The same way FANG stocks were hidden in plain sight in 2013, I believe the next leading technology stocks are well known by most investors and already recognized by Wall Street for their superiority and the inherent underlying quality of their business. The real challenge is not to find them….[but] to buy them and hold them for many years.

Back in February 2013 CNBC’s “Mad Money” host Jim Cramer introduced an acronym for 4 stocks (Facebook, Amazon, Netflix and Google – later re-branded as “FAANG” when Apple was added to the mix in 2017) that had dominant positions in their respective markets and strong momentum. He suggested that they had “the potential to really take a bite out of the bears.” As a result, he called them FANG stocks.

How did FANG stocks do since then? They returned +507% on average as of this writing, compared to a mere +71% for the S&P 500. FANG stocks…[and] have remained outstanding performers, driving the Nasdaq 100 to a record-high recently.

While I own all FAANG stocks, I always wonder which companies truly represent the next wave of dominant technology companies that are likely to see their positions reinforced over the years and continue to outperform. This prompted me to offer a new acronym for five companies that represent the future of the digital economy. They are clearly dominant in their respective industries and likely to generate FANG-like returns in the decade ahead. I call them the SMART stocks.

You may have heard of them and recognize that they have a lot of potential but the likelihood that all of them are already in your portfolio is pretty thin. I bet that most investors will find them overvalued, too hot, or believe that they have “missed the boat” on them. Nevertheless, I believe that investors who are looking for exposure to the highest quality businesses for the long-term would be hard pressed to find better places to put their money.

Let’s review what these best-of-breed companies are and why I believe these SMART stocks could make your portfolio look much smarter (Please go to the original article for the specific details.).

S is for Square, Inc. (SQ), a company disrupting payment processing.

- The business has been flourishing and is on the right track to justify far more than its current $55 billion market capitalization over the long run….

The upside potential is phenomenal and its most exciting prospect for me remains its optionality. Founder-CEO Jack Dorsey is willing to be aggressive with a land and expand strategy that could pay off in a meaningful way over time.

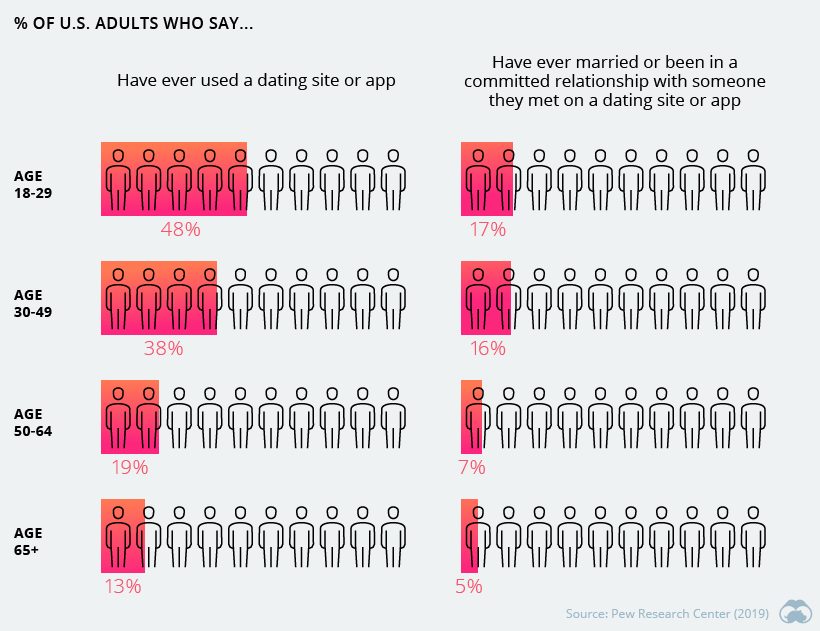

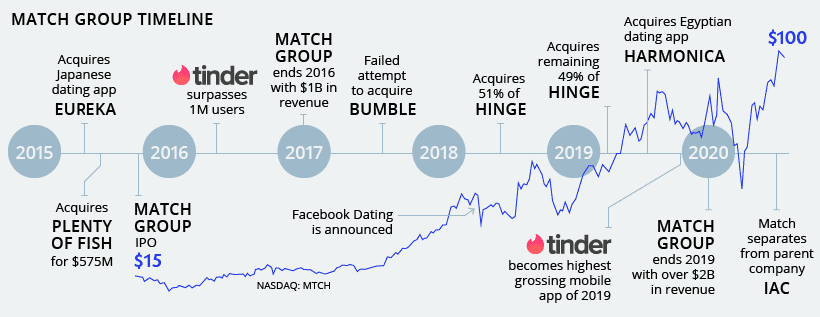

M is for Match Group Inc. (MTCH) and the rise of online dating which is now the primary way couples meet.

- Match has a portfolio of dating apps, Tinder, Hinge & Plenty of Fish

- Match Group is only a $30 billion company currently but is benefiting from long-lasting secular trends – the rise and extension of single lifestyles; the stigma around online dating fading and under-penetrated categories such as emerging markets.

- It could turn into an absolute giant with no one in sight able to get the know-how that the company has built over several decades.

A is for Alteryx, Inc. (AYX) a company that is championing an end-to-end analytics platform that enables companies to implement new ways to collect, organize, and visualize the numbers that are relevant to them to educate business decisions.

- Alteryx, with a market cap of almost $12 billion, has been able to grow at an outstanding pace (top line growth has been above 50% Y/Y consistently since going public) all while remaining profitable and cash flow positive since 2018.

The long-term trend for this relatively small company is exceptional, with improving gross and operating margins over time.

R is for Roku, Inc. (ROKU) and the shift to ad-supported connected TVs.

- Roku was spun out of Netflix…and offers the largest agnostic CTV ecosystem that supports all streaming services and offers it own ad-supported channels. Indeed, by investing in ROKU, you are betting on the death of linear TV…

- Roku is firing on all cylinders by optimizing

- user growth, up +37% Y/Y to 40 million in the most recent quarter, via partnerships with TV makers, hardware sales;

- engagement growth with users spending more time – streaming hours were up 49% to 13.2 billion most recently – watching content; and

- ARPU growth with revenue per user/hour improving over time (up +28% to $24.35 in Q1 FY20).

- Top line growth has been accelerating since Roku went public with revenue growing 55% Y/Y in the most recent quarter and

The long-term trend is exceptional, with expanding gross margin and economies of scale.

T is for The Trade Desk, Inc. (TTD), a digital ad platform serving the entire programmatic advertising market and, just like ROKU, is benefiting from the shift to digital advertising.

- Digital ad spending is expected to increase by+2.4% in 2020 despite COVID-19 and to resume a double-digit growth in 2021 and beyond….

- The Trade Desk, with a 420 billion market cap, is a another fantastic way to play the rapid growth in ad-supported connected TV and beyond. CTV is the fastest growing segment of the company, still growing +100% Y/Y in the most recent quarter.

If management can execute on the vision and continue to lead the way in programmatic ads outside big tech’s walled garden, the future is bright.

Bottom Line

Before you feel tempted to challenge the stretched valuations of the SMART stocks in 2020, you should know that three companies out of the four FANG stocks (Facebook, Amazon and Netflix) were trading at a PE ratio above 400 at the time the FANG acronym was coined for the first time in February 2013…

I believe the SMART stocks should be cornerstones of a portfolio exposed to the rising digital economy we live in. An economy driven by data, digital payments, targeted advertising, streaming and new social interaction at your fingertips. I would even argue that you could turn your portfolio into the SMARTEST, if you include Etsy (ETSY), Shopify (SHOP) and Twilio (TWLO) to the mix, but that will be for another article.

The rise of the App Economy is disrupting many industries: retail, entertainment, financials, media, social platforms, healthcare, enterprise software and more so, if you are looking for a portfolio of actionable ideas like this one, please consider joining the App Economy Portoflio.

Editor’s Note: The original article by App Economy Insights has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I already had a couple of these stocks but your article makes a huge amount of sense to me and I have since invested in the others…. I will be interested to see the outcome!

Any investment fund that invest in these companies?

Thank you

They Are in the ticket’s graphics !!!