With gold’s current setup, we’ve finally reached a significant cycle pivot…and I believe that we are likely to be treated to a very surprising turn of events. Directly ahead, I believe, is a major turn and rally for gold.

treated to a very surprising turn of events. Directly ahead, I believe, is a major turn and rally for gold.

The above are edited excerpts from an article* by Bob Loukas (thefinancialtap.com) originally entitled Laying Out the Traps.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Loukas goes on to say in further edited excerpts:

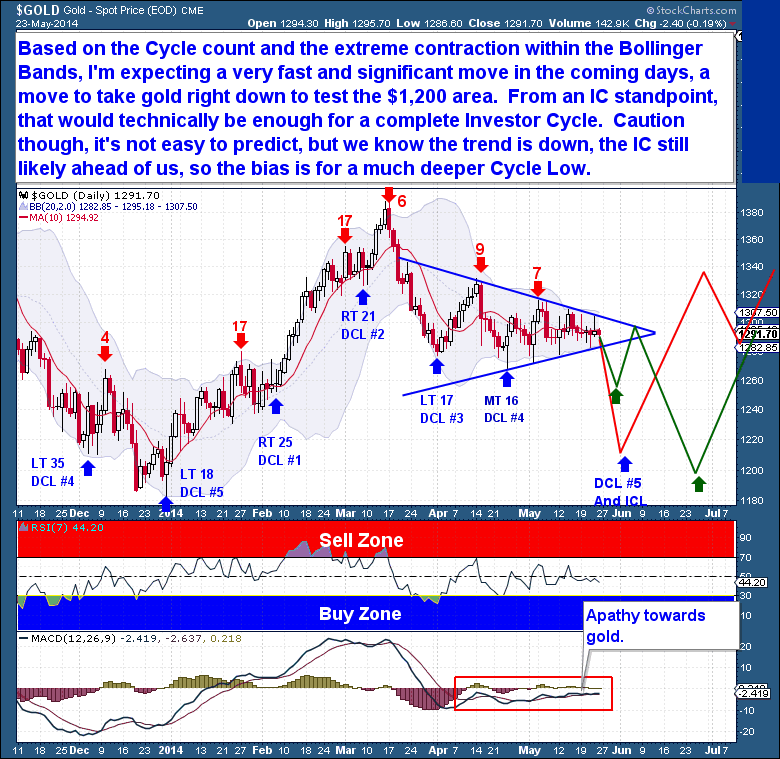

Gold has continued to chop sideways…[and that] is why the Bollinger Bands have constricted so tightly. The trading range…is now at an extreme low [and this] lack of volatility is reflected in the second tightest set of Bollinger Bands since the start of the bull market 14 years ago.

…I place significant predictive value on instances where tight Bollinger Bands occur near expected Cycle pivots [and] my current gold analysis…[indicates that] gold is in the timing band for a Daily Cycle Low (DCL), but has yet to complete a recognizable Cycle Low. Because moves out of tight Bollinger Bands are almost always fast and extreme, I expect that to happen this time as well – and the evidence continues to support the idea that the coming move will be sharply lower into a DCL.

Even though we’re expecting a sharp decline, such a drop could be good news for Gold bulls. If the coming DCL holds above $1,179, it should be an extremely bullish event. Cycle Lows serve as important, sentiment clearing events, and are necessary if a sustained move higher is to follow. In addition, with gold on week 21 of an Investor Cycle (which normally runs between 22-26 weeks), we could well be looking at an Investor Cycle Low (ICL) at the same time, one which could also mark a significant turning point in gold’s longer term outlook.

Stay connected!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

My goal has always been to assess asset price behavior in as unbiased a way as possible, focusing on the most probabilistic Cycle outcomes. Like any technical discipline, however, Cycles are not absolute; there is room for interpretation, and an allowance for alternative scenarios must be made. I don’t look to sensationalize my analyses, and they should not (and cannot) be presented in terms designed to give the illusion that they are foolproof. Cycle analysis is all about determining the most probable outcomes.

With gold’s current setup, we’ve finally reached a significant Cycle pivot…and I believe that we are likely to be treated to a very surprising turn of events. Directly ahead is, I believe, a major turn and rally for Gold.

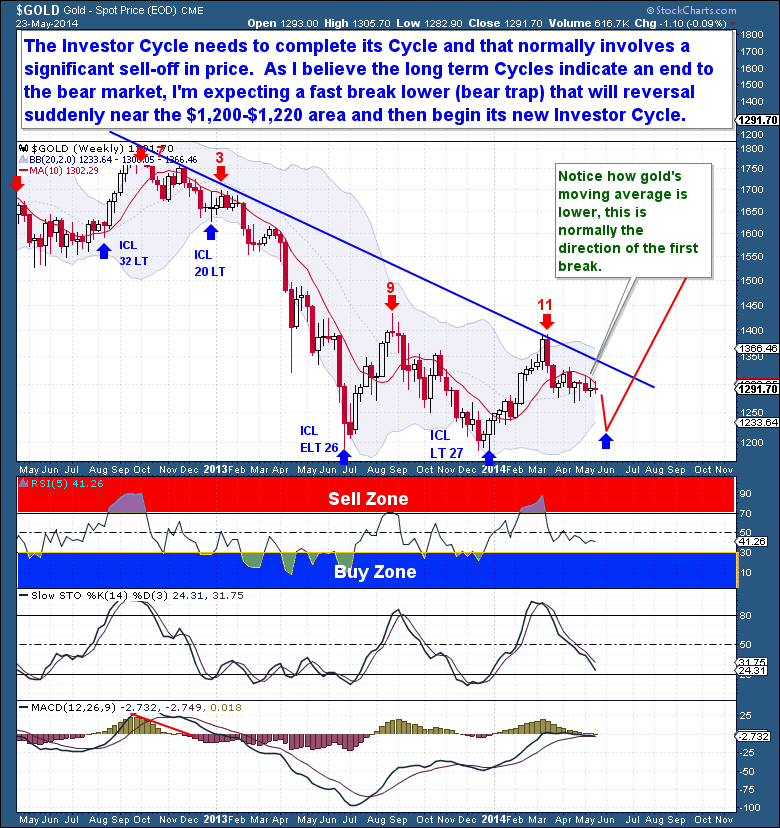

I can’t be certain of the exact timing, since there exists the possibility of another Daily Cycle (in the current Investor Cycle) which could stretch into late June, but I need to reiterate my belief that gold’s bear market ended last year, in June.

To confirm that gold’s bear market is over, the coming ICL will need to hold above the prior two ICLs ($1,179). If this plays out, the coming decline from tight Bollinger Bands should see the bears pile in on the short side, driving gold’s price toward the level of the last ICL. At some point, price should reverse sharply, trapping the bears and punishing them with a rally fueled by Short covering.

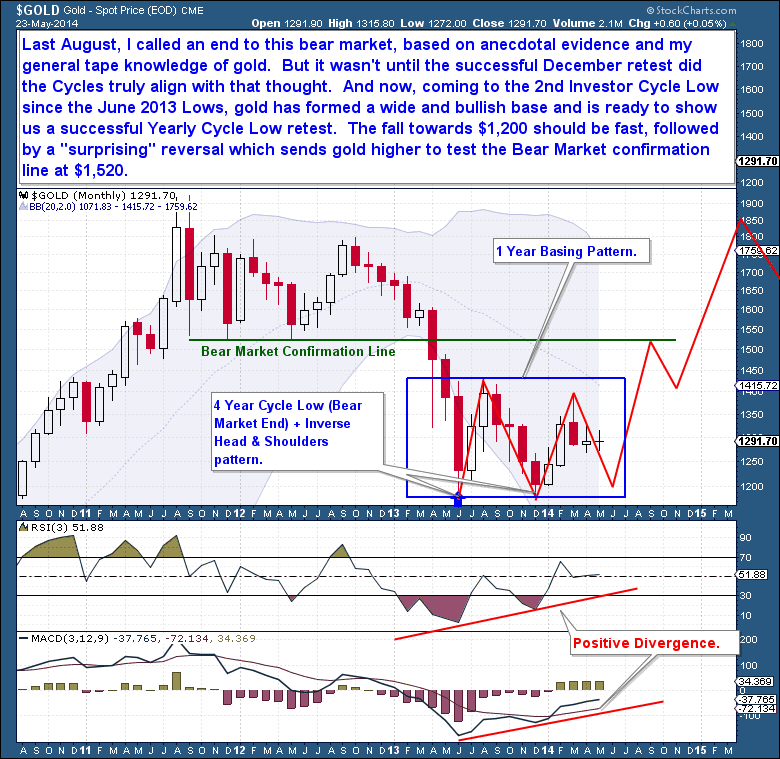

In August of last year, my call of an end to gold’s bear market was based both on anecdotal evidence and my experience reading the tape but it wasn’t until the successful retest of the low in December that Cycles truly supported the idea that a bottom was in. Now, with the approach of the 2nd ICL since the June 2013 bottom, gold appears to have formed a wide and bullish foundation upon which the next bull market will be built.

The last Yearly Cycle Low (YCL) occurred in June of 2013, making the coming YCL very important in confirming the end of the bear market. I expect that Gold will hold above $1,179, giving us both a 2nd straight Investor Cycle above the June 2013 Low and, more importantly, a successful retest of the last June’s Yearly Cycle Low. If the retest is successful, Gold will have completed a very bullish inverse monthly H&S pattern, and a sharp counter-trend rally will be almost assured.

Gold’s moves out of Yearly Cycle Lows are often explosive, and there is no reason to expect that this time would be different. A new rally should be intense, and my expectation is for a move back to prior resistance around $1,520.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://thefinancialtap.com/public/laying-out-the-traps (LIMITED TIME PROMOTION. You’re just 1 minute away from profitable trades! please visit http://thefinancialtap.com/landing/try# AND ENTER PROMO CODE: 29off. This will reduce ANY product by $29 (including the annual)

Related Articles:

1. Gold Dropping to $900 & Silver to $15 By End of June Before Going Parabolic!

Back in early May, 2013, I correctly forecast the lows in gold & silver which occurred 2 months later. Today, my new analyses of gold & silver indicates they both will show further weakness during the 2nd quarter of 2014 before both jumping dramatically in price before the end of 2014. Below are the specific details of my forecasts (with charts) to help you reap substantial financial rewards should you wish to avail yourself of my insightful analyses. Read More »

2. Gold In 2014: Price Forecasts ($900 – $1,435) & Commentary

Below are a series of forecasts and predictions of what 2014 could bring for the price of gold (as low as $900/ozt. & no higher than $1,435/ozt.) and the reasons why with interesting commentary by some individual investors and gold enthusiasts. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Those that depend upon flat money are doing everything they can to down play all PM’s, not just Gold.

The big question is will they continue to be successful and if so, for how long before PM’s value reclaims its past glory!

This is something that long range charts cannot hope to illustrate.