…The Central Bank credit expansion bonanza is now coming to an end [and when that happens] the exponential moves up in stocks, bonds and property prices will turn to catastrophic falls that will destroy most of the wealth in the world. In the next 3-7 years, it is not going to be a question of making a fortune but to lose as little as possible so let’s look at the major risks and the best financial protection.

exponential moves up in stocks, bonds and property prices will turn to catastrophic falls that will destroy most of the wealth in the world. In the next 3-7 years, it is not going to be a question of making a fortune but to lose as little as possible so let’s look at the major risks and the best financial protection.

This version of the original article, by Egon von Greyerz, has been edited* here by munKNEE.com for length (…) and clarity ([ ]) to provide a fast & easy read. Visit our Facebook page for all the latest – and best – financial articles!

This version of the original article, by Egon von Greyerz, has been edited* here by munKNEE.com for length (…) and clarity ([ ]) to provide a fast & easy read. Visit our Facebook page for all the latest – and best – financial articles!

The bubble assets will of course be the most vulnerable…

- The Nasdaq is up by over 700% since 2009…

- The Dow and S&P indices have gone up slightly less but are still at all time highs…

- [Yet, while] most stock markets are greatly overvalued…commodities are at historical lows against stocks and due for a substantial revaluation. As the chart below shows, stocks today are in a historical bubble and at a 50 year high against commodities.

The moves down in stocks and up in commodities will be massive. It is a virtual certainty that the ratio will go back to the 1990 level which would mean a 90% fall of stocks against commodities.

PRECIOUS METALS – TO OUTPERFORM ALL ASSETS

Although we are going to see commodities outperforming all asset markets, it will be critical to pick the right ones. Gold, silver, platinum and precious metal stocks are, of course, the obvious choice [because,] not only is the precious metal complex extremely oversold against all the bubble assets, but it is also the ultimate wealth preservation asset.

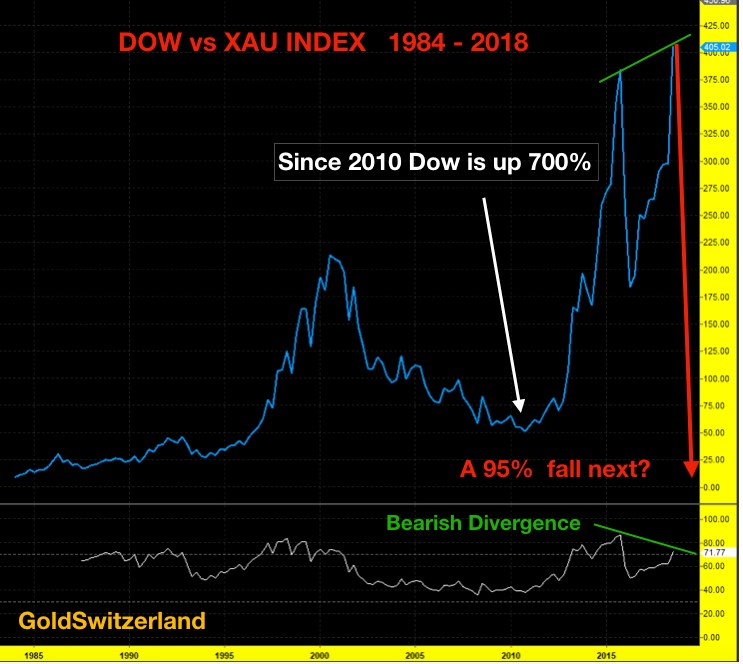

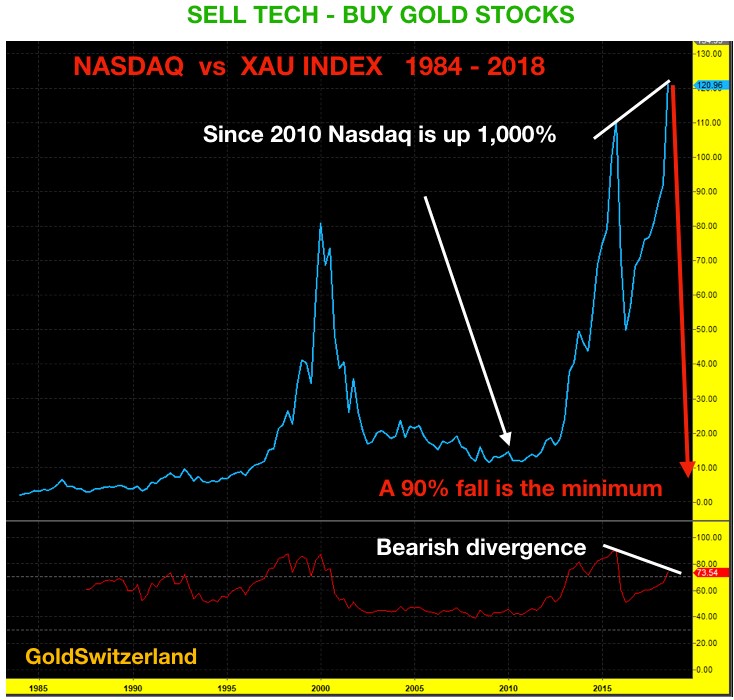

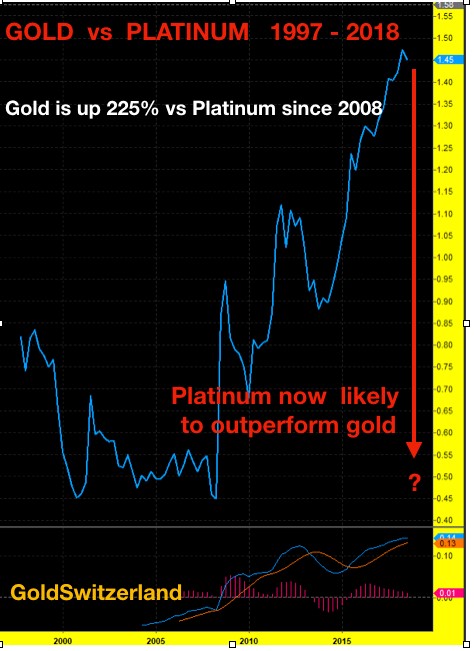

To understand the underperformance of the precious metals, let’s look at some enlightening charts:

Since 2010 the Dow is up 700% against the XAU Gold & Silver Index. A move back to the 2010 level is a minimum. That would be an 88% decline but, bearing in mind the extreme undervaluation of the XAU stocks and overvaluation of the Dow, a fall of 97% to the early 1980 level is more likely.

The Nasdaq’s relative overvaluation is even more extreme: it is up 11x or 1,000% against the XAU index since 2010.

- A decline back to the 2010 level is a virtual certainty

- but as the Nasdaq bubble bursts and the precious metals surge, a fall of 98% to the early 1980s level is more likely.

The HUI Gold index has declined 76% against silver since 2003.

- A return to the 2003 high is possible.

- This would mean that the HUI Gold Stocks would outperform silver by 300%.

- On the same basis, the HUI would outperform gold by 400% (not shown):

Platinum has been very weak since 2008 and is soon likely to rise against gold.

The Gold-Silver ratio is very significant for precious metal investors.

Since 2003 we have seen the Gold-Silver ratio fluctuate between the 80-84 level and 30. In 2018 it has reached a new high for this century of 84 but momentum indicators are not confirming this high which is bullish for silver.

- A return to the 2011 level of 30 is very likely and probably to the historical average of 15.

- Reaching 15 would mean that silver will move almost 6 times faster than gold.

- If gold for example reached $10,000, silver would be $666. An almost 5000% increase sounds incredible today but once the manipulation and Comex fails, there will be little to stop silver.

Whatever level the precious metal sector reaches is at this point irrelevant. The purpose of the graphs above is to show that precious metals are likely to vastly outperform ordinary stocks. They will also outperform most other bubble assets such as property and bonds…

From a historical perspective, gold must form the bottom of the wealth pyramid and be the biggest holding.

- Even if silver and platinum are likely to appreciate more than gold, they are much more volatile and we…therefore, recommend less allocation to these metals [and,]

- Although precious metal stocks look extremely attractive [these days], remember that…they are paper assets and therefore not a proper wealth preservation investment.

For the investor who understands the unprecedented risks in the financial system, the next few years could turn a massive potential loss to economic peace of mind and financial security…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money