It is most important to have a process that can mitigate the risk of loss in your portfolio and here are 15 rules of investment to accomplish that.

Read More »Who Are the ‘Greater Fools” Now? (+5K Views)

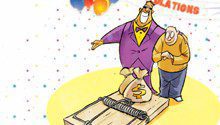

Many households, financial and non-financial firms and government, may well spend the next decade in debtor’s prison having to tighten their belts to pay for the losses inflicted by a decade of reckless leverage, over-consumption and risk taking. What fools we have been for living beyond our means all these years and taking no fiscal responsibility for our future well-being in the false hope that there always would be a ‘greater fool’ out there than us. Words: 1230

Read More »THE Book on Scams: What to Watch Out For & How to Protect Yourself (+3K Views)

If you want to stay on top of scams, this article will do just that like no other you have ever read. It is full of information on how to avoid being caught up in 12 of the most prevalent deceptive marketing practices (scams), such as false or misleading advertising, Internet scams and deceptive telemarketing or contests.

Read More »Start To Recession-Proof Your Household Now – Here’s How

Statistically, most families are not prepared for a recession but planning for personal financial deviations lowers anxiety, helps to reduce marital issues, and allows you to help others in their time of need. Here are our steps to glide through your next crisis.

Read More »How Much Do You Need To Be Super-Rich In Canada?

A new model to estimate wealth held by the country’s richest households shows that Canada’s one-percent actually holds a much bigger share of total wealth than previously thought.

Read More »Should You Contribute To A Traditional 401k, A Roth 401k – Or Both?

A common question investors ask is whether they should contribute to their traditional 401k, Roth 401k or both? To determine which account is most desirable you must first know certain characteristics of each account and this article does just that.

Read More »What’s In Your Wallet? Any Gold or Silver CombiBars™? (+5K Views)

CombiBars™ are precious metal bars which are constructed with predetermined breaking points so they can be separated easily without any loss of material. Indeed, they are designed such that the divisible bar can easily be carried in your wallet.

Read More »Stash Some Cash In a Foreign Bank! Here’s Why, Where and How (+4K Views)

Where abroad? In Scandinavia. Why? To seek refuge from currencies like EUR, USD, CHF, and GBP and diversify your political risk and secure your savings. How? Read on. This article explains why countries and specific banks in Scandinavia deserve your consideration as safe and reliable places to stash some cash abroad.

Read More »Stock Market Volatility Could Ruin Your Retirement – Here’s Why (+3K Views)

With markets so calm, it’s easy to become complacent about the corrosive effects that volatility can have on long-term investment success. If you don’t need the money for a long time, you can ride out the inevitable market squalls but if you’re close to or already drawing from those funds, volatility can be costly...Let me explain further.

Read More »Mexico Is One of the 10 Best Countries to Retire In – Here Are the Other 9 and the Reasons Why (+4K Views)

Rising costs in the U.S. are driving more people to consider retirement in less expensive locales and the list of potential resting spots is long and varied. International Living compiles annual lists on the best places to retire based on things like cost of living, ease of entry, healthcare, insurance and access to amenities. [Below are their top 10.] Words: 950

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money