According to the pricing of TIPS and Treasuries, the bond  market has decided that we’re likely to see:

market has decided that we’re likely to see:

- inflation returning to around 2% a year in the near future coupled with

- little hope for any meaningful pickup in the outlook for real economic growth.

Here’s why:

By Scott Grannis (scottgrannis.blogspot.ca). (The original article*, as posted on said site under the title TIPS say the deflation “threat” has passed, has been abbreviated below to ensure a fast and easy read.)

5-yr Inflation Expectations

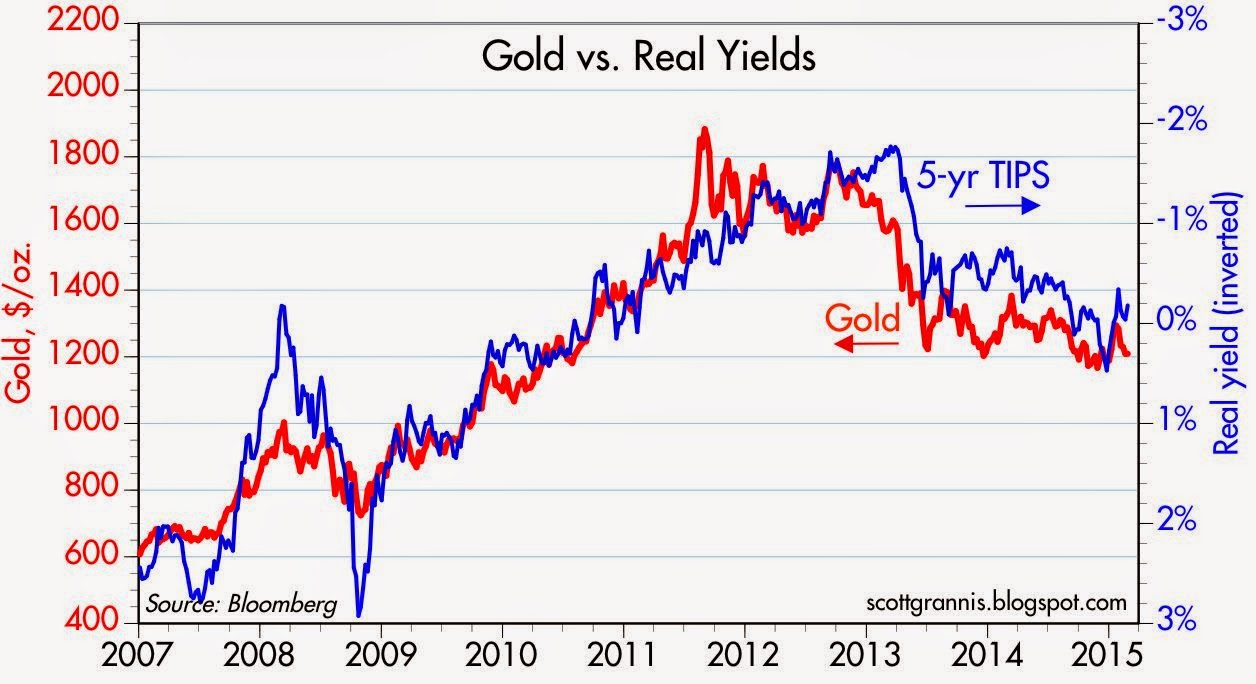

The chart below shows the nominal yield on 5-yr Treasuries, the real yield on 5-yr TIPS, and the difference between the two, which is the market’s expected average annual inflation rate over the next five years. Inflation expectations began to fall last summer, about the same time the oil prices began to decline. They reached a low of 1.2% late last year, and closed today at 1.7% [see UPDATE below].

In spite of the above indications, however, I remain optimistic if only because the market seems to be still so pessimistic. In fact, I’m willing to bet that both growth and inflation will prove higher than expected in the years to come.

Not into Facebook or Twitter? No problem. Subscribe (sample here) to our FREE “Market Intelligence Report” newsletter for access to every new article posted in the last day or two. It has an easy “unsubscribe” feature should you wish to do so at any time for any reason.

[The above article is presented by Lorimer Wilson, editor of www.munKNEE.com and has been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This paragraph must be included in any article re-posting to avoid copyright infringement.]

1. Inflation Will Become a Huge & Growing Problem Beginning In 2015 – Here’s Why

A temporary period of deflation will result from the end of the Fed’s massive asset purchases followed by a period of inflation that will make the ’70s seem like an era of hard money. Here’s why. Read More »

2. High Inflation IS Coming – It’s Just A Question Of When – Here’s Why

There have been many econoblog posts of the form, “ha, ha, the people predicting inflation have been wrong so far, when will they give up?”. Let me try to explain why we know high inflation is coming eventually. Read More »

3. We Will Experience the Anguish of Severe Inflation In the Coming Years – Here’s Why

The Fed’s buying of U.S. Treasuries by creating currency (paper money) out of thin air is inflationary (either now or long term) and those that do not accept this premise are, with all due respect, daft, and is sure to result in a momentous growth in the value of hard assets such as gold and silver. Here’s why. Read More »

4. Interest Rates Will Be LOW For the Rest Of Our Lives! Here’s Why

The argument that the past 10 years of low interest rates has just been an anomaly which will normalize to higher levels in the next couple of years is not going to unfold. Interest rates will be perpetually low for the rest of our lives! Here’s why. Read More »

5. No Inflation? No Way – Inflation Is Definitely Here! Take A Look

We keep hearing about how controlled inflation is but in reality, we are seeing increases in many important segments of our society. No inflation they say. Let us look at some key items. Read More »

6. Tips from TIPS on Prospects for Growth, Outlook for Inflation & Future for Gold

TIPS are telling us that the market is quite pessimistic about the prospects for real growth, but not concerned at all about the outlook for inflation. Read More »

7. The Future Price of Gold and the 2% Factor

It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Let me explain. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

The charts predicting inflation are right until they are not. That is, until something unknown happens that changes everything. Take this article with a grain of salt.