To ignore all the compelling charts and data below would be irresponsible and, as such, will NOT go unnoticed by institutional investors. Such bearish barometers for stocks worldwide will, unfortunately, be ignored by the ignorant and gullible hoi pollo causing them severe financial loss as investor complacency in the past has nearly always led to a stock market crash.

such, will NOT go unnoticed by institutional investors. Such bearish barometers for stocks worldwide will, unfortunately, be ignored by the ignorant and gullible hoi pollo causing them severe financial loss as investor complacency in the past has nearly always led to a stock market crash.

The above introductory comments are paraphrased edited excerpts from an article* by Vronsky (gold-eagle.com) entitled Global Stock Markets Are Due For A Tumble.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Vronsky goes on to say in further edited excerpts:

1. Dow Stock Index threatens to fall below its 21-month uptrend and its 40-week MA, which probably drive stocks downward.

2. Russell 2000 Stock Index shows a very bearish Double Top and threatens to fall below its 21-month uptrend. Moreover, the Technical Indicators demonstrate very Negative Divergence (heralding lower values ahead). It is imperative to notice the Russell 2000 Index has already fallen below its 40-week MA…indeed a very ominous omen predicting much lower prices ahead.

3. Wilshire 5000 Stock Index also threatens to fall below its 21-month uptrend. Moreover, the Technical Indicators MACD and RSI are heralding lower values ahead.

4. UK’s FTSE Stock Index has bear signs clawing all over its chart:

- there is a bearish triple top, and

- there is marked negative divergence of the technical indicators.

5. Germany’s DAX Stock Index is replete with bearish sell signals:

- a Diamond Reversal Formation (2007, 2011 and most recently) and

- TA Indicators of MACD, RSI and CCI are all screaming sell, Sell, SELL.

6. MSCI World Stock Index (sans USA):

- clearly shows a bearish Rising Wedge and, if the MSCI breaks below the Rising Wedge,

- the World Stock Index might plummet to 1400 support.

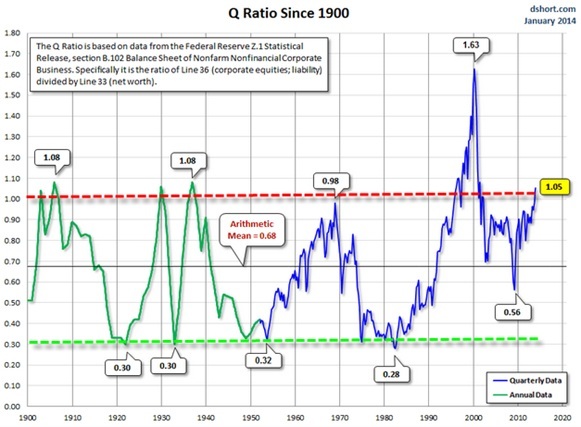

7. Q Ratio

“Today there is a tremendous amount of monetary distortion, on par with the 1929 stock market and certainly the peak of 2007, and many others,” warns Universa’s Mark Spitznagel, offering the following chart on the ratio of Corporate Equities Divided by Net Worth in support of his bearish prediction which is signaling the beginning of bear markets in stocks.

It is imperative to appreciate the accuracy of the above curve in signaling the beginning of bear markets in stocks:

- In 1907 it peaked at 1.08, which was followed by the Panic Crash of 1907 (where Dow fell nearly 50%)

- In 1929 it peaked at 1.06, which was followed by the Great Crash of 1929 (where the Dow Index eventually lost 89%).

- In 1937 it peaked at 1.08, which was followed by the Panic Crash of 1937 (where the Dow Index lost 49% in only 12 months).

- In early 1970 it peaked at 0.98, which heralded the 1972-1973 Crash (where the Dow lost 38%)

- In 2000 it peaked at 1.63, which was followed by the Crash of 2000-2003 (where the Dow dropped 45%).

- Today the ratio is peaking at 1.05.

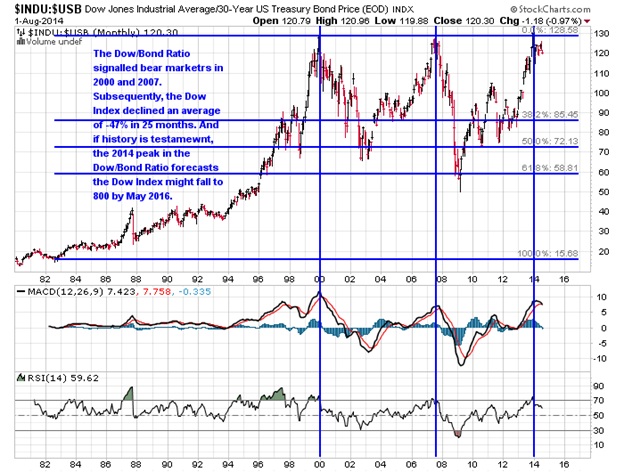

8. US T-Bonds/Dow Ratio

…The tell-tale trend of the US T-Bonds/Dow Ratio strongly suggests that a bear market in stocks is forming. The logic behind this indicator is the following.

- When a bull market in stocks becomes euphoric, investors blindly and irrationally pile into stocks, and tend to reduce their investments in US Treasuries. Hence the US T-Bonds/Dow Ratio trends lower and lower.

- When irrational investors become too greedy, stocks are bid to delusional, unsustainable levels.

Point 2 is exactly what happened in 2000 and 2007, which caused the US T-Bonds/Dow Ratio to fall to the bottom of the chart (see pink circle marking the bottoms in the chart below). Needless to say, both periods pin-pointed when the Dow Index topped out.

FAST-FORWARD to 2014 to see the US T-Bonds/Dow Ratio has again bottomed, thus announcing stocks are topping out – and preparing to correct. Please note the Dow Index is super-imposed on the graph.

9. The Dow/US T-Bond Ratio

Perhaps another more clear way to visually appreciate that stocks are topping out is to view a chart of the Dow/US T-Bond Ratio. Please see a very bearish Triple Top:

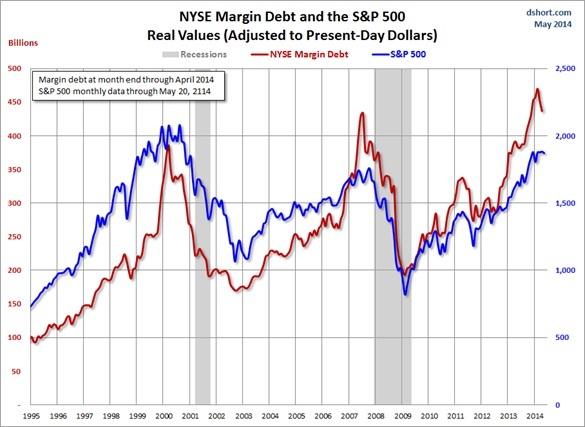

10. NYSE Margin Debt

Another infallible indicator showing stocks are grossly over-valued and may be approaching a market dangerously topping out is NYSE Margin Debt. Actually the NYSE Margin Debt is one of the principal causes why stock ultimately must face egregious correction. Observe in the chart below how the NYSE Margin Debt peaked in 2000 and 2007 when the S&P500 peaked and subsequently suffered horrific losses (-53% and -54%, respectively).

The theory behind this phenomenon is simple.

- After stocks have risen for years on end, investors throw caution to the wind and buy stocks on ever increasing margins.

- Eventually and inevitably all liquidity dries up, and there is practically no new money available to bid prices higher…ERGO, SMART INVESTORS BEGIN TO TAKE PROFITS and

- the market prices reverse sharply downward.

- Eventually, and inevitably, the bear market feeds on itself as imprudent investors dump stocks and flee to safe havens (i.e. cash, bonds and or gold).

Below is a chart showing the NYSE Margin Debt at an all-time record high with the S&P500 Index super-imposed:

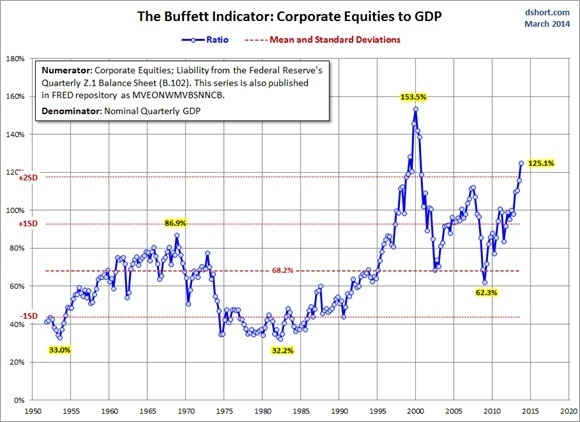

11. Warren Buffett’s Favorite Evaluation Metric: Total Market Value/GNP

The richest man in the world, billionaire Buffett has oft repeated that one of his most trusted metrics to determine relative valuation is Total Market Value/GNP…to wit: Are stocks over-valued or under-valued?

The Total Market Value/GNP chart below shows peaking in 1966, 1972, 2000 and 2007. Each peaking heralded the beginning of a bear market correction in stocks and it is vitally important to notice the Total Market Value/GNP has just recently forged the second highest peak since 1950.

Now we know why Buffett’s flagship company (Berkshire Hathaway) has been going to cash. His company has the highest cash level ($40 Billion) since 2007 (just before the stocks crashed). Surely Buffett knows!

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.gold-eagle.com/article/global-stock-markets-are-due-tumble

Related Articles:

1. Call the “Smart Money’s” Bluff & Stay Invested – Here’s Why

Brace yourself! The stock market is ripe for a nasty selloff according to a number of politicians and even more market pundits – but not so fast. Two very reliable long-term recession indicators strongly suggest that a correction – or worse, the end of the bull market – is highly unlikely given the current state of the economy. Let me explain. Read More »

2. Stock Market Bubble to “POP” and Cause Global Depression

In their infinite wisdom the Fed thinks they have rescued the economy by inflating asset prices and creating a so called “wealth affect”. In reality they have created the conditions for the next Great Depression and now it’s just a matter of time…[until] the forces of regression collapse this parabolic structure. When they do it will drag the global economy into the next depression. Let me explain further. Read More »

3. All Is NOT Hunky Dory In the Stock Market – Here’s Why

We look at this market and we see “too much.” Too much divergence, too much complacency, too much embedded downside risk…the list goes on and covers many things. Let’s make the rounds and see what we find [and what it means for the immediate well-being of the various stock markets.] Read More »

4. Mixed Signals About Direction of Stock Market Abound – Here Are 10

[No wonder you are confused!] Several technical and fundamental indicators have flashed caution to no avail and this has given way to an uncomfortable tension beneath the surface as investors try to find answers while keeping pace with performance. Below are 10 mixed signals about the near-term direction and theme of the markets. Read More »5. Risk Aversion Has Run Its Course. What Are the Implications for the U.S. Economy Going Forward?

With QE now winding down, the economy facing reduced headwinds, and risk aversion beginning to decline, risk taking is beginning to increase and that is an essential ingredient for healthier economic growth. Read More »

6. Bubble-level Valuations Don’t Cause Bear Markets! These Factors Do

So much analysis we see and hear lately is concerned with whether the stock market is in a bubble or not. The truth of the matter, however, is that bear markets do not begin due to bubble-level valuations being reached and then bursting, but in anticipation of half a dozen mitigating factors as outlined in this article. Read More »

7. What Are the 2 Catalysts That Cause Major Market Corrections Telling Us Today?

There are a number of potential pitfalls out there for the market but, right now, the behavior of the main catalysts for a major correction suggest that there continues to be more right than wrong with the market. Let me explain. Read More »

8. What’s the Best Way to Invest Given Today’s Disturbing World News Headlines?

It’s hard not to see some disconnect between recent disturbing world news headlines and the market’s quiet advance but this disconnect is rational in the short term, but not necessarily in the long term. Here are 3 rules of thumb for how investors can potentially respond. Read More »

9. Bigger IS Better! What Does This Selective Advance Mean For the Stock Markets Going Forward?

The average U.S. stock is DOWN over 1% thus far in 2014. How can that be when we’re being told almost daily that the Dow and S&P 500 are hitting new all-time highs? The answer is likely to surprise you. Read More »

10. Remember the “Nifty 50″? It’s Back! What Does It Mean For the Markets Going Forward?

Market historians will recall the term “Nifty 50” originated in the 1960’s bull market to describe 50 wildly popular large-cap stocks at the time. Interestingly, some of the same names from that list are leading the market higher today. The question for investors, of course, is what this selective advance means for the markets going forward. Read More

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

please unsubscribe me