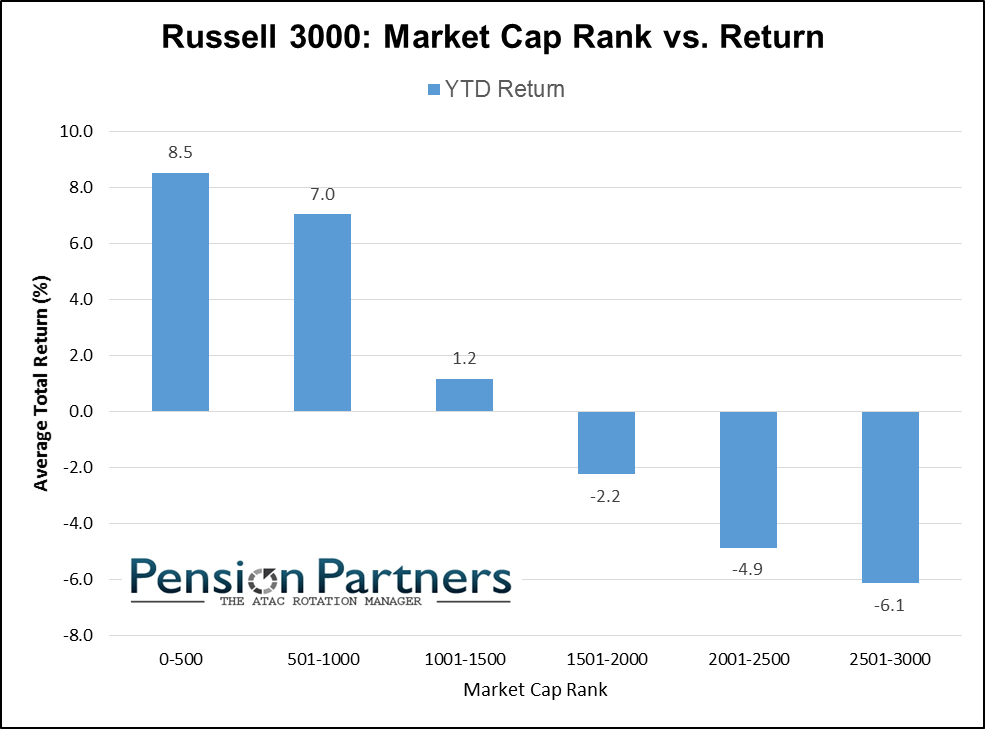

There continues to be an uncanny relationship between a company’s market  capitalization and year-to-date returns. The largest 500 stocks in the Russell 3000 are up an average of 8.5% this year, while the smallest 500 are down an average of -6.1%.

capitalization and year-to-date returns. The largest 500 stocks in the Russell 3000 are up an average of 8.5% this year, while the smallest 500 are down an average of -6.1%.

The above comments are edited excerpts from an article* by Charles Bilello, Director of Research, (pensionpartners.com) entitled The Single Best Predictor of Equity Returns in 2014?.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Bilello goes on to say in further edited excerpts:

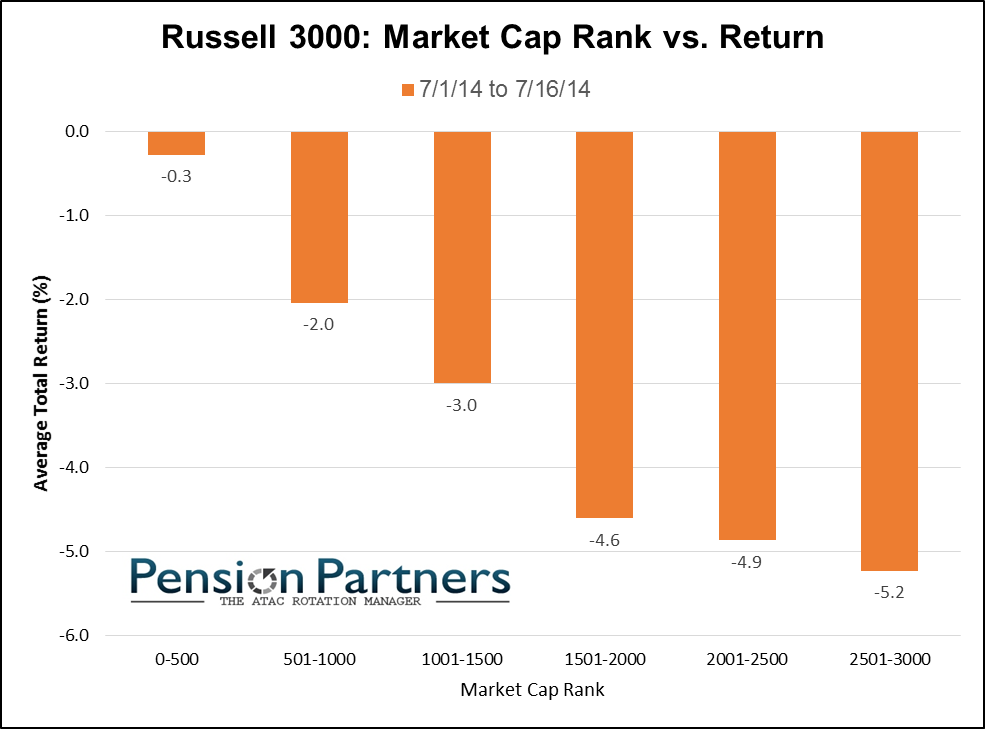

From the beginning of July, when the small cap Russell 2000 Index peaked, the differential has been stark, with the top 500 stocks only marginally lower while the bottom 500 are down over -5%.

What is driving this incredibly strong relationship between market cap and return?

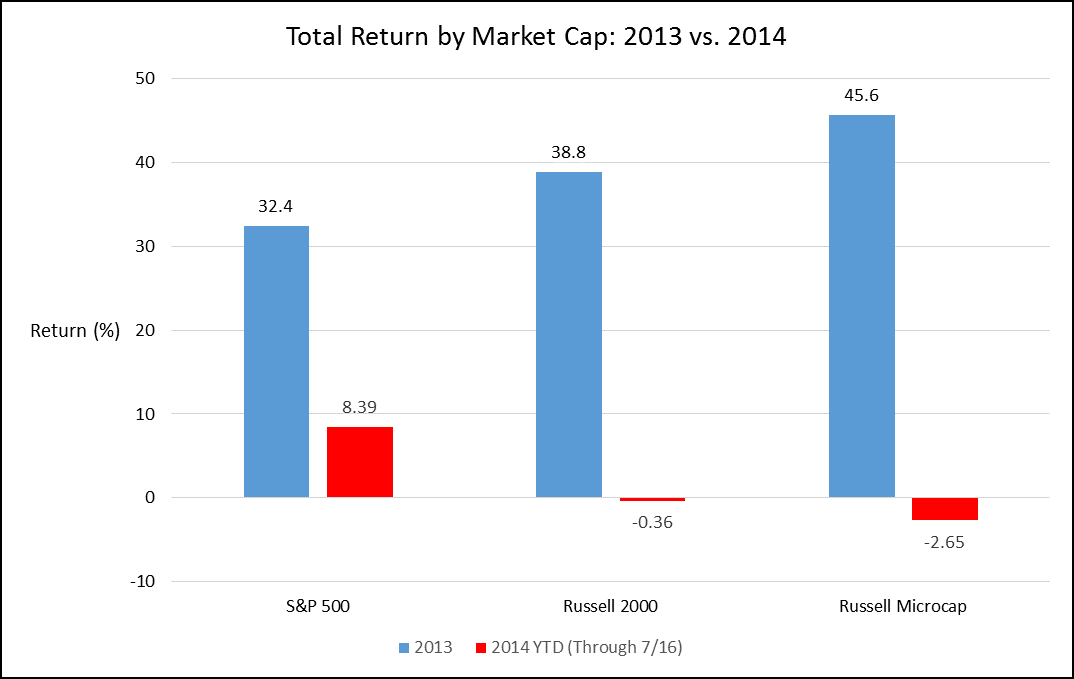

It can be explained in part by a simple reversion to the mean as last year the smallest stocks (microcaps) widely outpaced the S&P 500 and we are seeing a complete reversal thus far in 2014.

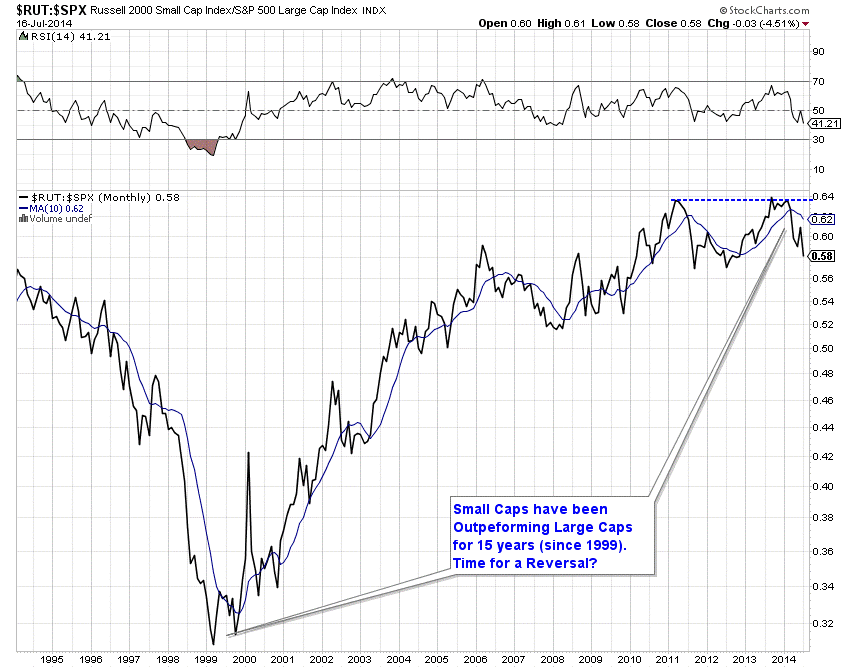

…Small caps have been outpacing large caps for over fifteen years. This incredible run has left their shares extremely stretched on both an absolute and relative valuation basis.

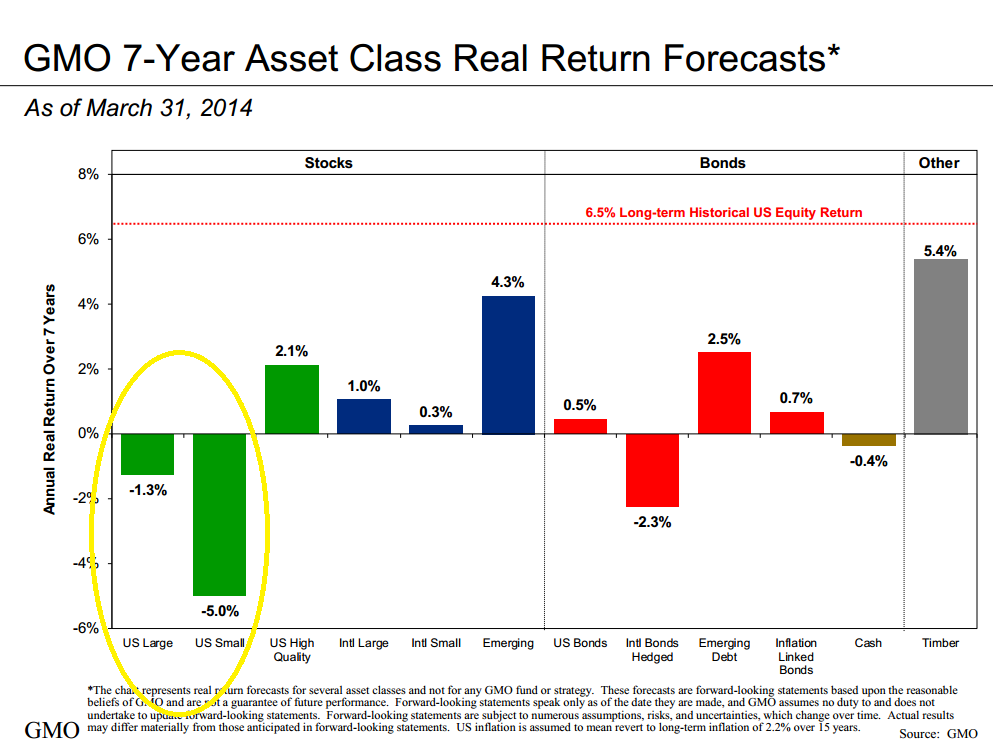

One could quite easily make the argument that small cap valuations are at/near their most extreme in history… Indeed, one of the smartest minds in the investment business, Jeremy Grantham of GMO, (with over $100 billion in AUM) is projecting U.S. small caps to have a negative real and absolute return over the next seven years.

This suggests that:

- the underperformance in small caps this year may not be a short-term phenomenon and could very well continue for some time…[and] that

- small-cap effect that many have become accustomed to may be absent for a while, at least until valuations are normalized.

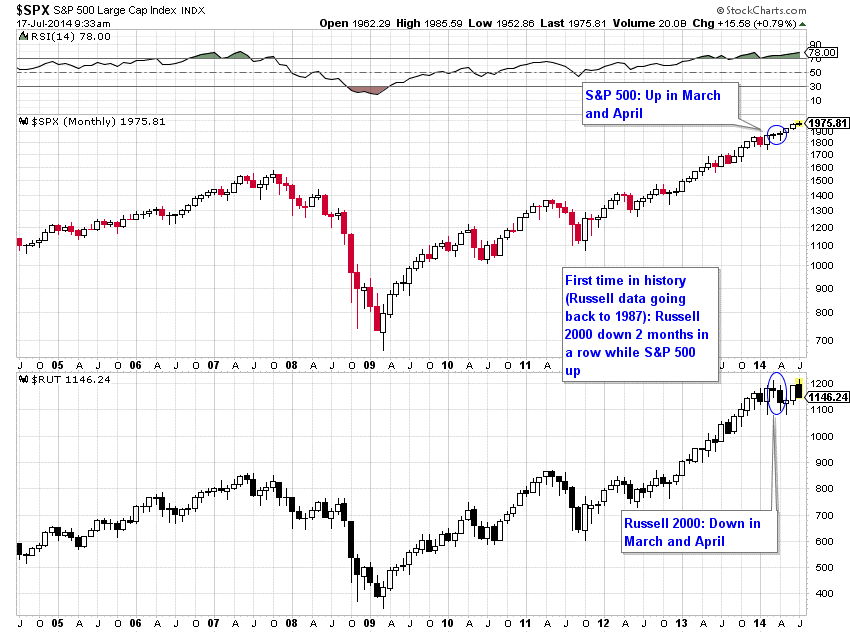

What does this mean for the broad markets? For now, market participants remain highly bullish and are largely ignoring the small cap weakness, focusing instead on the all-time highs in the Dow (DIA) and S&P 500 (SPY). Many of these participants are pointing to March and April of this year when small declined in consecutive months while the large cap indices continued higher as a template for what will happen next.

While this is certainly possible, I would caution investors against assuming this is high probability and a normal market relationship. It is not. As I wrote back then, this was the first time in history that such a consistently wide divergence had occurred.

Also, if you believe that small caps are declining because of valuation concerns, wouldn’t it stand to reason that investors will soon become concerned with large cap valuations? After all, while large caps are cheaper on a relative basis, they are anything but cheap on an absolute basis, as evidenced by the negative real returns expected by Grantham over the next seven years.

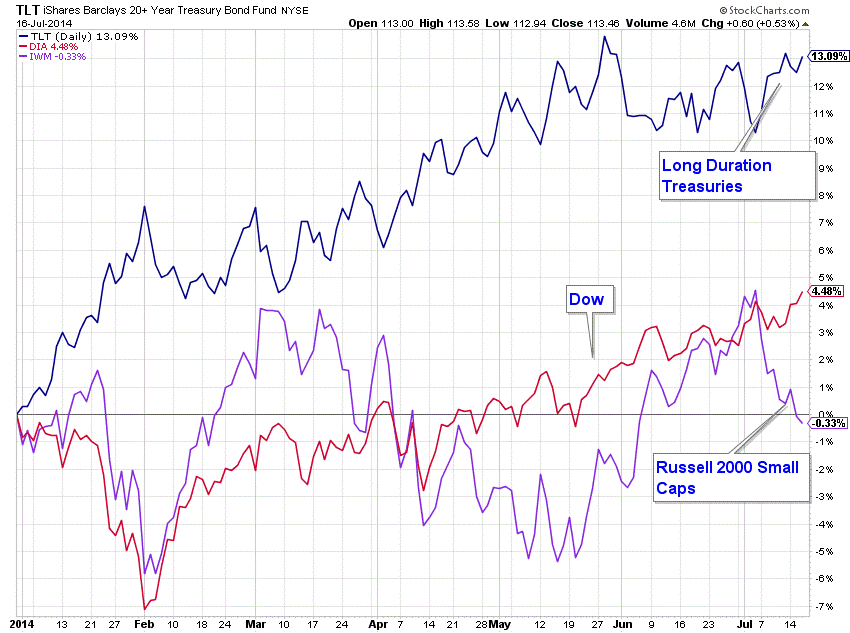

I would also note that despite the daily headlines about all-time highs, the most defensive area of the market, long duration Treasuries (TLT), continues to widely outperform. We are also seeing other signs of classic late cycle behavior, as I wrote about recently in showing the troubling similarities to July 2007.

Conclusion

Overall, the rotation out of small and micro caps should not be ignored by market participants. It is a clear sign of defensive behavior and is likely to have ramifications on investor returns not only in the near-term but for years to come.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://pensionpartners.com/blog/?p=521 (© 2014 Pension Partners, LLC – All Rights Reserved.)

Follow the munKNEE!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

Related Articles:

1. Bigger IS Better! What Does This Selective Advance Mean For the Stock Markets Going Forward?

The average U.S. stock is DOWN over 1% thus far in 2014. How can that be when we’re being told almost daily that the Dow and S&P 500 are hitting new all-time highs? The answer is likely to surprise you. Read More »

2. Size Does Matter: A Look at Market Capitalization and What It Means for Investors

People choose certain stocks for many different reasons – business location; sector strength; product innovation – but some investors choose what to buy based on company size, or market capitalization [believing that size does matter. Yes,] understanding the difference between small-cap, medium-cap and large-cap companies is the first step to making the right choice. [Let me explain.] Words: 600 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money