The Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index (DJIA) after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year.

The comments above and below are excerpts from an article by David I. Templeton, CFA which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

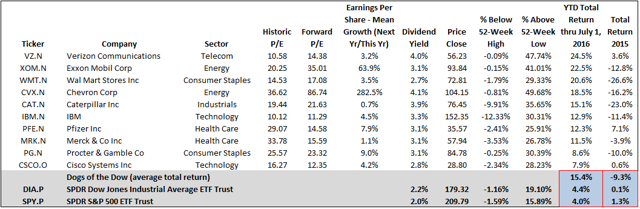

The average YTD total return through July 1, 2016, of the ten 2016 Dogs of the Dow equals 15.4%…compared to the Dow SPDR (NYSEARCA:DIA) and S&P 500 SPDR (NYSEARCA:SPY) returns of 4.4% and 4.0%, respectively.

The top performing Dow Dog this year is Verizon (NYSE:VZ), returning 24.5%. Of course, it was also the highest yielding Dow Dog at the beginning of 2016. Below is a table containing various metrics on the 2016 Dogs of the Dow.

A full list of the Dow stocks with return and yield data can be found at the Dogs of the Dow website.

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money