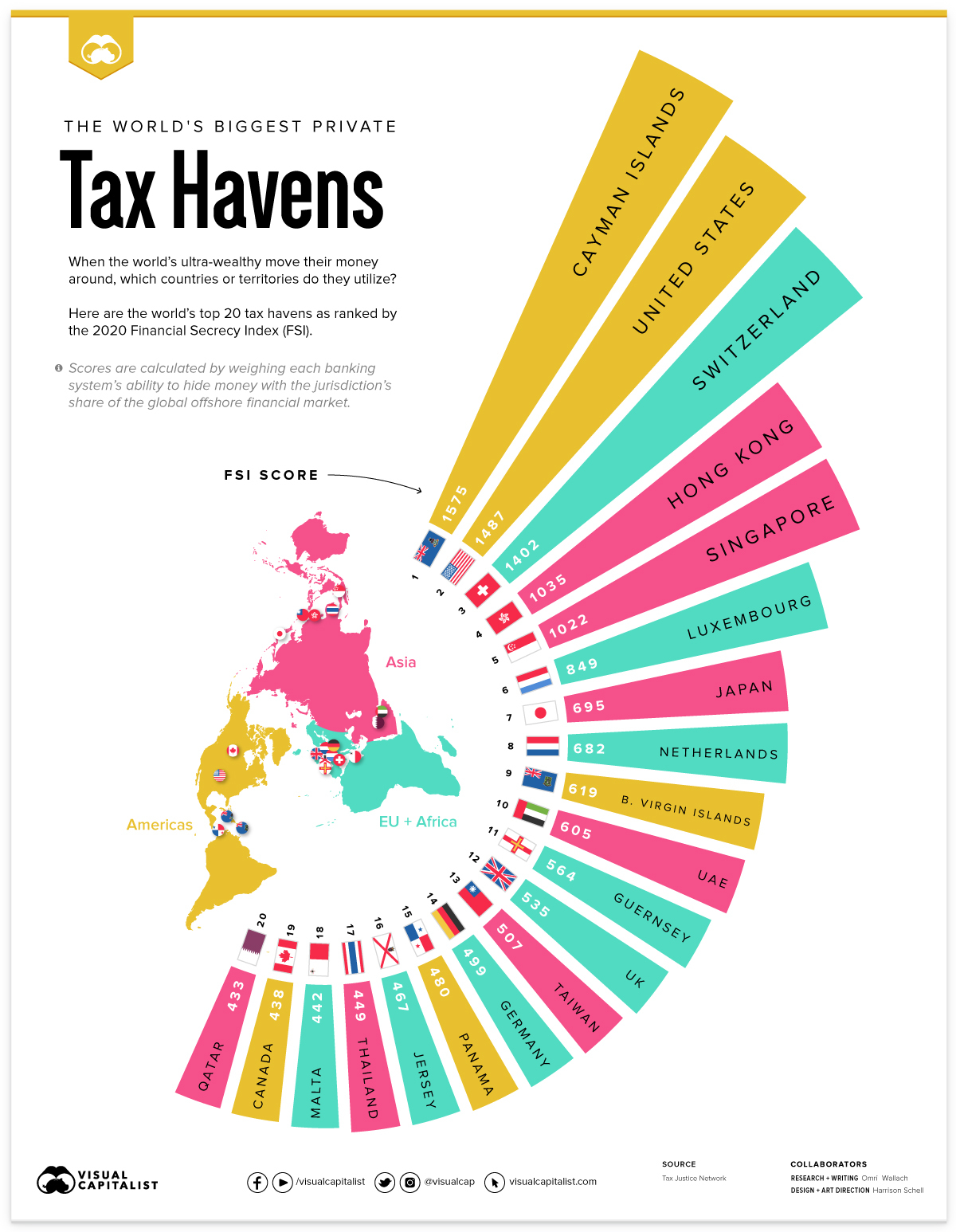

…When the world’s ultra-wealthy look for tax havens to shield income and wealth from their domestic governments, where do they turn? Here are the world’s top 20 tax havens, as ranked by the 2020 Financial Secrecy Index…

Based on pop culture and media reports, you might imagine a secretive bank in Switzerland or a tiny island nation in the Caribbean but the reality is that the world’s biggest tax havens are spread all over the world.

Some of the listed tax havens above might be confusing to nationals of those countries, but that’s where relativity is important. The U.S. and Canada might not be tax havens for American or Canadian nationals, but the ultra-wealthy from East Asia and the Middle East are reported to utilize them due to holes in foreign tax laws. Likewise, the UAE has reportedly become a tax haven for Africa’s ultra-wealthy.

In addition, many of the countries used as tax havens for individual wealth are also utilized by corporations…with the British Virgin Islands, Cayman Islands, and Bermuda being listed as the top three tax corporate tax havens.

Corporations are usually directly incorporated in the tax haven in order to defer taxes but the tax haven landscape might soon shift. The G7 struck a deal in June 2021 to start taxing multinational corporations based on the revenue generated in each country (instead of where the company is based), as well as setting a global minimum tax of 15%. In total, a group of 130 countries have agreed to the deal, including India, China, the UK, and the Cayman Islands.

As the campaign to bring back deferred taxes ramps up, the question becomes one of response. Will the ultra-wealthy individuals and corporations start to work in tandem with the new rules, or discover new workarounds and tax havens?

Editor’s Note: The original article by Omri Wallach has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money