Are we headed for rampant inflation or crippling deflation? I believe that we will see both. The next major financial panic will cause a substantial deflationary wave first, and after that we will see unprecedented inflation as the central bankers and our politicians respond to the financial crisis. [Let me explain why I think that will unfold.] Words: 1025 Charts: 3

both. The next major financial panic will cause a substantial deflationary wave first, and after that we will see unprecedented inflation as the central bankers and our politicians respond to the financial crisis. [Let me explain why I think that will unfold.] Words: 1025 Charts: 3

So writes Michael (http://theeconomiccollapseblog.com) in edited excerpts from his original article* entitled Will It Be Inflation Or Deflation? The Answer May Surprise You.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Michael goes on to say in further edited excerpts:

This is a subject that is hotly debated by economists all over the country.

- Some insist that the wild money printing that the Federal Reserve is doing combined with out of control government spending will eventually result in hyperinflation.

- Others point to all of the deflationary factors in our economy and argue that we will experience tremendous deflation when the bubble economy that we are currently living in bursts.

So what is the truth? Well, for the reasons listed below, I believe that we will see both. The next major financial panic will cause a substantial deflationary wave first, and after that we will see unprecedented inflation as the central bankers and our politicians respond to the financial crisis. This will happen so quickly that many will get “financial whiplash” as they try to figure out what to do with their money. We are moving toward a time of extreme financial instability, and different strategies will be called for at different times.

Why We Will See Deflation First

The following are some of the major deflationary forces that are affecting our economy right now:

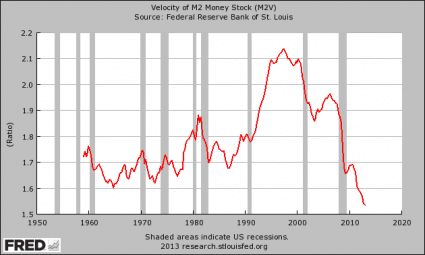

1. The Velocity Of Money

The rate at which money circulates in our economy is the lowest that it has been in more than 50 years. It has been steadily falling since the late 1990s, and this is a clear sign that economic activity is slowing down. The shaded areas in the chart [below] represent recessions, and as you can see, the velocity of money always slows down during a recession…Even though the government is telling us that we are not in a recession right now, the velocity of money continues to drop like a rock. This is one of the factors that is putting a tremendous amount of deflationary pressure on our economy.

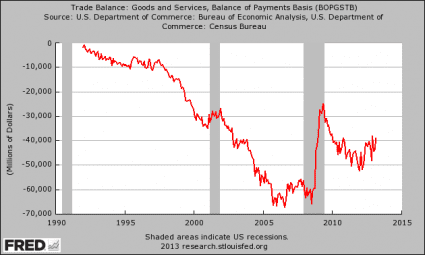

2. The Trade Deficit

[Every]…single month, far more money leaves this country than comes into it. In fact, the amount going out exceeds the amount coming in by about half a trillion dollars each year. This is extremely deflationary. Our system is constantly bleeding cash, and this is one of the reasons why the federal government has felt a need to run such huge budget deficits and why the Federal Reserve has felt a need to print so much money. They are trying to pump money back into a system that is constantly bleeding massive amounts of cash…The trade deficit is one of our biggest economic problems, and yet most Americans do not even understand what it is. As you can see below, our trade deficit really started getting bad in the late 1990s.

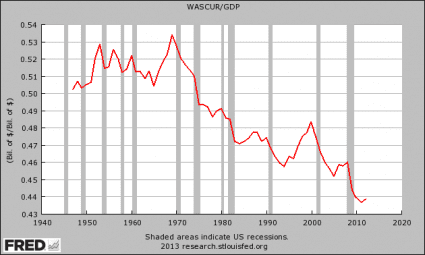

3. Wages And Salaries As A Percentage Of GDP

One of the primary drivers of inflation is consumer spending but consumers cannot spend money if they do not have it and, right now, wages and salaries as a percentage of GDP are near a record low [as can be seen in the chart below]. This is a very deflationary state of affairs. The percentage of low paying jobs in the U.S. economy continues to increase, and we have witnessed an explosion in the ranks of the “working poor” in recent years. For consumer prices to rise significantly, more money is going to have to get into the hands of average American consumers first…

4. A Bursting Debt Bubble

Right now, we are living in the greatest debt bubble in the history of the world. When a debt bubble bursts, fear and panic typically cause the flow of money and the flow of credit to really tighten up. We saw that happen at the beginning of the Great Depression of the 1930s, we saw that happen back in 2008, and we will see it happen again. Deleveraging is deflationary by nature, and it can cause economic activity to grind to a standstill very rapidly.

FREE Market Intelligence Report newsletter (sample here)

The Next Wave of the Economic Collapse – Deflation

During the next major wave of the economic collapse, there will be times when it will seem like hardly anyone has any money.

- The “easy credit” of the past will be long gone, and large numbers of individuals and small businesses will find it very difficult to get loans.

- Cash will be king – at least for a short period of time. Those that do not have any savings at all will really be hurting.

Some of the financial elite seem to be positioning themselves for what is coming. For example, even though he has been making public statements about how great stocks are right now, the truth is that Warren Buffett is currently sitting on $49 billion in cash. That is the most that he has ever had sitting in cash. Does he know something?

The Wave After That – Inflation

Of course there will be a tremendous amount of pressure on the U.S. government and the Federal Reserve to do something once a financial crash happens. The response by the federal government and the Federal Reserve will likely be extremely inflationary as they try to resuscitate the system. It will probably be far more dramatic than anything we have seen so far. Cash will not be king for long. In fact, eventually cash will be trash.

Conclusion

The actions of the U.S. government and the Federal Reserve in response to the coming financial crisis will greatly upset much of the rest of the world and cause the death of the U.S. dollar – and that is why gold, silver and other hard assets are going to be so good to have in the long-term. In the short-term they will experience wild swings in price, but if you can handle the ride you will be smiling in the end.

In the coming years, we are going to experience both inflation and deflation, and neither one will be pleasant at all. Get prepared while you still can, because time is running out.

(Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

*http://theeconomiccollapseblog.com/archives/will-it-be-inflation-or-delfation-the-answer-may-surprise-you (Copyright © 2013 The Economic Collapse)

Related Articles:

1. Hyperinflation: 21 Countries Have Experienced It In Last 25 Years – Is the U.S. Next!

[Hyperinflation is not an unusual phenomenon. 32 countries have experienced hyperinflation over the last 100 years of which no less than 21 have experienced it in the past 25 years and 4 in the past 10 years. The United States is one of the few countries to have experienced two currency collapses during its history (1812-1814 and 1861-1865). Is it about to happen again?] Words: 1450 Read More »2. These 5 Events Will Lead to Higher Gold & Silver Prices

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I still think we are seeing a “full court press” on PM’s by the Central Banks who are using all their fiscal power to push the PM market lower, while at the same time acquiring PM for themselves.

The key indicator for me is the availability of PM’s, when dealers are awash in PM’s then I will believe that the “value” of PM’s has really dropped, until then we are just seeing PM’s being “PLAYED”.

+

http://srsroccoreport.com/controlling-the-beginning-stages-of-hyperinflation-by-manipulating-the-precious-metals/controlling-the-beginning-stages-of-hyperinflation-by-manipulating-the-precious-metals/

snip:

The tactic by the Fed and Central Banks is to inflate the stock markets while manipulating the price of gold and silver lower. This achieves two goals, 1) it reassures the public’s faith by pumping up stock prices while the economic indicators continue to deteriorate and 2) it elevates the dollar while it destroys market sentiment in the precious metals.

====

I agree with this statement and think the Central Banks know how to “fix” the charts (by manipulating their paper money and Gov’t. numbers) to give those that use charts a false picture of reality, that is designed to protect paper money!

Behold: Fiscal Propaganda through the use of Twisted Charts – SeniorD