“…There are many ways that Americans are better off today than in previous decades (e.g.: house sizes, vehicle fuel efficiency, access to the internet, etc.) but here are 7 ways in which the average American consumer is worse off today than in previous decades.”

Prepared by Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money! [Editor’s Note: This version* of the original article has been edited ([ ]), restructured and abridged (…) by 52% for a FASTER – and easier – read. Also note that the original author is receiving compensation from Seeking Alpha for pageviews of his original unedited article as posted there so please refer to it for more detail.]

“…With all the ostensible ways that we are better off, [though,] it’s useful to highlight the important ways in which the American consumer is actually worse off today than in past decades.

The following are seven of those ways:

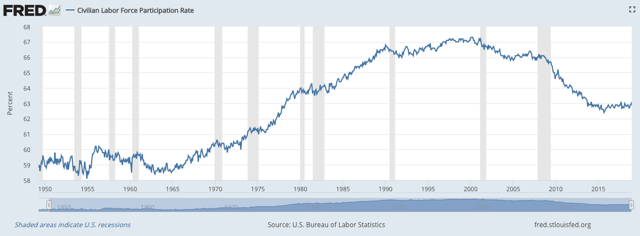

1. Participation in the Labor Force Has Dropped Off

After decades of bringing women into the workforce from the 1950s to the 1990s, participation in the employed population has dropped off without recovery.

- From 1996 to 2016, the labor force participation rate fell significantly among younger workers (especially those under 25 but also those under 55) and rose among older workers (those older than 55 and especially those over 65) who have found themselves woefully unprepared for retirement.

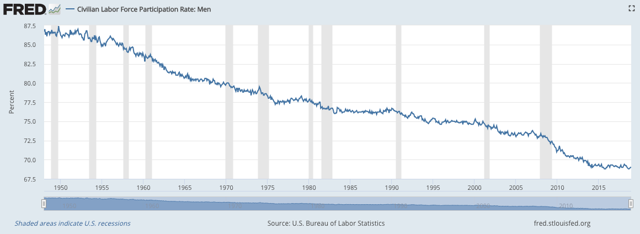

- Participation in the workforce has been especially weak for men, who have seen their employment rate trend lower for almost 70 years.

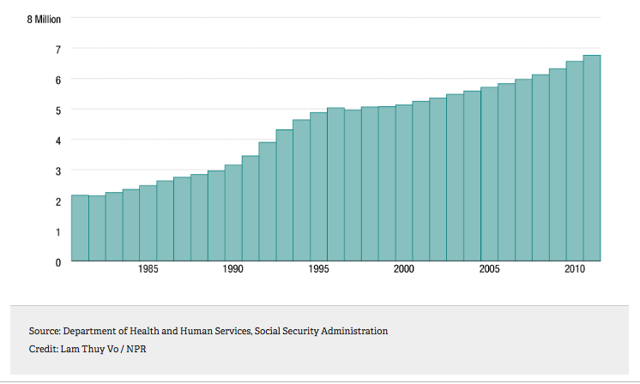

- …The inactivity rate (neither working nor looking for work) among men was under 2% in 1930. It rose to 4% in 1970, then exploded to 11.5% in 2016. Only 3% of those are “discouraged workers” – those who drop out due to frustration with the job market. This group accounts for less than 10% of the rise in inactivity from 1968 to 2014. Why the steep rise, then? The primary culprit seems to be the rise of disability claims:

Source: NPR, “Unfit for Work”

Source: NPR, “Unfit for Work”

…What does falling labor force participation rate have to do with consumption? Well, in case it isn’t obvious, working affords one a larger income to spend. Not working, even if one collects the average annual disability benefit of $14,808, results in far less spending power.

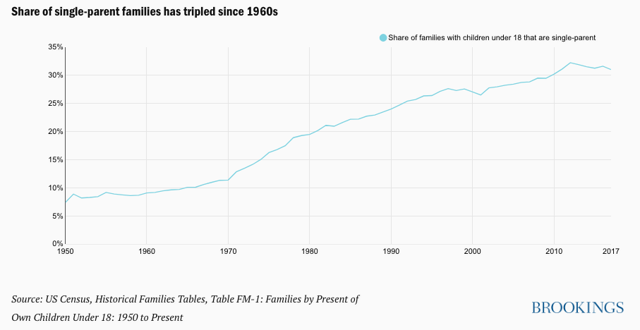

2. Single-Parenthood Has Risen Dramatically

Single parenthood has climbed from under 10% in 1950 to over 30% today.

Source: Brookings Institute

Source: Brookings Institute

Why is this a problem, financially speaking? It’s a problem because two-earner households have kept stagnating middle-income wages from declining since the 1970s. Without that second earner, or at least someone to watch the kids while the other pursues full-time employment, single-parent households will continue to struggle. Struggling households cannot afford to spend as much as non-struggling households.

3. Debt-Financed Vehicles Continue to Grow

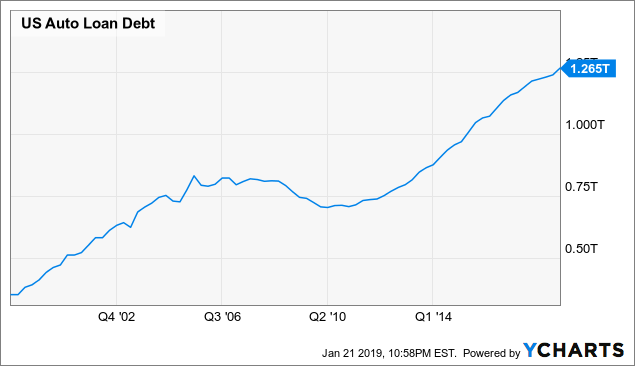

Auto loan debt currently sits at $1.26 trillion and continues to grow.

US Auto Loan Debt data by YCharts

US Auto Loan Debt data by YCharts

Much of this auto loan debt is subprime (about one-fourth, according to Matthew Frankel), which is unsettlingly high. Combine this with the fact that the average financing term for a new car is 65 months (over five and a half years). What happens to these consumers if and when their income is no longer able to service the debt on these vehicles? Less spending, certainly.

4. Student Loan Debt Is High & and Graduation Rates Are Low

…Young people are heavenly burdened with student loan debt today.

- Such debt would not be so bad if the job market made it feasible for most college grads to quickly pay down that debt and, of course, the job market is less welcoming to those with only some college education…

- 70% of college students graduate with at least $15k of student debt, and total national student loan debt is currently over $1.52 trillion versus $600 billion just ten years ago.

…While the job market has certainly improved since the Great Recession, it hasn’t been able to absorb the huge number of newly minted degree-holders with gainful employment.

- 43% of college graduates are underemployed…so it should be no surprise, then, that about 2.6 million student loans are in forbearance, which will add roughly $5.7 billion to total debt per year….

- Nearly 40% of student loans may default in the next five years according to a study by the Brookings Institute…

- African American bachelor’s degree graduates default at five times the rate of white bachelor’s holders.

…[The above] bodes poorly for future consumer spending and it helps explain the next point.

5. Millennials Are Falling Behind In Home Ownership

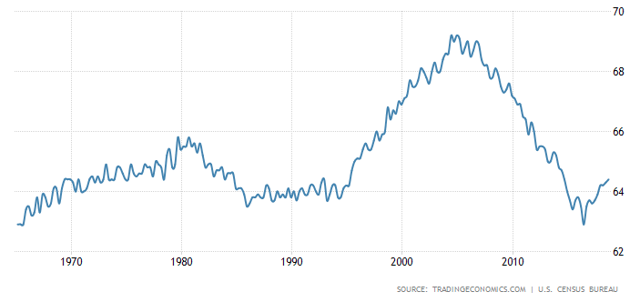

…The homeownership rate among Millennials has not risen at more or less the same pace as their parents’ generation.

- Only 35.8% of millennials who have reached age 30 are homeowners, whereas nearly half (48.3%) of baby boomers were homeowners at age 30. This relates to consumption because buying a home (especially a first home) correlates with increased spending on many things – from furniture to service providers…

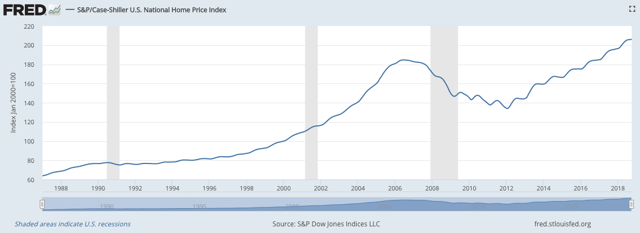

Home prices have not made it easy for the younger generation to enter home ownership.

- According to data from ATTOM Data Solutions, home prices are the least affordable that they’ve been since 2008. 30% of the U.S. population live in markets that require a 6-figure income to obtain a mortgage.

Demand for homes has been strong, but not widely dispersed. Hence the weak homeownership rate.

Source: Trading Economics

Source: Trading Economics

This is important because, as the national wealth increases and home prices rise, homeowners see large gains in their net worth. These gains then boost investment and consumption but, when a smaller percentage of the population can enjoy these gains (due to fewer homeowners), the growth in consumer spending is correspondingly smaller. Less consumer spending, less GDP.

6. Credit Card Debt Burden Is Increasing

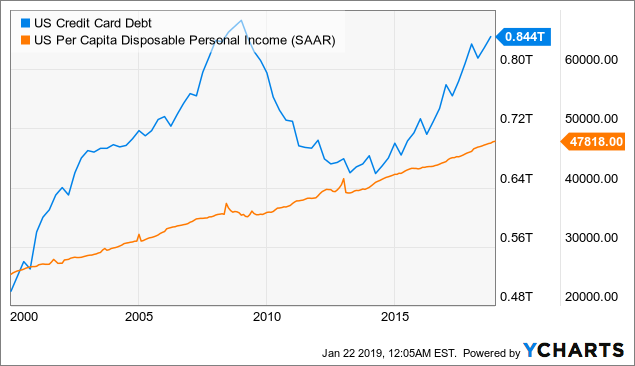

Credit card debt is exponentially worse than in previous decades.

- Over the past five years…the average credit card debt has increased by 18.5% which is much faster than personal income.

- 48% of U.S. households carry credit card debt, with an average of $15,561 per household. Considering that the average interest rate for a credit card is ~16%, the average household adds around $200 per month to their balance just in interest.

US Credit Card Debt data by YCharts

US Credit Card Debt data by YCharts

(Please note that this information from YCharts is a bit behind; total credit card debt currently tops $1.02 trillion.)

More American consumers rolling over balances to the next month and the month after that means that a day of reckoning will eventually come, and when it does, consumer spending will have to slow.

7. Most Americans Have Meager Savings Accounts

Most Americans have very little in savings.

- Only 35% of U.S. adults have only a few hundred dollars in savings.

- Another 34% have nothing at all.

Those household with an income:

- between $45,000 & $70,000…have a median savings account balance of only $2,200;

- between $25,000 & $45,000 have a median savings account balance of $1,500;

- less than $25,000 have a median savings account balance of just $500 – and that is just for households with savings accounts.

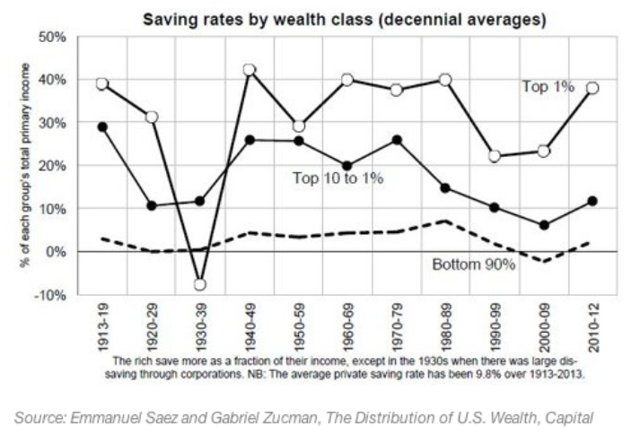

[A look at] the savings rates by wealth class shows that:

- The highest 1% of earners stash away an impressive 38% of their income;

- the top 10% save roughly 12%;

- the bottom 90% has hovered in the low single digits for decades.

Source: financialsamurai.com

Source: financialsamurai.com

Conclusion

With all this in mind it is not surprising that:

- 40% of Americans report that they struggle to pay for at least one basic need;

- 45% don’t believe they will ever achieve a financial status on par with their parents;

- +50% of children in America live in a household that receives at least one form of means-tested aid from the government;

- 42 million Americans are on food stamps – two and a half times more than the ~17 million on food stamps in 2000.

Putting these seven factors together paints a dreary picture for consumer spending growth in the future…

Debt has kept the American consumer spending in the last few decades, but this can’t last forever…Low interest rates can mask its true weight for a time, but not forever…The average consumer is in for some financial pain in the near-ish future. That pain will lead to attractive buying opportunities, but for now, money markets and ultra-short term bond funds…are a good place to store any profits you might be taking as markets regain some of their lost ground.”

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money