2016 is looking like the year in which all economic policies fail as they play out in an environment where all the other major economies are also rolling over and the U.S. Fed has just begun a tightening cycle. That makes 2016 a uniquely scary year.

play out in an environment where all the other major economies are also rolling over and the U.S. Fed has just begun a tightening cycle. That makes 2016 a uniquely scary year.

By John Rubino (dollarcollapse.com)

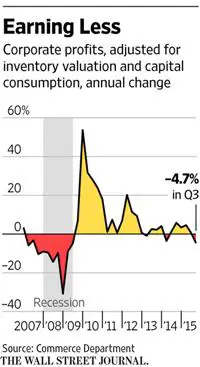

Corporate Profits Are Rolling Over

Already, at what should be the blow-off peak of a long expansion, U.S. corporate profits are instead rolling over:

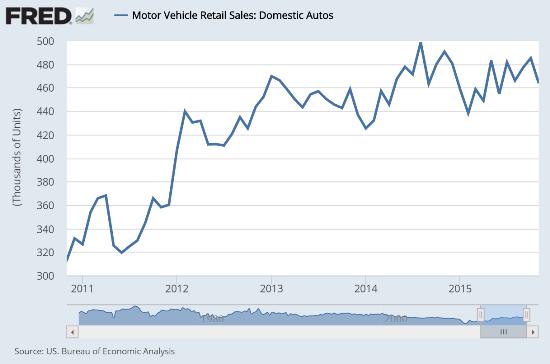

Industrial Production Is Down

In recent quarterly reports, most companies blame their dimming fortunes on the strong dollar’s impact on foreign sales, an assertion that’s borne out by recent declines in industrial production. We’re selling less real stuff abroad, so factories are making less:

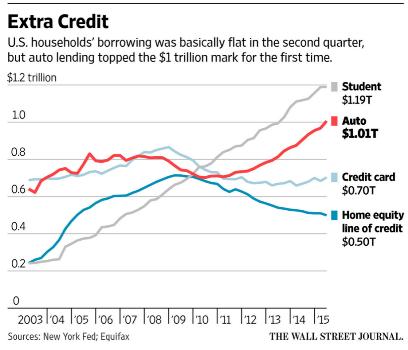

Easy Credit Growing

The huge bright spot in an otherwise bleak manufacturing landscape is auto sales, which have snapped back nicely, but they’ve apparently been floating on a tide of extremely easy credit.

In 2010, fewer than a tenth of car loans were for more than six years. Today the average loan is nearly that long. During the same expansion, outstanding auto credit rose from $600 billion to over a trillion.

Car buyers are now challenging college students for the title of most clueless borrower so expect all those breathless accounts of the bulletproof U.S. auto market to be replaced with laments about empty showrooms in the near future.

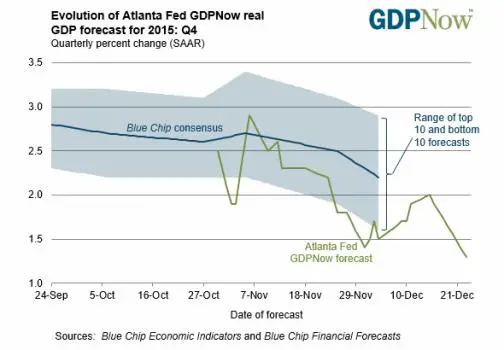

Economy Losing Momentum

Add it all up and you get an economy that’s carrying some serious weight on its shoulders and rapidly losing momentum. Here’s the Atlanta Fed’s latest GDP Now reading, which puts Q4 growth at less than 1.5%:

Bottom Line

…All the above trends are playing out in an environment when all the other major economies are also rolling over and the U.S. Fed has just begun a tightening cycle. That makes 2016 a uniquely scary year.

[The original post by John Rubino (dollarcollapse.com) is presented here by the editorial team of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – sign up in the top right corner) in a slightly edited ([ ]) and/or abridged (…) format to provide a fast and easy read.]Related Articles from the munKNEE Vault:

1 (or more) of These 6 Things Could Poison Stock Market Returns In 2016

I am convinced that trouble is coming in 2016 that could poison your returns if you are not careful. Here are 6 possibilities.

2. A Reminder Of What Usually Happens to Stocks When the Fed Raises Rates: Ouch!

I know, I know, no one likes the bearer of bad news — especially when it comes to stock prices – but someone needs to remind you what usually happens to stocks when the Fed raises rates so it might as well be me. They drop. Let me explain.

3. Coming Stock Market Crash Will Mirror Debacles Of 2001 & 2008

Given that this imminent recession will begin with the stock market flirting with all-time highs, the next stock market crash should be closer to the 2001 and 2008 debacles that saw the major averages cut in half.

4. If You Own Stocks Then This Article Is a MUST Read

Don’t be one of the people who don’t understand the vital importance of the bond market and what it’s telling you right now. This knowledge could help you avoid a huge hit to your net worth over the next 12-24 months. Here’s why.

5. Get Ready: Stock Market Crash Coming in 3-6 Months – Here’s Why

The deteriorating junk bond market, along with rising credit spreads, is indicating that we will have a stock market correction in about 3-6 months. Here are the details.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money