On 30 November 2014 the Swiss people will vote on ‘The Swiss Gold Initiative’ in a  national referendum giving them the opportunity to determine not just the fate of their own financial system but also to be the catalyst for the return to sound money in the Western World.

national referendum giving them the opportunity to determine not just the fate of their own financial system but also to be the catalyst for the return to sound money in the Western World.

The above introductory comments are edited excerpts from a post* by Egon von Greyerz (goldswitzerland.com) entitled Will this save the Swiss financial system?.

von Greyerz goes on to say in further edited excerpts:

On November 30th the Swiss will vote on:

- Returning their national gold which is held abroad back to Switzerland

- Requiring the Swiss National Bank to hold 20% of their assets in physical gold

- Prohibiting further gold sales

Switzerland has, for hundreds of years, been a bastion of sound monetary policy and low inflation but this has gradually changed in the last 100 years since the creation of the Fed in the U.S. and especially during the past 15 years when the Swiss government quietly removed the 40% gold backing from the revised Federal Constitution which was adopted by popular vote in 1999.

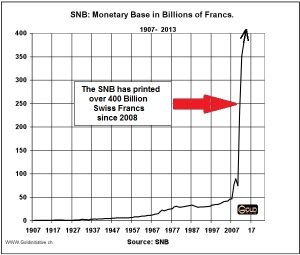

No paper currency has ever survived throughout history in its original form and the Swiss Franc has gone from having been a strong currency to now being in the process of being slowly destroyed by the recent policies of the Swiss National Bank (SNB)….[which] printed around 400 Billion Swiss Francs in the last 6 years in order to hold its currency down against the Euro and other currencies. CHF 400 Billion is around 2/3 of GDP which means that Switzerland has printed more money, relatively, than any major country in the world in the last 6 years.

Why is this referendum so important?

Because Switzerland now has the opportunity to be the first country in the world with official partial gold backing of its currency. A currency backed by gold means the government and the central bank cannot manipulate the currency at will and print worthless pieces of paper that they call money. This would stabilise the real value or purchasing power of the Swiss Franc. A currency with stable purchasing power leads to stable prices and promotes savings and investment rather than spending and credit…

(Even though the official Swiss inflation is low, there is massive inflation in some sectors like housing and financial assets. The money printing in Switzerland combined with artificially low interest rates have led to a major housing bubble. Swiss housing prices are now unaffordable for most Swiss and in relation to income prices are now in an unsustainable bubble. An increase of Swiss mortgage rates from current 1-2% per annum to a more normal 4% could lead to major mortgage defaults and a housing collapse.)

A “YES” vote in the referendum to partially back the Swiss Franc with gold would:

- be extremely beneficial for the long term prosperity of the Swiss economy and the Swiss Franc;

- make Switzerland respected, once again, by people worldwide for introducing sound money;

- likely set a trend for other countries to follow Switzerland’s example;

- likely have an immediate effect on the depressed and manipulated gold price and

- likely see a major surge in the price of gold as the holders of paper gold will be concerned and demand delivery of the physical gold against their paper claim and there is nowhere near enough physical gold to cover all the paper claims.

“If the referendum passes:

- the Swiss National Bank (SNB) would have to buy about 1,500 tons of gold over the next three years. This equates to half of the world’s annual production and they would have to compete with China to secure supplies. COMEX manipulators can keep the paper prices low for so long, but eventually the overwhelming demand for physical is going to blow up that fraudulent exchange.

- Repatriation would likely mean that the SNB can no longer lease gold into the market via the NY FED, the BOE in London and their private sector partners JPM and HSBC. Leasing (or even selling) is the only reason to “store” gold abroad in the post cold war age.

- It would fully restore confidence in the Swiss Franc and in Switzerland as one of the safest nations in the world.

It is therefore critical that the Swiss people and the rest of the world is made aware of this initiative. If successful, it could be the first step for Switzerland towards a new monetary system based on sound money.]

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://goldswitzerland.com/will-this-save-the-swiss-financial-system/ **http://www.goldstockbull.com/articles/switzerland-repartriate-gold/ (Copyright © 2014 Gold Stock Bull – All Rights Reserved)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. The History of the Gold Standard & Why It Likely Will NOT Be Re-introduced

As the protracted correction and consolidation in precious metals continues, what better time to brush up on the history of the gold standard to give proper context to gold’s demand today and potential role in a future currency to replace the dollar. Read More »

2. Gold Standard Should Replace “Exorbitant Privilege” of USD Reserve Currency Status – Here’s Why

The least imperfect monetary system by which civilized nations can conduct their business is the classical gold standard – a system in which every major nation defines its currency as a weight unit of gold. [Let me explain.] Words: 890 Read More »

There are those who keep insisting that there be a return to the gold standard without serious unrest and collapse. What they do not realize is that such propositions are really a call to arms. Government will not return to a gold standard because it would be a loss of power and overturn the very nature of how our republics (not real democracies) actually function….Words: 308 Read More »

In the years ahead we will witness the death of paper money and the reemergence of a global gold standard. This article examines why this transition is inevitable, how it might occur, and how to protect yourself from it. Words: 1086 Read More »

The gold standard is a solution in search of a problem. Actually, it’s worse than that. It’s a problem in search of a problem. Prices would have to fall a great deal if we adopted the gold standard today. In other words, it would turn the imagined problem of price stability into a real problem of price stability. And, of course, this ensuing deflation would send the economy into a death spiral due to still high levels of household debt. [Let me explain further.] Words: 910 Read More »

6. A Look At the History of the Rise and Fall of the Gold Standard and Other Exchange Rates

Much has been written about the merits of the Gold Standard but there seems to be a lack of knowledge about the history of the various exchange-rate regimes over the years and why each was introduced and replaced. The infographic below does an outstanding job of doing just that. Read More »

7. Paul Mladjenovic: Economists Exhibit Lunacy and Confusion over the Gold Standard

It drives me crazy when I read stuff by “economists” that is just plain wrong. Some of them are allegedly “MBAs” and “PhDs” but I think that their common sense is actually “DOA”. Unfortunately, millions in the public arena see their interviews and blogs and they seem to automatically swallow their commentaries… hook, line and sinker. Let’s address some of the nonsense that these pundits are expressing. Words: 870 Read More »

8. Why U.S. Will Never Return to Gold Standard and What That Means for Gold Price

The recent outperformance of precious metals, combined with budget problems in the United States and parts of Europe, has prompted some to speculate that gold or silver will become the next international reserve currency [but in my opinion that is highly unlikely. As such, investors would be highly encouraged to give pause [before] allocating a portion of their portfolios to precious metals. Let me explain further.] Words: 1094 Read More »

9. Is $5,000 Gold Necessary to Re-establish A Gold Standard?

I would conclude that to re-establish a new gold exchange standard probably would require a gold price of about $5,000. [That being said,] I wonder if any of those talking about re-establishing a gold standard have thought about the implications of [such a new price level for gold]? If people are scared of the inflationary impact of QE2, [it begs the question:] What would re-establishing a $5,000 gold standard mean for inflation? Words: 712 Read More »

10. A Return to the Gold Standard Has Major Shortcomings

World Bank president Robert Zoellick has stirred up a hornet’s nest with his recent call for a return to a gold anchor in the global financial system. The usual suspects immediately denounced him – Keynesian Brad DeLong has [gone so far as to] anoint Zoellick the “Stupidest Man Alive” – [and I would like to add my voice to the chorus by explaining] the dangers of Zoellick’s gold proposal, and why fans of the classical gold standard should be wary. Words: 1708 Read More »

11. Why We Will Never See a Return to a Gold Standard – Ever!

There are three simple reasons … you need your own private gold standard, rather than waiting on “sound money” from government. Words: 1323 Read More »

12. Noonan: Will We See A New Gold-backed Currency?

Before gold can rally, it has to first turn the trend from down to up. We see no evidence of a change in trend. The bearish spacing is repeated, again, as a reminder that it represents a weak market within its down trend. How anyone can posit a bullish scenario from what the charts show flies in the face of known facts, as depicted in the charts. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

If this passes then all those holding physical Gold will get an early Xmas present.