In an opposite mode to the very bearish outlook for stock markets, developing  evidence suggests that precious metals and in particular gold and gold stocks have completed a bear market low…and have already begun a major bull market.

evidence suggests that precious metals and in particular gold and gold stocks have completed a bear market low…and have already begun a major bull market.

The above comments are edited excerpts from an article* by Ian Gordon (longwavegroup.com) as posted on Gold-Eagle.com under the title Stock Markets Versus Gold presented here on munKNEE.com in a 2-part series. (See Part 1 here).

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Gordon goes on to say in further edited excerpts:

The bearishness in this domain is palpable. The junior sector has been decimated and investor participation in the sector is virtually non-existent. “After all, who needs gold when stock markets are at record high values?” In such a bearish environment most of the sellers are long gone and now all that it will take is some tentative buying to push prices slowly higher. There are indications that is now occurring.

Many gold stocks’ prices have already moved significantly off their lows. In the junior sector such movement is very limited. That is to be expected, money flows to the juniors only as confidence in the bullish outlook for gold and the gold stock miners builds. That process has further to go, before junior miners begin to attract money. In the meantime many of them are building large basing patterns that foretell significant price moves to the upside.

…When the debt bubble bursts, as it surely will, and deflation is the result, the run to gold and gold stocks, including the junior exploration companies will turn into a stampede. We are very close to this catastrophic period in the long wave cycle. The recent reports of major banking problems in Portugal and Austria may be the precursors.

Gold

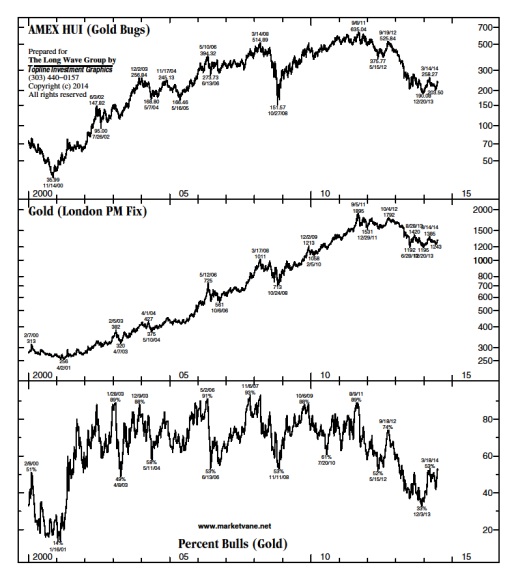

Bullish consensus, measured by Market Vane, for gold has moved off an extreme low of 33% recorded in the week of December 3, 2013 – the lowest level recorded since 2001 when the price of gold was hardly $300 (U.S.) per ounce. That in itself is an indication of how dispirited gold investors have become.

All previous bullish consensus lows since 2001 were above 50%, even following times of fairly significant corrections to the gold price. For a contrarian that extreme low is a bullish ‘buy’ signal. Since that low the consensus moved to 53% in the week of March 18, 2014. After that a small correction took the consensus down into the low 40s%. From there the bullish consensus has again risen to the low 50s%.

As for the price of gold, it made a double bottom in June and December 2013 at $1,192 (U.S.) and $1,195 (U.S.) per ounce based on the London PM fix. In technical analysis, double price bottoms are important indicators of a price reversal…

HUI Index

Meanwhile, the HUI (Gold Bugs Index) reached its low of $190.08 in late December 2013 and then moved up to $258.27 in the middle of March 2014. From that point the Index dropped to a low of $203.50 on May 28th, 2014...[While] from a technical standpoint prices have made a higher low than the December $190.08 low, it would be very constructive if prices could close meaningfully above the high of $258.27. This would convincingly demonstrate that the bearish trend consisting of lower high prices and lower low prices had changed in favour of a renewed bullish trend on the basis that HUI prices would be making higher high prices and higher low prices, which is confirmation of a bullish trend.

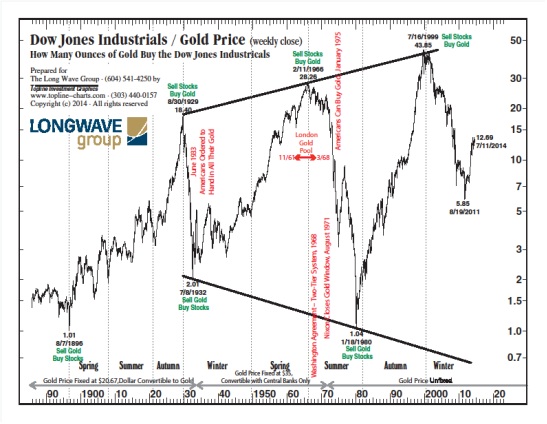

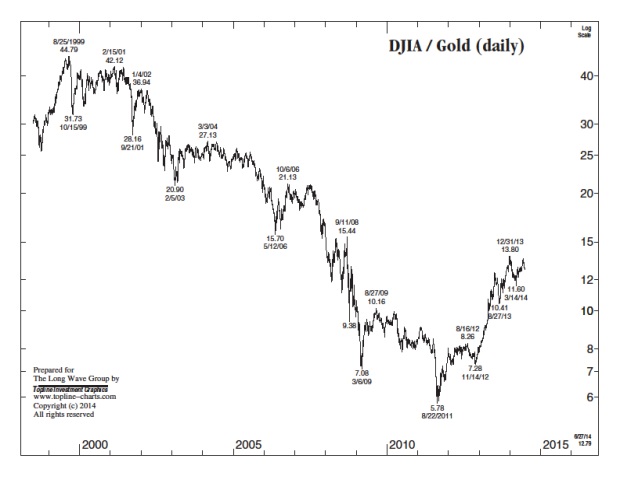

The Dow/Gold Ratio

…I consider the Dow/Gold ratio to be one of the most important relative measures of two competing investment themes…That competition for investment money is apparent within the long wave seasons.

- When stocks are in favour with investors, as in spring and autumn, gold is not;

- when stocks are out of favour with investors as in summer and winter, gold is always the investment of choice.

This can be seen by the highs and lows that the ratio achieves, typically at the end of the long wave seasons.

- In spring, which heralds the rebirth of the economy, stocks rise in sync with the growing economy. In the current long wave cycle spring (1949-1966), the DJIA increased in value from 161 points to 995 points and the Dow/Gold ratio peaked at 28.26.

- Summer is always the inflationary season in the cycle and stocks are out of favour, whereas gold is purchased as an inflation hedge. The price of gold increased from $35.00 (U.S.) per ounce at the beginning of summer of 1966 and reached $850.00 (U.S.) per ounce at summer’s end in 1980, dropping the ratio to 1 to 1.

- Autumn is always the speculative season in the cycle, and in this season, stock markets always make enormous price gains (4th. Cycle autumn-DJIA 777 points-11,750 points) and the price of gold on the other hand experiences a bear market. During the long wave autumn (1980/82-2000) of the current long wave cycle the gold price dropped from the summer ending $850.00 (U.S.) per ounce to $252.00 (U.S.) at the end of autumn. The Dow/Gold ratio as a result of the huge stock bull market and the major gold price bear market reached a record high of 43.85 in July 1999. That high signaled the end of autumn and the onset of winter.

- Winter is the most bearish season for stocks and the most bullish for gold.

[During this particular occasion]…stock prices have not adhered to the typical pattern of a winter stock bear market. In past long wave winter bear markets, while they have been devastating for stock prices, they have taken a relatively short time to run their course. (For example, in the previous long wave winter, the DJIA reached the autumn stock bull market peak of 381.17 points on September 3, 1929 and the winter bear market was complete by July 8, 1932 at 41.22 points, which amounted to a little less than a 90% loss in price.) Suffice to say, the present long wave winter bear market, which technically commenced in 2000 has been manipulated and controlled by the authorities and in particular the Federal Reserve…That control is about to end, and the ensuing bear market will overwhelm all attempts to forestall the natural process of a winter bear market.

The ongoing unscrupulous interference in the natural process of the stock market has contributed to a distortion in the Dow/Gold ratio in favour of the Dow…This perversion of the ratio occurred following the counter trend rally into August 2012 when the ratio reached a level of 8.26 following the ratio low of 5.78 in August 2011. Following that rally into August 2012, the ratio should have turned down to make a lower low than 5.78 if it had been following normal bear market price action, which until then had been a series of lower highs and lower lows. That was not to be.

Those of us who are in the gold camp can take solace in knowing that ultimately this ratio is going to fall to a minimum of 1 to 1. As I see it, however that ratio will drop to something significantly lower than that. I have long maintained the ratio will reach 1 to .0.25 or Dow 1,000 and the price of gold $4,000 (U.S.) per ounce. In other words, 1 gold sovereign (1/4 of an ounce) will buy the Dow Jones Industrial Average.

There is an old trader’s rule that reads-“If a stock in a bear market hasn’t made a new low in four months, it has probably seen its low for the cycle. Conversely in a bull market, if a stock hasn’t made a new high in four months, it has probably seen its high for the cycle.” The price of both the HUI and Gold have not made new lows in four months, thus according to the rule they have likely made their lows for the cycle and are now in a cyclical bullish phase. On the other hand, the general stock markets continue to make new highs, thus we can’t use the four month rule to determine whether stock markets have turned bearish.

Using this traders ‘yardstick’ we can conclude that the price low has already been reached for gold and for gold equities and that we are now at the start of a new bull run, which should ultimately take prices to record highs.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.gold-eagle.com/article/stock-markets-versus-gold

Follow the munKNEE!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

Related Articles:

1. Plenty of Additional Upside Potential Directly Ahead for PM Miners

Precious metals shares are breaking out again after a brief consolidation. It’s time to channel your inner Old Turkey, realize this is a bull market and act accordingly. Read More »

2. Broad Metals & Mining Sector Have Finally Bottomed! Here’s Why

I have to admit, this is a very hard call to make and I could easily be wrong…but I am courageously sticking my neck out here and stating that we have most likely seen the lows for the broad metals & mining sector. Read More »

3. Get on Board – NOW! We’re On the Verge of a Major Bull Market Advance Across the PM Sector.

The charts below make it crystal clear that we are on the verge of a major bull market advance across the PM sector. While these charts are for the Market Vectors Junior Gold Miners ETF, what happens to the GDXJ has major implications for the whole sector, for the simple reason that it is not going up without the entire sector going up too. Read More »

4. Incredible Bounce Coming Soon In Gold & Silver – Here Are 5 Reasons Why

Get ready for an incredible bounce higher in the gold & silver junior miner sector. Here are five reasons why. Read More »

5. Gold Going Parabolic In Next Few Years – Here’s Why

We are now starting the hyperinflationary phase in the USA and many other countries as a result of the accelerated fall of the U.S. dollar and this will be reflected in the parabolic rise in the price of gold over the next few years. Read More »

6. Mark My Words: Gold & Silver Are About to Explode Higher – Here’s Why

War cycles – cycles that govern human social interaction on a grand scale, cycles that can be quantified and used to forecast periods of peace and war, periods of civil unrest and international conflict – are now ramping up and converging in the worst possible combination of forces not seen since the late 1800s. In the process they are setting the stage for gold and silver to explode higher with gold going up to well over $5,000 an ounce a few years from now … silver to more than $125 an ounce … and mining shares, to the moon. Read More »

7. 3 Forces Could Provide Impetus for a Surprising Gold Run This Summer

We are monitoring three developing situations that we believe could have a profound impact on gold demand during the remainder of the year — driving forces that could provide impetus for a classic gold run that could begin with a summer surprise. Read More »

8. The Most Explosive Turnaround to the Upside — EVER — Is Coming In the Precious Metals Sector

I am 100% confident that 1) precious metals will bottom this year and resume a new leg to the upside, 2) the extreme emotions right now regarding gold and silver are typical at major turning points and 3) all the underlying fundamental, cyclical and technical conditions for a new bull market in gold and silver are in place. Here’s an update on the latest action in gold, silver, platinum and palladium Read More »

9. Gold Projected to Reach $4,000/ozt. Sometime Between Late 2015 & Mid 2017! Here’s My Rationale

I am not predicting a future price of gold or the date that gold will trade at $4,000, but I am making a projection based on rational analysis that indicates a likely time period for gold to trade at $4,000 per troy ounce. Yes, $4,000 gold is completely plausible if you assume the following:

10. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

11. 3 Models for the Future Price of Gold: $2,900 (2017); $3,500 – $4,000 (2017); $9,000

What will the future top prices for physical gold and silver be? Naturally, no one knows for sure but many analysts have developed interesting models and scenarios as to what the future holds and this article reviews 3 such analyses for your consideration. Read More »

12. Huge Rebound in Gold & Silver Stocks Coming Soon – Here’s Why

It’s been a tough road for precious metals but the path ahead has strong potential of being significantly profitable and in a short period of time. The buying opportunity that we’ve spoken of for months could be days away. When precious metals equities rebound, they rebound violently. Read More »

13. Early 2017 Should See A Minimum of $3,600 for Gold & $100 for Silver! Here’s Why

Since the start of June, typically the worst month for precious metals when looking at seasonal charts, gold is up $75 or 6% and silver is up over $2 or 11% while many of the mining stocks that we track are up 30% or more in the past 3 weeks. Prices normally start to gain momentum after June and close the year very strongly so, while a pullback tomorrow would not be surprising, I believe the trend will be towards higher prices for the remainder of the year. Read More »

14. Gold Should Bounce Sharply Higher – Here Are 10 Reasons Why

Is it time to throw in the towel? Is the bull market in precious metals really over? I don’t think so because my analyses suggest that nearly all of the fundamental factors that have been driving the gold price higher in the past decade have only strengthened in the past two years. Now that the correction has most likely run its course, I expect gold to bounce sharply higher. Here are 10 reasons why. Read More »

15. Here’s How to Choose Gold & Silver Stocks With the GREATEST Chance of Major Returns

Which gold/silver mining companies own quality undeveloped gold and silver deposits in safe stable countries – and are extremely well managed? Such companies offer exceptional value in that they provide the best exposure to a rising precious metals price environment. Below are a number of things to look for when considering an investment in such companies. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I think that the second half of 2014 is going to be a DIFFICULT time for many, since we are now dealing with real problems that are getting much worse in several parts of the Middle East and also in the Ukraine. It is also important to mention the formation of the New Development Bank (NDB), which will add to the pressures upon the US Economy to be able to cope with the reduced buying power of the US$ globally.

Does anyone else watching the value of the US$ (vs PM’s) keep having the phrase “Over Leveraged” come to mind?

This is why depending solely upon past history (charts) and not also listening to your “gut” is not prudent, especially when the world is chaotic.

Ask yourself, if things do get worse, how will my portfolio fair and more importantly, what can I do today to make my portfolio more resilient?