China has decided to try and walk back from the edge of a Minsky moment and engineer a soft landing. They have made a decision to pop the bubble deliberately, allow defaults to instill market discipline and remove the moral hazard currently in place. They are moving into the modern world as fast as possible based on the enormous tasks they have embraced so we probably can expect no more booms but probably not a bust either. Let me explain.

have made a decision to pop the bubble deliberately, allow defaults to instill market discipline and remove the moral hazard currently in place. They are moving into the modern world as fast as possible based on the enormous tasks they have embraced so we probably can expect no more booms but probably not a bust either. Let me explain.

The above are edited excerpts from an article* by Ty Andros (traderview.com) as posted on Marketoracle.co.uk under the title China Economy Countdown To Crisis? Yes or No?

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and the FREE Market Intelligence Report newsletter (sample here; register here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Andros goes on to say in further edited excerpts:

…The world’s economies are sitting on a knife’s edge of one type or another…All are in debt spirals as deficits and debt compound at a high rate, while the growth to service them is but an illusion of official account measures, public sector growth and understated inflation.

Waves of insolvency are just waiting to strike as elites, academics, government servants and banksters worldwide cling to the dying consumption, asset-backed economic model created at Bretton Woods II. Before that time, the developed world created wealth the old fashioned way: they produced more than they consumed creating savings for allocation to productive enterprises, also known as capitalism. Now growth is measured in how much you can consume creating a top line while ignoring the amount you borrowed from future income to do so.Money now is nothing more than a confiscation device used by the powers that be to rob their constituents of the fruits of their stored labor.

Consumption reported as growth fueled by borrowing from the future is now the new model…Government policy now is to borrow money with no intention of ever paying it back while telling the world it is risk-free when, in reality, mathematically, it is already worthless and the world is just waiting for people to wake up. Every developed economy and many emerging economies sit directly in the crosshairs of this simple statement.

The Situation In China

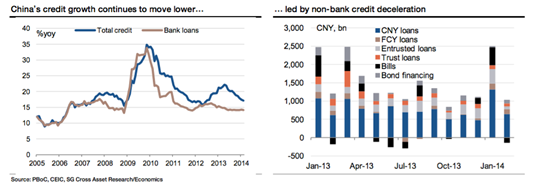

China has decided to try and walk back from the edge of a Minsky moment and engineer a soft landing… The task for China is enormous as half ($15 Trillion, or $15 million million) of the world’s credit creation mentioned previously emanates from the Chinese economy.

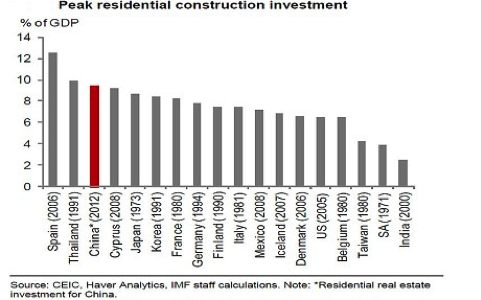

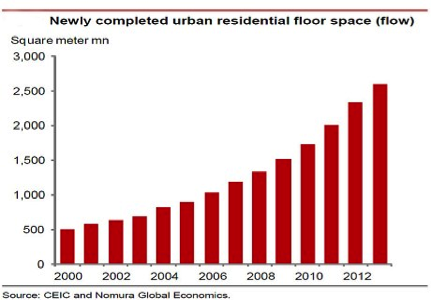

Much of the credit creation went into real estate development and lending:

Floor space per capital is now 30 square meters, surpassing the level that preceded the level in Japan just before the property collapse in 1988. Much of the lending is also threatened by rehypothication as developers have borrowed from many using the same collateral so titles are blurred!

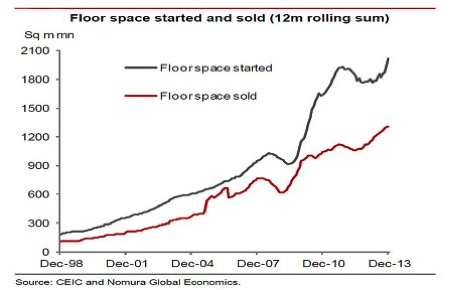

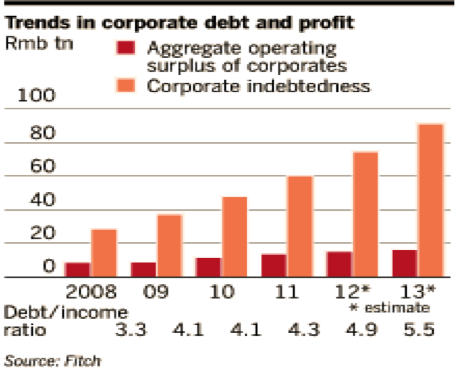

Looked at more broadly, corporate debt has been the principle destination for the credit creation and profits have barely budged or declined due to Yuan appreciation. Now the property markets are beginning their tumble:

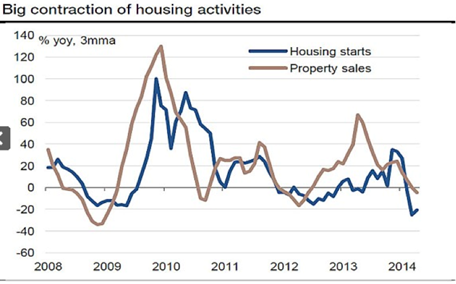

The Chinese have fully anticipated this and have instructed the major banks to pick up mortgage lending to individuals to cushion the fall…They are trying to execute a controlled crash. They have made a decision to pop the bubble deliberately, allow defaults to instill market discipline and remove the moral hazard currently in place. Let’s pray for their success, as no other central bank or government dares to walk this path…

This is a face of the debt spirals we see throughout the world as developed world economies’ debt compounds ferociously and growth is a distant memory. The Chinese just did it in the private sector while the developed world have done it in the public sectors since 2008.

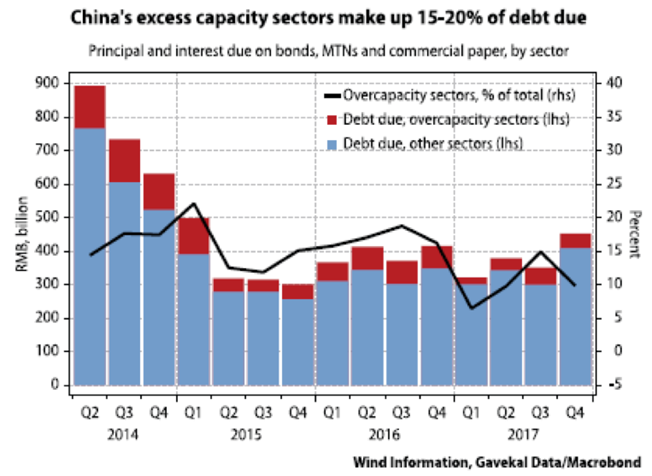

The corporate buildup of infrastructure – industrial, energy, and state owned enterprises – is excess capacity that lays idle or underutilized. It is why the Yuan has suddenly weakened as China must become more globally competitive; what was a one way train in Yuan appreciation is now probably going to become a one way train lower to regain export competitiveness and profitability…

Huge carry trades (some operating at 50 or 100 to 1 leverage) are in place to capture the appreciation of the Yuan and have enjoyed a one way bet for years but this is most likely over! The fireworks as these unwind should be full of excitement and big losses as the global specs get burned to a crisp.

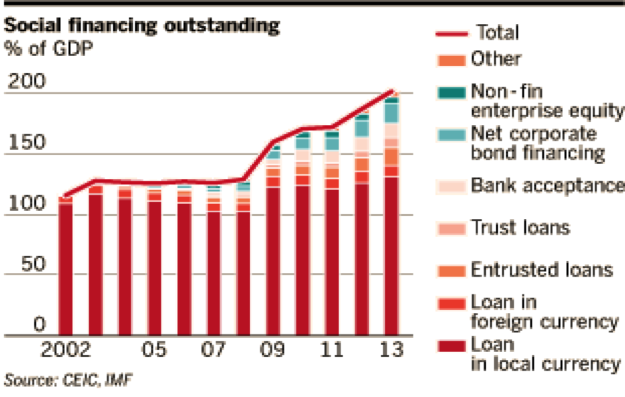

Fortunately, most of these loans didn’t go for consumption so a good amount of value is recoverable. Very little of the credit creation is denominated in foreign currency and what is is subject to capital controls, thus China’s mostly closed economy is not threatened by the tide of liquidity and hot money going out as many other emerging economies are.

Notice in the chart above how much debt is Yuan denominated – almost all of it. The Chinese are painfully aware of the problem and determined to address it, trying as hard as they can to reduce the credit growth rate without triggering an implosion – a high wire act of historic proportions. They have forcefully dealt with bank runs by trucking in loads of cash and have used state run media support, while a financial firefighting team is clearly visible when questions or fears arise.

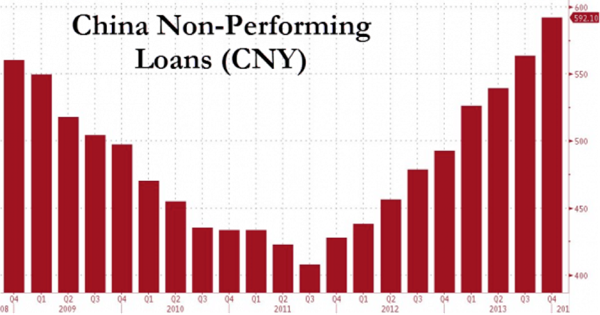

Private sector wealth management trust products present the biggest challenges this year as many of their offerings mature this year presenting big challenges to avoid a Lehman moment to the Chinese banking system. Non-performing loans are skyrocketing as we can see from the chart below from www.zerohedge.com:

Will some eggs be broken? Yes, as intended. Fortunately, for depositors, most of the banks are state-owned and the solution is just as close as the printing press, which they have no problem deploying. Can you say a bad bank for the second time in the last 18 years? They will not be allowed to fail.

Editor’s Note: An opposing point of view – The End Is Near: China’s Economic Bubble Is About to Burst

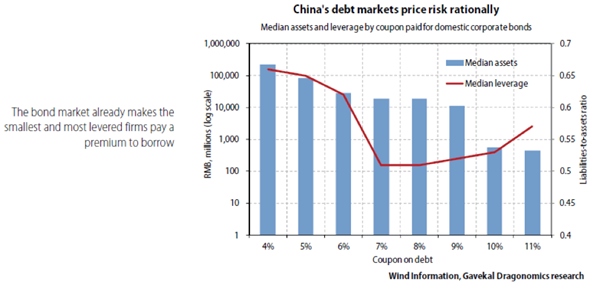

Contrary to popular belief the cost of money is not as badly priced as most people believe in China, and contrary to the developed world there is a cost for money and it is mostly paid in full (another graph from Gavekal and Mauldin):

People underestimate the level of brains in the communist party upper echelons; most were identified at an early age, have been groomed since an early age and have attended the finest schools in the world. They are not the political ignoramuses you see in the developed world. Do not underestimate their bona fides or the powers they wield in a one party state to address systemic weaknesses. Those five and ten year plenums are serious long-term planning as well as political slug-fests, but when they are over everybody has a game plan.

They have done a good job in my opinion by cutting credit growth from 35% year over year at the peak of credit expansion to 12-14 % you today, a monster reduction already. The clean ups will be messy as financial mishaps occur and mal-investments fall to their demise, but moral hazard will recede which is the goal.

Chinese leaders have repeatedly talked about slower economic growth and are tightening their grips on credit growth. They are prepared to fight the fires as they emerge. They are also opening capital accounts, beginning interest and exchange rate liberalization, attacking pollution, reforming state owned enterprises, banking reform and job creation to name a few. If only the developed world would tackle their problems which have been unaddressed since the 2008 crisis.

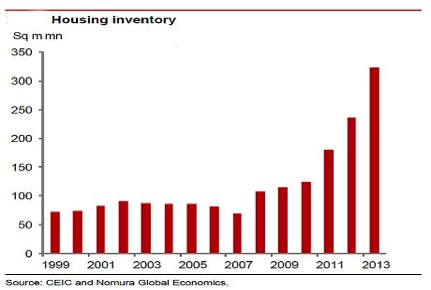

Yes, the residential real estate markets have commenced their slides from bubblicious levels, but the fact remains the buildings are there as is the recoverable value. Anyone who has been to China (I have and my wife is mainland Chinese) knows there are plenty of people looking for better places to live and to move. The Chinese government is not blind. They see the ghost cities and have prepared for it. You can count on it. Now affordability will loom making the inventory attractive. They are just waiting for Mother Nature to do her stuff and strong hands to surface, and they will.

Everybody underestimates the Chinese (which they love), but in the end the Chinese will deal with the banking and lending crisis as they have done numerous times in the last 20 years – they will print the money and defuse the crisis and let the Chinese people take the inflationary hit. For the People’s Bank of China and the Communist Party, money is free. They will print whatever is necessary and use the media and force to control confidence and fear to the chagrin of the China bears. They are moving into the modern world as fast as possible based on the enormous tasks they have embraced so [we probably can expect] no more booms but probably not a bust [either].

In conclusion: the Chinese boom is over but the bust talk is far overdone in my opinion. Chinese leaders acknowledge the mistake they have made with the credit bubbles and are determined to walk back from the precipice...

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.marketoracle.co.uk/Article45640.html ((c) 2005-2014 MarketOracle.co.uk (Market Oracle Ltd) & Copyright © 2013 Ty Andros All rights reserved.) Don’t miss the next edition of TedBits subscriptions are free at CLICK HERE.

Related Articles

1. The End Is Near: China’s Economic Bubble Is About to Burst

China’s model (and economy) will fail drastically, proving once and for all that government-planned economies do not work as well as free market capitalism balanced by democracy. This article identifies seven signs showing that the end is near. Read More »

2. China’s Debt Binge & Buying Spree Is About to Burst!

When it comes to reckless money creation, China is the king. Over the past five years Chinese bank assets have been fueled by the greatest private debt binge that the world has ever seen. Unfortunately for China (and for the rest of us), there are lots of signs that the gigantic debt bubble in China is about to burst, and when that does happen the entire world is going to feel the pain. Let me explain. Read More »

3. Richard Duncan: China Headed Into a Serious Crisis

China’s miracle is driven by one thing and one thing only: its trade surplus with the U.S., which went from zero in 1990 up to now more than $300 billion a year [but] since the darkest hours of the 2008 global economic meltdown, China has made little progress in shifting its reliance away from exports, and, as a result, the Chinese economy is dangerously exposed to a renewed downturn in global trade. Words: 500 Read More »

4. The China Syndrome – Fully Understanding China’s Economic Prospects: Michael Pettis

In order to argue that we will not see a sharp slowdown in Chinese growth, it is not enough to claim that:

- some expert or institution has predicted that Chinese growth will not slowdown,

- China has enough savings in its coffers to bail itself out of a crisis or that

- Beijing leaders cannot tolerate growth below 8%, so of course growth will not drop below 8%.

As greater evidence for the bear camp surfaces, China bulls need stronger justifications for their positions or risk losing credibility. [In fact, they need precise answers to 3 questions put forth in this lengthy but extremely insightful (dare I say, absolute best, article on the China sydrome to have ever been written!) article. Words: 4130 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

China will model the way for most Asian countries since they are big enough to do pretty much want they want and their citizens know that their Government cannot be challenged…