The Dow has begun a major rally 13 times over the past 112 years which equates to  an average of one rally every 8.6 years. As it stands right now, the current Dow rally that began in March 2009 would be classified as well below average in both duration and magnitude. [As such,] don’t allow the current new highs to scare you away from this market. More gains are on the way in the coming months.

an average of one rally every 8.6 years. As it stands right now, the current Dow rally that began in March 2009 would be classified as well below average in both duration and magnitude. [As such,] don’t allow the current new highs to scare you away from this market. More gains are on the way in the coming months.

So says Greg Guenthner for The Rude Awakening in edited excerpts from his original article* as posted on dailyreckoning.com under the title The Irrational Fear of New Highs.

[The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Guenthner goes on to say in further edited, and in some instances paraphrased, excerpts:

More new closing highs, courtesy of the Dow Jones Industrial Average, are unnerving many investors…again. The worries stem from the scars of the financial crisis. For the past decade, new highs (or approaching new highs) signal that it’s time to get the hell out. [Nevertheless, while…it’s easy to remember the recent pain, if you take a couple steps back you’ll find that new highs aren’t so ominous after all.

What about when the Dow was making highs in 1983? What about 1992? Or 1995? Each of these appearances of new highs was a strong buy signal. I could go on, but I think you get the point.

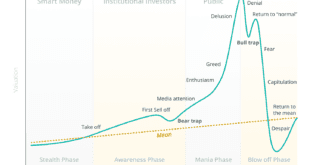

Another popular complaint that usually travels with the “new highs are bearish” theme is that the market is overextended. The Dow has chugged higher for more than four years, so another crash is in order.

The chart above shows, all major market rallies of the last 112 (a rally in this case is an advance that follows a 30% decline) years [and] you’ll find the current rally in the bottom left corner. As the chart shows, the current Dow rally has been shorter and less powerful than most post-crash rallies over the past century.

Conclusion

As mentioned in the introduction to this article, the Dow has begun a major rally 13 times over the past 112 years which equates to an average of one rally every 8.6 years so, as it stands right now, the current Dow rally that began in March 2009 (blue dot labeled you are here) would be classified as well below average in both duration and magnitude.

Don’t allow new highs to scare you away from this market. More gains are on the way in the coming months.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://dailyreckoning.com/the-irrational-fear-of-new-highs/(© 2013 Agora Financial, LLC. All Rights Reserved.

Related Articles for a Balanced View:

A. Optimistic Views of the Market

1. Correlation of Margin Debt to GDP Suggests Stock Market Has More Room to Run

Are stocks in a bubble? While leverage has returned to the stock market driving up stock prices and aggregate demand in the process, margin debt is still shy of its all-time high as a percentage of GDP, so there is certainly some headroom for further rises. A look at the following 5 charts illustrate that contention quite clearly. Read More »

2. The Stock Market: There’s NOTHING to Be Bearish About – Take a Look

There’s nothing to be bearish about regarding the stock market these days. I’ve reviewed my 9 point “Bear Market Checklist” of indicators and it is a perfect 0-for-9. Not even one indicator on the list is even close to flashing a warning sign so pop a pill and relax. There’s no immediate danger threatening stocks. Read More »

3. Pop a Pill & Relax ! There’s NO Immediate Danger Threatening Stocks

Right now there’s nothing to be bearish about. I say that with conviction, because my “Bear Market Checklist” is a perfect 0-for-9. Heck, not a single indicator on the list is even close to flashing a warning sign. We’ve got nothing but big whiffers! Take a look. Pop a pill and relax. There’s no immediate danger threatening stocks. Read More »

4. Latest Action Suggests Stock Market Beginning a New Long-term Bull Market – Here’s Why

There are several fundamental reasons to believe that this week’s stock market activity, where the S&P 500 has moved more than 4% above the 13-year trading range defined by the 2000 and 2007 highs, could mark the beginning of a long-term bull market and the end of the range-bound trading that has lasted for 13 years. Read More »

5. Sorry Bears – The Facts Show That the U.S. Recovery Is Legit – Here’s Why

Today, I’m dishing on the unbelievable rebound in residential real estate, pesky rumors about the dollar’s demise and a resurgent U.S. stock market. So let’s get to it. Read More »

6. Stocks Are NOT In Another Bubble – Here’s Why

U.S. stocks are off to one of their best starts in years. Most indices are up 10% year to date, prompting many investors to ask: “Are we in another bubble?” The answer is no, at least when it comes to equities. Here are three reasons why:

7. Research Says Stock Market Bull Should Continue Its Run Until…

The mainstream financial press would like us to believe that because the S&P 500 and Dow 30 are at or near their record highs that it must mean we’re nearing the end of the current bull market and, as such, now must be a terrible time to buy stocks. Let’s not jump to any conclusions, though. Instead, let’s do our own due diligence to find out. Hint: If you’ve been stuffing cash under the mattress since the last market crash, you might want to finally go deposit it in your brokerage account. Here’s why… Words: 420

8. These 4 Indicators Say “No Stock Market Correction Coming – Yet”

While I remain cautious on stocks and the risk trade, the technical picture shows that the uptrend to be intact and the bulls should still be given the benefit of the doubt for now. At this point, any call for a correction is at best conjecture [as evidenced by the following 4 indicators]. Words: 399; Charts: 4

The Swimsuit Issue Indicator says that U.S. equity markets perform better in years when an American appears on the cover of Sports Illustrated’s annual issue as opposed to years when a non-American appears on the cover. [What is the nationality of this year’s cover model? Can we expect returns above the norm or will we see a year of underperformance for the S&P 500 this year? Read on.] Words: 323 ; Table: 1

10. Bull Market in Stocks Isn’t About to End Anytime Soon! Here’s Why

As we all know, money printing always leads to inflation. It’s just a matter of figuring out which assets get inflated. This time around gold is not the only beneficiary, stocks are, too, and I’m convinced that the chart below holds the key to the end of the bull market. Words: 475; Charts: 1

11. QE Could Drive S&P 500 UP 25% in 2013 & UP Another 28% in 2014 – Here’s Why

Ever since the Dow broke the 14,000 mark and the S&P broke the 1,500 mark, even in the face of a shrinking GDP print, a lot of investors and commentators have been anxious. Some are proclaiming a rocket ride to the moon as bond money now rotates into stocks….[while] others are ringing the warning bell that this may be the beginning of the end, and a correction is likely coming. I find it a bit surprising, however, that no one is talking of the single largest driver for stocks in the past 4 years – massive monetary base expansion by the Fed. (This article does just that and concludes that the S&P 500 could well see a year end number of 1872 (+25%) and, realistically, another 28% increase in 2014 to 2387 which would represent a 60% increase from today’s level.) Words: 600; Charts: 3

12. 5 Reasons To Be Positive On Equities

For the month of January, U.S. stocks experienced the best month in more than two decades [and the Dow hit 14,009 on Feb. 1st for the first time since 2007]. Per the Stock Traders’ Almanac market indicator, the “January Barometer,” the performance of the S&P 500 Index in the first month of the year dictates where stock prices will head for the year. Let’s hope so…. [This article identifies f more solid reasons why equities should do well in 2013.] Words: 453

13. Start Investing In Equities – Your Future Self May Thank You. Here’s Why

As Winston Churchill once said: “A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty” and in that vain I challenge all readers to fight off the negativity, see long-term opportunity in global equity markets and, most importantly, remain invested. Your future self may thank you. Words: 732; Charts: 6

B. Pessimistic Views of the Market

1. Level of Investor Margin Suggest Its Time to Lower Stock Exposure

2. This Metric Strongly Suggests a Major Correction in the S&P 500 Could Be Coming

History shows that when investors experience a rapid decline in the amount of available cash in their brokerage account to spend/invest quickly such “negative net worth” leads to major corrections in the stock market. Currently such is the case so can we expect another such decline or will it be different this time?

There are many, many different takes on why the stock market has been ripe for a fall and why it has finally happened. Below are 30 of the best-of-the-best such analyses to help you come to some sort of resolution. Read More »

The rubber band of Mr. Market has been stretched tight and is ready to release. The problem is that it is impossible to know which end is going to snap. Will it snap up or snap down? Read More »

Eiffel tower patterns can be very important to your portfolio construction & management because, when you experience the left side of the tower, you often experience the right side as well which often results in declines of as much as 50% from the peak. Currently it would appear that three specific assets could well be forming such patterns. Read More »

I believe this sell-off is a good thing for the market – as the outcome will show us where fair value might be. I believe that we will see the market return to a more reasonable forward P/E of 13, sending SPY to $150.00 – or another 5 percent decline. [Let me explain further.] Read More »

8. Bernanke Has Created the Mother of ALL Stock Market Bubbles – Here’s Why

We have NEVER been this overextended above this line at any point in the last 20 years. Indeed, if you compare where the S&P 500 is relative to this line, we’re even MORE overbought that we were going into the 2007 peak at the top of the housing bubble. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money