With two huge market declines in a the same decade, investors are constantly on edge waiting for the next crash, but we’re more likely to see cyclical, not secular, market drops for the simple fact that they happen more often. Here are the details.

waiting for the next crash, but we’re more likely to see cyclical, not secular, market drops for the simple fact that they happen more often. Here are the details.

The above introductory comments are edited excerpts from an article* by Ben Carlson (awealthofcommonsense.com) entitled What Are the Odds We’re Heading For Another Crash?.

Carlson goes on to say in further edited excerpts:

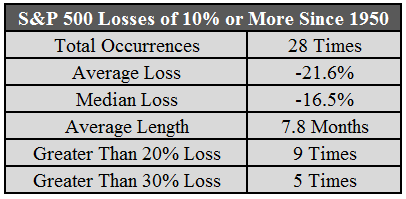

Let’s assume the S&P 500 ends up falling 10% or more, something that hasn’t happened since 2011. I don’t know if this will happen, but it’s not out of the realm of possibilities. Does this mean we’re heading for another 50% crash? Maybe, but probably not as that magnitude of loss is fairly rare historically:

- Since 1950 there have been

- only 28 instances when stocks fell by 10% or more, roughly once every two years (go back to 1928 and it happens around once a year),

- only 9 times when stocks fell 20% or more and

- only 5 occasions when stocks have fallen 30% or more. It happens, but it’s rare. That’s one out of every thirteen years.

Below are the rest of the stats on the double digit losses:

You can see…[from the above that] the huge losses are the exception, not the rule…These numbers don’t make you feel any better when you see the value of your portfolio drop, but it’s puts things into perspective. There are no rules set in stone in the financial markets and there’s no playbook that tells you ahead of time [what will happen]…The above stats aren’t actual odds – it’s just what’s happened historically. [After all,] anything can happen.

There are always outlier events that could strike and upset market dynamics to cause a crash – no one really knows – but you can’t plan on a stock market crash every single time stocks fall. Sometimes stocks go down without an enormous crash…

Conclusion

Plan on seeing stocks fall plenty of times over your lifetime, including the occasional crash.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://awealthofcommonsense.com/heading-another-crash/

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. This Weekend’s Financial Entertainment: “A Stock Market Crash IS Coming!”

Our financial system is in far worse shape than it was just prior to the financial crash of 2008. The truth is that we are right on schedule for the next great financial crash. You can choose to ignore the warnings if you would like but, ultimately, time will reveal who was right and who was wrong and, unfortunately, I think I will be proven to have been right. Read More »

2. Coming Stock Market Enema Will Be A VERY Messy Occasion!

Who knows how long before the Dow Jones Index finally receives a well overdue market enema, but I can assure you of this, when it arrives it will be a VERY messy occasion! Read More »

3. We’re All Cued Up For A Bear! Here’s Why

When taking a step back and viewing longer-term gauges, we see warning signs flashing. Many of these readings are in extreme territories, and historically bear markets have occurred from such overbought positioning. We are all cued up for a bear! Read More »

4. Present Bull Rally In Stocks Dangerously “Beyond the Pale” – Here’s Why

It is frighteningly clear to any objective analyst and/or intelligent investor that the present bull market rally in stocks (2006-2014) is “beyond the pale” (outside the bounds of acceptable behavior) i.e. the excess valuation is dangerously above the market excesses of the 1920s. Read More »

5. SELL! U.S. Stock Market Is An Investor’s Nightmare – Here’s Why

The stock market is presently a roulette wheel with dimes on black and dynamite on red. We continue to have extreme concerns about the extent of potential market losses over the completion of the present market cycle. Read More »

6. Harry Dent: Get Into Cash – Stock Market Will Crash to 5,500-6,000 By 2017!

You have to get out of stocks. Stocks have bubbled again and when they go down they’re going to go down hard. Read More »

7. Coming Bear Market Could Turn Into A Historic Crash – Here’s Why

Amazingly, we are on the verge of a global deflationary downturn and what could be a historic bear market, yet Wall Street prognosticators remain focused on the inflationary risks of excessive monetary stimulus. Their focus could not be more wrong. Let me explain further. Read More »

If the past long-term cyclical correlations between interest rates, equities, and commodities were to play out as they have done going back to the 1880s, U.S. stocks and interest rates should continue to rise as commodities either fall or underperform according to a 60-year cyclical pattern model referred to as The Market Map. Read More »

9. It’s Just A Matter Of Time Before the Stock Market Bubble Is Pricked! Here’s Why

Once again the stock market is in full bubble mode. The market was already overvalued earlier this year and the froth continues to build. Valuations are off the chart and euphoria is setting in while, at the same time, you have inflation eroding the purchasing power of regular Americans not participating in this casino. All the signs of a bubble top are there – massive speculation, unexplainable valuations, and blind optimism – even though the fundamentals don’t make any sense. This article substantiates that contention. Read More »

10. These 6 Indicators Reveal A Great Deal About Market’s “Upside” Potential

Trying to predict markets more than a couple of days into the future is nothing more than a “wild ass guess” at best but, that being said, we can make some reasonable assumptions about potential outcomes based on our extensive analysis of these 6 specific price trend and momentum indicators. Read More »

11. What Does the 10-year Yield’s Death Cross Mean For Stocks?

The 10-year yield’s Death Cross has proven to be a pretty significant risk-off shot across the bow over the last decade and this matters today because the 10-year yield put in a Death Cross back in early April of this year. So what does the 10-Year’s Death Cross mean for stocks this time? Read More »

12. Financial Asset Values Hang In Mid-air Like Wile E. Coyote – Here’s Why

The financial markets are drastically over-capitalizing earnings and over-valuing all asset classes so, as the Fed and its central bank confederates around the world increasingly run out of excuses for extending the radical monetary experiments of the present era, even the gamblers will come to recognize who is really the Wile E Coyote in the piece. Then they will panic. Read More »

13. Look Out Below? Buffett Market Indicator Has Now Surpassed 2007 Level

Market Cap to GDP is a long-term valuation indicator that has become popular in recent years, thanks to Warren Buffett and it is now at the second highest level in the past 60 years – even surpassing the levels reached in 2007. Read More »

14. World’s Stock Markets Are Saying “Let’s Get Ready to Tumble!”

To ignore all the compelling charts and data below would be irresponsible and, as such, will NOT go unnoticed by institutional investors. Such bearish barometers for stocks worldwide will, unfortunately, be ignored by the ignorant and gullible hoi pollo causing them severe financial loss as investor complacency in the past has nearly always led to a stock market crash. Read More »

15. Stock Market Bubble to “POP” and Cause Global Depression

In their infinite wisdom the Fed thinks they have rescued the economy by inflating asset prices and creating a so called “wealth affect”. In reality they have created the conditions for the next Great Depression and now it’s just a matter of time…[until] the forces of regression collapse this parabolic structure. When they do it will drag the global economy into the next depression. Let me explain further. Read More »

No stock market crash (a decline greater than 15%) has occurred over the past 30 years without the presence of a Hindenburg Omen except on one occasion (the mini-crash of July/August 2011). As such, without an official confirmed Hindenburg Omen, we are pretty safe from experiencing a major stock market correction. On the other hand, if we have an official Hindenburg Omen, then a critical set of market conditions necessary for a stock market crash exists. As of September 19th, 2014, we have such a condition in the market… Read More »

17. Another 35% Crash In the Stock Market Would Not Be That Unusual – Here’s Why

Some witless pollyannas will say the title of this article is inappropriate. Unfortunately, these hapless souls suffer from excessive greed, rampant euphoria and hyper-complacency. Furthermore, they are ignorant of stock market history and its immutable cycles where only magnitude and duration vary. They foolishly delude themselves into believing that the US Fed has “banned” bear markets and has discovered the “magic elixir” to kill all potential bears while they are still cubs or in hibernation. Read More »

18. “Is the Stock Market Sitting On A Trap Door?” These 2 Indicators Say “Yes”

The Russell 3000, a broad equity index representing 98% of the investable U.S. stock market, is up 9.3% for 2014 on a total-return basis…[but] the median total return for Russell 3000 constituents is just 1.5% reflecting the fact that small- and mid-cap stocks are under-performing… This current alarming deterioration in breadth, a term that refers to how much of the market is participating in the advance, begs the question: “Is the stock market sitting on a trap door?” This article looks at 2 trap door indicators that suggest that that might, indeed, be the case. Read More »

19. The Stock Market Needs A 1987-like Crash – Here’s Why

If you’re in the business of fear-mongering, one of the go-to moves to try to scare investors is to predict that the markets are looking eerily similar to October of 1987. That being said, you could actually argue that the 1987 crash was a good thing for the markets. It knocked some of the wind out of its sails after more than doubling from 1982-1986 so it begs the question “Would a Repeat of the 1987 Crash Really Be That Bad?”. Read More »

20. Take Note Because Those Investors Who Ignore These Observations Do So At Their Great Peril

Is a major top at hand? It is often said that bells do not ring to signal the end of a bull market but if the broad averages were in fact to plummet in the weeks ahead, never forget that bells did indeed ring. This article contains the opinions of three heavyweights in the guru world which are so insightful that any investors who ignore their observations do so at their great peril. Read More »

21. History Says “Expect An Economic Crash AGAIN In 2015″ – Here’s Why

Large numbers of people believe that an economic crash is coming next year based on a 7-year cycle of economic crashes that goes all the way back to the Great Depression. Such a premise is very controversial – some of you will love it, and some of you will think that it is utter rubbish – so I just present the bare bone facts below for you decide for yourself if it is something to seriously consider protecting yourself from in 2015. Read More »

22. Should Financial Market Cycles Play A Role In Your Decision-making Process?

Financial markets are influenced by relatively predictable cycles and should play a big role in one’s decision-making process just as they do in our day-to-day lives. This article takes a look at several and discusses their relevance to one’s investment management process. Read More »

23. Market & Economic Cycles Suggest We’re in the Fall Season in More Ways than One – Here’s Why

The key to long term success in investing is understanding the difference between the “seasons” in the markets and the economy. [Let me explain the four “seasons” and why we might very well be in the “fall” season and, if that is indeed correct, why] it is time to pack away the summer allocations and break out the winter coats to hunker down for what may be a chilly 2012. Words: 1016 Read More »

24. These 20 Cycle Theories Suggest Stock Markets, Gold & Bonds To Severely Correct

Unsustainable trends can survive much longer than most people anticipate, but they do end when their “time is up” – at the culmination of their time cycles…In an effort to bring clarity in how and when these trends could change direction we analyzed more than 20 different cycles. They almost unanimously point to tectonic shifts in the months and years ahead … starting now. We have been warned. At this point, we have enough confirmation to accept that the gold and silver crash – starting in April of 2013 – was the first shot across the board of what is to come. Read on! Read More »

25. Where Are We In the Current Economic/Market Cycle? These Charts Will Help You Decide

There is a debate on Wall Street between those who believe we have entered into the next “secular bull market” and those who believe that the current market advance is predicated on artificial stimulus and, as such, the “secular bear market” remains intact. Take a look below at a series of charts designed to allow you to draw your own conclusions and convey your view in the comments section at the very bottom of the page. Words: 719; Charts: 12 Read More »

26. Many Economic Cycle Theorists Believe 2014 to 2020 Is Going To Be Pure Hell For the U.S.!

Many mainstream economists want nothing to do with economic cycle theorists, but it should be noted that economic cycle theories have enabled some analysts to correctly predict the timing of recessions, stock market peaks and stock market crashes over the past couple of decades – and there are many economists who believe that the period from 2014 to 2020 is going to turn out to be pure hell for the United States. Read More »

27. Cycle Analysis Suggests S&P 500 Has Topped & Will Decline To Major Low In 2016

While the majority is looking at the Megaphone Pattern correction since the 2000 high and is expecting the market to go back to the lower trend line of this pattern and to make new lows, I think that it will not happen. The opinion of the majority can be used as a contrarian indicator. I think that a healthy correction in this new Secular Bull Market could push the Dow Jones to 12500-13500 (end of 2015 – half 2016) followed by a second leg up of this new Secular Bull Market. Read More »

28. Take Note: A Bubble Isn’t Necessary To Have A Sharp Decline In Stocks

With valuations stretched, investors seem to be justifying their stock purchases here with the argument that we have yet to reach the mania of 1999-2000 but history has shown us that there doesn’t have to be a bubble for there to be a sharp decline in stocks. As we saw in 2007, it doesn’t mean there is no risk of a significant market decline or that valuations are compelling and that investors should be expecting above average long-term returns from here. They should not. Read More »

29. All Is NOT Hunky Dory In the Stock Market – Here’s Why

We look at this market and we see “too much.” Too much divergence, too much complacency, too much embedded downside risk…the list goes on and covers many things. Let’s make the rounds and see what we find [and what it means for the immediate well-being of the various stock markets.] Read More »

30. Bubble-level Valuations Don’t Cause Bear Markets! These Factors Do

So much analysis we see and hear lately is concerned with whether the stock market is in a bubble or not. The truth of the matter, however, is that bear markets do not begin due to bubble-level valuations being reached and then bursting, but in anticipation of half a dozen mitigating factors as outlined in this article. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money