TIPS are telling us that the market is quite pessimistic about the prospects for real growth, but not concerned at all about the outlook for inflation.

The above are edited excerpts from an article* by Scott Grannis (scottgrannis.blogspot.ca/) entitled Gold and Real Yields Have Tracked Each Other Post-Crisis.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and the FREE Market Intelligence Report newsletter (register here; sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Grannis goes on to say in further edited excerpts:

The introduction of TIPS (Treasury Inflation Protected Securities) in 1997 …gave us the ability to see real interest rates in real time [as opposed to having] to infer real yields after the fact.

Real Yields

Real yields are a significant contribution to analysts’ arsenal of data, since they can be used to discover what the market is expecting about the future of economic growth and inflation.

- Currently, TIPS are telling us that the market is quite pessimistic about the prospects for real growth, but not concerned at all about the outlook for inflation.

Nominal Yields

Before, when nominal yields rose we didn’t know how much of that was due to rising inflation expectations or rising real growth expectations. Now,

- if real and nominal yields rise by the same amount, then we know it’s because the market’s real growth expectations are rising and

- if nominal yields rise more than real yields, then we know it’s because inflation expectations are rising.

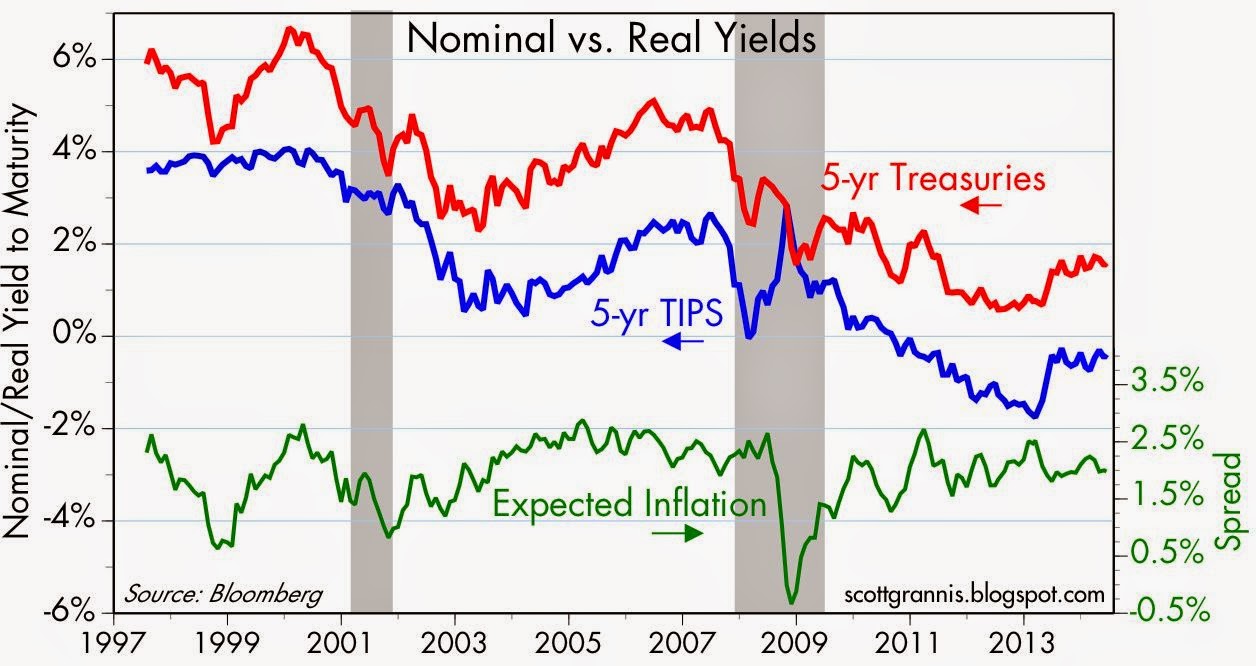

Nominal vs. Real Yields

The chart below compares the nominal yield on 5-yr Treasuries to the real yield on 5-yr TIPS. If you subtract the real yield on TIPS from the nominal yield on Treasuries you get the market’s expected inflation rate over the next 5 years (more commonly referred in the bond market as the “break-even” inflation rate, since that is the inflation rate that would cause holders of TIPS and Treasuries of similar maturities to have similar total returns).

The main message of the above chart is that:

- inflation expectations haven’t changed much over the past 17 years: the average expected inflation rate since 1997 is 1.94%, and the current expected inflation rate, by this measure, is 1.98% and

- the market is not very concerned about rising or falling inflation, and that, in turn, suggests that the Fed is doing a good job.

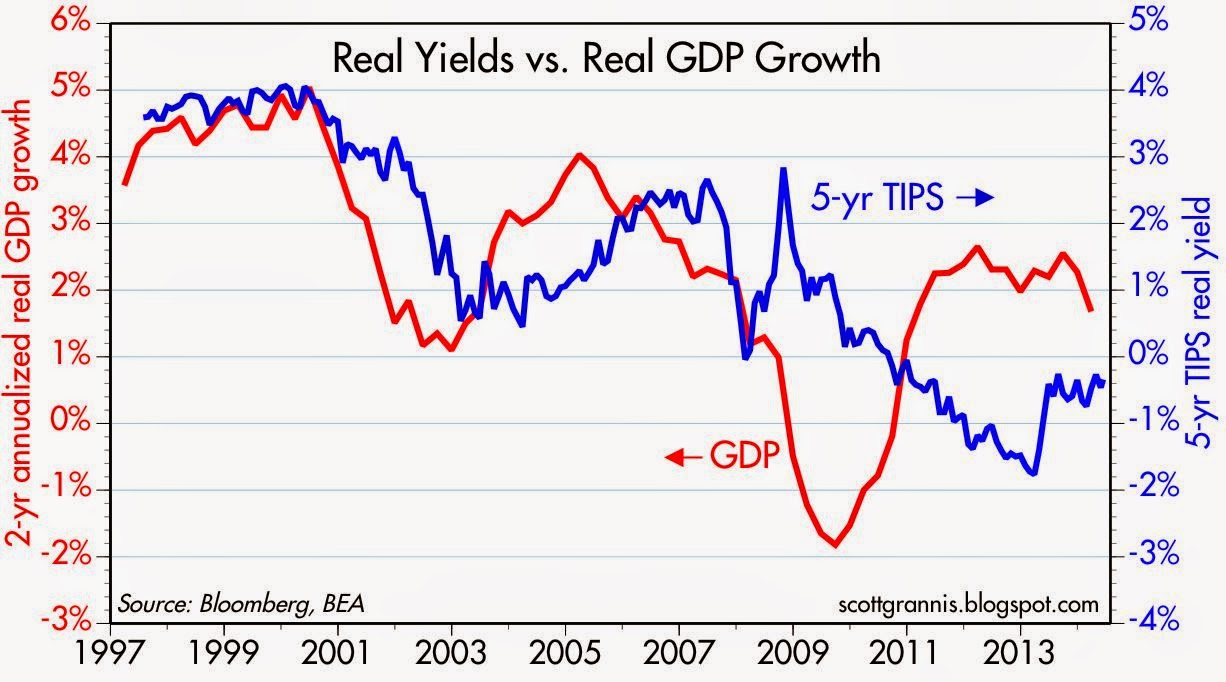

Real Yields vs. Real GDP Growth

In theory, real yields on financial instruments should tend to track real economic growth, because you need economic growth to deliver positive real returns to investors. Not surprisingly, we can observe this thanks to TIPS. Real yields on TIPS have tended to track the real growth rate of the economy, as the chart below shows, where I’ve used 5-yr real yields on TIPS as a proxy for the market’s expectation for future growth, and I’ve used a 2-yr annualized measure of real GDP growth as a proxy for the current level of growth.

When real economic growth was in the 4-5% range in the late 1990s, TIPS’ real yields were 3-4%. Since then, economic growth has been trending lower, and so have the real yields on TIPS. The current level of real TIPS yields, according to the above chart, suggests that the market is priced to the expectation that real growth in coming years will be 1% at best. That’s pretty pessimistic.

Stay connected!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

Gold vs. Real Yields

Real yields on short- and intermediate-maturity TIPS can also serve as proxies for the market’s desire for safe assets. TIPS are unique in that they are default-free, inflation-protected, and they are the only security in the world with a government-guaranteed real yield that you know in advance. Gold is a classic “safe asset,” being historically a refuge from inflation and geopolitical risk. As the chart below shows, the price of TIPS (shown here using the inverse of their real yield as a proxy for their price) has tracked the price of gold in recent years quite closely since 2007. Both have acted as safe havens for all the concerns that arose in the wake of the 2008 financial and economic collapse that affected nearly everyone around the globe.

One of the more important developments of the past year or so is the decline in both TIPS and gold prices. That tells us that the world’s demand for safe assets has declined meaningfully, even though it remains elevated.

I’ve been watching these two assets very closely for over a year, looking for signs of a further decline in the demand for safe assets. Should it occur, I think that would go hand in hand with a return of optimism, a decline in the demand for money, and, eventually, an acceleration in nominal GDP and inflation. That, in turn, would show up as higher interest rates and probably a somewhat stronger economy.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://scottgrannis.blogspot.ca/ (Copyright © Calafia Beach Pundit)

Related Articles:

1. The Future Price of Gold and the 2% Factor

It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Let me explain. Read More »

2. Some Tips from TIPS Regarding Future Inflation & U.S. Economic Growth Expectations

TIPS (Treasury Inflation Protected Securities) are telling us that inflation is expected to be low for as far as the eye can see, and the economy is expected to be weak for some time to come. This article provides an understanding of what TIPS are, how they work and what they are currently saying. Read More »

3. Probability of Deflation Is 60%, Inflation Is 25% and Muddling Through Is 15% – Here’s Why

At the end of last year virtually every every single economist expected interest rates to rise this year as the Fed tapered their purchases and the economy improved but, in fact, interest rates on the 10 year U.S. Treasury have been going down year to date (from 3% to 2.5% after rising from about 1.6% to 3% last year). The masses, going along with this crowd, got fooled but we have been calling for a decline in interest rates for some time now due to world-wide deflation and it couldn’t be clearer to us that this is the most likely scenario for the United States. Let us explain. Read More »

4. Interest Rates NOT Rising Any Time Soon – Even With Fed Tapering. Here’s Why

Everyone and their mom is expecting long-term interest rates to rise now that the Fed is tapering its bond buying programs. I have a couple of problems with this line of thinking because, although it seems like reducing demand for a security (i.e. tapering QE) would result in a drop in price, when you really think about how quantitative easing works this makes no sense and, secondly, the market is telling us this makes no sense. Let me explain. Read More »

5. Any Way You Look At It, Key Economic & Market Fundamentals Point In A Positive Direction

Here’s a quick update of some key indicators that I track regularly. All continue to point in a positive direction. Financial markets are extremely liquid and systemic risk is very low which is a good sign that the outlook for the economy is positive. If financial fundamentals are in very good shape, it is likely that the economy will also be in good shape in the months to come. Read More »

6. Low Real Interest Rates Say Gold Bull Still Has Legs! Here’s Why

Many agree that the United States’ massive budget deficits and global monetary inflation support the gold bull market. I don’t see this changing in the near future. Still, sentiment is not enough upon which to rely. I need a yardstick and, for me, that yardstick is U.S. real interest rates. [Let me explain why that is the case.] Words: 1600 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Re: “TIPS are telling us that the market is quite pessimistic about the prospects for real growth, but not concerned at all about the outlook for inflation.”

This is no surprise to me since it is impossible to have “real growth” in the USA when the middle class is shrinking drastically, the Ultra Wealthy own more of the USA than ever before in our history thanks to the SCOTUS and a Congress that are both doing everything they can to move us backwards into financial “Slavery” to the Wealthy.