The charts in this article come from CPM Group’s 2018 Silver Yearbook and point to a silver trend that is:

trend that is:

- so entrenched in its development,

- so inevitable in its outcome,

- so inescapable in its consequences

that it comes as close as one can get to a guarantee and, once fully underway, it will have major implications for the silver price, along with the availability of investment metal.

The original article has been edited here for length (…) and clarity ([ ])

Let’s jump in, starting with the demand side.

Investment Demand For Silver Is Up

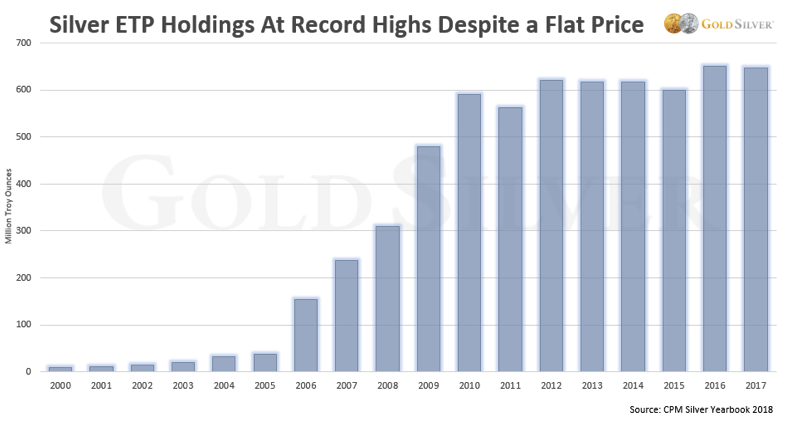

Silver demand is down…Yes, coin and bar sales fell 52% last year, ending up at approximately the same level as 2007 but demand for ETPs (exchange-traded products, including ETFs) remained near all-time highs, as the data shows.

SLV and other silver paper vehicles saw virtually no drop in holdings last year, in spite of a weak silver price and falling physical demand…and, as CPM notes, “There are various political and economic risks at present which could easily derail economic growth. This makes the lack of investment demand in silver now an even more grave concern, relative to the 1980s. Should investors increase their net buying once more, as CPM’s main long-term projections for silver suggest, prices would be expected to rise beyond 2018.”

Demand For Fabricated Silver Is Up

We certainly agree that investment demand will increase in the coming monetary regime change, but that’s only one piece of the demand pie – demand for fabricated silver isn’t letting up.

Fabricated product refers to anything a refiner forms from raw silver into a usable application or commercial product so it includes almost all forms of silver, from medical applications and solar paste to jewelry, silverware, coins and bars.

Total fabrication demand is up 15% just since 2012, back near all-time highs.

Solar Power Demand For Silver Is UP

One of the biggest growth areas for silver demand has been photovoltaic use. Analysts predicted that solar power demand would fall last year. They were wrong.

Demand for solar-panel-use silver rose a whopping 23.1% in 2017…and CPM reports “The use of silver in solar photovoltaic panels continued to grow rapidly, at rates that exceeded even the most optimistic projections… Given the strong emphasis being placed on solar power by China and other governments as a means to fight pollution and global warming, it seems more likely that 2018 will once more see strong growth in solar panel use of silver.”

Chinese Demand For Silver Is Up

You can’t talk about precious metals without looking at China. Most recent reports cite “softening” silver demand there, but again that’s not what the data says. Year after year the appetite for fabricated silver products in the world’s largest economy continues to grow stronger.

Since just 2015, fabrication demand in China is up 22%. You can see there’s been no “down” year in silver demand since the turn of the century. That won’t change anytime soon.

Now let’s look at the supply side of the equation.

Scrap Silver Supply Is Down

Silver scrap is primarily comprised of recycled metal from jewelry and electronics. It is often overlooked by investors, but it amounts to roughly a fifth of all supply sources and it’s not helping matters.

Recycled scrap metal supply has fallen a stunning 41% from its 2012 peak. Yes, it will rise again when the price does, but that rise will have to be both substantial and sustainable before it’ll help overall supply in any meaningful way.

Meanwhile, some reports claim that high silver prices will reduce overall industrial demand. As silver gets more expensive, industrial users will switch to other metals but that depends on how easy it is to transition to cheaper sources, and the degree to which those sources function as conductors as well as silver does. There is no easy and obvious conversion option with CPM reporting “The increase in demand for electronics going forward is not likely to be limited easily. While there are substitutes that can end this discussion, the reality is that silver is a very good conductor of electricity and is fairly low cost for the efficiency it brings to the table. For this reason demand for silver is not likely to be substituted in electronics.”

Perhaps the most compelling data of all when it comes to supply can be seen in this simple list of facts. As the Silver Yearbook outlines…

- Total supply peaked at 1.01 billion ounces in 2014, and has been in a declining trend since.

- Total market economy mine supply declined to 775.4 million ounces in 2017, down 26.5 million ounces, or 3.3%, from 2016 levels.

- Last year was the first year that mine supply joined scrap supply in driving total supply lower…

The CPM says “The decline in mine supply since 2016… is expected to continue over the next decade… There is a broad set of problems that are negatively influencing global silver mine supply, which include an absence of a healthy pipeline of new projects, declining ore grades at both primary silver mines, and gold and base metals mines that produce silver as a byproduct, and depleting reserves.”

It is no longer a “prediction” that fewer ounces of silver will be dug up by the mining industry. It’s already happening – and it will continue for the next decade.

Mine Supply Of Silver Is Down

Mine supply is in a decade-long decline. Fabrication demand is rising globally. These facts are irrefutable…

Conclusion

Supply and demand trends are clearly poised to continue tightening the silver market and when the next crisis hits…the silver price will be significantly impacted by this trend. It may not happen this year, but the 20,000-foot view of this market says a crunch is on the way. It’s supply/demand 101…

Related Articles From the munKNEE Vault:

1. Frustrated By the Comatose Silver Price? Don’t Be. Here’s Why

Frustrated by the comatose silver price? Tired of it going nowhere and being held down? Well, history has a message for you: This trading behavior is normal. Furthermore, similar scenarios from the past say the next price explosion is on the way.

2. Silver Could Hit $150 A Troy Ounce – Here’s Why

…A collapse of the U.S. dollar is inevitable. The U.S. Dollar Index has been bouncing off of four-year lows for the past several weeks but this cannot last much longer with a global trade war and U.S. equity correction looming….The U.S. dollar and fiat currencies are in trouble, hinting that gold and silver prices could again go screaming higher…[as] the two still generally trade inverse to each other and, while gold is perhaps the safest way to hedge against a falling dollar, the most profitable option is silver.

3. New All Time Record Highs For Gold & Silver Coming In 2019

Gold is gaining momentum after a 5-year consolidation and is set to challenge the 2011 highs some time next year. Once gold clears $2,000, a powerful bull market should drive the gold price meaningfully higher.

4. In Coming Upsurge Silver Will Move Up Almost 4x As Fast As Gold! Here’s Why

The moves in gold and silver will be explosive. The time to own physical gold and silver is today and not when they move to new highs. Both metals are at inflation adjusted historical lows and the downside risk is minimal. Also, they probably are the most undervalued of all assets currently.

5. A Breakout In the Silver-Gold Ratio Could Spring Silver Much Higher & Carry Gold With It

A breakout here would “spring” silver much higher, and likely carry gold with it. Precious metals investors need to be watching this ratio here!

6. Silver Prices: How High Will They Go? $100? $300? $500?

7. 5 Key Reasons To Own Silver

This infographic illustrates 5 key reasons why it is important to own some silver.

9. Are You A Silver Bug? Take This 10-question Quiz To Find Out

If you’re a silver believer like us, check out our 10-question quiz to see if you can call yourself a silver bug.

10. Silver: Diversify Your Holdings & Juice Your Returns – Here’s How

50 ways to diversify your silver holdings. Now you can make sure you have the right form of silver, for the right purpose, for the right time, for a diversified hard-asset portfolio.

11. Silver Is In A Massive Bull Market – Here’s Why

It’s Economics 101. Price works to balance supply and demand. Limited supply causes higher prices; higher prices help curb demand…[and] that equation is playing out right now in the silver market. Mined silver supplies have been drying up over the past few years, while silver prices have climbed 20% in the same time frame…

Silver has often rebounded nearly 100% within 12-15 months after bad and long bear markets. History says Silver is ripe for a similar move over the next 12 to 18 months.

13. Silver is Now Even More Precious Than Gold! Do You Own Any?

Silver is now rarer than gold and will be for all of eternity. From this point forth we work from current silver production alone and, from this point forth, demand will outstrip production without exception. Can you imagine what that means for the future price of this, indeed, precious metal? Forget about the popular expression: ‘Got gold?’ The much more important – and potentially more profitable – question to ask these days is, ‘Got silver?’

14. Silver Is THE Antidote to Bubble Craziness – Here’s Why

Silver in early 2018 is inexpensive compared to M3, National Debt, government expenditures, the Dow and gold.

15. Gold & Silver Price Predictions For 2018

Coming off two successive positive years, gold seems to be building toward something. Fizzling or dropping seems unlikely given 2017’s surprise performance and the general state of global equity markets – most of which seem to be overpriced, over-loved and over the top. 2017 will be recorded as a transition year for gold; 2018, in my opinion, will go down as the year gold reasserted itself as a primal force in the global financial marketplace.

For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money