The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Roche goes on to say in further edited excerpts:

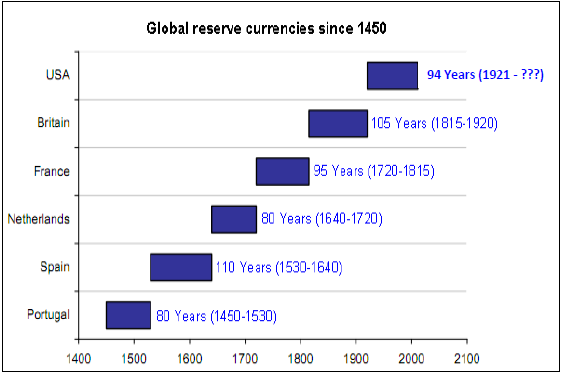

[As you can see in the table below,]… no one maintains reserve currency status forever [and] that shouldn’t be remotely surprising. The global economy is dynamic and market shares shift….[and] today nations accumulate reserves of U.S. dollars today because the U.S. economy is the dominant player in global trade.

(Source: DoubleLine)

Of course, the U.S. Dollar isn’t the only currency that nations maintain reserves of…but since the USA produces 22% of all world output it happens to play a particularly special role in the global economy. By virtue of being the largest economy in the world the accumulation of U.S. dollar denominated financial assets happens to dominate the global financial system. It’s sort of like being the top market share producer of a particular product in a particular industry. Other entities accumulate your products because you’re the top producer – and that changes over time. Market shares change and regimes shift with the evolving economy.

Conclusion

Will the USA lose its reserve currency status at some point?

Yes….

Will it cause everyone to suddenly ditch the dollar?

Probably not.

It just means the USA will produce a lower proportion of global output and therefore, as a matter of accounting, the rest of the world will hold a lower percentage of U.S. dollar denominated financial assets as a percentage of global output.

Will it be the end of the world?

No…

It’s just a sign that market shares change and when you’re #1, well, there’s only one direction to go.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://pragcap.com/how-much-longer-will-the-dollar-remain-the-reserve-currency-of-the-world (Copyright © 2014 All Rights Reserved )

Related Articles:

1. Would Major Sanctions Against Russia Hasten End of USD As World’s Reserve Currency?

Russia is a huge supplier of oil and gas — traded in US dollars — which gives it both leverage over near-term energy flows and, far more ominous for the U.S., the ability to threaten the dollar’s reign as the world’s reserve currency – and it’s taking some big, active steps towards that goal. Read More »

2. Shift From U.S. Dollar As World Reserve Currency Underway – What Will This Mean for America?

Today, more than 60% of all foreign currency reserves in the world are in U.S. dollars – but there are big changes on the horizon…Some of the biggest economies on earth have been making agreements with each other to move away from using the U.S. dollar in international trade…[and this shift] is going to have massive implications for the U.S. economy. [Let me explain what is underway.] Words: 1583 Read More »

3. Gold Standard Should Replace “Exorbitant Privilege” of USD Reserve Currency Status – Here’s Why

The least imperfect monetary system by which civilized nations can conduct their business is the classical gold standard – a system in which every major nation defines its currency as a weight unit of gold. [Let me explain.] Words: 890 Read More »

4. Dollar’s Days As Reserve Currency To End In 2 Years (10 Years Latest) – Here’s Why

The American dollar will be overthrown…in as short a period as 5 to 10 years says one analyst while another believes it will happen as early as 2015, 2016 latest. Here’s why. Read More »

5. Will May 20th Go Down In History As the Day the U.S. “Petrodollar” Monopoly Was Finally Shattered?

The struggle over Ukraine has caused Russia to completely re-evaluate the financial relationship that it has with the United States. If it starts trading a lot of oil and natural gas for currencies other than the U.S. dollar, that will be a massive blow for the petrodollar, and it could end up dramatically – and negatively – impacting the average American’s current standard of living. Let me explain. Read More »

6. 2012: The Beginning of the END for the U.S. “Petrodollar”!

A major portion of the U.S. dollar’s valuation stems from its lock on the oil industry and if it loses its position as the global reserve currency the value of the dollar will decline and gold will rise. Iran’s migration to a non-dollar based international trade system is the testing of the waters of a non-USD regime…transition to a world in which the U.S. Dollar suddenly finds itself irrelvant. [Let me explain.] Words: 1200 Read More »

7. Is There a Viable Alternative to the Dollar as the Reserve Currency?

Within the recent retracement of the U.S. currency there has been endless speculation about the future role of the dollar as the world’s primary reserve currency. Moreover, there has even been conjecture that the dollar will no longer exist at some point in the near future but any case made for the vulnerability of the dollar falls short when it comes to naming alternatives. Words: 631 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I think the next World Currency will be a conglomeration of several currencies, which would make it far more stable and attractive to a much wider user base.

For example, Russia, India and China could co-sponsor the RIC!