The market wants what the market wants – and they certainly did not want “Brexit.” On Friday  investors had the opportunity to see what happens when markets get surprised as markets around the world plummeted (take notes, Janet Yellen) and risk-off was the name of the game as gold and bonds rose. [This article analyzes] what Brexit means for gold from both a bullish and a bearish perspective [and concludes with our recommended course of action].

investors had the opportunity to see what happens when markets get surprised as markets around the world plummeted (take notes, Janet Yellen) and risk-off was the name of the game as gold and bonds rose. [This article analyzes] what Brexit means for gold from both a bullish and a bearish perspective [and concludes with our recommended course of action].

The comments above and below are excerpts from an article by hebbainvestments.com/ which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

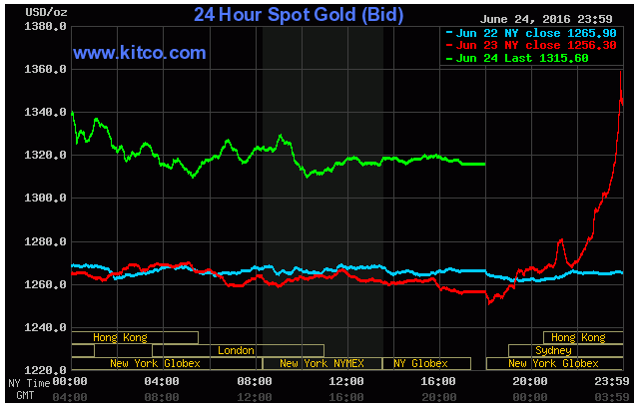

Of course the knee-jerk reaction was bullish as gold did this:

We think, however, this issue is a bit more complex than what meets the eye, and it is certainly not the end of the world as we know it…

The Implications of the Brexit Vote on Gold

While there are a few more items we can get to regarding Brexit, let’s now move on to the implications for gold. As the earlier gold chart from Kitco shows, the initial reaction in gold was stunning as the precious metal rose close to $100 at one point in the night – a completely parabolic move – but after that parabolic move, gold’s Friday close of $1,315.60 was actually $25 lower than its midnight price and close to $40 lower than its high – gold actually declined on Friday when looked at through those lenses. That is generally not a bullish sign and suggests short-covering and then a lack of buyers to propel the price higher.

In fact, looking on a weekly basis, gold was only up 1.43% on the week. We would have expected a much greater move. That is something that shouldn’t be lost on investors simply because we saw a huge Friday move.

Let’s now get into the two sides arguing for buying or selling/avoiding gold now.

The Bullish Camp’s Argument for Gold

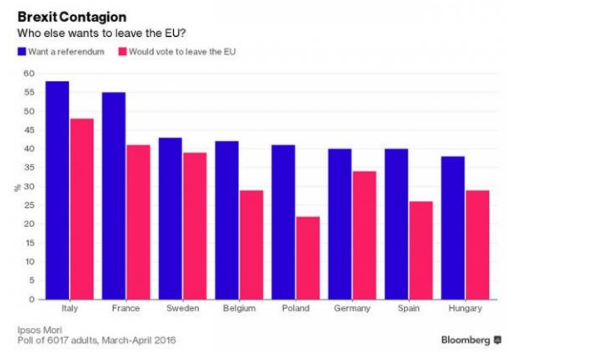

The bullish argument for gold has nothing to do with what happens in the UK and everything to do with what happens to other countries in Europe. The strongest argument here is that other countries follow suit and hold their own referendums, and the Brexit vote significantly emboldens them:

Source: Zero Hedge

With more than 50% of the population of France and Italy calling for a referendum, that’s the fear that Soros was talking about when he felt the Brexit vote could lead to the end of the EU. A UK exit means little to the EU as it is barely an EU country and doesn’t even use the Euro, but a French of Italian exit from the EU would mean the end of the EU and the Euro.

Those consequences would be tremendous. Ignoring the huge political consequences, from a currency perspective, a collapse of the Euro would cause utter chaos in Europe and around the world as people, companies, and central banks unload their Euro holdings in advance of this type of chaos. All that would do is bring forward the consequences as everybody tries to exit at the same time.

Investors should imagine what that would do to the billions and trillions in EU government debt trading with negative rates. Some of the supposedly safest bonds in the world may suddenly have little value overnight – you don’t hold a German or French bond at negative rates for 10 years because it has uncertainty. That’s exactly what would happen to some of the most risk averse institutions.

In that world, both the US Dollar and gold would skyrocket as trillions of Euro holders try desperately to exchange their holdings for safer currencies. We wouldn’t be talking about $1350 or $1500 gold – we are talking gold well over $2000 in that scenario and it would happen fairly quickly.

Thus the biggest bullish reason to own gold is related to what happens in the other European countries as a result of this UK vote – primarily France and Italy where Euro-skeptic parties are already calling for their own referendums.

The Bearish Camp’s Argument for Gold

The bearish camp’s argument, or rather, the argument that gold is a bit over-valued here is based primarily on a few things that we have been pointing out to investors recently.

1. First of all, gold is hardly a contrarian investment right now as there are plenty of funds long gold at this point. In fact, as we pointed out in a recent piece, speculative gold longs are at all-time highs in their net long position in gold. That is generally not a bullish thing as it means there is little in the way of additional speculative firepower to come into gold – and a lot of potential to exit if anything makes speculative traders antsy. This also may explain a bit of the drop in gold on Friday from the midnight highs – a speculative spike as shorts cover, and then nobody willing (or able) to jump in as gold gradually dropped over the day. From this perspective positions are extremely over extended on the long side.

2. In terms of physical gold demand, Chinese and Indian demand has recently been weak. Since these two countries make the two largest physical buyers of gold, that’s something that we are concerned about and is in stark contrast to strong ETF buying. Investors need to remember that the biggest difference between the two categories of buyer is how fast they can change their minds and unload their gold holdings. Since Indian and Chinese buyers buy with a much longer term view, it’s very unlikely that they will unload their holdings without a significantly higher gold price. This is very different from ETF gold holdings, which as investors know from 2013, can unload their holdings in a hurry.

That means that all of this physical demand that has moved from Eastern individual buyers to large ETFs, is a much less stable form of ownership – and can drive the price down significantly if they choose to sell.

3. Finally, in a little publicized move, the CME raised the margin requirements for gold traders on Friday by 22% from $4500 to $5500. While this doesn’t affect physical buyers of gold, this can have a huge effect on paper gold traders that buy primarily on margin as now they will have to put up more money to maintain their positions or lower their gold exposure. We saw this in 2011 in silver, and it is not bullish.

Our Take for Gold Investors

These are the major two sides in the gold argument stemming from the Brexit vote – so where do we stand?

Our view is that Friday’s Brexit spike in gold was a knee-jerk reaction that was justified to some degree – but we think that the direct consequences of Brexit are not as significant as the reaction in the markets (at least not yet). In fact, there’s an excellent piece by Salient’s Ben Hunt that should remind investors that this is more a Bear Stearns moment than the Lehman one:

Brexit is a Bear Stearns moment, not a Lehman moment. That’s not to diminish what’s happening (markets felt like death in March, 2008), but this isn’t the event to make you run for the hills. Why not? Because it doesn’t directly crater the global currency system. It’s not too big of a shock for the central banks to control. It’s not a Humpty Dumpty event, where all the Fed’s horses and all the Fed’s men can’t glue the eggshell back together. But it is an event that forces investors to wake up and prepare their portfolios for the very real systemic risks ahead.

What’s the result? I think it works for while, just like it worked in the aftermath of Bear Stearns. By May 2008, credit and equity markets had retraced almost the entire Bear-driven decline. I remember vividly how the Narrative of the day was “systemic risk is off the table.” Yeah, well … we saw how that turned out.

The second paragraph should remind investors that while Bear Stearns scared everyone initially, the market made back the losses only a few months later. That’s extremely important to remember when we have these emotional type events that have little in the way of concrete short-term consequences.

Thus our view is that gold is overbought right now and there are simply too many paper traders bullish and not enough physical demand from individuals and the East to provide cushion if these traders unloaded their holdings. Additionally, the consequences of Brexit are minimal until we see some solid dates on referendums and moves in EU countries to leave the Euro. Finally, the fact that the CME is raising margins worries us as it may cause a good amount of paper selling…

In the meantime, we think that we’ll see a lower gold price and a much better entry point for gold bulls (which includes ourselves). Thus gold bulls should keep core positions but don’t get emotional here as there’s much more slogging to go before we get a truly “Lehman” moment.

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money