China’s slowdown in its GDP growth rate will definitely lead to a global meltdown. [Here’s why supported by a number of charts and some well reasoned rationale.]

meltdown. [Here’s why supported by a number of charts and some well reasoned rationale.]

By Chris Vermeulen (TheGoldAndOilGuy.com)

The Chinese GDP growth rate: “The New Normal”

The ten-year growth chart below shows a dip in Chinese growth since 2012. Even during the ‘The Great Recession”, China’s growth rate never dropped below 8%, within four connective quarters. However, since 2012, growth has not increased over the 8% mark for two consecutive quarters and is currently at less than 7%. I suspect that the numbers are “bogus”, and that China’s economy is not expecting more than 3%-4%…

In May 2015 the Chinese government announced the growth of 7% as the “New Normal” for China. This underlines acceptance that the Chinese economic growth has peaked.

In May 2015 the Chinese government announced the growth of 7% as the “New Normal” for China. This underlines acceptance that the Chinese economic growth has peaked.

Chinese actions have not been able to stimulate growth

The Chinese Central Bank has cut interest rates six times in 2015, reduced the reserve requirements for banks, devalued the Yuan and pledged to do more, if necessary, however, growth is still struggling to reach the 7% target.

Their domestic growth is not picking up. The investment led boom has raised the debts to 292% of the GDP. Meanwhile, factories are cutting jobs, manufacturers have reduced their prices, due to competition, etc. Deflationary pressures within the Chinese economy are increasing and it appears it may last for an extended period of time…

How much does China contribute to global GDP growth?

The chart below signifies the effect China has on the global economy. Although, it is the second largest economy in the world, after the US, it is a major contributor and the engine of world GDP growth. These top two nations contribute to more than 82% of the global GDP growth. Any slowdown in China will affect the global GDP growth since no other country is capable of offsetting the “Chinese Effect”.

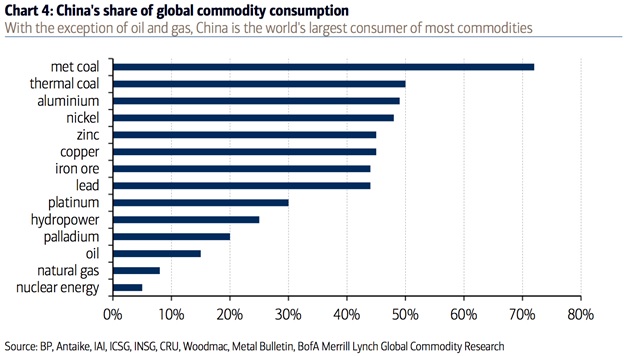

The reason for the drop in commodity prices – China

The chart below speaks for itself. Many nations like Brazil and Australia are dependent on the commodity exports to China; countries like Canada, are indirectly affected, as they are mainly dependent on crude oil prices. A few producers have announced large production cuts in order to prepare for the low demand from China.

The direct effect of China’s slowdown within the U.S. economy and the S&P companies

The shale oil industry in the U.S. expanded rapidly to fulfill the rising energy demands of the world. As the crude oil prices were high, many investors participated in the junk bond issues of the shale oil companies, although they were not investment grade. The big drop in crude oil prices is financial hurting these companies and, in turn, their ability to pay their bond holders. If prices don’t recover immediately, we are likely to see many energy companies declaring bankruptcies, which are a risk to the banks and junk bond funds which loaned them monies. This fear has led to recent junk bond collapses.

Apple sells more iPhones in China, compared to US sales. Although, iPhone sales have continued to grow, chances are that a sustained slowdown in China will adversely affect Apple. Similarly, several luxury brands, hoping to capitalize on the Chinese growth, will find it difficult to sell their products, within a slowing economy.

China’s stock market performance in the last 20 years

Although, most of the world markets have reached new highs, the Chinese market is now collapsing!

Trading, Investing and Economic Conclusion

In short, no one knows how the global markets will react to the collapsing economy in China. This is a major risk factor as there are no concrete actions that can be implemented to avoid this deteriorating situation.

The Chinese growth is not responding to any growth stimulus at all. Currently, the world is at a critical junction, with all of the major economies; the U.S., Japan, Europe, and China, all facing deflationary pressures. There is nothing left to propel the global economy, with stock markets all over the world at risk of a MAJOR DROP occurring in 2016…

Want more such articles? Just “follow the munKNEE” on Twitter; visit our Facebook page; or subscribe to our free newsletter – see sample here – sign up in top right corner.

[The original article was written by Chris Vermeulen (TheGoldAndOilGuy.com) and is presented here by the editorial team of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – sign up in top right corner) in an edited ([ ]) and abridged (…) format to provide a fast and easy read.]

Related Articles from the munKNEE Vault:

Will It Be China That Pricks the Stock Market Bubble?

Let’s imagine the stock market as a whole bunch of balloons. One or two can pop loudly and everyone will jump and then laugh it off but, eventually, enough balloons will pop that the weight of the debris overwhelms the remaining balloons’ ability to keep the string aloft. Then your whole bunch falls down. In like manner, some kind of catalyst sets off every market collapse.The last balloon to pop isn’t any bigger or smaller than the others; it just happens to be last. What are some candidates for that last balloon?

2. China’s Stock Market Crash Has Major Economic, Political, Financial & Social Ramifications

The government needed a safe place for Chinese people to put their savings to work but the stock market turned out not to be that safe. Now the government may have to hold off on some painful reforms to keep confidence and consumption up and cash flowing through the economy and provide more time for China’s 3 bubbles to pop to the country’s detriment.

3. If China won’t eat at KFC – or at Pizza Hut – the world has a problem! Here’s why

KFC and Pizza Hut may not be standard economic indicators, but they’re flashing a warning sign about the state of the Chinese economy right now and, if China won’t eat at KFC, or at Pizza Hut, the world has a problem! Let me explain.

4. Blame China For Continued Low Commodity Prices – Here’s Why

The role that China plays in commodity prices is so big that the future of metal prices is totally dependent on China. In this article we analyze some key Chinese indicators all of which give us no reason to expect higher metal prices in 2016.

5. 70% Probability of Recession In China By 2020 – Here’s Why

I think there is a 70% probability that it will do so within the next five years and the probability that China will suffer either a hard landing OR a long period of Japanese-style stagnation…is over 95%.

6. The End Is Near: China’s Economic Bubble Is About to Burst

China’s model (and economy) will fail drastically, proving once and for all that government-planned economies do not work as well as free market capitalism balanced by democracy. This article identifies seven signs showing that the end is near.

7. The Boom in China Is Over BUT the “Bust Talk” Is Far Overdone. Here’s Why

China has decided to try and walk back from the edge of a Minsky moment and engineer a soft landing. They have made a decision to pop the bubble deliberately, allow defaults to instill market discipline and remove the moral hazard currently in place. They are moving into the modern world as fast as possible based on the enormous tasks they have embraced so we probably can expect no more booms but probably not a bust either. Let me explain.

8. China’s Debt Binge & Buying Spree Is About to Burst!

When it comes to reckless money creation, China is the king. Over the past five years Chinese bank assets have been fueled by the greatest private debt binge that the world has ever seen. Unfortunately for China (and for the rest of us), there are lots of signs that the gigantic debt bubble in China is about to burst, and when that does happen the entire world is going to feel the pain. Let me explain.

9. Richard Duncan: China Headed Into a Serious Crisis

China’s miracle is driven by one thing and one thing only: its trade surplus with the U.S., which went from zero in 1990 up to now more than $300 billion a year [but] since the darkest hours of the 2008 global economic meltdown, China has made little progress in shifting its reliance away from exports, and, as a result, the Chinese economy is dangerously exposed to a renewed downturn in global trade. Words: 500

10. The End Is Near: China’s Economic Bubble Is About to Burst

China’s model (and economy) will fail drastically, proving once and for all that government-planned economies do not work as well as free market capitalism balanced by democracy. This article identifies seven signs showing that the end is near.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money