We believe:

- we are in the early to middle stages of a worldwide sovereign debt bubble collapse,,,and, as such,…. we believe

- inflation is in our future – not just a little bit of inflation but a lot of inflation – and with deficits growing wider each year, we believe

- there is a very high likelihood that the price of gold will rise in the next few years.

Historically, these crises occur when sovereign debt exceeds 100% of GDP as identified by Reinhart and Rogoff in their book This Time is Different: Eight Centuries of Financial Folly (see munKNEE article here). Presently, the on-balance sheet U.S. Federal Debt ($28.1 Trillion) is 130% of GDP ($21.6T). Off-balance sheet liabilities (Social Security, Medicare/Medicaid) add another $100 to $200T depending upon assumptions.

This debt level could not be serviced (much less reduced or paid off) if interest rates, which are the price of money, were set by a free market. In this respect, the monetary authorities worldwide, through price-fixing of interest rates, have broken the financial markets. History proves that price-fixing does not work (see USSR and grain prices). The price of money is the most important price in capitalism and messing with it distorts the price of everything. Capital is not allocated efficiently.

With over-indebtedness as a backdrop, history shows us that there are only three ways for a country to deal with a situation like this.

1. Default. Debts collapse to worthlessness as entities fail. Which leads to Deflation.

2. Restructure/Revalue against some superior form of money. Reset.

3. Inflate the currency and GDP versus the Debt.

Option 1 is possible, and perhaps in due course, option 2 could be chosen. However, in our current political structure, we believe the most likely path the U.S. will take is option 3 (Inflation). Therefore, we believe inflation is in our future. Not just a little bit of inflation, a lot of inflation!

When an economy becomes too debt-saturated things begin to break, and the government generally intervenes to prevent the natural deflationary cleansing that would occur without intervention. The government intervened in 2008 during the GFC. In March 2020 when the economy ground to a halt (COVID was the match, but the fire had been built), the government again stepped in (with an unprecedented order of magnitude) to prevent a severe deflation and economic collapse.

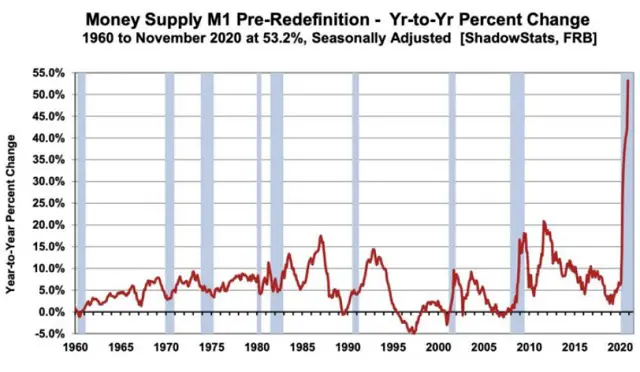

Historically, the Money Supply has never grown like this (past 60 years view):

Inflation Clearly Emerges

In our last letter, we talked about the balance between inflation and deflation. We are now of the opinion that higher inflation is an absolute lock. We believe we are in a clear case of a “crack up boom”. The prices of everything are going up sharply.

For example, nationwide median house prices are up 10% in January and 15.8% in February year on year. This has never happened before, even during the housing bubble of 2007-2008. But the most worrisome form of inflation is food inflation. This is what leads to revolutions.

As for gold…

All of these spending plans require borrowing. Someone has to purchase that debt and the trends on that front do not look good. In this low rate world, the buyer of last resort is the Fed, and they will have to keep purchasing bonds or interest rates will spike higher. Our view is that they are in a doom loop and they can never stop. The only unknown is how long it takes for all of our fellow citizens and the financial markets to figure this out.

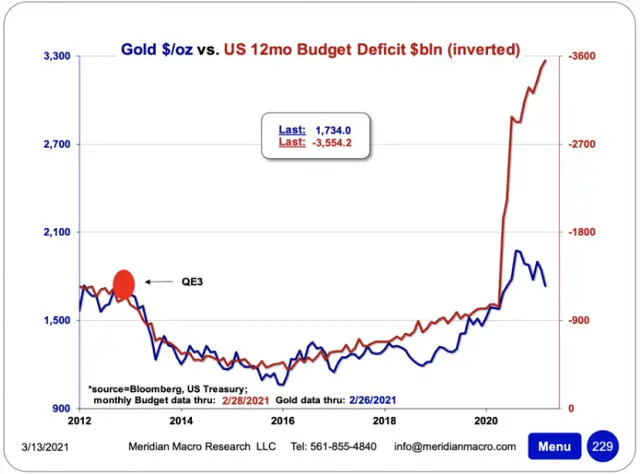

While it is impossible to say there is a direct link between US Government deficits and the price of gold, it is interesting to notice the correlation between the two since 2012. (we know correlation is not causation).

From this chart, and with deficits growing wider each year, we infer that there is a very high likelihood that the price of gold will rise in the next few years.

Editor’s Note: The original article by Lawrence Lepard has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

My observations over the years lead me to believe that those who get to govern banking and government are those most blessed by a nation’s irresponsibility, currency and debt, so predictably they will never initiate a course of action that steers away from that which profits them and insures their position and power for continued control. The status quo usually means they are firmly in control, but they could care less about GDP, inflation or deflation as long as their thumbs and forefingers flip the switches. So, if there’s change, expect to see what the controllers think will be most rewarding to them.