualcapitalist.com/number-crunching-the-impact-of-chinas-currency-devaluation/ **https://www.inovancetech.com/chinese-yuan-infographic.html

Past Related Articles from the munKNEE Vault:

1. Chinese Yuan Set to Increase Dramatically in Value – Buy Some Now – It’s Easy!

June 27, 2012: If you’re serious about protecting the value of your money then please, as much as I love gold, don’t just buy the yellow metal — also buy some Chinese yuan! [Here’s why.] Words: 400

2. China’s Doubling of the Yuan’s Trading Band Seen As Very Significant – Here’s Why

April 10, 2012: The Chinese central bank’s doubling of the trading band on the Yuan/U.S.$ exchange rate to 1.0% as of today has been greeted by general enthusiasm and is seen as a very significant move on China’s part for a number of reasons. Let me explain. Words: 772

3. Don’t Forget China When Formulating A Diversified Secure Financial Strategy

May 4, 2012: It is well known that holding uncorrelated asset classes in our investment portfolio gives diversification benefits. In the same sense, diversifying among competing or rival countries or jurisdictions helps to maximize freedom by mitigating political risk. This article discuss the merits, and ease of, diversifying in a country that virtually all have never given a second thought, let alone an initial one.

4. China is Buying Up the World – Big Time! Take a Look

June 10, 2015: A currency war is a battle, supposedly an economic policy to cheapen a country’s currency compared to that of others, to promote exports but the real reason, the one that’s less talked about, is that countries actually want to import inflation – a way of creating monetary ease and importing inflation. Let me explain.

July 10, 2014: The U.S. holds great power over international monetary transactions via the SWIFT network system given the USD’s world reserve currency status…It is entirely possible, however, that China and its closest partners might someday implement their own SWIFT system…The world’s players could then choose between the two and, given the resentment that exists worldwide toward the U.S. for the bullying of FATCA, many would likely align with China in their SWIFT system. In doing so it would eliminate their need to comply with FATCA and other draconian U.S. demands [which might well bring about a swift] end to the U.S. dollar as the world’s default currency.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Great Charts

People can nit pick over tiny changes in their own stocks but if a country like China makes sweeping changes to its currency many don’t even bother to pay attention.

Got PM’s?