“The Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Average Index (DJIA) after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year. The popularity of the strategy is its singular focus on dividend yield.”

Prepared by Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money!

[Editor’s Note: This version* of the original article by David I. Templeton has been edited ([ ]), restructured and abridged (…) by 32% for a FASTER – and easier – read. Templeton is receiving compensation from Seeking Alpha for pageviews of his original unedited article as posted there so please refer to it for more detail. Please note: This complete paragraph must be included in any re-posting to avoid copyright infringement.]

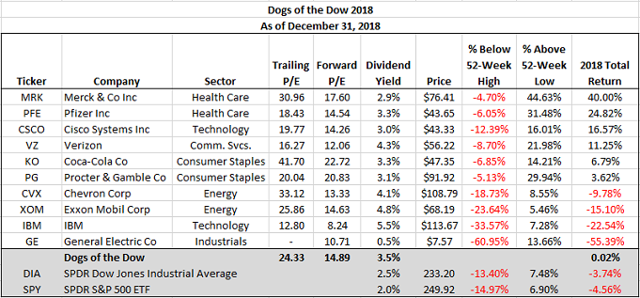

“…The Dogs of the Dow ended up generating a slightly positive total return of .02% for 2018. This compares to a loss of 3.74% for the SPDR Dow Jones Industrial Average ETF (NYSEARCA:DIA) and a loss of 4.56% for the SPDR S&P 500 Index ETF (NYSEARCA:SPY) as displayed in the below table.

Both Merck (NYSE:MRK) and Pfizer (NYSE:PFE) were the top performing Dow Dogs and the top performing stocks in the broader Dow Jones Industrial Average Index for 2018 as well.

As the new year begins, one new member joins the Dogs of the Dow for 2019. Entering the Dow Dogs in the coming year is JPMorgan (NYSE:JPM) with a dividend yield of 3.28%. Dropping out of the Dogs is General Electric (NYSE:GE) not only because of its lower yield, but GE was removed from the Dow Jones Index last year.”

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

Related Articles from the munKNEE Vault:

1. Dogs of the Dow: A Simple Strategy Using the Dividend Yield

Investing in the Dogs of the Dow, which refers to the 10 highest-yielding stocks in the Dow Jones Industrial Average at the end of the year, is a very simple strategy you can use in 2018 to beat the market. Here’s everything you need to know.

4. What You Should Know About the “Dogs of the Dow” Investment Strategy

5. The ‘Dogs’ of the TSX May Not Be Sexy But They Have Bite

The “Dogs of the Dow” as applied to Canada’s TSX 60 would, on an annualized basis, return of 19.88% before dividends, on a 252-day trading year.

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

Want your very own financial site? munKNEE.com is being GIVEN away – Check it out!A note from Lorimer Wilson, owner/editor of munKNEE.com – Your KEY to Making Money!:

“Illness necessitates that I spend less time on this unique & successful site so:

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Hi,

Really great topic you post in this blog post.

I like the helpful information you provide in this.

Thanks for sharing…