In reality most Americans are winging it when it comes to their retirement plans. The plan for most will be the default with Social Security which was never intended to be the primary source of incomes for millions of Americans. The new retirement is no retirement and working well into old age. If that’s you here is how to avoid such a future.

plan for most will be the default with Social Security which was never intended to be the primary source of incomes for millions of Americans. The new retirement is no retirement and working well into old age. If that’s you here is how to avoid such a future.

The above introductory comments are edited excerpts from an article* from mybudget360.com entitled Winging it through retirement: 30 percent of Americans have no retirement savings.

The article goes on to say in further edited excerpts:

Planning for retirement does not happen overnight. You need to diligently plan and sock away savings like a squirrel stocking up for the season. [That seems to be too much to expect, however, from the] many Americans who have no retirement savings and…[for the] many near retirement who face a compressed timeline where they will need to save [aggressively] or face a massive decline in living standards in their later year.

Retirement has become a sort of idealized vision of doing nothing.

- Many think that once retirement hits, all expenses will go away and that they will have unlimited funds to purchase Margaritas and spend time at a beach with crystal blue water in some part of the Mediterranean.

- Instead many will be working deep into older age and will be fighting off the cold because the heating bill is eating into their Social Security check.

Many Americans are completely unprepared for retirement and despite the massive surge in the stock market since the Great Recession ended, many Americans are looking at retirement and are planning to wing it.

Winging retirement

There is a deep cognitive dissonance in our culture. We are obsessed with planning yet people fail to prepare. We have an obsession with eating right and staying healthy but are one of the fattest nations on the planet. This kind of split mentality helps to explain why, in a country with so many retirement plans and options, most people are inadequately prepared for retirement.

Take a look at how poorly prepared Americans are for retirement:

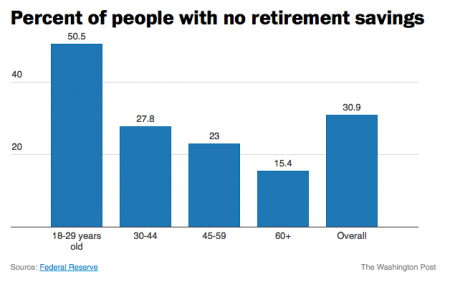

Source: Federal Reserve

Those 18 to 29 would have a big advantage in their future years if they only socked away a few bucks per month, yet half of this group has nothing saved. Those 30 to 44 don’t do all that better. Ultimately, 30% of all Americans have no retirement savings. This is troubling.

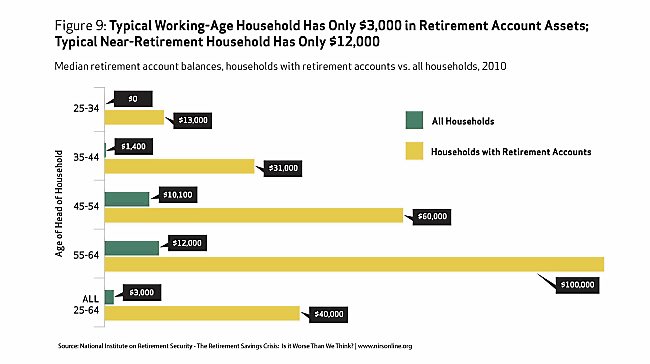

Furthermore, when you look at how much is saved you realize that even those with some kind of retirement savings are virtually focusing on Social Security as their main source of income. The typical near-retirement household only has $12,000. This is one minor medical emergency away from being fully bankrupt.

Why are Americans so unprepared for retirement?

- For most Americans they are living paycheck to paycheck.

- For many others, there is little left from the paycheck once the necessary expenses are paid.

The typical American makes $26,000 per year and, with inflation eroding purchasing power, those dollars are not going very far. The immediate needs of the day take precedent over the potential problems of the future.

The unfortunate aspect of all of this is that it would take only a few hundred dollars per month starting at an early age saved to have a decent sized nest egg but people don’t see the value in that. It is an all or nothing kind of mentality…When people look at the end goal of needing $500,000 or $1 million for a nest egg they simply get overwhelmed. [They needn’t be.] Any financial advisor would be more than happy to step in and take your money if you are unwilling to do the research [but, unfortunately,] many Americans also distrust the financial sector which only compounds the problem.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.mybudget360.com/winging-it-through-retirement-savings-nest-egg/

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. How to Make a Rich Retirement Your Reality

Since WWII, we have enjoyed one of the most productive economies the world has ever seen, yet many seniors are broke. When you reach retirement age, you don’t have to be one of them. Below is some straight talk on how to make a rich retirement your reality. Read More »

2. 3 Ways To Manage Your Eventual Retirement

The Employee Benefit Research Institute surveys workers each year concerning their retirement confidence. Despite an uptrend, the latest report shows that 82% of workers feel less than “very confident” about having enough money to retire comfortably. With that statistic in mind, this article looks at three different 40-year retirement scenarios. Read More »

3. Here’s How To Set Up A Risk Averse Retirement Plan

One of the most difficult challenges of transitioning to retirement from the working world is a complete change in mindset with regards to an investment portfolio. You go from being a saver to a spender. There’s no future income or nearly as much time to soften the blow from bear markets. Growth is still necessary but you have to be cognizant of the fact that you’ll need to protect some of your assets for spending purposes. Here’s an interesting case study in how to approach this change in mindset. Read More »

4. Stock Market Volatility Could Ruin Your Retirement – Here’s Why

With markets so calm, it’s easy to become complacent about the corrosive effects that volatility can have on long-term investment success. If you don’t need the money for a long time, you can ride out the inevitable market squalls but if you’re close to or already drawing from those funds, volatility can be costly…Let me explain further. Read More »

5. 12 Top Notch, But Low Cost, Retirement Spots Around the World

Scanning the world map in 2014, 12 places stand out as top-notch retirement options and, while each place is different, all of them offer tremendously appealing lifestyles for the cost. Here’s how much it costs to retire in these 12 great retirement spots. Read More »

6. How Much Investment Income Do You Need to Retire? Here Are Some Guidelines

Here’s an interesting rule of thumb that most retirees and would-be retirees would do well to adopt. Read More »

Loll in the lap of inexpensive luxury at any one of International Living’s 10 best retirement destinations: North America (1); Central America (2); South America (3); Europe (2); Asia (2) Words: 1155 Read More »

8. Retiring Soon? Check Out These Best-of-the-Best Locations

In your 50s or 60s and thinking about retiring and moving to somewhere less expensive and with great weather, great food and friendly people? Look no further. We have the best-of-the-best right here! Read More »

9. The 10 Best Places in the World to Retire

Where are the world’s best places to retire? Here are 10. Read More »

10. Retirement for Most Americans Is Largely a Mirage – Here’s Why

With defined benefit pension plans slowly going extinct and Americans not saving enough for retirement it is becoming tougher for Americans to retire and is setting the stage for a retirement disaster… Read More »

11. The 10 Best Places to Retire in Mexico

Below is an unbiased look at the best places in Mexico to retire – with real pros and cons – to help you make an informed decision as to which best meets your needs, interests and ambitions. Read on! Read More »

12. Retiring Soon? Consider Relocating to One of These Cities or Countries

If you are retiring soon you might well be considering relocating to somewhere less expensive and with a slower pace and better weather. This post outlines retirement destinations well worth considering. Read More »

13. You Might Be Saving TOO MUCH for Retirement – Here’s Why

How much money do you really need to retire on? We’re bombarded with messages about retirement savings – that…[we] haven’t saved enough; that company pension plans are underfunded; that the Canada Pension Plan [or U.S. Social Security] won’t be able to handle the influx of boomers who are set to retire over the next 10 to 15 years. If that’s you, then you might be panicking right now. Stop! According to a new book retirees may not need as much as they’ve been led to believe. Read More »

14. Coming Retirement Crisis Will Shake America To The Core

The pension nightmare that is at the heart of the horrific financial crisis in Detroit is just the tip of the iceberg of the coming retirement crisis that will shake America to the core. As a society, we have made trillions of dollars of financial promises to the Baby Boomers, and there is no way that we are going to be able to keep those promises. The money simply is not there. Read More »

15. What Are Your Investment Default Settings? Don’t Forget These Crucial Ones

There is a crucial component of the investment process that gets surprisingly little attention: our investment default settings. We can use them when we aren’t sure what to do, when we’re deciding what to do, when our circumstances have changed but our plan hasn’t (yet), or when we’re just starting out. Here they are. Read More »

16. Retirement Planning: Take This “Life Expectancy” Test

Medical researchers have created a quiz that predicts how long you’re going to live [i.e how many years you will live into retirement – if any!]. It’s called a ‘mortality index‘ and it’s composed of 12 questions. It claims to predict with some accuracy whether you’ll live out the decade. Read More »

17. Canada is a Great Place to Retire – Here’s Why

While [Green Valley] Arizona, [Naples] Florida, [Ajijic – Mexico or Mendoza – Argentina,] or some hidden island in a foreign land, might seem like the dream place to live out the end of one’s life, it turns out that Canadians just might be better off at home [and Americans and others should seriously consider emigrating to Canada sooner than later]. Here is a brief summary of the reasons why. Words: 842 Read More »

18. Want a Secure & Enjoyable Retirement? Here’s Exactly What to Do

Retirement planning is more intimidating for most than any other personal finance topic. We know we should be saving but not how much. We know it’s important to use a tax-deferred account but not which one. Most devastatingly, we often leave saving itself completely up to chance trusting that we will have enough willpower to set money aside for 30-50 years. Luckily, finding a secure and enjoyable retirement need not be mysterious. Here’s exactly what to do. Read More »

19. Retirement Age Keeps Going Up – When Will You Retire?

Just 10 years ago, most Americans felt confident they’d hang up their hat by the time they turned 60. Now the average working stiff expects to retire at age 65 due to the housing crisis and credit crunch, among other nest egg busters….Experts are predicting that the trend will continue, thanks to the Great Recession so, for now, Americans are just focused on keeping their day jobs. When will you retire? Check out the graphic below to find out. Read More »

20. The New Retirement Model is NO Retirement! Here’s Why

Welcome to the new model of retirement. No retirement. In 1983 sixty two percent (62%) of American workers had some kind of defined-benefit plan. Today less than 20% have access to a plan. The majority of retired Americans largely rely on Social Security as their de facto retirement plan [and the 35 and younger cohort are not able to save, or save enough, to eventually retire. True retirement is now a thing of the past except for a privileged few. Let me support this claim.] Words: 1091 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money