China, Russia and other nations are exiting their dollar-denominated holdings in favor of gold. This action should put pressure on the dollar and U.S. treasuries, pushing not only central banks, but mainstream investors towards the safety of precious metals and other tangible assets that cannot be defaulted on. There will be a rush out of dollars and into assets with no counter-party risk, it is just a matter of how soon it happens.

favor of gold. This action should put pressure on the dollar and U.S. treasuries, pushing not only central banks, but mainstream investors towards the safety of precious metals and other tangible assets that cannot be defaulted on. There will be a rush out of dollars and into assets with no counter-party risk, it is just a matter of how soon it happens.

So says Jason Hamlin (goldstockbull.com) in edited excerpts from his original article* entitled China Hints at Dumping U.S. Debt, Saying De-Americanized World is Needed.

[The following article is presented by Lorimer Wilson, editor of www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Hamlin goes on to say in further (and perhaps paraphrased in some places) excerpts:

China’s official news agency has published an op-ed commentary [see details at end of article] calling for the ‘de-Americanizing’ of the world economy. They specifically mentioned the threat to nations with large amounts of dollar holdings, suggesting that one nation should not have the ability to impact the rest of the world economy so powerfully. In other words, one nation should not be able to print the world reserve currency or issue so much outstanding debt.

China holds roughly $1.3 Trillion in U.S. treasury bonds, so if they decide to follow their words with action, we may see an accelerated selling of U.S. debt and dollars in the East. I don’t foresee an outright dumping of debt as many are anticipating, but I would not be surprised to see China’s treasury holdings cut in half within the next year or two.

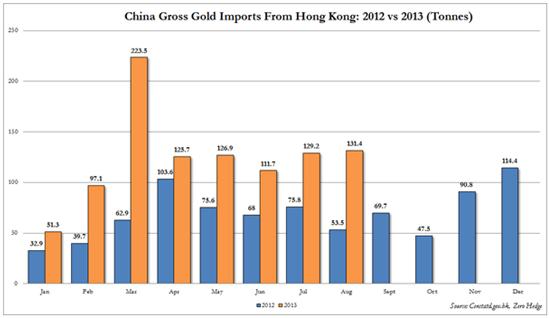

The Chinese move from U.S. dollars to gold has been very aggressive, yet under-reported by the mainstream media. At the current pace, Hong Kong will send, just to Mainland China, an amount of gold roughly equivalent to 50% of the rest of the world’s mined supply. Gold imports from Hong Kong to mainland China are set to double the imports from 2012.

Not only are exports from Hong Kong to mainland China skyrocketing, but Hong Kong itself will likely import over 2,000 tonnes for the year. Considering that global mined supply (excluding China) is only 2,400 tonnes, this leaves the rest of the world scrapping for the remaining 400 tonnes.

Editor’s Note: The following chart shows that through August, China has imported 994 tons of gold through Hong Kong, versus 511 tons in the year-ago period – and that doesn’t include the production of China’s domestic gold mines (300 or so tons, all of which stays within the country) and whatever else finds its way in through other ports. Assume monthly imports for the rest of the year average 100 tons, add in domestic gold production, and China will have accumulated at least 1,700 tons of gold in one year.

One then has to ask where all of the gold is coming from that enters Hong Kong. It is coming from Western nations at a staggering pace. In fact, some have estimated that the United States is exporting more than they produce, quietly selling gold reserves in order to keep a cap on the price. Inventories are down sharply on the COMEX, as can be seen in the chart below.

Whatever the exact truth may be, it is evident that China, Russia and other nations are exiting their dollar-denominated holdings in favor of gold. They have also been busy buying up energy resources around the globe and expanding their own reserves. This slow transition out of dollars and into real assets makes sense and allows them to get a good price for the debt they are selling.

- Shift From U.S. Dollar As World Reserve Currency Underway – What Will This Mean for America?

- Russia & China Have Power to Collapse U.S. Economy! Is Hoarding of Gold Their First Step In Doing So?

This action should put pressure on the dollar and U.S. treasuries, pushing not only central banks, but mainstream investors towards the safety of precious metals and other tangible assets that cannot be defaulted on. There will be a rush out of dollars and into assets with no counter-party risk, it is just a matter of how soon it happens.

The move out of U.S. dollars and debt is well underway, with a series of bilateral trade agreements being established in local currencies and the FED needing to step in and buy an increasing amount of government debt to stabilize the economy and avoid a default but the true panic has yet to set in, as many continue to have full faith in the ability of the U.S. government to service its debt.

Greenspan famously said that the FED can guarantee cash benefits as far out as needed, but they can not guarantee their purchasing power. The same can be said of the U.S. servicing its debt, so long as the FED continues to assist. So while a standard default may not occur anytime soon, the slow eroding of the dollar’s purchasing power amounts to a default nonetheless. It is simply occurring at a pace slow enough to keep investors and the masses placated or unaware. There are a number of factors that could cause this pace to quicken:

- the words and actions of China or

- a failure of politicians to raise the debt ceiling in time to avoid a default.

Conclusion

Whatever the spark that ignites the fuse, I believe it is wise to have some insurance against the possibility of a panic out of dollars. Gold and silver are the best insurance for this type of event and they happen to be on fire sale right now with some of the lowest dealer premiums seen in years.

From Xinhua: U.S. fiscal failure warrants a de-Americanized world

As U.S. politicians of both political parties are still shuffling back and forth between the White House and the Capitol Hill without striking a viable deal to bring normality to the body politic they brag about, it is perhaps a good time for the befuddled world to start considering building a de-Americanized world…

Most recently, the cyclical stagnation in Washington for a viable bipartisan solution over a federal budget and an approval for raising debt ceiling has again left many nations’ tremendous dollar assets in jeopardy and the international community highly agonized.

Such alarming days when the destinies of others are in the hands of a hypocritical nation have to be terminated, and a new world order should be put in place, according to which all nations, big or small, poor or rich, can have their key interests respected and protected on an equal footing. To that end, several corner stones should be laid to underpin a de-Americanized world.

- All nations need to hew to the basic principles of the international law, including respect for sovereignty, and keeping hands off domestic affairs of others.

- The authority of the United Nations in handling global hotspot issues has to be recognized. That means no one has the right to wage any form of military action against others without a UN mandate.

- The world’s financial system also has to embrace some substantial reforms.

- The developing and emerging market economies need to have more say in major international financial institutions including the World Bank and the International Monetary Fund, so that they could better reflect the transformations of the global economic and political landscape.

- What may also be included as a key part of an effective reform is the introduction of a new international reserve currency that is to be created to replace the dominant U.S. dollar, so that the international community could permanently stay away from the spillover of the intensifying domestic political turmoil in the United States.

Of course, the purpose of promoting these changes is not to completely toss the United States aside, which is also impossible. Rather, it is to encourage Washington to play a much more constructive role in addressing global affairs.

And among all options, it is suggested that the beltway politicians first begin with ending the pernicious impasse.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*https://www.goldstockbull.com/articles/china-believes-de-americanized-world-needed/ (Copyright © 2013 Gold Stock Bull – All Rights Reserved; Become a Gold Stock Bull Premium Member and get my top-rated newsletter, instant access to the model portfolio and email alerts whenever I am buying or selling. Click here to get started for just $39!)

Related Articles:

1. Noonan: Is Gold’s Decline Being Caused By Fed Payback Time to China?

The manipulated raids in the gold market since last April may be hurting the Precious Metals game players, weakening their confidence and “disproving” gold’s worth against a fiat currency, but they serve a greater purpose, as in Federal Reserve payback time to China. Here’s why. Read More »

2. Shift From U.S. Dollar As World Reserve Currency Underway – What Will This Mean for America?

Today, more than 60% of all foreign currency reserves in the world are in U.S. dollars – but there are big changes on the horizon…Some of the biggest economies on earth have been making agreements with each other to move away from using the U.S. dollar in international trade…[and this shift] is going to have massive implications for the U.S. economy. [Let me explain what is underway.] Words: 1583 Read More »

3. Continuing U.S. Dollar Strength Depends on Asia’s Self-interests Continuing – Here’s Why

In an odd twist of fate the future of the U.S. dollar is in the hands of Asian governments [and particularly China and Japan. Let’s hope they continue to put their own interests first.] Here’s why. Read More »

4. Gold Standard Should Replace “Exorbitant Privilege” of USD Reserve Currency Status – Here’s Why

The least imperfect monetary system by which civilized nations can conduct their business is the classical gold standard – a system in which every major nation defines its currency as a weight unit of gold. [Let me explain.] Words: 890 Read More »

5. Dollar’s Days As Reserve Currency To End In 2 Years (10 Years Latest) – Here’s Why

The American dollar will be overthrown…in as short a period as 5 to 10 years says one analyst while another believes it will happen as early as 2015, 2016 latest. Here’s why. Read More »

6. China Continues Buying Gold Like There Was No Tomorrow! Here Are the Impressive Numbers

China continues to buy gold with both hands, keeping up all the gold they produce and importing even more! Imports were up 50% in October vs. the previous month; up 68% in November and up 74% in December. What will January bring given the continued weakness in the price of gold? Probably even more buying!

Most Americans simply don’t understand that Russia and China have the power to collapse the U.S. economy by going to a gold for oil system. All they have to do is pull the trigger. Let me explain. Words: 1515 Read More »

8. The Decline in Gold & Silver Is Being Orchestrated By the Fed – Here’s Why

By its obvious and concerted attack on gold and silver, the U.S. government could not give any clearer warning that trouble is approaching. The values of the dollar and of financial assets denominated in dollars are in doubt. For Americans, financial and economic Armageddon might be close at hand…. Read More »

9. Which Country Will Win the Race to Debase Its Currency the Most?

Competitive devaluation [the race to debase] or “Currency War” is more of a process than an event. Nations take turn to debase, back and forth, until the purchasing power of their currencies approaches zero. The map below monitors the progress of debasement as it unfold; country by country, currency by currency. Read More »

I expect the eventual endgame to this whole Keynesian monetary experiment that has been going on ever since World War II [will] finally terminate in a global currency crisis. [That being said,] I’m starting to wonder if we aren’t seeing the first domino – the Japanese yen – start to topple…[It has] cut through not only the 2012 yearly cycle low, but also the 2011 yearly cycle low and never even blinked [and should it continue its steep decline] and break through the 2010 yearly cycle low [of 105.66] I think we have a serious currency crisis on our hands. Needless to say, if the world sees a major currency collapse… it’s going to spark a panic for protection – to gold and silver. Wouldn’t it be fitting that at a time when they are completely loathed by the market they are about to become most cherished? [This article analyzes the situation supported by 3 charts to make for a very interesting read.] Words: 620; Charts: 3 Read More »

11. Coming Currency Superstorm Will Be Absolutely Catastrophic for U.S. Economy

What would happen if someday the rest of the world decides to reject the U.S. dollar and that process suddenly reversed and a tsunami of U.S. dollars come flooding back to this country? It is frightening to think about. Just take a moment and think of the worst superstorm that you can possibly imagine, and then replace every drop of rain with a dollar bill. The giant currency superstorm that will eventually hit this nation will be far worse than that. Read More »

[According to the chart in this article,] all currencies are being debauched. The price of gold in each currency approximates a parabola, meaning the use of printing presses is accelerating. Each unit of currency is losing purchasing power at an increasing rate. The trend points to a worldwide currency collapse unless the creation of money stops. [Take a look!]. Words: 282 Read More »13. IMF Proposing New World Currency to Replace U.S. Dollar and Other National Currencies!

Over the past few years, there have been many rumors about a coming global currency, but at times it has been difficult to pin down evidence that plans for such a currency are actually in the works but not anymore. A shocking new report by the IMF is proposing just that – a global currency beyond national control! Words: 820

14. The Beginning of the END for the U.S. “Petrodollar”!

A major portion of the U.S. dollar’s valuation stems from its lock on the oil industry and if it loses its position as the global reserve currency the value of the dollar will decline and gold will rise. Iran’s migration to a non-dollar based international trade system is the testing of the waters of a non-USD regime…transition to a world in which the U.S. Dollar suddenly finds itself irrelevant. [Let me explain.] Words: 1200

15. Why America Should Relinquish Reserve Status for its Dollar

Conspiracy theory notwithstanding, claims that the reserve status of the U.S. dollar unfairly benefits the U.S. are no longer true. On the contrary, it has become a burden, both for America and the world. [Let me explain.] Words: 825

16. Will the Trickle Out of the U.S. Dollar Now Become a Torrent?

China and Russia have announced that they intend to stop using the U.S. dollar and begin to pay for trade between their two countries in renminbi and rubles, respectively, from now on. It begs the following question: Will the OPEC countries of the Middle East follow suit in abandoning the U.S. dollar? Words: 614

17. The U.S. Dollar: Too Big to Fail?

Those in the U.S. power structure know what the plan is if the U.S. dollar should fail. They are not admitting publically that there is even the remotest chance that it could happen but, rest assured, there is a plan. There is always a plan. To paraphrase Franklin Roosevelt, nothing happens by chance in government, so don’t be caught up in such a ‘surprise’ event – whatever it may be and whenever it occurs. Words: 1345

18. Is There a Viable Alternative to the Dollar as the Reserve Currency?

Within the recent retracement of the U.S. currency there has been endless speculation about the future role of the dollar as the world’s primary reserve currency. Moreover, there has even been conjecture that the dollar will no longer exist at some point in the near future but any case made for the vulnerability of the dollar falls short when it comes to naming alternatives. Words: 631

19. What Would USD Collapse Mean for the World?

I came to the conclusion several years ago that it was just a matter of time before the world realized that the relative functionality of the U.S. dollar was about to go belly up – to collapse – and that that time happened… Words: 881

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Is this return of dollars to America and a flight of gold to China a mistake or a silly accident ? It could be neither.

There is always the possibility that a large scale market oriented payment system is in development, possibly one that distributes gold accounted for by its weight. In order to bridge the use of weighted payment for things priced in fiat currency, the bridge of “USD/oz” has to be used. The US (the FED) has the intellectual property rights on the use of that “debt-to-asset bridge” as we move toward the circulation of debt free bullion as a real-time (floating) currency.

You cannot pour new wine into old wineskins