Silver’s “real deal” rally will happen when people run to silver for its monetary benefits. That is not really happening yet, in a big way, but it is about to – very soon. Money is what silver is, and it is this that will drive the coming spectacular silver rally.

happening yet, in a big way, but it is about to – very soon. Money is what silver is, and it is this that will drive the coming spectacular silver rally.

So says Hubert Moolman (hubertmoolman.wordpress.com) in edited excerpts from his original article* entitled Silver Price Forecast 2014: Silver’s Ultimate Rally When Paper Assets Collapse,

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Moolman goes on to say in further edited excerpts:

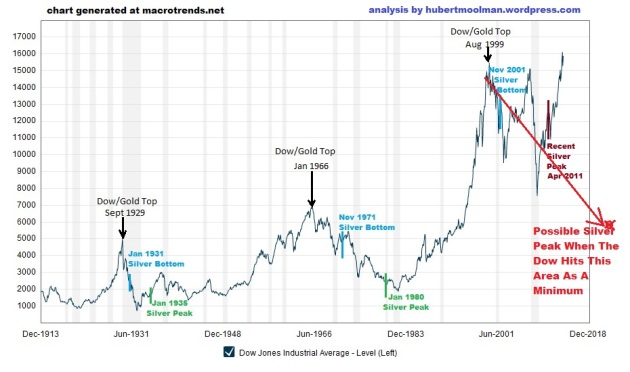

The relationship between the Dow and silver has been very consistent during the last 100 years. After each of the major Dow peaks (real, not necessarily nominal peaks), we eventually had a major bottom in silver.

Below, is a 100-year inflation-adjusted Dow chart:

The Dow’s Performance During Silver Rallies

1. In September, 1929, the Dow peaked in terms of U.S. dollars, as well as in terms of gold ounces (real terms). After about 1 year and 4 months, silver made a significant bottom. While the Dow continued to fall for most of the time, silver rallied until it peaked in January of 1935. At silver’s peak, the Dow was about 30% lower in real terms than what it was at silver’s bottom.

2. Again, in January 1966, the Dow peaked in real terms. After about 5 years and 10 months, silver made a significant bottom. While the Dow continued to fall for most of the time, silver rallied until it peaked in January of 1980. At silver’s peak, the Dow was about 55% lower than it was at silver’s bottom.

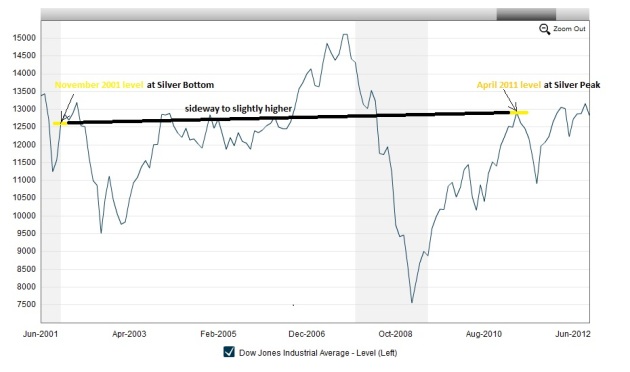

3. In 1999, the Dow once more peaked in real terms, and after 2 years and 3 months, silver again made a significant bottom. However, over the period from the silver bottom to the peak in April 2011, The Dow actually went sideways (actually slightly higher) as illustrated in the following chart:

The April 2011 high in silver is not the peak for this bull market. Why? Because silver stands in direct opposition to paper assets like the stocks that are part of the Dow and, therefore, when silver has a “real deal” rally, paper assets like the Dow will lose significant value over the same time. Why? Because the debt-based monetary system does what I call a “mirror-effect”, whereby silver (and gold) is pushed down in value to a similar extent as to which paper assets such as general stocks are pushed up in value. When the rally of the paper assets eventually runs out of steam, then there is a big push for silver and gold.

Silver’s “real deal” rally will happen when people run to silver for its monetary benefits. That is not really happening yet, in a big way, but it is about to – very soon. Money is what silver is, and it is this that will drive the coming spectacular silver rally.

A look at the Dow chart again (below), shows that the silver peaks of the 70s and 30s occurred when the Dow was trading closer to the lower levels of its range but, currently, the Dow is trading at all-time high levels.

Conclusion

- If the Dow is currently having a “real deal” rally, then it means we are going to have to wait a long time before silver has its real rally.

- If the Dow is just having a fake rally, however, then silver will spike as soon as the Dow’s fall gathers steam, and possibly peaks when the Dow hits a level indicated on the chart above, as a minimum.

Which will it be – a long wait for a spike in silver or will it be soon? It all depends on whether this current Dow rally is real or fake. I think it’s fake. [Express your views in the Comment Section at the bottom of the page.]

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*https://hubertmoolman.wordpress.com/2014/04/13/silver-price-forecast-2014-silvers-ultimate-rally-when-paper-assets-collapse/ (For more of this kind of analysis on silver and gold, and why I think that the Dow’s current rally is fake, you are welcome to subscribe to my premium service. I have also recently completed a Long-term Silver Fractal Analysis Report.)

Related Articles:

1. Gold Dropping to $900 & Silver to $15 By End of June Before Going Parabolic!

Back in early May, 2013, I correctly forecast the lows in gold & silver which occurred 2 months later. Today, my new analyses of gold & silver indicates they both will show further weakness during the 2nd quarter of 2014 before both jumping dramatically in price before the end of 2014. Below are the specific details of my forecasts (with charts) to help you reap substantial financial rewards should you wish to avail yourself of my insightful analyses. Read More »

2. Stock Market Will Collapse In May Followed By Major Spike in Gold & Silver Prices! Here’s Why

The unintended consequences of five years of QE are coming home to roost! In May or early June the stock market parabola will collapse…followed by a massive inflationary spike in commodity prices – particularly gold & silver – that will collapse the global economy. Read More »

3. Silver Has the Potential to Increase 4-Fold From Today’s Price – Here’s Why

The price ratio of gold to silver has fallen precipitously in raging bull markets for the metals, so the silver price could have an upwards move at four times the rate of any gold price increase. I think that the fundamentals look better than ever, and…[that] there is an explosive move coming in 2014. [Indeed,] I think that within a reasonable timeframe silver will probably trade over $100. Read More »

4. Massive Debt Levels Will Push Silver To $150 And Beyond

The process of the devaluation of gold and silver, started by the demonetization of gold and silver, is about to reverse at a greater speed than ever before. Read More »

5. Golden Cross” Suggests MUCH HIGHER Prices Coming for Gold, Silver & PM Equities

History is testament that there exists monumental probability (76% to 100%) that 2014-2016 will witness impressive gains for Gold, Silver and Precious Metal Equities…across the board. Below are charts of 8 different forms of precious metals assets that show that Golden Crosses are a fait accompli or are about to experience imminent completion thus heralding an immediate new Bull Market and that the forth-coming secular bull markets in all forms of precious metals may well far surpass the forecasts herein stated. The focus of the following analysis is to prove the predictable accuracy and timing of the The Golden Cross. Read More »

6. Silver On Its Way to $50/ozt. & Then to “Blue Sky Country”

Silver has moved above its 200-day moving average which is a signal for silver prices to challenge the $50 area, overcome it and then traverse ‘blue sky country’ to target the upper trendline shown in the chart shown below. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Look for a Geo-Political issue that will start Silver going upwards as investors hedge their stock portfolios with less expensive Silver instead of Gold which will be in shorter supply.