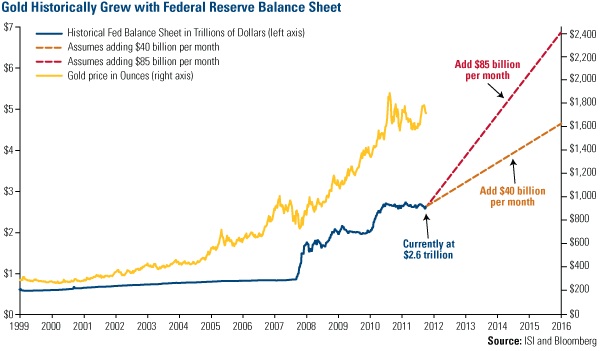

Since 1999 the gold price has moved in concert with the growth in the U.S. Federal  Reserve Balance Sheet including the recent correction in both during the past three years. Accordingly, the following objective analysis forecasts the gold price out to 2016 based solely on historical Central Bank data.

Reserve Balance Sheet including the recent correction in both during the past three years. Accordingly, the following objective analysis forecasts the gold price out to 2016 based solely on historical Central Bank data.

The above introductory comments are edited excerpts from an article* by Vronsky (gold-eagle.com) entitled Gold Price Forecast Per US Federal Reserve Balance Sheet.

Vronsky goes on to say in further edited excerpts:

The chart below estimates two balance sheet growth rates from 2012-2016 (when Obama leaves the Presidency):

- Adding $40 Billion per month…equating to a Compound Annual Growth Rate (CAGR) = 14.8%

- Adding $85 Billion per month…equating to a Compound Annual Growth Rate (CAGR) = 26.6%

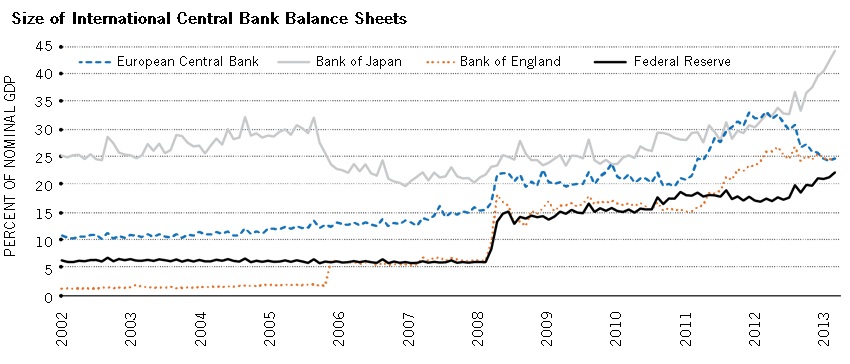

Steady Balance Sheet Increases of Major International Central Banks

Moreover, it’s noteworthy that the balance sheets of major international central banks have likewise been growing in tandem since the beginning of the millennium.

The chart below clearly shows steady balance sheet increases in the Euro Central Bank, Bank of Japan, Bank of England and the US Federal Reserve.

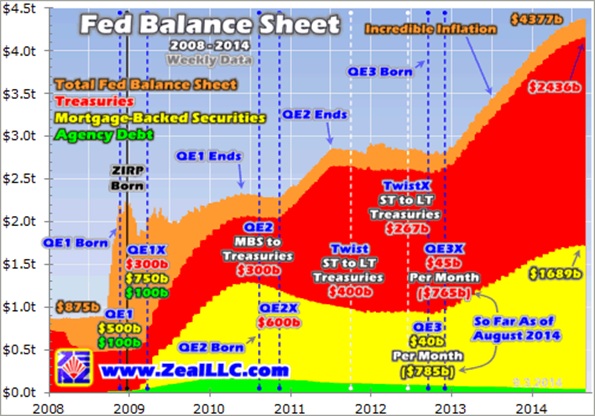

Accelerated Growth of the Fed’s Balance Sheet Since 2008

Likewise, internationally acclaimed market analyst Adam Hamilton observes: “ The chart below shows the Fed’s balance sheet accelerated growth since 2008 when QE was initially born. This data is stacked within the Fed’s total balance sheet (orange), with US Treasuries (red) sitting on top of mortgage-backed securities (yellow).”

[As can be seen in]…Hamilton’s detailed chart above, the increase in the Fed’s balance sheet has been dramatic during the past seven years and, despite the fact the Republicans now hold a majority in both houses, it is hard to imagine that the Fed’s balance sheet will not continue to expand during President Obama’s last two years in the White House – and such would translate into a higher price for the shiny yellow well into 2016.

Many factors can affect the gold value up or down…[such as]:

- The possibility of a recession in the U.S..

- The probability the Euro Union will implode, thus trashing the value of the Euro currency.

- Russia’s Putin sparks World War III over the growing turmoil in the Ukraine.

- Inflation and interest rates might soar as they did in the late 1970s under President Jimmy Carter, when gold price soared +507% ($140-$850) from 1977 to 1981 (a CAGR = 56.9%).

- Other countries may follow Switzerland’s lead in voting to establish a Gold Standard.

- Peoples Bank of China accelerates its covert objective to replace the US$ with the Renminbi as the world’s reserve currency.

Projected Gold Prices Per US Federal Reserve Balance Sheet Projected Growth

Obviously, these future gold price estimates are NOT set in stone as many but, based upon the above historical data, it is estimated the price of gold may reach either of the following values by 2016:

- Projecting the gold price at a CAGR of 14.8% yields an estimated value of $3,022.

- Projecting the gold price at a CAGR of 26.6% yields an estimated value of $4,470.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.gold-eagle.com/article/gold-price-forecast-us-federal-reserve-balance-sheet

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

2. Gold Projected to Reach $4,000/ozt. Sometime Between Late 2015 & Mid 2017! Here’s My Rationale

It is very likely that national debt and the price of gold will continue their 11 year exponential growth trend. Since gold correlates closely with debt gold should reach $4,000 as early as November 2015 (should there be another crash or an unexpected bout of Congressional fiscal irresponsibility) and no later than June 2017. Time will tell!

The pullback I’ve been warning you about in the U.S. equity markets is finally at hand but, once this pullback in the broad stock indices is over, the Dow Jones Industrial will lead the way higher yet again, and catapult to 31,000 over the next three years, with gold reaching $5,000, silver $125 and select individual stocks in the mining sector spinning off gains of 2,000%, 3,000% and even more. No, I’m not out of my mind. Quite to the contrary, I believe I am the one analyst who really understands the forces that are building to enable such to occur. Read on to learn about my enviable track record over the years and specifically why such gains will be realized over the next three years. Read More »

4. Authors Of “The Money Bubble” Foresee $10-12,000 Gold & $500 Silver – Here’s Why

James Turk and John Rubino are well known figures in the gold industry and they’ve just published a new book, ‘The Money Bubble’ in which they argue that the price of gold is about to soar to $10-12,000/ozt. – and silver to $500/ozt. Here’s why. Read More »

5. Gold Price Forecasts (Update): $5,000 to $11,000 In 2 to 5 Years

During 2011 into 2013 I kept a record of those individuals who expected gold to rise substantially in the coming years and presented updated summaries in a number of articles (see links below). Below are additional or recently updated forecasts by 11 prognosticators whose projections are surprisingly consistent, on average, with previous such estimates. Read More »

6. 33 Analysts: Average Gold Price to Be $5,250 – $6,500 by Late 2014/Early 2015!

Lately analyst after analyst (161 at last count) has been climbing on board the golden wagon with prognostications as to what the parabolic peak price for gold will eventually be. That being said, however, only 33 have been bold enough to include the year in which they think their peak price estimate will occur and they are listed below. Take a look at who is projecting what, by when and why. Words: 644

7. Could a World of $7,000 Gold, $100 Silver & $400 Oil Be Coming?

Jim Rickards explains in his new book “The Death of Money – The Coming Collapse of the International Monetary System” why a US dollar collapse could be coming and why gold would probably emerge at the heart of a new global monetary system as the only money that you can really trust. Read More »

8. James Rickards on $7000 – $8000 Gold

You are going to see the price of gold go up… a lot and it may go up a lot in a very short period of time. It’s not going to go up 10% per year for seven years and the price doubles. It’s going to chug along sideways, maybe in an upward trend, with a lot of volatility. It will have a kind of a slow grind upward… and then a spike… and then another spike… and then a super-spike. The whole thing could happen in a matter of 90 days — six months at the most. Read More »

9. 3 Models for the Future Price of Gold: $2,900 (2017); $3,500 – $4,000 (2017); $9,000

What will the future top prices for physical gold and silver be? Naturally, no one knows for sure but many analysts have developed interesting models and scenarios as to what the future holds and this article reviews 3 such analyses for your consideration. Read More »

10. Jim Willie: Gold Will Rise to $5,000/ozt. and Beyond & Silver Will Rise Multiples Higher

In the last several months, the world economic crisis has entered a new elevated level of perma-crisis and constant tension, widely recognized as something more serious, more dangerous, and more risk-filled. This new normal is neither without resolution nor the attempt to resolve anything and, as such, is why the price of gold will rise to $5,000 per troy ounce, then higher, and at the same time, the silver price will rise multiples higher. Let me explain. Read More »

11. Gold Projected to Reach $4,000/ozt. Sometime Between Late 2015 & Mid 2017! Here’s My Rationale

I am not predicting a future price of gold or the date that gold will trade at $4,000, but I am making a projection based on rational analysis that indicates a likely time period for gold to trade at $4,000 per troy ounce. Yes, $4,000 gold is completely plausible if you assume the following:

12. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

13. Nick Barisheff: $10,000 Gold is Coming! Here’s Why

This is not a typical bull market. Gold is not rising in value, but instead, currencies are losing purchasing power against gold and, therefore, gold can rise as high as currencies can fall. Since currencies are falling because of increasing debt, gold can rise as high as government debt can grow. Based on official estimates, America’s debt is projected to reach $23 trillion in 2015 and, if its correlation with the price of gold remains the same, the indicated gold price would be $2,600 per ounce. However, if history is any example, it’s a safe bet that government expenditure estimates will be greatly exceeded, and [this] rising debt will cause the price of gold to rise to $10,000…over the next five years. (Let me explain further.] Words: 1767

From questions whether gold is in a bubble to predictions that soaring prices are just around the corner, one thing is clear: a new phase of awareness for gold is upon us. How far might it move before these troubling times are over? [Let’s take a close look at a variety of factors and scenarios before coming to a conclusion.] Words: 5717

15. Gold Will Reach $3,000/$4,000/$5,000 Before This Bull Market Is Over! Here are 12 Factors Why

I believe that the price of gold will… reach… $3,000, $4,000, and even $5,000 [per troy] ounce…during the course of this long-lasting bull market, a bull market that still has years of life left to it…[although] prices will remain extremely volatile – with big swings both up and down along a rising trend…The future price of gold is a function of past and prospective world economic, demographic, and political developments [and in this article] I review some of these developments and trends – so that you can come to your own “golden” conclusions. Words: 3800

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Happy Thanksgiving Day to all those that celebrate it!

I believe that we are seeing a global effort to use paper trading (aka Naked Shorting) to move the PM prices downward which is allowing the really large investors and the Countries they control to acquire physical PM’s at low prices.

Lets use China as an example, they hold tons of Gold so they can easily use naked shorting, since if they get “caught” they can always simply give up some of their physical Gold. This allows them to use their physical PM’s as “leverage” to move PM’s to their own advantage.

In another example, they could decide to “dump” enough US$ to make up for any loses they have, which would then probably make the prices of PM go up (as compared to the US$).

Sooner or later, some combination of events will cause physical PM’s value to start increasing rapidly and when that happens all those still holding paper PM’s will be unhappy to say the least.

Also posted: https://gos.ixm.mybluehost.me/gold-going-1000-perhaps-even-low-850-heres/#comment-151688