Data from Barclays Research clearly shows that the strain on US consumers from student loans isn’t going to improve any time soon and that the risk to the taxpayers is on the rise.

student loans isn’t going to improve any time soon and that the risk to the taxpayers is on the rise.

So writes Walter Kurtz (SoberLook.com) in edited excerpts from his original article* entitled The US Student Loan Problem – Facts, Charts, & Thoughts.

[The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Kurtz goes on to say:

Let’s take a look at where we stand with the overall student loan problem and how we could move forward. Here are six facts to consider:

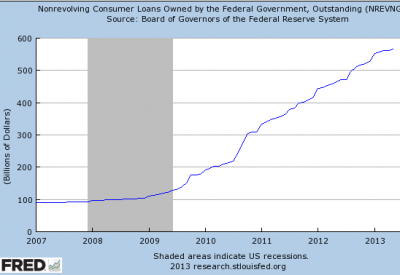

1. There is about a trillion dollars worth of student loans outstanding with all but 15% of that owned or guaranteed by the federal government. The chart below shows the student loan amount held directly by the federal government. That balance is rising at about $110 bn per year.

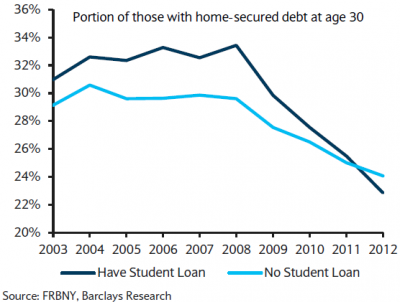

2. Higher education still provides a clear financial advantage, with the unemployment rate among college graduates at about half that of those with just a high school diploma. However when you add student loans into the mix, the financial situation of graduates is not as compelling. For example, while homeownership has declined across the board, the decline has been much sharper for those with student loans.

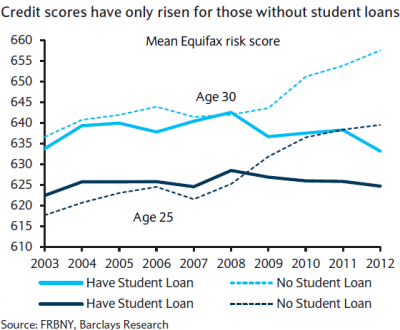

3. Not surprisingly, since 2008, the credit score of young people with student loans increasingly lags the score of those without this type of liability.

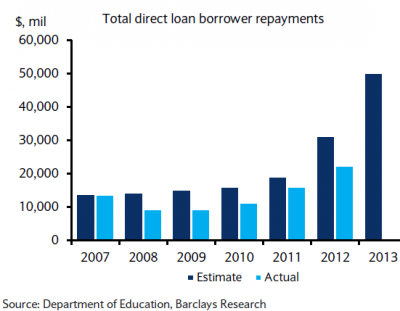

4. Based on the expected repayment schedule of outstanding student debt, an increasingly large volume of loans is forecast to be repaid each year yet, since 2007, the actual repayments keep falling further behind the repayment expectations. Based in this trend, the situation for 2013 looks a bit scary.

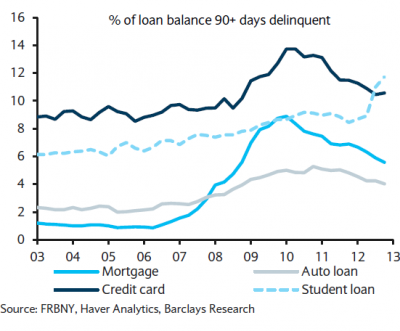

5. Student loans now have the highest delinquency rate among all major consumer credit asset classes. Based on the latest data, the trend isn’t encouraging.

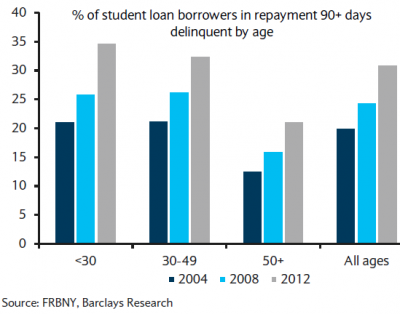

6. While there is a perception that student loan delinquencies are limited to generation-Y borrowers, delinquencies are rising across all ages.

Conclusion

The data clearly shows that the risk to the taxpayers is on the rise and the strain on US consumers from student loans isn’t going to improve any time soon.

- The unlimited availability of student loans has allowed colleges to sharply raise tuition and fees over the past few years – often simply because they could.

- Rising cost for higher education in turn forced students to take out larger loans and in greater numbers, increasing the overall loan balances. This feedback loop is clearly unsustainable, particularly as household income growth remains weak.

- Higher delinquencies are inevitable and, as long as the government funds this program, there really is only one way to arrest rising levels of student debt…The taxpayers funding this program should insist that if a college accepts over a certain percentage of students paying with federally backed student loans, that college must agree to cap tuition and fees.

It’s time for institutions of higher learning to start living by the concept of “chained CPI” rather than to just keep writing research papers on it.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://soberlook.com/2013/07/the-us-student-loan-problem-facts.html (Content copyright 2009-2013. SoberLook.com. All rights reserved.)

Related Articles:

1. Grads in Higher Demand Than Last Year – Here’s What Employers Want

While the economy can certainly make job hunting frustrating for some recent grads, it’s not all bad news. 59.3% of employers surveyed rated the current job market good to excellent, and 9.5% plan on increasing their number of hires this year. Learn more from the infographic below. Read More »

A recent survey by the National Association of Colleges and Employers has revealed that the majority of paid interns receive a job offer and the majority who accept such offers (the majority) stay with their new employer for more than 5 years. Conclusion: internships are a “win-win” for students and employers alike. Read More »

4. Which U.S. Universities & Fields of Study Generate the Highest ROI?

Recent research by PayScale has revealed that the average ROI for U.S. university graduates (693 schools surveyed) is $387,501 over a 30-year period. 6 of the universities generated a return on investment for its graduates in excess of $1.6 million. Read More »

5. American Grads: Here’s a Great Guide to Personal Finance

Graduating from college can be an exciting and stressful time. Suddenly you need to find a job, replay loans and make solid financial decisions. Fortunately, you don’t need to be unprepared. Below are some budgeting basics to keep your spending under control, some suggestions on how to set financial goals and a list of the top 10 American cities for starting out. Read More »

6. In Debt? Kick it to the Curb, Get Rich, and Start Living Life to the Fullest! Here’s How

The rising cost of college tuition translates into many students re-evaluating higher education, their future professional careers as well as other major life decisions. Find out more in our very enlightening infographic on The Surprising Side Effects of Rising College Costs. Read More »

If you’re reading this and under 30, let me be absolutely clear about one indubitable point: your government is going to sacrifice your future in order to pay for its own mistakes from the past. [If that kind of future does not sit well with you] then get out of Dodge. Stop playing by the same rules of the game that used to work in the past because the old playbook of “go to school, get a good job, work your way up the ladder” simply doesn’t apply anymore. [This article outlines what is being laid out as your future unless you take independent action and, in conclusion, outlines suggestions on how to make a better life for yourself. Feel free to share this article with one and all!] Words: 1058 Read More »

9. These Degrees Are the Ticket to the 10 Top Paying Careers

Staying in school has always been seen as the way to get ahead. Post-secondary education, especially a university degree, is often the ticket to the big pay cheque but not all degrees are created equally when it comes to earning potential. Which programs lead to the best paying jobs? Check out our list of the top earning degrees. Words: 775 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money