China consumed, mined and imported the most gold ever in 2013. Does this mean that the PBOC in Beijing plans to eventually back its currency, the Renminbi, with gold with a view to replacing the U.S. dollar as the world’s reserve currency? Here are the details.

that the PBOC in Beijing plans to eventually back its currency, the Renminbi, with gold with a view to replacing the U.S. dollar as the world’s reserve currency? Here are the details.

The above introductory comments are edited excerpts from an article* by Vronsky (gold-eagle.com) entitled China Goes For The Gold As Beijing Gold Demand Goes Parabolic.

Vronsky goes on to say in further edited excerpts:

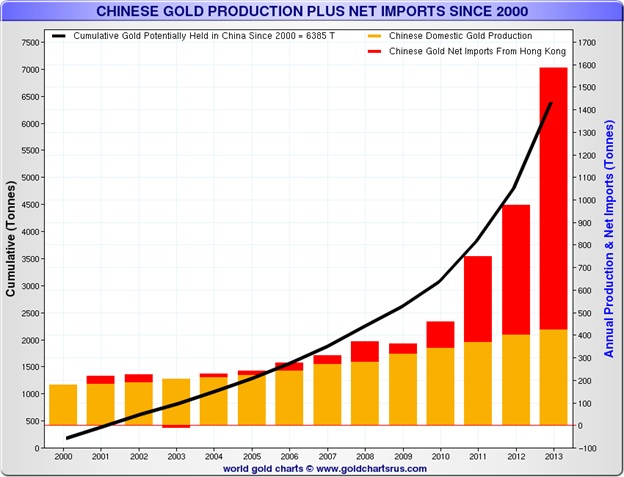

Based upon the charts below, and assuming China’s yearly gold accumulation remains stable (i.e. a 10.7% CAGR), China will possess nearly 14,000 tonnes of gold by the year 2020. Compare this to U.S. gold reserves at 8,134 tonnes, which is today the world’s largest gold holder. This gives credence to the oft expressed idea that the PBOC in Beijing plans to eventually back its Renminbi via gold with a view to replacing the U.S. dollar as the world’s reserve currency.

World’s Largest Consumer of Gold

The country overtook India as the world’s largest consumer of gold in 2013, with consumer demand soaring 32% to 1,066 tonnes for 2013. That’s the most gold ever demanded annually by one country’s consumers.

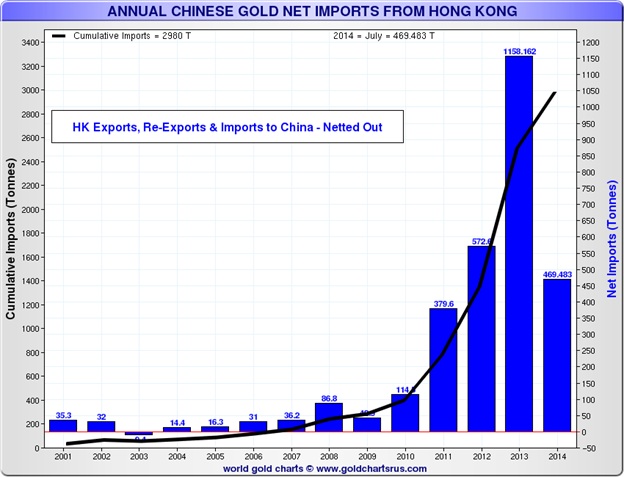

World’s Largest Importer of Gold

Chiina imported more gold imports than any other country – a record 1,108 metric tons in 2013, up 33% from a year ago – via Hong Kong.

World’s Largest Miner of Gold

China is already the world’s top producer of gold, mining 437 tonnes in 2013 on industry estimates, with the largest annual increase globally for 2013 having displaced South Africa as the world’s largest gold producer in 2007.

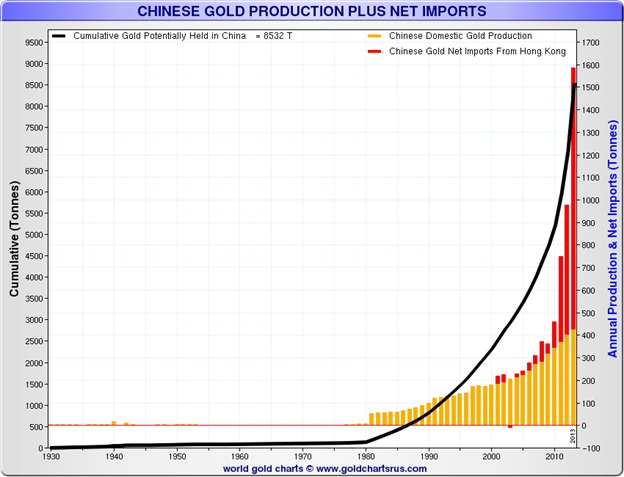

Below is the same view over 84 years showing the parabolic nature of China’s gold accumulation (Production plus Net Imports), especially since the year 1980. It is imperative to note that China’s gold accumulation is enjoying an astounding 10.7% Compound Annual Growth Rate (CAGR).

Above Charts Source Courtesy of Nick Laird & http://www.sharelynx.com/

Forecast for China’s Gold Accumulation by 2020

Based upon the above charts and assuming China’s yearly gold accumulation remains stable (i.e. a 10.7% CAGR), it translates to the Sino nation possessing nearly 14,000 tonnes of gold by the year 2020. Compare this to US gold reserves at 8,134 tonnes, which is today the world’s largest gold holder…

Conclusion

History is testament that a universally accepted world currency has material control over all other currencies as the18th century financier Mayer Amschel Rothschild once said: “Give me control of a nation’s money and I care not who makes the laws.”

In the event China backs its Renmini currency with sufficient gold, The Peoples Bank of China will control the world’s currencies from Beijing – and that includes the U.S. greenback.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.gold-eagle.com/article/china-goes-gold-beijing-gold-demand-goes-parabolic (Gold-Eagle provides regular commentary and analysis of gold, precious metals and the economy. Be the first to be informed by signing up for our free email newsletter.)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Don’t Worry About the Future Price of Gold – China’s Got Your Back! Here’s Why

This eye-opening article explains how China is influencing gold demand and prices and what it means for Western investors. Readers will discover how much gold China is really buying and steps they are taking to undermine the U.S. Dollar as the world reserve currency. It even includes a prediction for gold prices. It’s a must-read for any precious metals investor. Read More »

2. Gold Demand In China & India – What Does the Future Hold?

Lifted by a continued surge in Asian gold sales, consumer demand for gold reached an all-time high in 2013 at 3,893 tonnes. Amazingly, 54% of this demand came from two places: India and China. However, it is only recently that the East has dominated global demand for the yellow metal. In this infographic, we look at India and China specifically to see why demand keeps expanding in the East. Read More »

3. What Does Slowdown In China Mean for Gold Prices?

The latest data shows that China is slowing tremendously and this should have positive effects on the future price of gold. Here’s why. Read More »

4. China GROSSLY Understates Its Gold Reserves! Here’s Why & What They REALLY Are

Today China came out with their Central Bank Gold Holdings reporting 1054 tonnes but this is impossible. Here is why. Read More »

5. China Knows Something About Gold That the West Does Not – Here’s What It Is

It has been suggested recently that there must be collusion between America and China over the transfer of gold from Western capital markets. They assume that governments know what they are doing, so there is a bigger game afoot of which we are unaware. The truth of the matter, though, is simply that China and Western capital markets view gold very differently. Let me explain. Read More »

6. China Converting U.S. Dollar Debt Holdings Into Gold At Accelerating Rate

China, Russia and other nations are exiting their dollar-denominated holdings in favor of gold. This action should put pressure on the dollar and U.S. treasuries, pushing not only central banks, but mainstream investors towards the safety of precious metals and other tangible assets that cannot be defaulted on. There will be a rush out of dollars and into assets with no counter-party risk, it is just a matter of how soon it happens. Read More »

7. Noonan: Is Gold’s Decline Being Caused By Fed Payback Time to China?

The manipulated raids in the gold market since last April may be hurting the Precious Metals game players, weakening their confidence and “disproving” gold’s worth against a fiat currency, but they serve a greater purpose, as in Federal Reserve payback time to China. Here’s why. Read More »

Most Americans simply don’t understand that Russia and China have the power to collapse the U.S. economy by going to a gold for oil system. All they have to do is pull the trigger. Let me explain. Words: 1515 Read More »

9. China Continues Buying Gold Like There Was No Tomorrow! Here Are the Impressive Numbers

China continues to buy gold with both hands, keeping up all the gold they produce and importing even more! Imports were up 50% in October vs. the previous month; up 68% in November and up 74% in December. What will January bring given the continued weakness in the price of gold? Probably even more buying! Read More »

10. China’s Role in the Future of Gold

In this infographic we look at how gold growth in China will impact the future of the precious metal. In Q4 of 2011 and continuing into 2012, China has bought more gold overall than even India and will continue to play an important role in consumption. Read More »

11. Gold Reserves: Who Are the 10 Biggest Owners – and How Soon Might China Become #1?

China currently is a distant 5th behind the U.S. in the extent of gold reserves it currently owns but gives every indication that it is intent on adding more. How long might it take for China to be number one in gold reserves? Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money