This article presents 10 Dividend Contenders that I considered most attractive based on valuation and forecast long-term earnings and dividend growth. Hopefully, there is something here for every reader depending upon their own unique investment goals and objectives.

attractive based on valuation and forecast long-term earnings and dividend growth. Hopefully, there is something here for every reader depending upon their own unique investment goals and objectives.

The primary focus of my last article which featured 10 undervalued Dividend Champions for 2016 (see here) and this article is on identifying attractive dividend paying stocks that I feel are currently attractively valued for the long-term. I want to be clear that these selections are not offered as a portfolio. Instead, these are 10 individual selections with various degrees of safety, yield and valuation levels that prospective investors can choose from.

In my opinion, the true value investor buys the company and not the stock. Consequently, this approach requires focusing more on the underlying strength and fundamental value of the business in lieu of reacting to short-term price action. To clarify, I personally never judge the success (or lack thereof) resulting from my investment in a business over a time frame shorter than 3 to 5 years. This is not an arbitrary time frame; instead, this represents a normal business cycle. In other words, my minimum definition of long-term is a business cycle spanning at least 3 to 5 years. I emphasize that this is my minimum holding period. Ideally, my objective is to own a great company forever…[and] there is a simple logic supporting my view. When I am investing in the business, I am buying the company’s future earnings power and dividend growth potential. Although stock prices are reported virtually every minute of every passing day, operating results are only reported 4 times a year. Moreover, it takes the passing of time for future earnings growth and dividend growth to manifest. Understanding this, I personally recognize that the acid test for judging my investment in a business is to measure the level of earnings and dividends I am receiving no earlier than 3 to 5 years after my initial investment, and preferably longer.

In other words, if I invested in the business at a sound or attractive valuation in the first place, I can be almost certain of achieving a successful return if both earnings and dividends have grown over the 3 to 5 year time frame. Additionally, it might be helpful to also understand that since I have no intention of selling my business for a minimum of 3 to 5 years, the price the market is placing on it between that time frame is of little importance to me. On the other hand, I do expect to see earnings growth along the way, and for those stocks where I am investing for dividend income, it’s critical to me to see the dividend continuing to grow with each passing year. As long as those things are happening as expected, I have little or no concern about short-term price volatility.

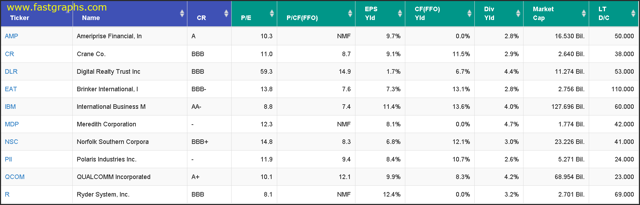

The following F.A.S.T. Graphs portfolio review lists my top 10 attractively valued Dividend Contenders for 2016 based on valuation. [Afterwards, go here] to find individual earnings and price correlated F.A.S.T. Graphs™ plus performance reports on each company.

10. Ameriprise Financial, Inc. (AMP)

9. Crane Co. (CR)

8. Digital Realty Trust, Inc. (DLR)

7. Brinker International (EAT)

6. International Business Machines (IBM)

5. Meredith Corporation (MDP)

4. Norfolk Southern Corporation (NSC)

3. Polaris Industries Inc. (PII)

2. Qualcomm Inc. (QCOM)

1. Ryder System, Inc. (R)

Value investing is not a short-term oriented strategy. It is both possible and likely that short-term total return results may be disappointing for a time. Therefore, a key component for implementing a successful value investment strategy is patience. However, I like to think of it as intelligent patience that is supported from understanding the fundamental value of the businesses you are investing in. The most accomplished value investors trust fundamentals more than they do fickle short-term price action.

“Follow the munKNEE” via Twitter and/or Facebook and have your say. Shock us, surprise us, inform us, entertain us. Here’s your opportunity to start a dialogue. Also one of the most comprehensive resources of the very best-of-the-best financial, economic, investment and gold/silver related Twitter & Facebook pages out there. Mark them as your favorites and get access to every article as posted.

[The original article was written by (FastGraph.com) and is presented here by the editorial team of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter in a slightly edited ([ ]) and abridged (…) format to provide a fast and easy read.]Related Articles from the munKNEE Vault:

1. 10 Go-To Dividend Paying Stocks For 2016

Dividend Champions/Aristocrats are the go-to dividend paying stocks for prudent investors desirous of a safe, predictable and growing stream of income on the common stock portion of their retirement portfolios. Here are 10 undervalued Dividend Champions for 2016: be greedy when others are fearful!

2. Retired or Close to Retirement? Some of These 39 Dividend Stocks May Belong In Your Portfolio

This article identifies 39 fairly valued dividend growth stocks with above-average historical earnings growth over the past 5 years and a current dividend yield of 1% or better and, as such, is oriented to those retired, or close to retirement, investors that require above-average growth and/or above-average long-term total return.

3. Short List of 12 Attractively Valued Above-average Growing Dividend Growth Stocks

In this article I present 12 dividend growth stocks that are fairly valued and offer above-average earnings and dividend growth potential.

4. Do Aggressive High Yield Investments Belong In Your Retirement Portfolio?

When you are employed, you are working for your money. In retirement, you begin the stage in your life where your money must work, which changes the investing dynamic considerably – primarily as it relates to suitability. This article is offered to reveal and articulate the risks, dangers and advantages of reaching for yield.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money