Inflation is finally picking up, and could quickly get out of hand…If inflation tops 5%…the potential top for gold prices…is $6,000, taking into account money supply expansion since 1980.

inflation tops 5%…the potential top for gold prices…is $6,000, taking into account money supply expansion since 1980.

By “Austolib” (thejewishlibertarian.com) – The following article is an edited ([ ]) & abridged (…) version of the original to provide a fast & easy read. (#Follow-the-munKNEE on Facebook or Twitter)

For the last couple of years, analysts have ruminated over the fact that the seeming recovery and expansion of the U.S. economy doesn’t look well supported by some key economic metrics. Yes, employment has risen. Yes, business sentiment has improved and yes, the equities markets are fresh off the back of a close to half decade period of expansion. Up until the last few months of 2015, however, improvement in one figure has proven elusive – price inflation.

For the first half of 2015, U.S. price inflation fluctuated between lows of -0.2% and highs of 0.1%, and this weakness served to undermine any possibility of a U.S. Federal Reserve rate hike. Around the middle of the year, a small boost to inflation prospects saw sentiment improve slightly, but not enough to instigate a rate hike in the closely watched end of third quarter announcement.

Throughout the final quarter of the year, however, things started to ramp up. From 0.2% in October, inflation hit 0.5% and 0.7% in November and December respectively. The latest data – January 2016 – revealed a 1.4% figure, the highest level recorded since October, 2014. On the 16th of this month, the US Bureau of Labor and Statistics will report February’s figure, with consensus forecasts suggesting a repeat, or at most a 0.01-point decline, on January’s 1.4%.

The fact that we are finally seeing some price inflation in the U.S. economy has wide ranging implications, and will likely come as a relief to policymakers, for now. As yet, however, the Fed remains seemingly reluctant to hike rates any further. Across the last two weeks alone, a number of prominent Federal Reserve officials, including Dallas Federal Reserve President Robert Kaplan, William C. Dudley, and St. Louis Federal Reserve President James Bullard, have publicly warned about the impact higher rates might have on the somewhat fragile recovery of the U.S. economy.

The reasoning behind their arguments comes down to this: things may be looking up in the U.S., but in Europe, Asia and Australia, things are extremely fragile. This fragility is offsetting a portion of the accommodative monetary policy that U.S. businesses and consumers are enjoying at present, and that a tightening would amplify this offsetting. In turn, this amplification could cause a rapid and unexpected tightening of conditions – a tightening that could quickly derail any supposed recovery.

Over the last month alone, data out of the U.S. has shown:

- an increase in wages (0.5% average hourly earnings),

- a decrease in unemployment to 4.9% for January,

- an increase in job openings by 5.6 million during December,

- lower than expected jobless claims,

- an increase in both core retail sales (0.1%) and raw retail sales (0.2%),

- consumer expectations, GDP and personal spending data all doing better than expected at the end of February,

- manufacturing data doing better than expected at the beginning of March, and

- non-farm data beating expectations.

[In addition,] oil remains down, which should serve to fuel consumer spending on the back of increased disposable income.

In short, the U.S. economy could quickly go from low, fragile inflation, to high, unsustainable levels. The gains we have seen across the last couple of quarters alone illustrate this potential, but with a heating up of the U.S. economy, and ongoing reluctance of the U.S. Federal Reserve to raise rates significantly if at all, this potential is compounded. By significantly, I don’t mean 25 basis points. I mean hundreds.

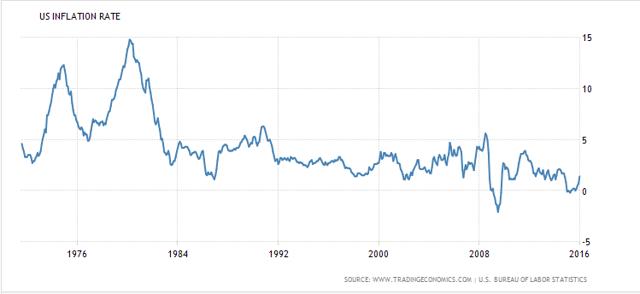

The correlation between the price of gold (NYSEARCA:GLD) and U.S. inflation indexes is well known. In fact, the two charts below show the inflation rate and the inflation-adjusted gold price since 1971.

Adjusted for inflation, gold still has not surpassed its 1980 high, which hit at the same time as inflation peaked at 15% in 1980. Now again, we could well be heading into a period of uncontrollably high price inflation in the U.S.. Yes, this is a sharp turn from the view of the majority of analysts who just a quarter ago were stating that flat inflation illustrates the difficulty that lay ahead for the U.S. economy, but its potential as an unfolding situation is serious.

- Prices are already rising at the fastest rate we’ve seen in almost a decade,

- [There are a] flurry of major U.S. economic indicators that underlie the inflation figure, or at least fuel its rising are on the up.

- At the same time, the Fed is dragging its feet on a second hike,

- and interest rates are still near record lows.

It’s very easy to imagine a scenario in which the ability of the Federal Reserve to materially affect rising price inflation through rate hikes diminishes, because the idea of rate hikes is to get ahead of inflation, not chase it. If rates are chasing inflation instead of being ahead of it, then they’ll have to go very high to control it as they did in 1980, and the U.S. government cannot afford that, the debt being nearly $19 trillion, let alone the U.S. economy.

Gold Goes Up From Here

With things as they are, even if inflation rises to 3 or 4%, the Federal Reserve is limited in its ability to raise rates. Even if it does hike, and the U.S. economy slows, the ensuing switch to risk-off sentiment should fuel an upside run in gold.

If inflation gets out of control like it did around 1980, then judging by the inflation of the money supply at $12.4 trillion now versus $1.8 trillion in January 1980 when gold peaked at $875 an ounce, then gold could even head to $6,000, since the money supply is close to 7x larger than it was back then. This is if price inflation ever reaches 15% or more as it did in 1980.

Conclusion

The takeaway here is that eventually, inflation will go higher. Maybe that spike is starting now, maybe it’s still a bit farther off, but when it does, there is little the Fed can do about it. Because of that, gold could repeat what it did in 1980, in inflation adjusted terms, which means a top at $6,000 or so. Especially after 4 years of sustained declines, gold is ready to move higher for a long time now.

#Follow-the-munKNEE via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner) to get every article as posted.

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; CreditWriteDowns;

Related Articles from the munKNEE Vault:

1. Gold & Silver Likely Going to $2,000 & $50/ozt. Before End Of Year – Here’s Why

Gold is in a hurry and is unlikely to wait for investors to acquire it at anywhere near these prices. We could now see a quick move to $1,400 and if gold doesn’t stay too long at that level, the acceleration is likely to continue towards the previous high of $1,900 and go even as high as $2,000/ozt. That being said, silver will move twice as fast as gold and could well reach $50 in 2016. Here’s why.

2. Gold Will Reach $2,500/ozt In the Near Future – and $10,000 Thereafter

After two years of declines, many investors sold their gold holdings and vowed never to invest in gold again. However, in the fall of 1976, gold began an ascent that saw it rise 750%, peaking at $850 a troy ounce three years and four months later. After a 3-year correction, the same opportunity to buy low exists today, just as it did in 1976.

3. Gold: $3,000 – $5,000 Possible By 2020 – 2022, If Not Sooner. Here’s Why

The future price of gold is very much dependent upon the reactions of governments and central banks regarding the current deflationary forces. $3,000 – $5,000 per ounce is quite possible at some time in 2020 – 2022, if not sooner.

4. Gold Likely To Rally Into the $4 – 8,000 Range By 2020 – 22

Higher gold prices look both reasonable and inevitable. Fifty years ago gold sold for under $40. Gold selling for over $4,000 does not seem unlikely. Depending on the unfolding “insanity” in our political and financial world, $4,000 might be considered quite low in 5 – 10 years.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money