“Since less than 0.5% of world financial assets are in gold, most people neither hold gold, nor understand the purpose of gold. [Indeed,] many people use [the term] “goldbug” scathingly as a pejorative as they have never bothered to understand the significance of gold. [This article defines the term “goldbug”, identifies the real purpose of holding gold and provides 9 reasons why we should own some physical gold.]”

Prepared by Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money! [Editor’s Note: This version* of the original article by Egon von Greyerz has been edited ([ ]), restructured and abridged (…) by 35% for a FASTER – and easier – read.]

“What is a Goldbug?

- If we look at Wikipedia, they define it as “a person who is extremely bullish on the commodity gold as an investment and or a standard for measuring wealth. Goldbug can also be used as a pejorative”.

- Investopedia states that “A gold bug is an individual who is very enthusiastic about gold as an investment and its prospects for significantly increasing in value.”

#A Site for Sore Eyes & Inquisitive Minds

…If we are not Goldbugs, what is the purpose of holding gold?

- In simple terms, gold is wealth preservation and insurance against a rotten financial system, inflated by $100s of trillions of credit and printed money as well as quadrillions of dollars of derivatives.

- If you understand the bubble that this has created in all asset and debt markets, you will also understand that gold is your best protection against the coming implosion of all these markets.

…Let’s look at some of the reasons why it is critical to hold physical gold:

Gold protects against:

1. Currency debasement

– The 97-99% fall of all currencies in the last 100 years will continue until the currencies have reached zero so there is only 1% to 3% to go but remember that this fall is a 100% loss value from today.

2. Bank failures – bail-ins

– With leverage of 10-50x banks will not survive the next credit crunch. Add to that their derivatives exposure and a systemic failure is guaranteed.

3. Stock market collapse

– Stocks have been fuelled by money printing and buybacks and are now overvalued on all criteria. A 90% fall in real terms like in 1929 is likely. The economic and financial risks in the world are today exponentially greater than in the late 1920s.

4. Bond market failure

– The 35 year up-cycle in bonds is now a mega-bubble that will implode. It turned down three years ago and rates are now on their way back to above the early 1980s level of 16% for the 10 year US treasury. This is a long cycle and will not happen immediately. As governments print unlimited amounts of money, default or implement moratoria, bond market investors, including China and Japan will dump their US bonds just like Russia has done already.

5. Inflation – hyperinflation

– As governments, in a desperate and futile attempt try to save the system, print endless amounts of money, most major economies will have inflation leading to hyperinflation. Anyone who has lived in a hyperinflationary economy, like Argentina, Zimbabwe and Venezuela knows that their money is totally destroyed. Sadly, few people realise that gold would have saved them.

6. Deflation

– Contrary to what many people believe, gold has historically performed very well in deflationary periods. In my opinion we will first have hyperinflation as governments try to save the world with money printing. When that fails and asset as well as credit markets implode we will have a severe deflationary implosion. Banks are unlikely to survive this in their present form. As banks fail, so will the money in the bank. Gold will then be money used for payment or barter.

7. Peak gold

– Gold production has already peaked. There have been no major finds since the 1990s. Even if unexpectedly there will be substantial new discoveries, it takes at least 15 years from discovery to production. Thus we will see substantial shortages of gold in coming years.

8. Paper gold

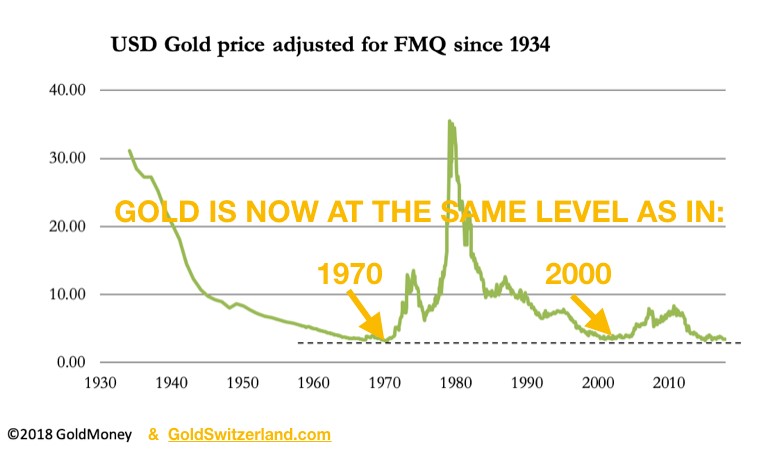

– The gold price is only at the currently ridiculously cheap level due to a paper gold market which determines the gold price whether it is physical or paper gold. The price of gold adjusted for money supply is now at the same level as in 1970 when gold was $35 and 2000 when gold was $280. Paper gold outstanding is at least 100x the physical gold backing it. When paper gold holders get worried and ask for delivery, there will be no gold available and price will go “no offer” which means there is no gold available at any price. This is when gold will go to multiples of the current price.

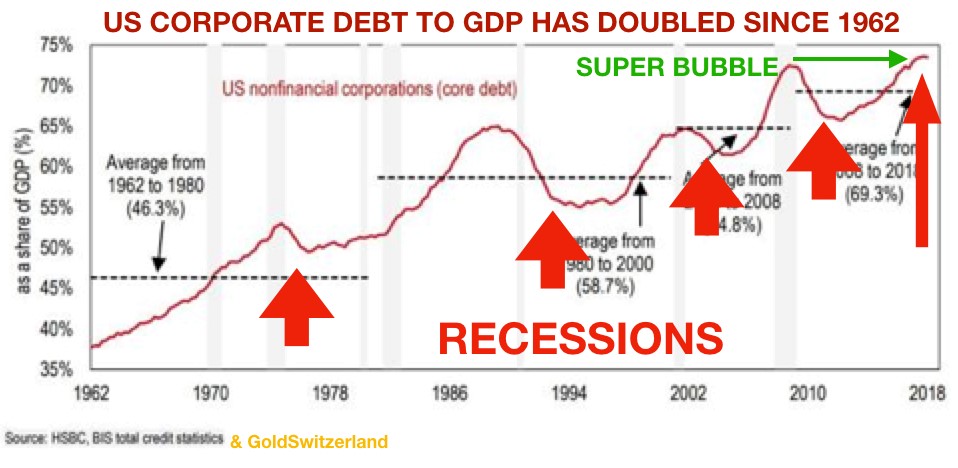

9. Corporate debt

– Corporate debt has exploded in most industrial nations and is now at danger level. In the U.S., for example, corporate debt to GDP has doubled since the 1960s. Irrational optimism and share buy-backs have fuelled this debt boom.

10. Other risks

– There are a number of other major risks which can erupt at any time. These include:

- geopolitical risks,

- civil war,

- social unrest,

- country risk.

Many of these things have already started like the US government shutdown, the Brexit fiasco in the UK, Yellow Vests in France and mass migration on several continents. All this is just the beginning.

#munKNEE.com (Gold & Silver)

Conclusion

Gold is clearly not the panacea for all the problems listed above BUT:

- there is no better insurance against the financial and economic risks in the world today…[and,]

- especially in periods of crisis, gold is the most important wealth preservation asset as well as a store of value and medium of exchange.

…Despite, or maybe because of, most people’s total ignorance of gold, it will be the most superb asset to hold in the next few years both as insurance and for capital appreciation purposes. Remember, though, to hold physical gold and store it outside the financial system in a very safe vault and jurisdiction.”

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

The points made in this article are all valid and an allocation of 10$ into gold as an insurance against catastrophic outcomes is a prudent diversification strategy.

Among the many risks humanity is facing in the future is the escalation of cold wars into hot wars. If the US wins a hot war against Russia and China, the gold accumulation of Russia and China will become property of the US. If that happens, the Dollar and the paper assets will enter another bull market lasting at least 50 years if not longer. if the US loses the war, then the Dollar will collapse and gold will have a great future. If however, a hot war can be avoided, then it is impossible to predict what will happen. Quite possibly, the paper world will continue to expand for decades to come. The end of the paper world will be reached when worldwide oil production will start to decline in a serious way, say at rates in excess of 3$ per year. That will mark the end of economic growth and a financial system based on gold like in the 19th century may return.

We need paper assets to push economic growth to its Limits, Once we are past the limits and the world will face depletion of major resources, sanity will return and a sound financial system based on stability may return. Only then will gold return as a desirable asset to hold, Until that point, paper assets promising return without work will be in high demand. But is infinite wealth on a finite planet possible ?

That is the ultimate value of gold: It is the insurance against the insanity of infinite wealth. Gold stands for scarcity.

Mr. Greg Bigger, I am sure you were looking in a mirror when you dropped your BRILLIANT comment. If you really believe yourself… why do you waste your time reading? It’s a rhetorical question… Good Day. More gold for me.

You have no understanding of economics and / or commodities. The paranoid speak you spread is useless and to the ignorant harmful. Shut up!

You sound like someone who fervently believes The Emoeror’s New Clothes are ravishingly beautiful. And you hate anyone willing to say the Emperor is in actually NAKED – much like the current fiat currency hose of cards system!

If you don’t like dissenting voices I recommend you place your fingers in your ears and hum loudly!